If you had a self-insured group health plan with BCBSTX your employer sends you a 1095-C form. See this TurboTax support FAQ for a Form 1095-C - httpsttlcintuit.

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

Your 1095-C tax form is now available in UAccess Employee.

Marketplace identifier 1095 c. And the marketplace assigned policy number. This form is for your information only and is not included in your tax return unless you purchased health insurance through the progress in addition to this. The form that applies to you is based on your health plan type.

Used to report certain information to the Franchise Tax Board FTB about. I got a 1095-A form from the MarketplaceExchange. In Line 8 enter the code that corresponds with the origin of the policy or coverage being reported.

A hard copy has also been mailed to your home address unless you requested to only receive your 1095-C electronically. If they are self-funded they just fill out all sections of 1095-C. It is not from the Marketplace and has no Marketplace policy number on it.

The term Marketplace refers to. A date of birth is reported in column C only if an SSN isnt entered in column B. Individuals will receive Form 1095-C if they work for a firm with 50 or more employees.

Your 1095-A contains information about Marketplace plans any member of your household had in 2020 including. 1095-C forms are filed by large employers. You do not report your Form 1095-C on a tax return nor do you report the Form 1095-C as a Form 1095-A.

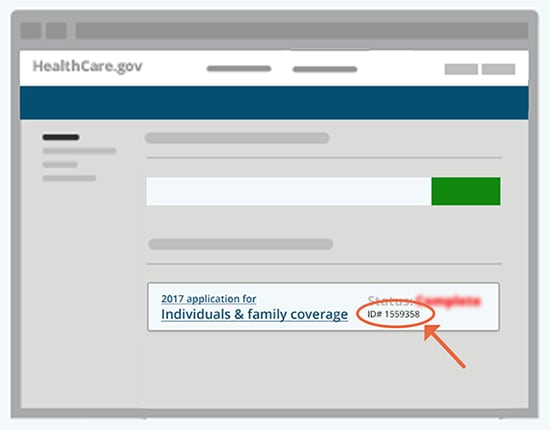

If you certified to the Marketplace at enrollment that one or. Employers who use the SHOP small self-funded groups and individuals who get covered outside of the health insurance Marketplace. Your 1095-A may also be available in your HealthCaregov account as soon as mid-January.

There are different 1095 forms. Only form 1095-A is from the Marketplace. Form FTB 3895 California Health Insurance Marketplace Statement is.

Forms 1094-C and 1095-C are used in combination with the IRS automated Affordable Care Act Compliance Validation ACV System to determine whether an ALE owes. You will only need to enter healthcare information if you were insured through the Marketplace. 1 Marketplace identifier 2.

There are different 1095 forms. Form 1095-B is for information onlyand is issued by your health insurance provider. In order to remain ACA compliant these larger businesses must offer health insurance to full-time employees.

Enter letter identifying Origin of the Policy. If you had a BCBSIL plan through the Health Insurance Marketplace in Illinois the Marketplace may send you a 1095-A form. Visit the UA Employee Main Homepage and select Benefits View Form 1095-C.

Your 1095-C provides information about the employer-sponsored health insurance offered to you. If you had a BCBSTX plan through the Health Insurance Marketplace in Texas the Marketplace may send you a 1095-A form. You must have your 1095-A before you file so dont file your taxes until you have an accurate 1095-A.

Form 1095-C contains information about the health coverage offered by your employer in 2020. Form 1095-A comes from the Marketplace. My 1095-c doesnt say any of those it has my name ssn and my employers name.

Every year Applicable Large Employers ALEs must file Forms 1094-C and 1095-C with the IRS and furnish Forms 1095-C to employees considered full-time under the Affordable Care Act ACA. If they are fully insured they get a 1095-B from the insurer and fill out Sections I and II of 1095-C. Individuals who enroll in a qualified health plan through the California Health.

The form that applies to you is based on your health plan type. Marketplace-assigned policy number 3 Policy issuers name Covered Ca 1 XXYY-1 CCHP 4 Recipients name 5 Recipients SSN 6 Recipients date of birth John Doe 111-11-1111 10011975 7 Recipients spouses name 8 Recipients spouses SSN 9 Recipients spouses date of birth 10 Policy start date 11 Policy termination date. These two forms come from employers.

You do not enter form 1095-B on your tax return. If advance credit payments are made the only individuals listed on Form 1095-A will be those whom you certified to the Marketplace would be in your tax family for the year of coverage yourself spouse and dependents. A figure called second lowest cost Silver plan SLCSP Youll use information from your 1095-A to fill out.

According to Forbes the forms 1095-A and 1095-B are new for the 2015 tax season. Premium tax credits used. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

Use the information contained in the 1095-C to assist you in determining in you are eligible for the premium tax credit. Form 1095-C Employer-Provided Health Insurance Offer and Coverage reports whether your employer offered you health insurance coverage and information about what coverage was offered to you. Whats a Market Identifier.

I got a 1095-A form from the MarketplaceExchange. This may include information about whether you enrolled in coverage. Origin of Policy Codes.

Your 1095-A includes information about Marketplace plans anyone in your household had in 2019 so you may receive multiple 1095-A forms if family members enrolled in different plans. Generally 1095-B forms are filed by insurers for. If you had a self-insured group health plan with BCBSIL your employer sends you a 1095-C form.

Small Business Health Options Program SHOP B.