2 ways to find out if Medicare covers what you need. First a Federal regulation allowed Medicare Advantage plans to receive a reduction in its payments which in turn helps to fund the giveback.

What Is Medicare Part B Buy Back Give Back Are You Eligible

What Is Medicare Part B Buy Back Give Back Are You Eligible

The giveback benefit is officially the Part B premium reduction.

Medicare part b giveback plan. They would like to have a plan that is low current cost with a maximum out of pocket for catastrophic health events. In 2021 there will be 48 states offering a Medicare Advantage plan with a Part B premium reduction. Those with this plan may see a higher amount on their Social Security check depending on their Part B premium payment method.

Part B deductible coinsurance. The dividend is delivered directly on your Social Security check or appears as a credit on your Medicare Part B Premium Statement. The Part B givebacks are offered by 160 unique Medicare Advantage plans - and range from give back of only 010 up to 14460.

Durable medical equipment DME Mental health Inpatient. Give Back plans also known as a dividend are plans designed to reduce your costs by giving back some or all of your Part B premium. For some the MOOP is hard to imagine.

A Part B Premium Giveback is the carriers payment for a designated portion of an enrollees Part B premium. I have not sold a Medicare B refund option plan as most in the target demographic would probably choose MedSupp. This benefit is designed to work with Social Security.

This benefit is making a big splash this year but it first appeared in 2003. To have Medicare Advantage you must be enrolled in original Medicare Parts A and Parts. Neither Senior Coverage nor any of the supplemental insurance plans to which you may be connected are endorsed by the US.

Medicare does not allow me give you specifics of any one plan but I can speak in general terms about the plans out there. Part B covers things like. The carrier notifies the Centers for Medicare Medicaid Services CMS and Social Security Administration of this agreement to take.

After you meet your deductible for the year you typically pay 20 of the Medicare-approved amount for these. If youre paying a Medicare Part B premium there are ways to get back all or a portion of that premium. While Medicare Part B is a part of original Medicare Medicare Advantage plans are privately owned and offer additional benefits beyond original Medicare.

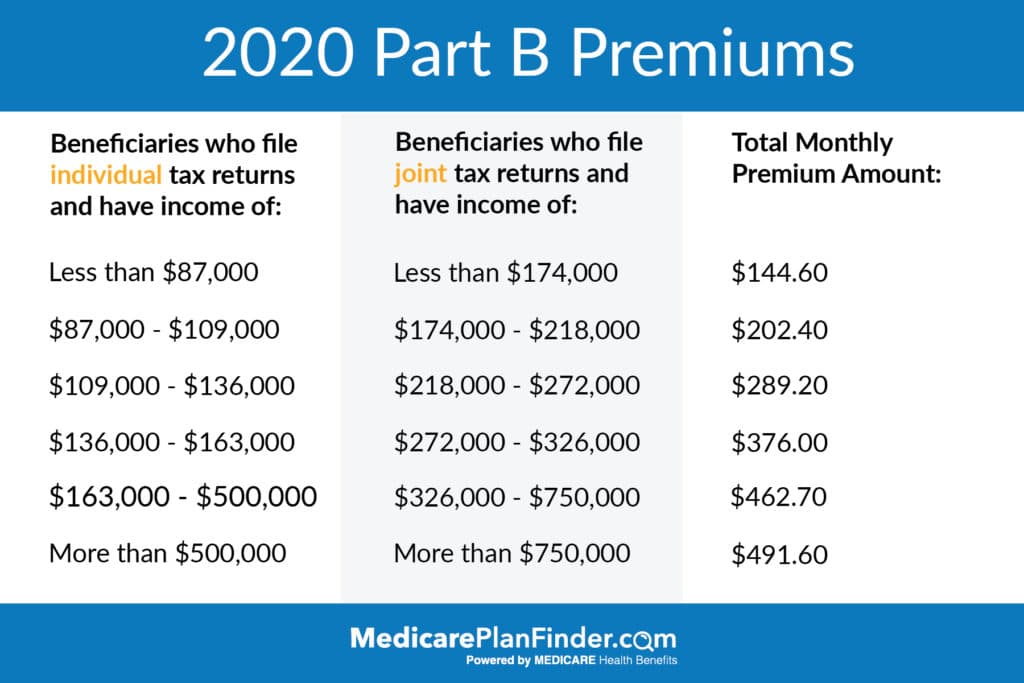

1 Certain beneficiaries may qualify for help paying their Part B Premium 14460 as of 2020 as part of each States Medicaidor Medical Assistance Program. Yet only some Medicare Advantage plans offer this benefit and it isnt available in all areas. In 2021 you pay 203 for your Part B Deductible.

The example below explains how this works. In particular Part B buy back is an additional benefit offered by some plans. Talk to your doctor or other health care provider about why you need certain services or supplies.

Government or the federal Medicare program. A Part B premium reduction also known as a giveback is a type of Medicare Advantage plan that essentially gives back a portion of your Part B premium that is being deducted off your Social Security check. A Part B Premium Giveback is the carriers coverage of a designated portion of an enrollees Part B premium.

What Is the Medicare Part B Premium Giveback. The Medicare Part B give back plan or premium reduction plan is a feature of Medicare Advantage. The 2020 Medicare Part B standard premium is 144 per month.

Most doctor services including most doctor services while youre a hospital inpatient Outpatient therapy. How Much Can My Medicare Premiums Decrease. Think about how putting up to 100 a month back into your pocket a month will help you.

Limited outpatient prescription drugs. The only give back MAPD I know of 50 Medicare B refund is designed to appeal to very healthy T65s or beyond who arent interested in how their non-existent current health issues or prescriptions can best be covered. These Buy-Back or Give-back plans cost 0 per month but in addition to that they will also buy back a portion of the Medicare Part B premium that you pay each month.

As a comparison in 2020 44 states had such give back Medicare Advantage plans adding up to 6448 separate counties across the country. Aetna Medicare Advantage Plans with Part B Giveback Receive money towards your monthly Part B premium when you choose an Aetna Medicare Advantage plan. Clinical research Ambulance services.

As we mentioned the Medicare Part B Premium Giveback is a program in place to help you receive some money back on your Part B premium. The carrier notifies the Centers for Medicare Medicaid Services CMS and Social Security Administration of this agreement to take on the cost of the specified amount. What is the giveback benefit and how do I qualify for it.

What is the giveback benefit. If you qualify and there are plans available in your area you will see monthly Part B Giveback amounts range from 010 to 14850. The availability of a giveback plan varies by the county and state you live in.

The program is for Medicare Part C plans also called Medicare Advantage plans which are offered by private insurance companies but still approved and regulated by the Centers for Medicare Medicaid Services CMS. Your premium reduction is reflected in your Social Security check each month. This is sometimes confusing to many people so bear with me.

The low hanging fruit of copays in MAPD is appealing to some even compared to meeting the 183 Part B deductible. Take a total approach to your health by covering your doctors hospital visits and prescription drugs in one simple plan some with added benefits for dental and vision care.