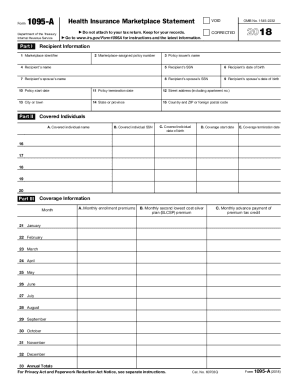

If anyone in your household had Marketplace coverage in 2017 you can expect to get a Form 1095-A Health Insurance Marketplace Statement in the mail by mid-February. If anyone in your household had a Marketplace plan in 2020 you should have received Form 1095-A Health Insurance Marketplace Statement by mail from the Marketplace not the IRS.

Corrected Tax Form 1095 A Katz Insurance Group

Typically it is sent to individuals who had Marketplace coverage to allow them to.

Marketplace insurance 1095a. If you bought health insurance through one of the Health Care Exchanges also known as Marketplaces you should receive a Form 1095-A which provides information about your insurance policy your premiums the cost you pay for insurance any advance payment of premium tax credit and the people in your household covered by the policy. It comes from the Marketplace not the IRS. Form 1095-A 2020 Page 2 Instructions for Recipient You received this Form 1095-A because you or a family member enrolled in health insurance coverage through the Health Insurance Marketplace.

Darcys parents have to figure out how much of column A monthly enrollment premiums column B monthly SLCSP and column C advanced payments on the 1095-A will go on their return and how much will go on Darcys return. If you didnt get the form online or by mail contact the Marketplace Call Center How to use Form 1095-A If your form is accurate youll use it to reconcile your premium tax credit. After confirming that its accurate be sure to store it with important tax information like W-2 forms and other records so that you can easily find it.

It may be available in your HealthCaregov account as soon as mid-January. Use the California Franchise Tax Board forms finder to. The IRS is still sorting out how theyre going to handle this.

Form 1095-A is provided here for informational purposes only. Store this form with your important tax information. This Form 1095-A provides information you need to complete Form 8962 Premium Tax Credit PTC.

The form does not have to be returned to the government but. A 1095-A Health Insurance Marketplace Statement is a form you receive from the Health Insurance Marketplace or Health Insurance Exchange at healthcaregov if you and your family member s purchased health insurance through the Marketplace for some or all of the year. Look for Form 1095-A.

As the form is to be completed by the Marketplaces individuals cannot complete and use Form 1095-A available on IRSgov. Corrected or Voided Forms 1095-A If you enrolled in coverage through a Health Insurance Marketplace the Marketplace should mail you a Form 1095-A Health Insurance Marketplace Statement by January 31 in the year following the year of coverage. The federal IRS Form 1095-A Health Insurance Marketplace Statement.

The Premium Tax Credit PTC subsidy you got every month towards your health insurance premium is based on what annual income you entered when you filled out your Marketplace health insurance application. Form 1095A is just for your records. Form 1095-A is a form that is sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier.

Claim Premium Tax Credits. 1095-A makes me owe money. Theyre on their Marketplace health plan and listed on their 1095-A.

It does not have to be sent to the IRS the marketplace sends them a copy. Dont file your taxes until you have an accurate 1095-A. You must have your 1095-A before you file.

For Forms 1095-A with APTC read the cover letter sent with these forms For Forms 1095-A. During tax season Covered California sends two forms to members. Health Insurance Marketplaces use Form 1095-A to report information on enrollments in a qualified health plan in the individual market through the Marketplace.

Information about Form 1095-A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file. Darcy didnt receive a 1095-A in their name. The California Form FTB 3895 California Health Insurance Marketplace Statement.

If anyone in your household had a Marketplace plan in 2020 you should get Form 1095-A Health Insurance Marketplace Statement by mail no later than mid-February. Form 1095-A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Marketplace. The Form 1095-A is used to reconcile Advance Premium Tax Credits APTC and to claim Premium Tax Credits PTC on your federal tax returns.

Form 1095-A Health Insurance Marketplace Statement Overview Form 1095-A is an IRS form for individuals who enroll in a Qualified Health Plan QHP through the Health Insurance Marketplace. Its tax season. If anyone in your household had Marketplace health coverage in 2020 you should have already received Form 1095-A Health Insurance Marketplace Statement.