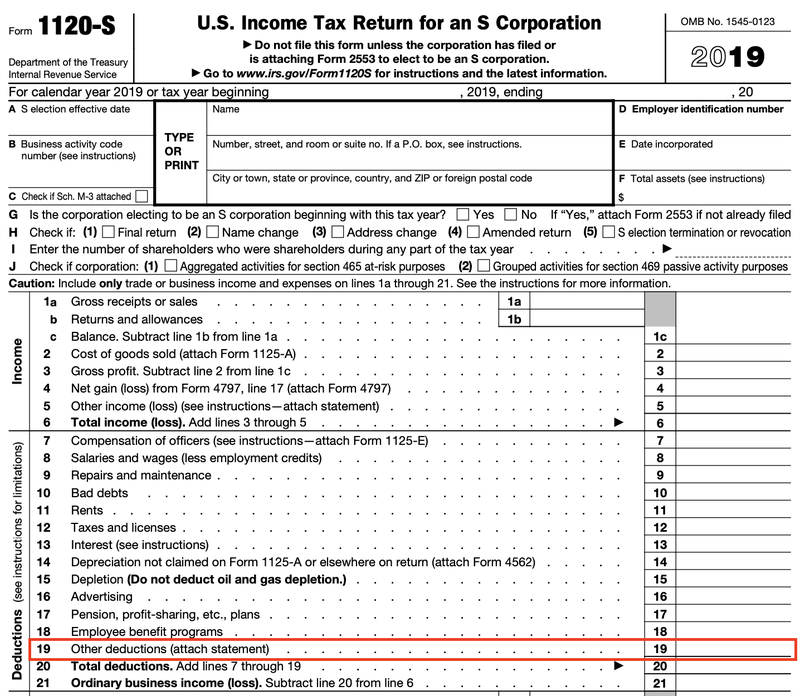

You must itemize to claim this deduction and its limited to the total amount of your overall costs that exceed 75 of your adjusted gross income AGI. If you already filed and have excess advance Premium Tax Credit you dont need to file an amended return or take any other action.

A Beginner S Guide To S Corp Health Insurance The Blueprint

A Beginner S Guide To S Corp Health Insurance The Blueprint

Hi if I was on my parents health insurance plan throughout 2020 obviously me not having to pay for any of it can I still put that I had health insurance all year on my 2020 tax returns.

Do you need health insurance to file taxes 2020. Taxpayers should receive Affordable Care Act information statements from their employer s or coverage provider by early March in 2021 regarding their 2020 health insurance coverage. There you can pick an Affordable Care Act-compliant health plan for 2020. The steps you take will depend on your eligibility for the premium tax credit.

If you and your dependents had qualifying health coverage for all of 2020. Have qualifying health insurance coverage Obtain an exemption from the requirement to have coverage Pay a penalty when they file their state tax return You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021. I was 25 at the end of 2020 if thats needed.

There is no longer an individual mandate for health insurance. You can find it on Form 1040 PDF 147 KB. If you have excess advance Premium Tax Credit for 2020 you are not required to report it on your 2020 tax return or file Form 8962 Premium Tax Credit.

Individuals who have health insurance should receive one of three tax forms for the 2020 tax year. There is no longer a federal mandate to have health insurance and you do not have to file Form 1095-C on your 2020 Tax return. There is no longer a Federal Mandate to have Health Insurance.

For tax years other than 2020 if advance payments of the premium tax credit APTC were made for your or a member of your tax familys health insurance coverage through the Health Insurance Marketplace you must complete Form 8962 Premium Tax Credit and attach it to your return. The Form 1095-A Form 1095-C or Form 1095-B. I had a Marketplace plan in 2020 Watch your mail for Form 1095-A.

Applicable large employers are those with 50 or more full-time employees. If you got Form 1095-B or 1095-C dont include it with your tax return. It can charge a flat amount 695 per adult or 34750 for each child who goes without insurance based on.

The Golden State has two ways to assess penalties. Since Tax Year 2019 you have not needed not make a shared responsibility payment or file Form 8965 Health Coverage Exemptions with your tax return if you dont have a minimum essential coverage for part or all of 2020 and do not need to receive or keep the 1095-B form. How Health Coverage Affects Your 2020 Taxes If you had a Marketplace plan in 2020 you must file a 2020 federal income tax return.

However if you werent in college and only received a W-2 you could skip those tax documents. If you got excess advance payments of the premium tax credit APTC for 2020 you dont need to pay it back. Form 1095-C is sent to certain employees of applicable large employers.

This means that you will not pay a penalty if you did not have health insurance in 2020. Fact Sheet News Release. If you claim a net Premium Tax Credit for 2020 you must file Form 8962.

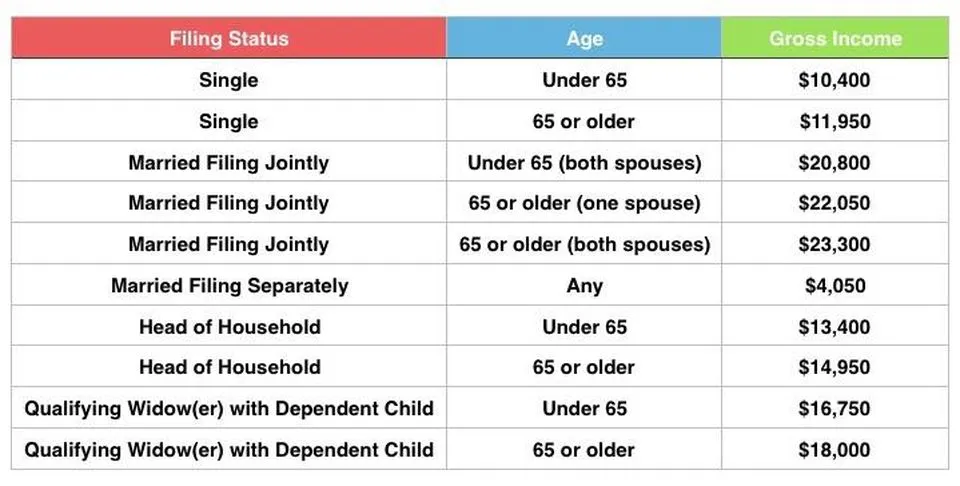

And this is in terms of both level of coverage and consumer protections. What you need to file your taxes varies depending on your situation. Need guaranteed issue coverage due to health history or pre-existing conditions That said if for one reason or another you want to explore other non-ACA qualifying health insurance options and decide to enroll in one of them you can do so without facing the federal tax penalty in 2020.

Save it with your other tax. Find your situation below for more information. For example if youre a self-employed college student you may need 1099 and 1098-T forms to file your taxes.

However under the California Health Mandate beginning in 2020 if you did not have Medi-Cal or other qualifying health care coverage for all twelve months of the previous calendar year and you do not qualify for an exemption from the required coverage you may be penalized by the FTB when you file your state income taxes. Check the Full-year coverage box on your federal income tax form. Complete your tax return.

Getting an Obamacare health insurance plan means knows you are getting care that meets certain standards. 2020 tax filing changes due to the American Rescue Plan. 2020 health coverage your federal taxes.

The forms are sent to individuals who are insured through marketplaces employers or the government. You do not need to wait for the forms to file your taxes and they do not have to be attached to your tax return. 1095-C If you andor your family receive health insurance through an employer the employer will provide Form 1095-C by early March 2021.

You still need to use your Form 1095-A to reconcile your 2020 premium tax credits when you file your 2020 taxes. It makes sense to put that I did but just double checking. Health insurance costs are included among expenses that are eligible for the medical expense deduction.