Plans to Fit Every Small Business Budget When you partner with Blue Cross Blue Shield of Michigan youre selecting the strongest network of providers in Michigan. Blue Cross Blue Shield of Texas - Health Insurance Texas.

Http Www Bluecrossnc Com Providers Blue Medicare Providers Policies And Responsibilities Specialty Networks

Selecting the Right Plan.

Bcbs employer plans. Blue Cross Blue Shield of Illinois - Health Insurance Illinois. Disability insurance from Equitable. Whether your organization is a large multi-national corporation or a small business with just a few employees we have a plan that works for your company.

Head-to-toe coverage for your employees We work with you to make sure your employees are covered with best-in-class insurance plans. Blue Shield of California welcomes you. Life insurance provides an answer to that question.

Find Blue Shield health dental vision and life plans total health programs tax-advantaged accounts and more for Small Midsize and Large employer groups. These are also commonly referred to as group plans. Blue Cross Blue Shield of Oklahoma - Health Insurance Oklahoma.

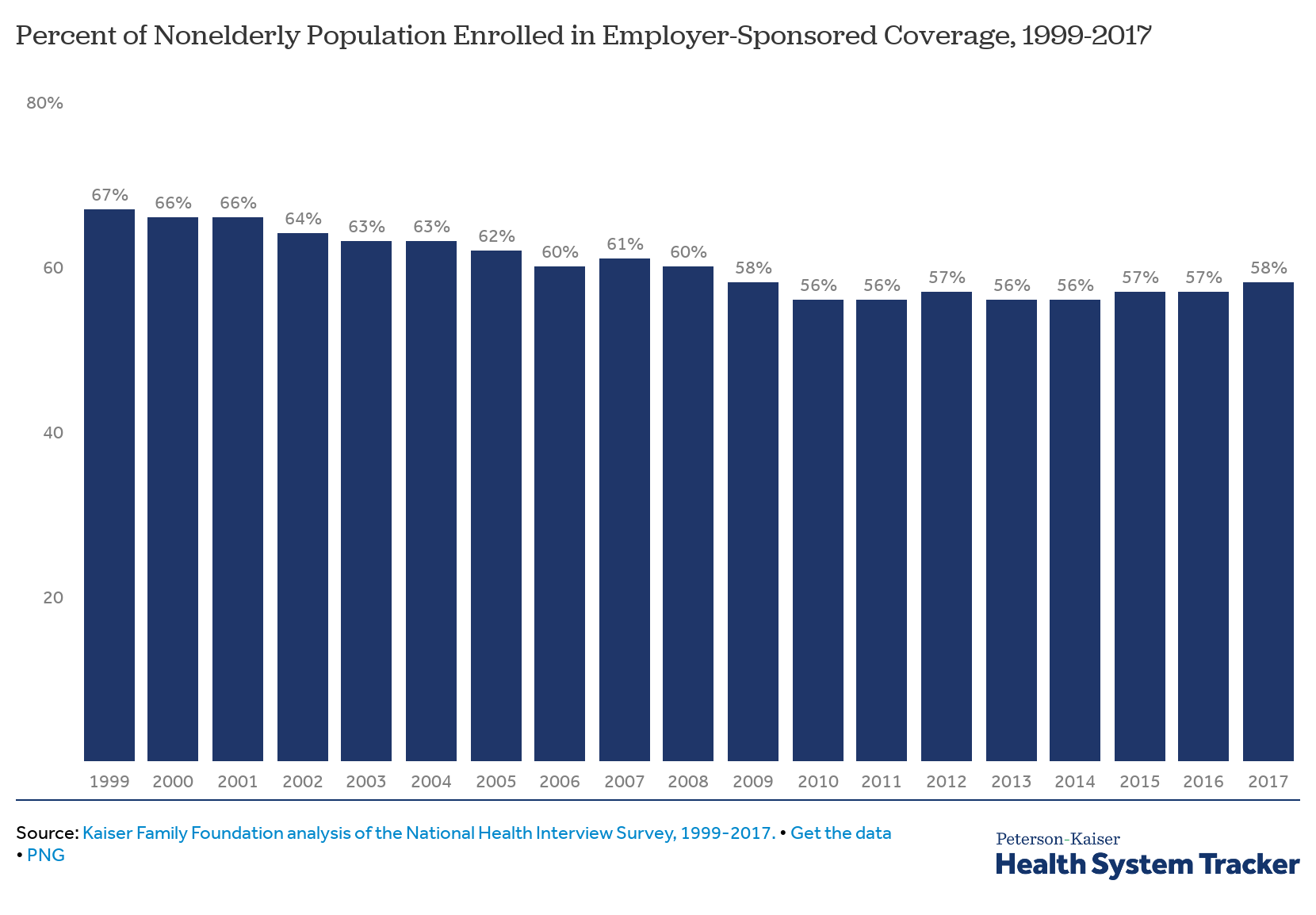

Critical Illness insurance from Equitable. Plus the largest PPO network and our custom management services make BCBSOK your best choice. Employer provided insurance is a health coverage policy selected and purchased by your employer and offered to eligible employees and any dependents.

Small employer plans 2-50 employees are generally fully insured and some large employer plans over 50 employees are fully insured. Interested in BCBS FEP. Federal Employee for More Than 1 Year Wed suggest starting in one of these areas.

Accident insurance from Equitable. We offer our employees the following options for life insurance coverage. Im an Employer Find Coverage The my Blue Group Agent Member Pharmacy and Provider portals will be unavailable Saturday May 15th from 600 PM until 900 PM.

Coverage programs and services available can vary depending on the plan. Your employer will typically share the cost of your premium with you. Our medical pharmacy dental vision and wellness plans all work together.

Employers - Blue Cross Blue Shield of Oklahoma. For fully insured plans the insurance company pays for the members health care claims and sets the plan benefits. Choose from a variety of affordable group health plans to fit the needs of your employees and your business.

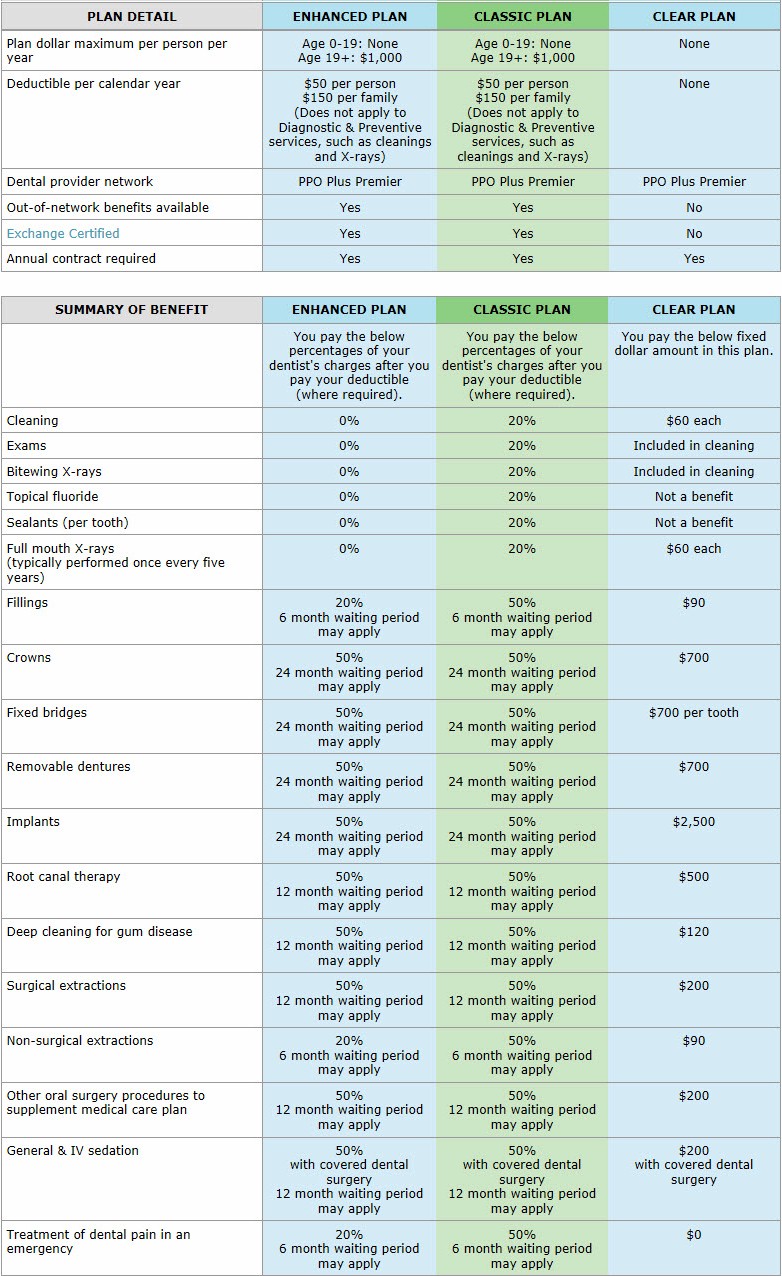

These include dental and vision plans as well as a prescription drug program. Who will protect and support your family if you are gone. Blue Cross Blue Shield of Arizona has teamed up with industry-leading insurance providers to provide specialty solutions.

Life insurance from Equitable. From a variety of employer offered insurance options to several member-based association and trade plans youll find the best solution for your group. BCBSA offers a variety of medical plans to meet our employees needs and budgets.

Take advantage of our low-cost premium plans 0 copay for preventive services and coverage that opens doors in all 50 states. Find the ideal health insurance plan life insurance and disability product for any business. KNOWLEDGE CENTER Explore this hub for Blue Shield news articles and reference information about health care and insurance industry topics of interest especially for California employers.

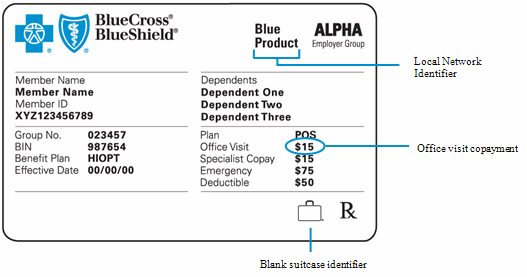

Which means you and your employees have one card and one team thats here for all of your coverage. Whats New in Health Care. Blue Cross Blue Shield of Massachusetts benefit solutions include long-term strategies for reducing the cost of care and robust wellness programs designed to help your employees get healthier.

BlueCross BlueShield of Western New York offers a variety of small group plans to best fit the needs of your clients. Apply for individual or family medical dental and life insurance plans. Explore Our Plans Compare Our Plans Side-by-Side Get a Plan Recommendation See If Your Doctor is in Our Network.