People who dont have health insurance from work can buy health coverage under the Affordable Care Act also known as Obamacare. What is the maximum income for ObamaCare.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

The household has a simple structure for assessing income.

What is the cutoff income for obamacare. Premium Tax Credits to lower your premiums. For 2021 those making between 12760-51040 as an individual or 26200-104800 as a. With the recent passage of the ARPA there is now NO INCOME LIMIT for ACA tax credits.

More people than ever before qualify for help paying for health coverage even those who werent eligible in the past. Estimating your expected household income for 2021. Your income puts you under the poverty level but the ACA Obamacare has a special provision allowing recent immigrants to get premium subsidies even if their income is under the poverty level.

The discount on your monthly health insurance payment is also known as a premium tax credit. Obamacare uses an income unit called a household. The assistance types available under the Affordable Care Act ObamaCare include.

You can also get insurance other ways through a private insurance company an online insurance seller or an agentbroker. 4 What if you want a more expensive plan. It is important to mention that Alaska and Hawaii are unique states and they have separate charts of their own.

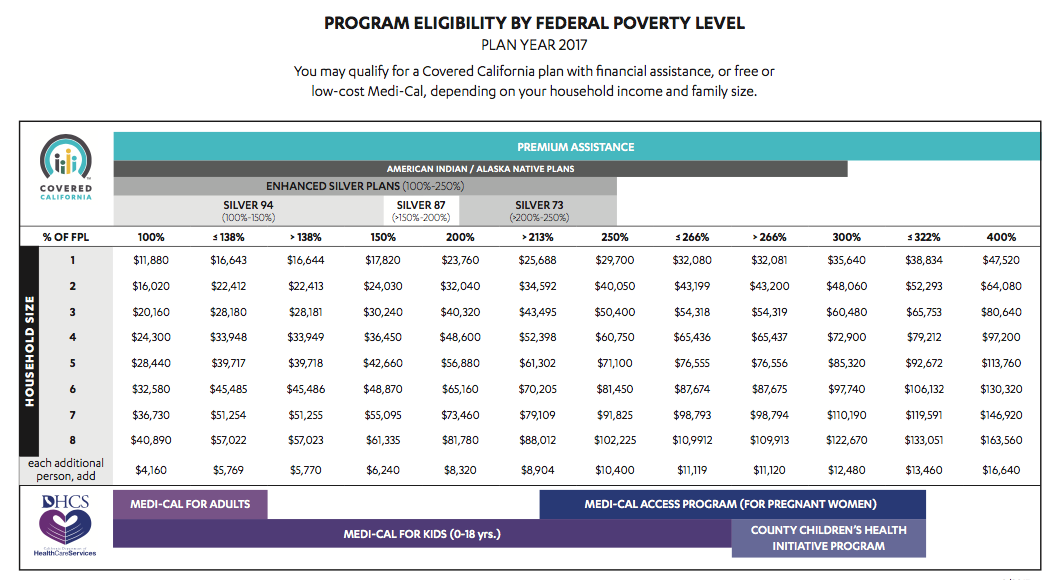

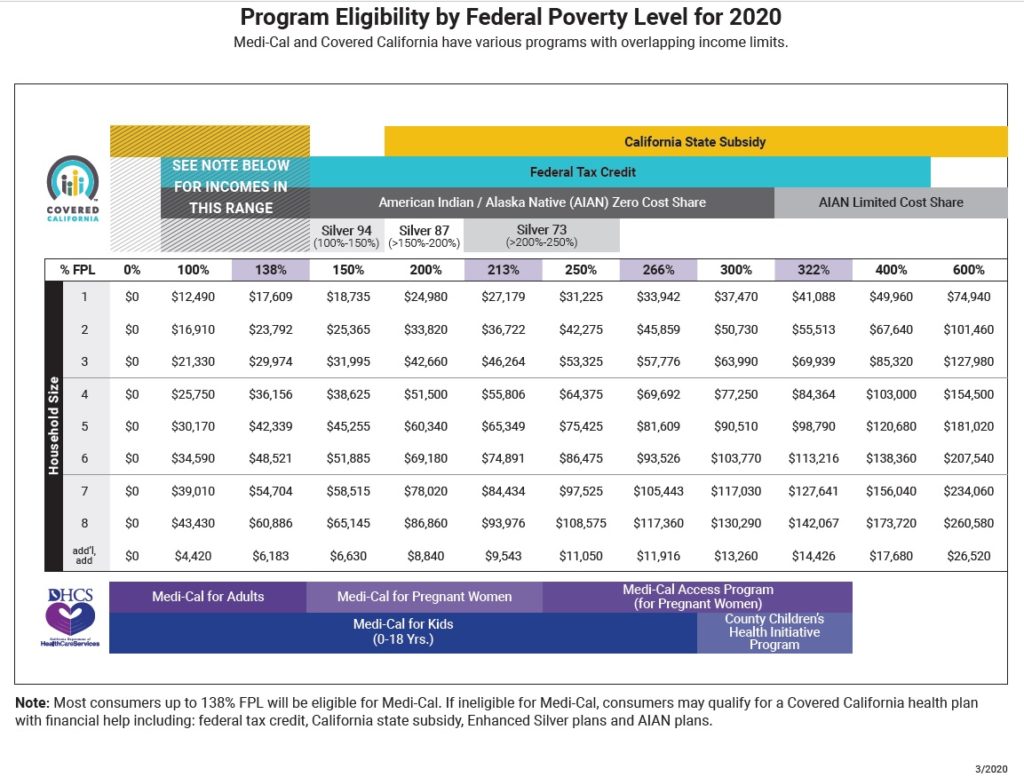

If your income is 100 higher and no more than 400 of the Federal Poverty Level then you are eligible for Obamacare subsidies. Cost Sharing Reduction CSR. So if the plan is 5000 your subsidy is 35244.

For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare. Log in to apply. But you must also not have access to Medicaid or qualified employer-based health coverage.

Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to. So based on those numbers your income would be too high to qualify for Medicaid barely. You can be worth millions of dollars and still receive Obamacare subsidies if your income is below 45000 per individual or 95000 for a family of four for example.

If your household income falls within these levels youll qualify for the credit. For example if youre single and have no more than 48560 in income in 2019 youll qualify for a health care credit. The household concept is a tax family group that consists of the people who file a family form and cost assistance benefits go on the basis of a coverage family which includes those who share a policy.

The average subsidy amount in 2020 was 492month which covered the large majority of the average 576month premium note that both of these amounts are lower than they were in 2019. You must make your best estimate so you qualify for the right amount of savings. Use your new coverage.

Marketplace savings are based on your expected household income for the year you want coverage not last years income. Your subsidy is the cost of the plan minus 464746. Those with incomes over the set 400 FPL income limit may now qualify for lower premiums based on their location age and income.

The cut off for ACA subsidies is 400 of the FPL which for 2019 is 48560 for an individual and 100400 for a family of 4. Thats because Medicaid which is available in most states to people with income below the poverty level is not available to recent immigrants who have been in the US for less than five years. You can enroll in Marketplace health coverage through August 15 due to the coronavirus disease 2019 COVID-19 emergency.

A family of four can earn as much as 100400 and qualify. Again subsidies have increased for 2021 and will remain larger in 2022 due to the American Rescue Plan. This stiff cut off is responsible for the subsidy cliff.

You can probably start with your households adjusted gross income and update it for expected changes. In 2021 Obamacare subsidies begin if your health plan cost is greater than 85 of your household income towards the cost of the benchmark plan or a less expensive plan the benchmark plan is the second-lowest silver plan. Obamacare promises you wont pay more than 978 of your income a year or 464746 for the second-lowest Silver plan.

The premiums are made affordable by a premium subsidy in the form of a tax credit calculated off your income relative to the Federal Poverty. To qualify for a subsidy your household income must be between 100 and 400 of the FPL. For each household family with more than 8 people 4320 per person should be added to the minimum and maximum limit.

For those with incomes between 100 400 of the Federal Poverty Level FPL. There is currently no phase out for subsidies for those making just above 400 of. Whose income to include in your estimate.

2020 2021 2022 Federal Poverty Levels FPL For ACA Health Insurance. You will be asked about your current monthly income and then about your yearly income. If youre not eligible for lower costs on a health plan because your income is too high you can still buy health coverage through the Health Insurance Marketplace.

The upper cutoff to receive subsidies for 2021 plans is 51040 for a single person 68960 for a family of two 86880 for a family of three 104800 for a family of four 122720 for a family. If I did my math right your income is 22464 and the cutoff for Medicaid under the ACA is 138 of the Federal Poverty Line which is currently 22108 for a family of two.