Care Health Insurance was earlier known as Religare health insurance. The following table shows the average rates a 40-year-old would pay for individual health insurance based on plans in the different tiers.

Tips To Find Best Health Insurance Plans Truecoverage

Tips To Find Best Health Insurance Plans Truecoverage

It is a comprehensive and affordable medical insurance policy formulated especially for individuals and nuclear families.

Best full coverage health insurance. The higher the deductible longer and wider is the coverage. Just like in your home country if you choose to purchase private health insurance in Thailand you gain one major benefit. One of the largest.

18 years and above Children. If youre looking United Healthcare offers fixed-benefit plans. SBI Arogya Top-Up Health Plan.

If you want health insurance that gives peace of mind for a hospital visit a Gold policy is for you. However what qualifies as short-term varies from one provider to the next and in some cases a short-term insurance. If you obtain your own policy you.

46 from 81 reviews. Full coverage policies are the way to minimize financial expenses if you are regular at getting medical check ups. In 2019 several commercial plans from Blue.

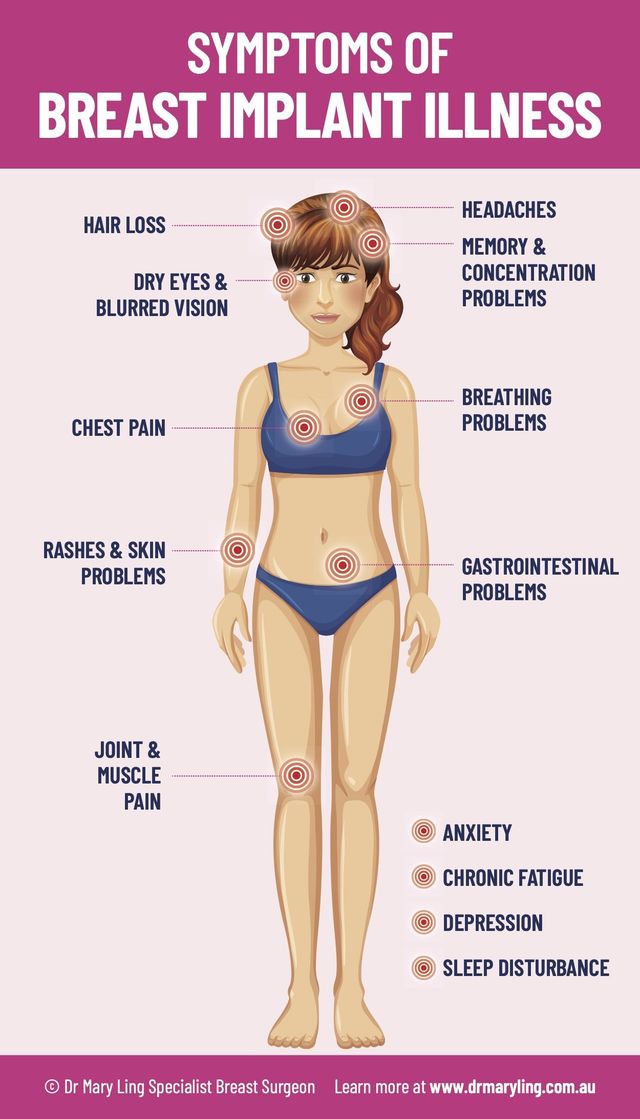

A critical illness could be defined differently by each policy but could include Alzheimers or presenile dementia cardiac arrest deafness loss of speech paralysis of a limb stroke or brain injury. If youre concerned about how your health fund uses its profits Phoenix Heath Fund is a not-for-profit health insurance company thats been around for 65 years and enjoys high overall satisfaction with its happy members. It has been around since 1929 and insures 1 in 3 Americans.

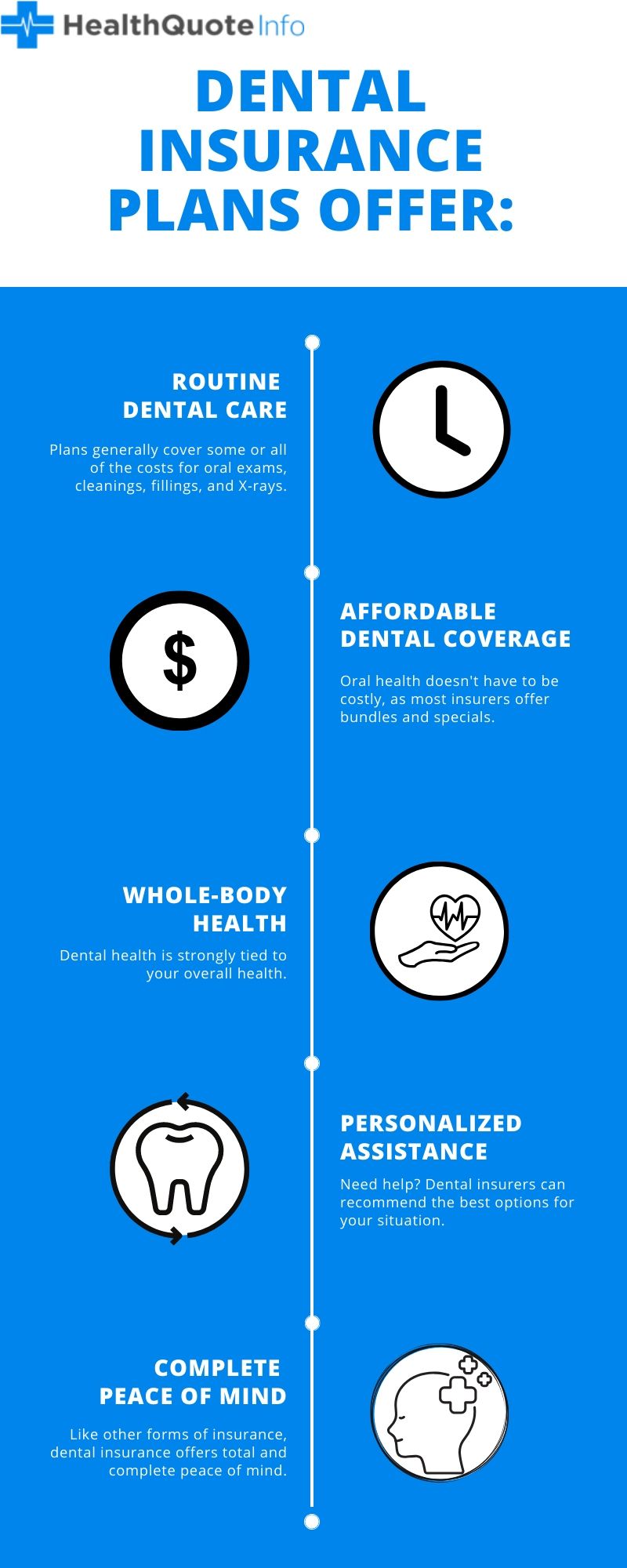

Best for HSA Options Kaiser Permanente is one of the most well-known health insurance providers and has 842 22 of the healthcare market share coming in second behind United Healthcare. However thats not the only advantage of personal health insurance. Delta Dental has a generous network that includes more than 130000 dental offices.

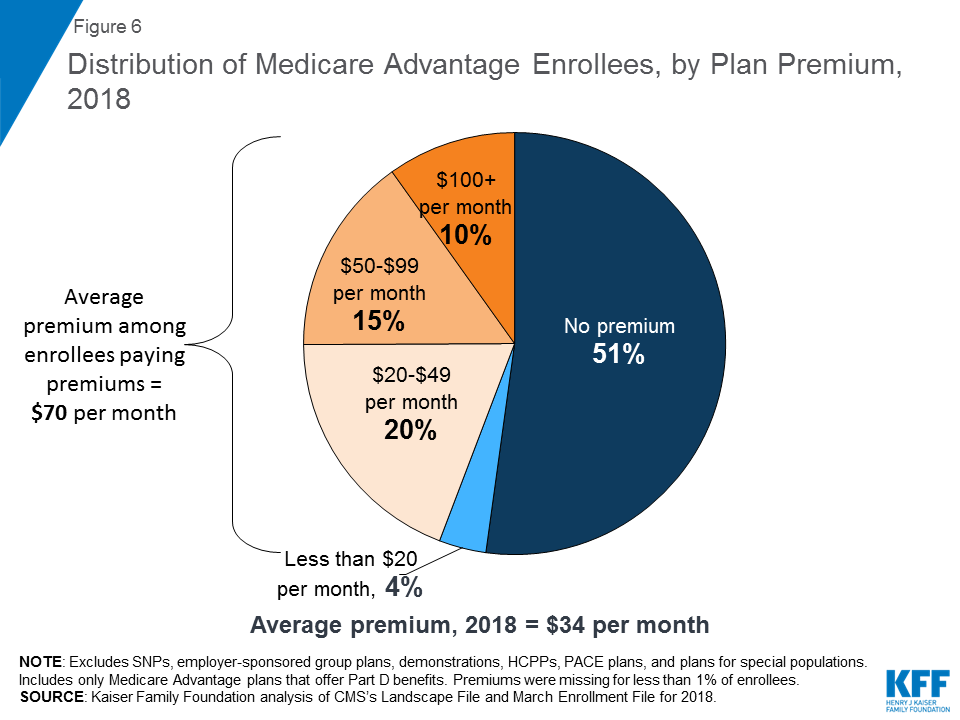

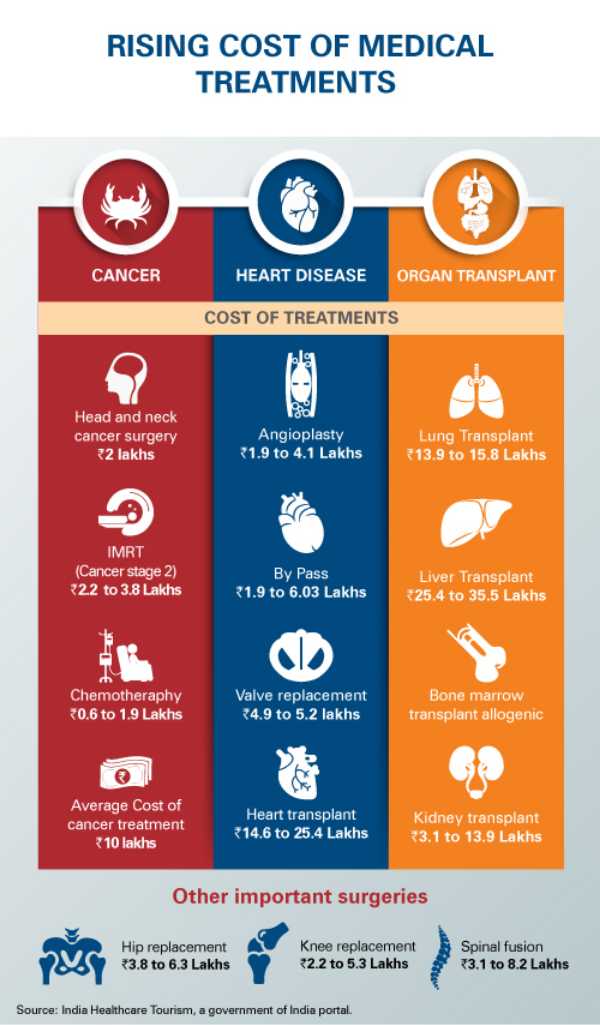

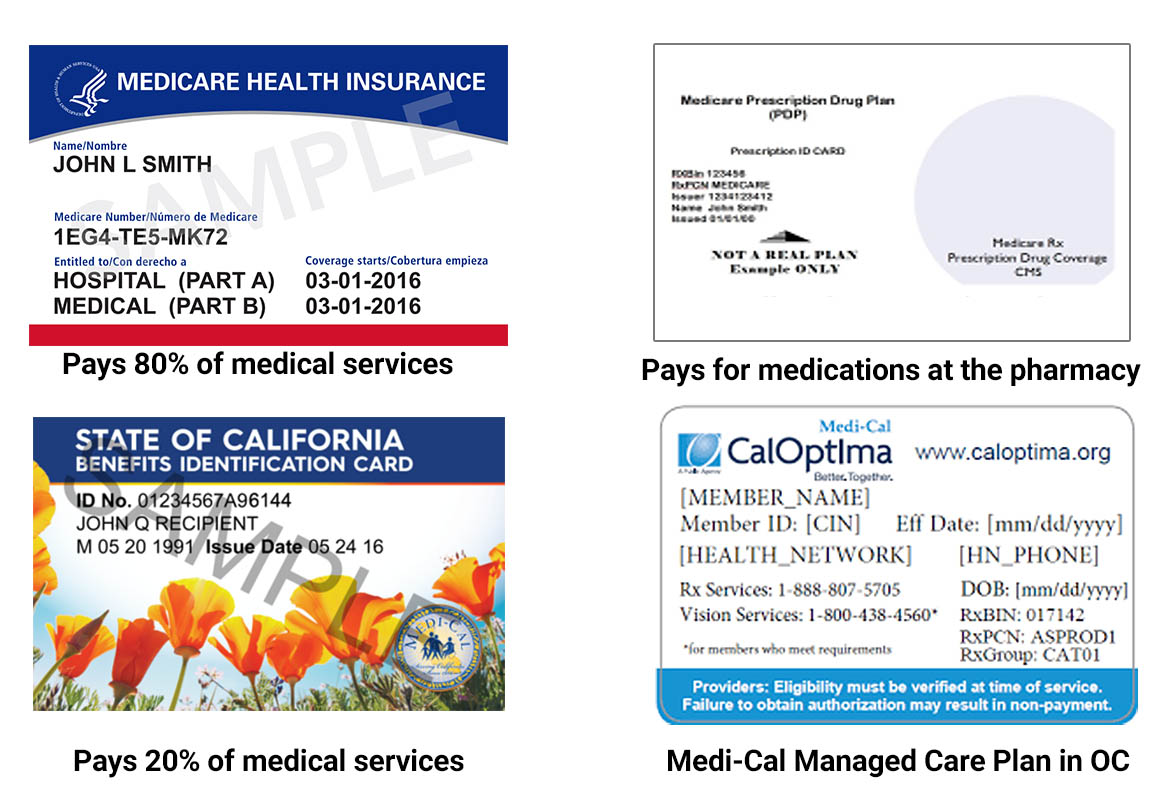

The average rates paid for health insurance plans are inversely related to the amount of coverage they provide with Platinum plans being the most expensive and Bronze and Catastrophic plans being the cheapest. Some of the top-rated providers may not have hospitals or medical facilities near to your house or they may offer comprehensive policies that are out of your price range. Consider a gold policy if you need cover for things such as pregnancy and birth cataract eye surgery and hip or knee replacement.

The starting point for individual deductibles for UnitedHealthOne. UnitedHealthcare offers a wide variety of insurance options from. Care Health Insurance is one of the best health insurance in India which offers coverage for health insurance critical illness personal accident top-up coverage international travel insurance and maternity along with group health insurance.

The coverage for hospitals and doctors is subject to deductibles. As the name implies short-term health insurance iswell health insurance for the short term. You have full control of what type of coverage you receive.

Gold health insurance is the highest level of private hospital cover available in Australia. Max Bupa Health Companion plan is the best-suited health insurance policy offered by Max Bupa health insurance Company. Blue Cross Blue Shield is a top provider of individual health insurance plans nationwide.

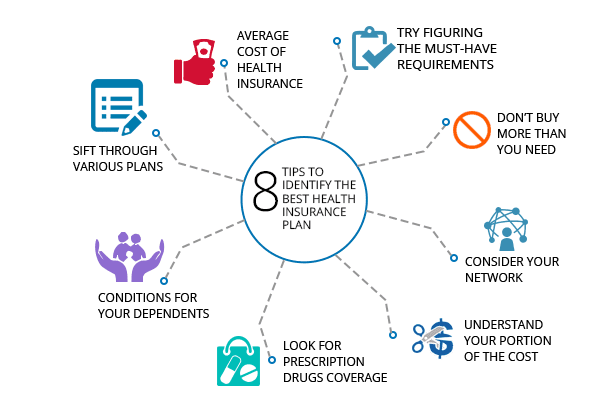

However to find the best health insurance to suit your needs you need to think about the reasons you want private medical cover and what your budget is. Personal Health Insurance in Thailand. Older consumers would see their.

It comes with an option of two- year policy tenure. Identifying The Best Full Coverage Health Insurance. Private health insurance pays for medical treatment to get you better whereas critical illness pays out a lump sum to help offset any loss in income.

As one of the largest health insurance providers in the United States UnitedHealthcare is available in nearly every ZIP code. Best Dental Insurance The 5 Top Full Coverage Plans in 2020 1. Care Enhance Super Top Up Health Insurance Plan.

1 day to 24 years with at least 1 member of age. It is available in three variants that provide a different range of medical coverage to the insured. Money put into an HSA is tax deductible helping to lower your health insurance costs overall.

Its different from a critical illness insurance policy. The Good and Bad.

/Silver_Sneakers-69444e737a074454947f1132f2c493a8.jpg)