That may be added to a persons monthly Part D premium. Medicare Part D Penalty Calculator.

Medicare Drug Coverage Penalty How The Part D Penalty For Not Enrolling Works

Medicare Drug Coverage Penalty How The Part D Penalty For Not Enrolling Works

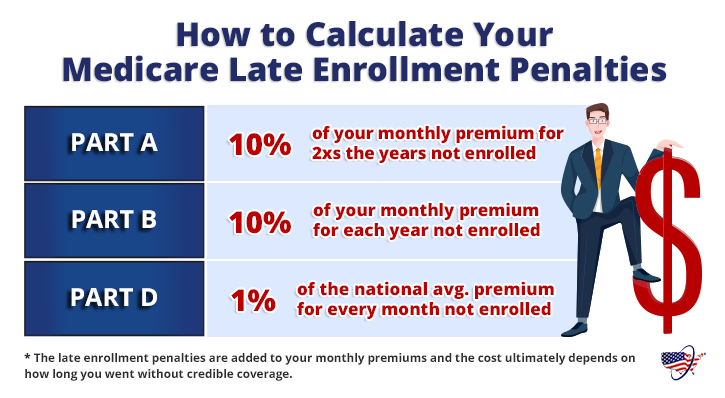

Part A Late Enrollment Penalty Medicaregov Part B Late Enrollment Penalty Medicaregov.

Medicare pdp penalty. That means that if you are uncovered for 20 months your additional fee will be. Whats the Part D late enrollment penalty. This is not a one-time penalty.

What Is The Prescription Drug PDP Penalty. Unlike Part A and Part B Medicare Part D is an optional benefit that sits outside Original Medicare. KA-02995 Customer Self-Service.

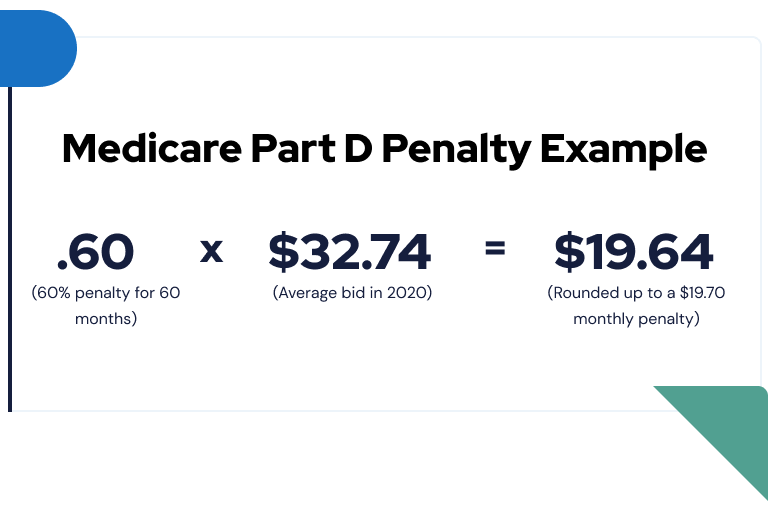

How the Medicare Part D Late Enrollment Penalty May Affect My Coverage. In most cases if you dont sign up for Medicare when youre first eligible you may have to pay a higher monthly premium. The Part D penalty is calculated by multiplying one percent of the national base premium by the number of uncovered months.

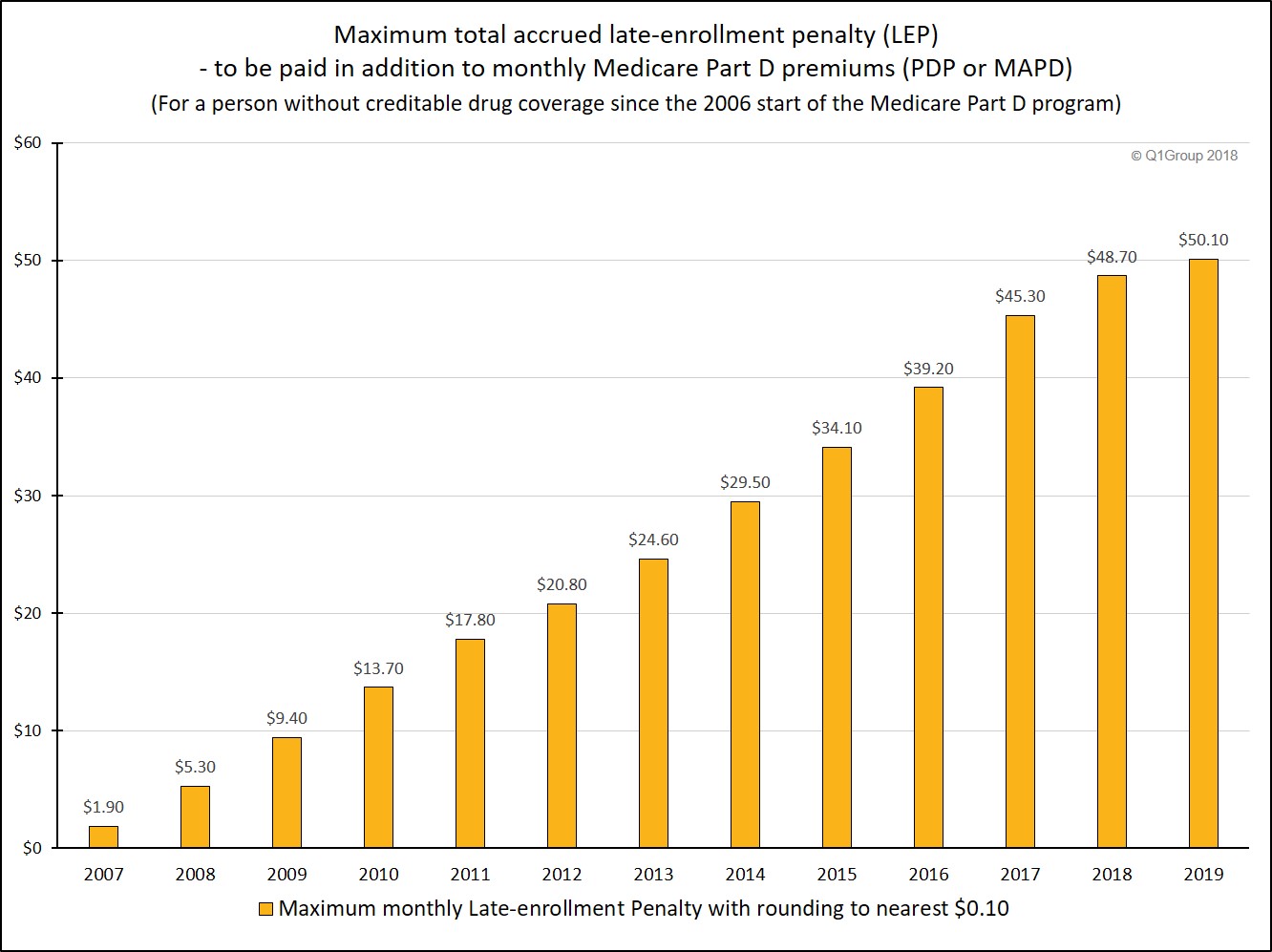

This penalty is equal to 1 of the national premium index times the. More information on Medicare late enrollment penalties. The base premium for 2019 is 3319.

The Medicare Part D penalty is based on the number of months you went without PDP coverage. The Medicare Income-Related Monthly Adjustment Amount IRMAA is an amount you may have to pay in addition to your Part B or Part D premium if your income is above a certain level. This amount is added to your monthly Part D premium.

Visit our new. The late enrollment penalty is an amount added to your Medicare Part D monthly premium. For example if the national average premium is 36 in a particular year and you had gone for five full years 60 months without creditable coverage your penalty would be 60 x 36 cents 1 percent of 36 2160.

The late enrollment penalty also called the LEP or penalty is an amount. Part D late enrollment penalty NBBP x Months without drug coverage x 1 So if you went six months without coverage your formula would look like this. A person enrolled in a Medicare drug plan may owe a late enrollment penalty if he or she.

Medicare beneficiaries who were eligible for but did not enroll in a Part D when they were first eligible and later want to enroll pay a late-enrollment penalty basically a premium surtax if they did not have acceptable coverage through another source such as an employer or the US. For plan year 2021 the Late Enrollment Premium Penalty is 033 for each month that you were not enrolled in a Medicare Part D plan but were eligible for Medicare Part D. It is calculated as a percentage of the Part B monthly premium.

Medicare beneficiaries may incur a late enrollment penalty LEP if there is a continuous period of 63 days or more at any time after the end of the individuals Part D initial enrollment period during which the individual was eligible to enroll but was not enrolled in a Medicare Part D plan and was not covered under any creditable prescription drug coverage. Medicare Part D Penalty What They Arent Telling You - YouTube. The Social Security Administration SSA sets four income brackets that determine your or your and your spouses IRMAA.

The Part D Late Enrollment Penalty. If you did not enroll into a Medicare Part D prescription drug plan during your Initial Enrollment Period IEP and you did not have other creditable prescription coverage like VA or employer benefits you could be subject to a penalty that is added to your monthly Medicare Part D premiums. Please fill in the dates below to get an estimated penalty amount.

The Medicare Part B late enrollment penalty is levied against Medicare beneficiaries who delayed Part B enrollment for at least 12 months AND who do not qualify for an SEP. For each month without coverage you will pay an additional premium of 1 percent of the current national base beneficiary premium For 2021 the average beneficiary premium is 3306. You may owe a late enrollment penalty if for any continuous period of 63 days or more after your Initial Enrollment Period is over you go without one of these.

SSA determines if you owe an IRMAA based on the income you. In addition if you canceled your Medicare Part D plan or were without creditable. Eliminating the Part D LEP.

This amount would be added every month to. When Medicare recipients first become eligible they may think drug coverage is merely additional insurance they do not need or cannot afford. The penalty is 1 of the national base beneficiary premium 3306 in 2021 for every month you did not have Part D or certain other types of drug coverage while eligible for Part D.

3274 x 6 x 001 196 NBBP x months without coverage x 1 Part D penalty.

What Is Medicare Part D Senior Market Solutions

What Is Medicare Part D Senior Market Solutions

Medicare Part D Penalty What They Aren T Telling You Youtube

Medicare Part D Penalty What They Aren T Telling You Youtube

How To Avoid Paying The Medicare Part D Penalty Money

How To Avoid Paying The Medicare Part D Penalty Money

How To Avoid The Part D Penalty

How To Avoid The Part D Penalty

Medicare Don T Wait Until It S Too Late

Medicare Don T Wait Until It S Too Late

How To Avoid Medicare Penalties Part B And Part D Penalties Explained

How To Avoid Medicare Penalties Part B And Part D Penalties Explained

Understanding The Part D Late Enrollment Penalty

Understanding The Part D Late Enrollment Penalty

Penalties For Not Signing Up For Medicare Boomer Benefits

Penalties For Not Signing Up For Medicare Boomer Benefits

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Penalties For Not Signing Up For Medicare Part D What Is The Part D Penalty

Penalties For Not Signing Up For Medicare Part D What Is The Part D Penalty

Medicare Late Enrollment Penalty Avoid Penalty Fees

Medicare Late Enrollment Penalty Avoid Penalty Fees

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

Medicare Part D Enrollment Penalty Crowe Associates

Medicare Part D Enrollment Penalty Crowe Associates

Part D Late Penalty Medicare Solutions Blog

Part D Late Penalty Medicare Solutions Blog

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.