Alignment Health Plan Platinum HMO Aetna Medicare Choice Plan PPO Part D in California. Enter your zip code to pull plan options available in your area.

Medicare Supplement Plans Comparison Chart Compare Medicare Plans

Medicare Supplement Plans Comparison Chart Compare Medicare Plans

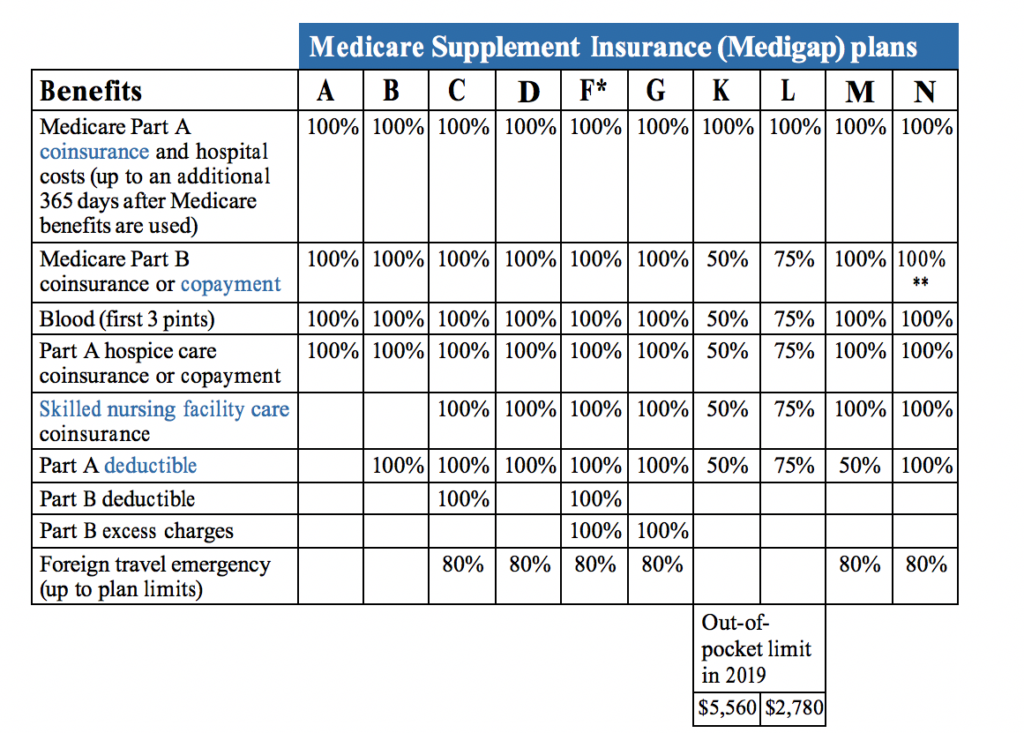

In 2021 the Plan K and Plan L out-of-pocket limits are 6220 and 3110.

Compare medigap plans in california. These first two parts of Traditional Medicare are designed to cover most of your health care needs including hospital visits and outpatient care. We make comparing Medigap plans as well as keeping up with changes to Medicare simple. The plans range from basic to full coverage.

Some Medicare Advantage plans do but not all. This is a maximum amount that youll have to pay out-of-pocket. California Medigap Birthday Rule.

Medicare Supplement plans are standardized and offer various benefits to help offset your healthcare cost. The best time to buy a Medicare Supplement plan. Attained age-rated policies increase in price as you age because as you get older you typically require more health care.

Some factors that may determine your choice of Medigap plans in California include. Find the best 2021. Expected frequency of specialist visits.

Lifestyle risks smoking unhealthy diet sedentary etc Plans for international travel. Expected frequency of primary care visits. 10 Zeilen Find the Best Medigap Plans Available.

Call the number above to speak to one of our Medicare experts and get your free rate comparison. Blue of California for example offers a New to Medicare discount for your first year 25 per month discounts for using automatic bank payments 3 per month discounts for enrolling in a dental plan at the same time 3 per month and a 7 discount if. On this page we help consumers.

Medigap Plan K and Plan L have out-of-pocket limits. Insurance companies set prices for Medigap policies in 1 of 3 ways. Male age 65 in zip code 92551.

Youre eligible for Medigap insurance if youre enrolled in Original Medicare Part A and Part B. The benefit of changing plans during this. Attained-Age Rating This is the most common way policies are priced in California.

Select your plan and compare rates from each Medicare insurance company with those factors plus your budget in mind. Medigap Plan G rates can vary widely depending on several variables including what part of the country you are in your age and your gender Get Plan G pricing in your area by email. The reason for this is quite simple.

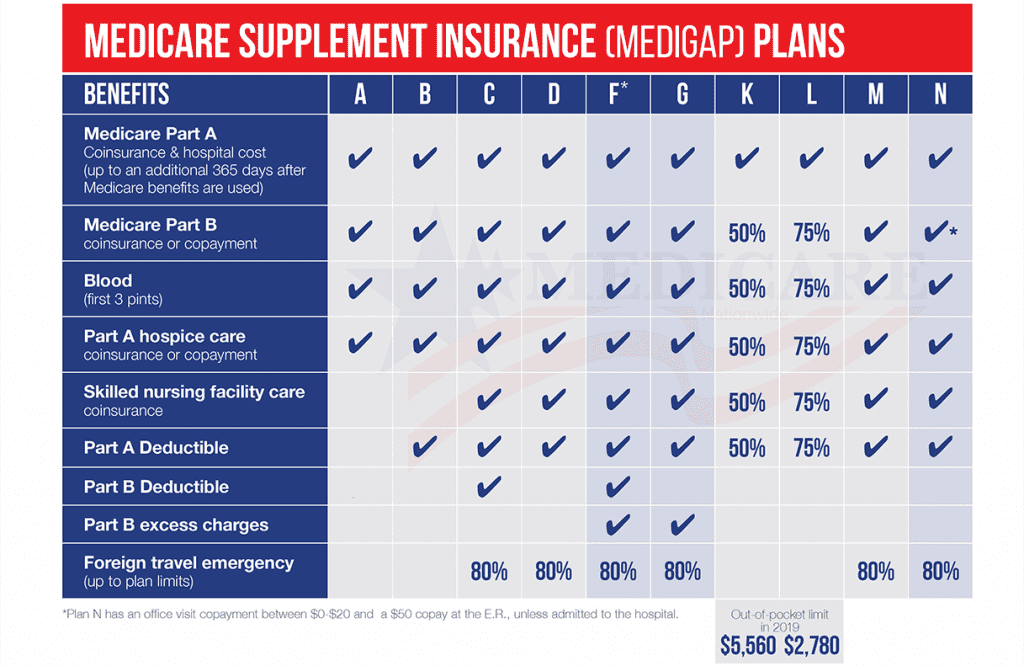

Each Medigap plan is labeled with one of 10 letters A B C D F G K L M and N and plans of the same letter offer the same benefits. The short answer for how much does Plan G cost is it depends on where you live how old you are and what gender you are. California Plan F premiums have a difference of 75 from the lowest to the highest priced plan.

Original Medicare and Medicare Supplements dont cover prescription drugs. Or submit an online rate form to see rates in your area now. Heres a chart to compare Medigap plans is available.

Most Popular Medicare Supplement Plans in California Like many other states California residents prefer Medigap Plan F to all of the other available plans. In most areas of the country Plan G prices start at. Plan F is the most popular Medigap option in California with 373889 enrollees in 2017 according to AHIP.

In California you have access to the same 10 standardized Medigap plans available in 47 states all but Massachusetts Minnesota and Wisconsin which have different types of Medigap plans. When you enroll youll be signing up for both parts A and B. The birthday rule allows California Medicare beneficiaries to change Medicare Supplement Insurance Medigap plans around their birthday every year.

California Medigap Plans Like in most states California offers the ten federally standardized Medigap Plans. Any California resident who is 65 years of age can enroll in one of the many Medicare plans in California. Certain companies increase the premium each year.

Plan F covers every single gap in Medicare coverage and all seniors have to do to protect themselves is pay one affordable monthly premium. The CDI assists consumers in resolving complaints and disputes concerning premium rates claims handling and many other problems. Blue Cross Blue Shield BCBS companies offer a number of discount programs for Medicare Supplement Plan G.

How to Compare Medicare Medigap Plans for 2021. Medicare Supplement insurance also called Medigap helps senior and disabled California residents pay for certain Medicare co. Californians can change their Medigap plan 30 days before their birthday and up to 30 days after their birthday giving beneficiaries a 61-day window.

12 Zeilen For Plans K and L after you meet your out-of-pocket yearly limit and your yearly. Others increase the premium every 4 years based. The California Department of Insurance CDI regulates Medicare Supplement policies underwritten by licensed insurance companies.

8 Zeilen Medigap Plan A. The lowest Plan F premium is 14800. If so you may want to enhance your benefits with a California Medigap plan.

The below Medicare Advantage plans are rated 45 out of 5 stars in California.