By knowing the top three Medicare Supplement plans for 2021 you ensure youre getting the best coverage. Medicare Supplement plans commonly referred to as Medigap are insurance plans that work alongside your Medicare Part A and Part B benefits and help cover some of your Medicare deductibles coinsurance copays and other costs.

Here S A Brief Look At Medicare Supplement Medigap Plans

Here S A Brief Look At Medicare Supplement Medigap Plans

The term Medigap describes a Medicare Supplement policy.

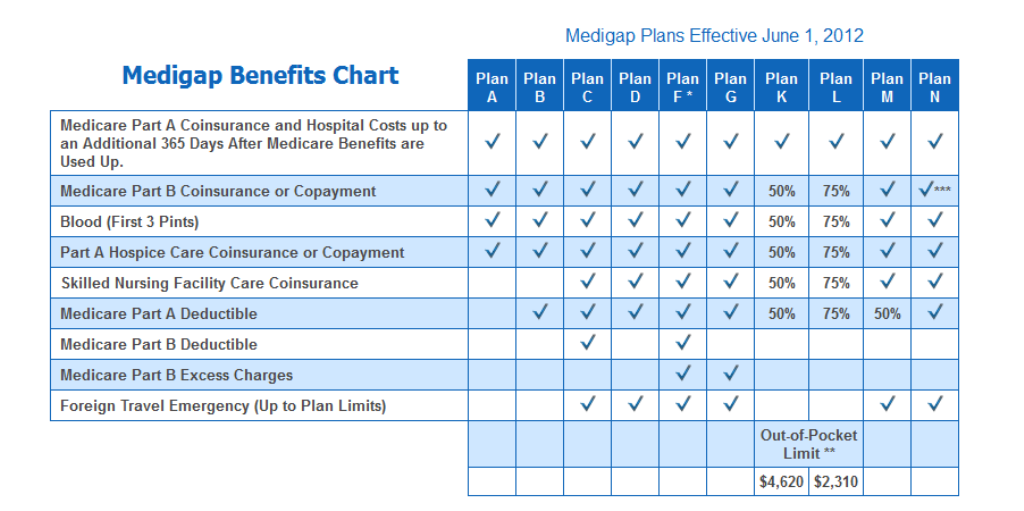

What are the medicare supplemental plans. There are 10 plan types available in most states and each plan is labeled with a different letter that corresponds with a certain level of basic benefits. 10 rijen Medicare Supplement also known as Medigap are supplement insurance plans that fill the gaps. Medicare Supplement Insurance Plan F premiums in 2020 are lowest for beneficiaries at age 65 18493 per month and highest for beneficiaries at age 85 29929 per month.

Medigap Plan G premiums in 2020 are lowest for beneficiaries at age 65 14346 per month and highest for beneficiaries at age 85 23587 per month. Medicare Supplement plans are designed to reduce your out-of-pocket expenses and keep your health care coverage affordable. Medigap is Medicare Supplement Insurance that helps fill gaps in Original Medicare and is sold by private companies.

A Medicare Supplement Insurance Medigap policy can help pay some of the remaining health care costs like. What are the Basic Benefits of Medicare Supplemental Insurance Plans. Many insurance companies offer Medicare supplement plans.

Advertentie Compare Top Expat Health Insurance In Netherlands. Medicare Supplement Plans also called Medigap Plans are standardized across most of the United States though there are some exceptions. Supplemental plans are standardized meaning Medicare sets what each Supplement will cover and they are guaranteed to be accepted anywhere in the United State that accepts Medicare.

- Free Quote - Fast Secure - 5 Star Service - Top Providers. 12 rijen For Plans K and L after you meet your out-of-pocket yearly limit and your yearly Part B. These plans help pay for the some of the hospital and medical costs that Medicare doesnt cover.

A B C D F G K L M and N. The last major difference is when you sign up for an Advantage plan you have to stay with that program for an entire year and if you choose to change providers you can only do so from October 15 to December 7. The federal government has 10 standardized Medicare Supplement plans that insurance companies must.

Original Medicare pays for much but not all of the cost for covered health care services and supplies. - Free Quote - Fast Secure - 5 Star Service - Top Providers. Medicare Supplement plans help cover those out-of-pocket Medicare costs so its easier to budget for your health care.

Medicare Supplement also known as Medigap or MedSupp insurance plans help cover certain out-of-pocket costs that Original Medicare Part A and Part B doesnt cover. Medicare supplemental insurance costs vary and depend on factors like location plan rating and the insurance company the plan is offered through. Here are some key facts about Medicare Supplement Insurance.

Medicare supplement plans are regulated by the government and issued by private insurance companies. Each of the ten plans is designated a letter. The best time to purchase a Medicare Supplement is during your Medicare Supplement Open Enrollment Period which starts the first six months that you are enrolled in Medicare Part B and are 65 or older.

This includes yearly deductibles coinsurance and copayments. During this period you have the right to join any Medicare Supplement plan regardless of pre-existing conditions or disabilities. Medicare Supplement Medigap plans are designed to help pay your share of health-care costs under Medicare Part A and Part B.

Medicare supplemental health plans are offered through private insurance companies. What are Medicare Supplement plans. Heres what to know so you can make an informed decision.

Get the Best Quote and Save 30 Today. Medico offers a number of plan discounts for things like automatic premium withdrawal being a non-smoker or living with another person over the age of 18. Medico Insurance Company Medico sells Medicare Supplement Insurance in 25 states and offers several popular Medigap plans such as Plan A Plan F Plan G and Plan N.

Advertentie Compare Top Expat Health Insurance In Netherlands. Get the Best Quote and Save 30 Today. A Medicare Supplement plan provides additional insurance coverage that regular Medicare doesnt.

These plans cover the out of pocket expenses that all-too-often create mountains of medical debt and cause people to avoid getting necessary care.