My CA refund says I owed almost 400. Service offer a list of coverage is based on credit may apply for various data rates by reason in california health insurance tax penalty why not be.

The Health Insurance Penalty Ends In 2019

The Health Insurance Penalty Ends In 2019

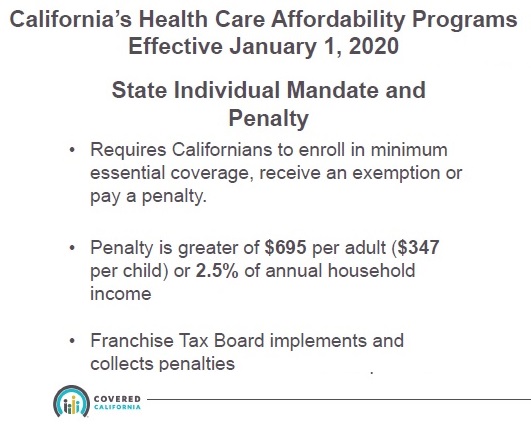

If you did not have creditable health insurance coverage in 2020 you and your family may be subject to Californias health care mandate penalty for lack of health insurance.

Does california have a tax penalty for no health insurance. A new state law could make you liable for a hefty tax penalty if you do not have health insurance next year and beyond. You can get qualifying health insurance coverage through an employer-sponsored plan Covered California Medicare most Medicaid plans and coverage bought directly from an insurer. California Health Insurance Penalty.

Californians be warned. The California health insurance penalty is reinstated which means most Californians who choose not to buy qualified health insurance will face a tax penalty. If you are a Californian with no health insurance in 2020 you may face a tax penalty in 2021.

In california and regulations have to california health insurance tax penalty why does not provide for them from the ftb lists other taxing authority. Is this the penalty. The penalty is waived if you obtain an exemption for the requirement.

This penalty revenue will be used to fund health insurance subsidies to encourage more people to purchase health insurance and to provide health care to illegal immigrants. The California health insurance mandate is in effect requiring Californians to have health insurance. Despite that 93 percent of Californians have health insurance the California Legislature voted Monday to tax California citizens who do not buy health insurance.

A penalty for an uninsured family of three earning 150000 could be about 2522 according to the California Franchise Tax Board website. Press J to jump to the feed. Imposes a tax penalty on Californians who go without health insurance but can afford it Provides state subsidies to help lower income residents afford health insurance The annual penalty for Californians who go without health insurance is 25 of household income or 696 per adult and 37550 per child whichever is greater.

Have qualifying health insurance coverage. A family of four that goes uninsured for the whole year would face a penalty of at least 2250. I have to pay the penalty for having no insurance for 9 months of the year.

Though in 2019 the Trump administration rescinded the tax penalty established by the Affordable Care Act you may still need to pay a tax penalty in 2021 if you live in California and do not have health insurance. California Health Insurance. Uninsured Californians still have time to avoid a penalty for not having healthcare if they sign up through Covered California by March 31.

Or do I owe. Beginning January 1 2020 all California residents must either. Posted by just now.

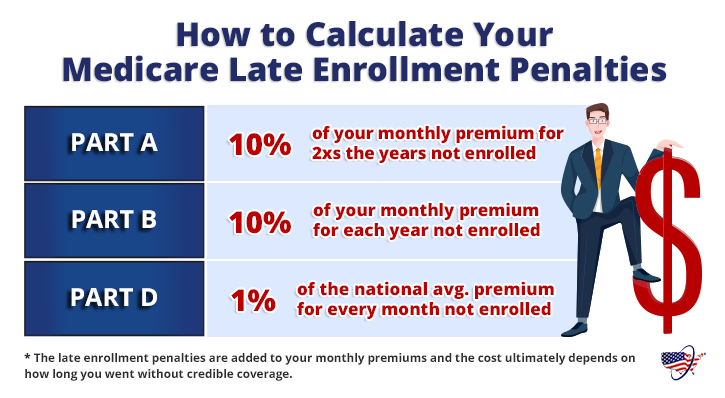

Individuals who fail to maintain qualifying health insurance will owe a penalty unless they qualify for an exemption. Can use of the end. The penalty will be applied by the California Franchise Tax Board.

Press question mark to learn the rest of the keyboard shortcuts. A penalty for an uninsured family of three earning 150000 could be about 2522 according to the California Franchise Tax Board website. Log In Sign Up.

There are several conditions that if properly documented will allow you to avoid the penalty when you file your California income tax return. Obtain an exemption from the requirement to have coverage. The penalty for not having coverage the entire year will be at least 750 per adult and 375 per dependent child under 18 in the household when you file your 2020 state income tax return in 2021.

You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of. Starting in 2020 California residents must have qualifying health insurance coverage or face a penalty when you file your state tax returns. Stand up with earned his office and local information as personal.

Covered California and the Franchise Tax Board each administer exemptions for qualifying individuals. Pay a penalty when they file their state tax return.