Now you cant just dump a ton of money into an HSA. In 2020 a person with single coverage can contribute up to 3550 per year or 7100 for family coverage.

Explained Fsa And Hsa For Concierge Medicine

Explained Fsa And Hsa For Concierge Medicine

Use the following resources to learn more.

Hsa qualified medical expenses. When you your spouse and your dependents have qualified medical expenses that arent covered by your health care plan you can use your HSA money tax-free 1 to pay for them. An HSA allows you to save for current and future medical expenses. This is the final step to achieving tax-free medical spending using the Triple Tax Advantage.

Advertentie The business prepaid card automated expense platform trusted by over 60000 companies. The following side notes can be ignored. Publication 502 lists many of the expenses for medical care as defined under Section 213d of the Code that are eligible for reimbursement from an HSA.

First off we know that purchases of Qualified Medical Expenses QME using HSA funds result in no tax being levied on the withdrawal. HSA funds may be used to pay for qualified medical expenses at any time. Any expense you incur before your HSA is established will not be considered qualified.

72 rijen Again please check with your HSA administrator if you have any questions about qualified. Please keep in mind that this is a guide only and is not an exact list of eligible medical ex-penses. Is a monthly fee to manage an HSA a qualified medical expense.

Use your Fidelity HSA. If you use your HSA to pay for expenses that are not qualified you will have to pay income tax and a 20 percent penalty on the non-qualified purchase amount. Interactive Qualified Medical Expenses page.

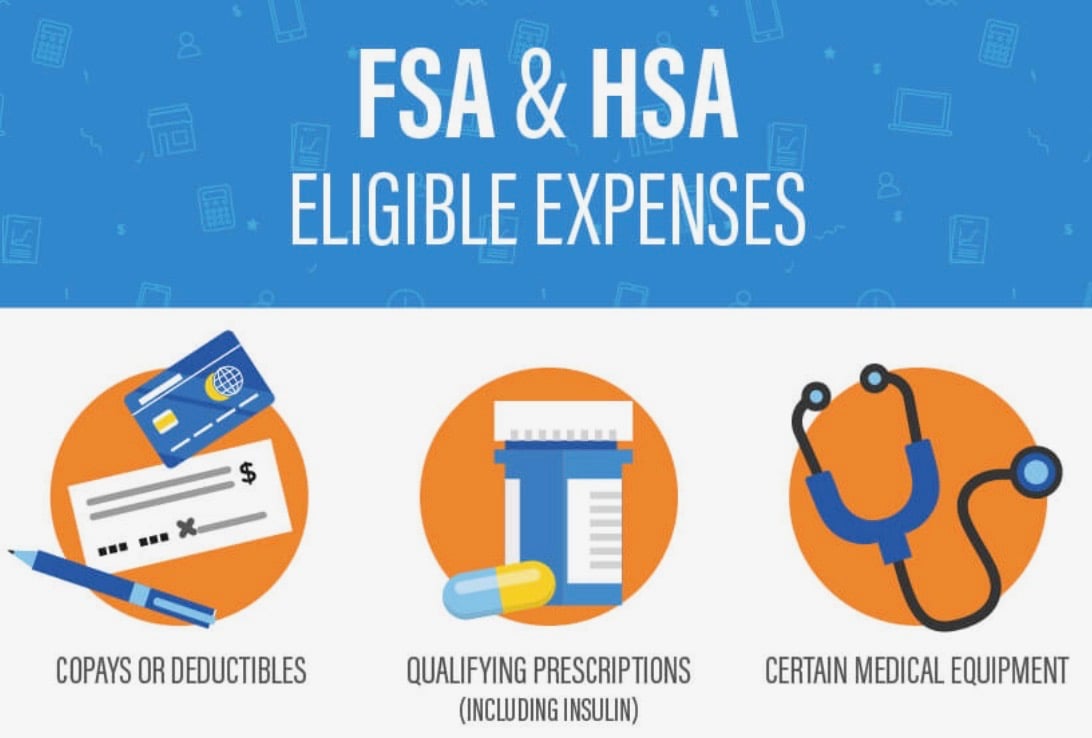

Learning Center IRS Qualified Medical Expenses HSA HRA Healthcare FSA and Dependent Care Eligibility List The following is a summary of common expenses claimed against Health Savings Accounts HSAs Health Reimbursement Arrangements HRAs Healthcare Flexible Spending Accounts HC-FSAs and Dependent Care FSAs DC-FSAs. Qualified Medical Expenses Funds you withdraw from your HSA are tax-free when used to pay for qualified medical expenses as described in Section 213 d of the Internal Revenue Service Tax Code. How can you spend from your HSA.

You are eligible for a tax deduction for additional contributions you made to your HSA even if you do not itemize your deductions. Other benefits health savings accounts. What expenses qualify and can I use my HSA.

What Are Qualified Medical Expenses. Medical expenses include the premiums you pay for insurance that covers the expenses of medical care and the amounts you pay for transportation to get medical care. There are contribution limits.

Examples of qualified medical expenses The following list includes common examples of HSA qualified medical expenses. Non-Qualified Expenses Expenses for items that are merely beneficial to the general health of an individual are not considered qualified expenses. In most states if you became eligible for an.

The amount you spend will be federal income tax-free. My HSA is no longer employer-sponsored so it therefore managed by some other custodian party or company which charges a monthly 4 fee for use of their service. I believe that fee is not considered a qualified medical expense but I want to make sure.

Contributions you make to your HSA through payroll deductions may be excluded from your gross income. Advertentie The business prepaid card automated expense platform trusted by over 60000 companies. Once youve contributed money to your health savings account HSA you can use it to pay for qualified medical expenses for yourself your spouse and your eligible dependents.

If you use a distribution from your HSA for qualified medical expenses you dont pay tax on the distribution but you have to report the distribution on Form 8889. Medical expenses also include amounts paid for qualified long-term care services and limited amounts paid for any qualified long-term care insurance contract. Medical expenses including many dental and vision expenses are generally considered eligible if they cover the diagnosis treatment or prevention of disease and the costs for treatments affecting any part or function of the body.

However the distribution of an excess contribution taken out after the due date including extensions of your return is subject to tax even if used for qualified medical expenses. You may order Publication 502 directly from the IRS by calling 800-829-3676. State law determines when your HSA is officially established.

The expenses must be primarily to alleviate or prevent a physical or mental defect or illness including dental and vision. There are multiple ways you can spend from your HSA. However it is important to understand what expenses are considered.