If you are not working currently or your employer doesnt offer any insurance or decent insurance then marketplace. Under the Affordable Care Act health insurance companies cant refuse to cover you or charge you more just because you have a pre-existing condition that is a health problem you had before the date that new health coverage starts.

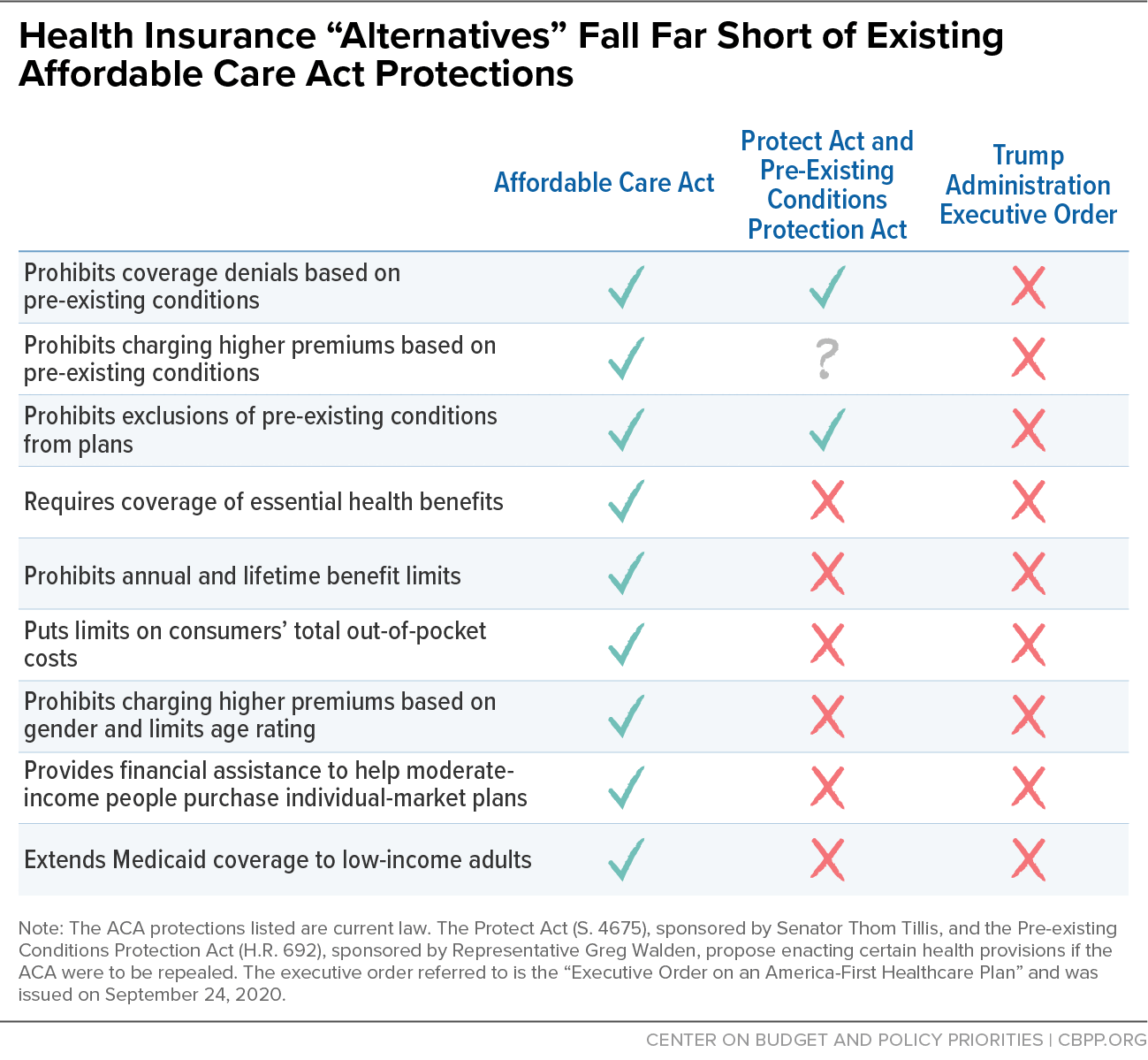

Commentary Aca Alternatives Don T Protect People With Pre Existing Conditions Center On Budget And Policy Priorities

Commentary Aca Alternatives Don T Protect People With Pre Existing Conditions Center On Budget And Policy Priorities

This means they do not cover costs related to a pre-existing condition.

Marketplace insurance and pre existing conditions. All Marketplace plans must cover treatment for pre-existing medical conditions. A pre-existing condition is any condition that was discovered before a pet insurance plan takes effect. Also Marketplace plans cant put annual or lifetime limits on your coverage.

The length of time that short-term policies look back for preexisting conditions varies by state ranging from the previous six months to five years. Once youre enrolled the plan cant deny you coverage or raise your rates based only on your health. Marketplace plans and non-Marketplace plans are generally mirror images of each other though off-Marketplace plans dont provide premium subsidies and enrollees have to pay rate increases themselves.

Why would people buy non-Marketplace health insurance. Just about any health condition that you have prior to the start of an insurance policy can qualify as a pre-existing condition. This means that people who dont receive Obamacare tax credits will generally pay less by picking lower-cost off-Marketplace health insurance on a private website.

An insurance company cant deny you charge you more or refuse to pay for essential health benefits because of any condition you had before your coverage started. Additionally once you enroll in a Marketplace health plan it cannot raise your rates or deny coverage based. Make sure to check the exact details of a plan since each health insurance company decides what it considers a pre-existing condition.

It is always wise to disclose your health condition to the insurer at the time of policy purchase. Starting November 1 2019 you can enroll in or renew a plan for 2020 so you can continue to get these benefits. Covering pre-existing conditions is high-risk from the perspective of the pet insurance company which is why they dont cover them.

If you are purchasing coverage through the health insurance marketplace then your health insurance plan is not only required to cover your pre-existing condition but charge you the same amount of money as if you didnt have any chronic illness or disease. Learn more about coverage for pre-existing conditions. Marketplace insurance is meant to be very affordable and you will likely find the rates to be agreeable- certainly less than if you had to pay for the same care on your own.

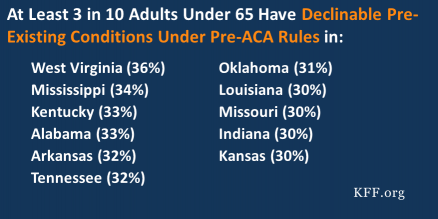

Even a more minor medical condition like acne tonsillitis high blood pressure or menstrual. This means that no Marketplace health insurance plan can reject your application charge you more or deny essential health benefits based on pre-existing health conditions. Pre-ACA a pre-existing condition could affect your health insurance coverage.

These rules went into effect for plan years beginning on or after January 1 2014. All Marketplace plans cover essential health benefits pre-existing conditions and preventive care. This is a good type of insurance for anyone who does not get coverage from their employer or a union.

If youd like to purchase another short-term policy after the first policy expires your new plan may not cover conditions that developed during your first policy term. It could be anything from a viral infection to a lifelong condition like diabetes. A Pre-Existing Condition is an injury illness disease or other medical condition that occurs prior to the travel plans effective date.

1 If you were applying for insurance in the individual market some health insurance companies would accept you conditionally by providing a pre-existing condition exclusion period or a full exclusion on the pre-existing condition. Is pregnancy treated as a pre-existing condition. Pre-existing health conditions should be disclosed.

All Marketplace plans provide coverage for pre-existing conditions. This is true for all plan categories all metal levels including Catastrophic plans and all plan types like HMO and PPO. If you were pregnant before you applied your insurance plan cant reject you or charge you more because of your pregnancy.

Non-disclosure of a pre-existing condition may result in a rejection of a claim. So what is Marketplace insurance. If you are purchasing health insurance outside the marketplace then insurers are not required to cover your pre-existing condition.

Remember travel insurance plans automatically exclude cover for pre-existing conditions. No insurance plan can reject you charge you more or refuse to pay for essential health benefits for any condition you had before your coverage started. Does Health Insurance Have To Cover Pre-Existing Conditions.

Pre-Existing Conditions Under current law health insurance companies cant refuse to cover you or charge you more just because you have a pre-existing condition that is a health problem you had before the date that new health coverage starts.