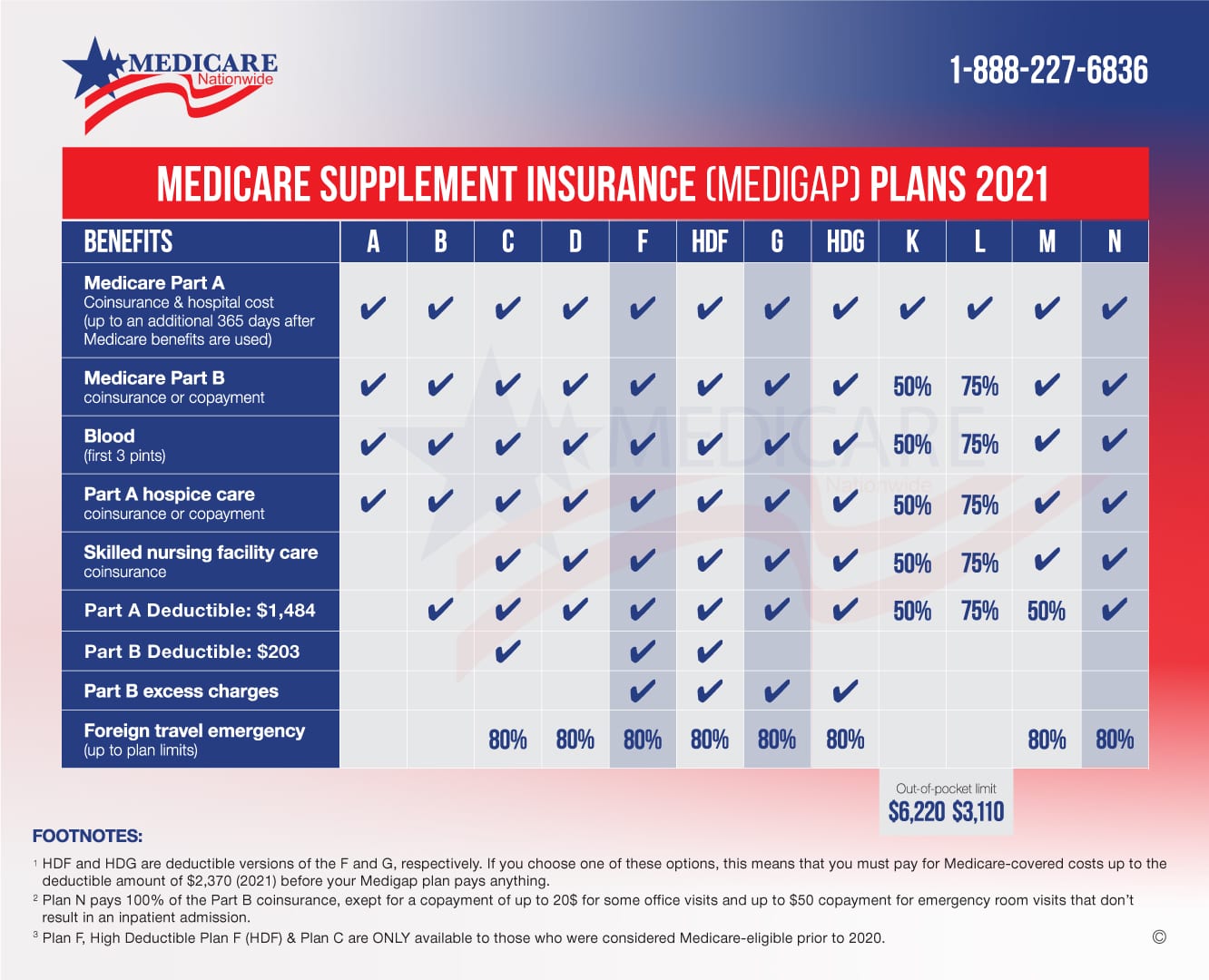

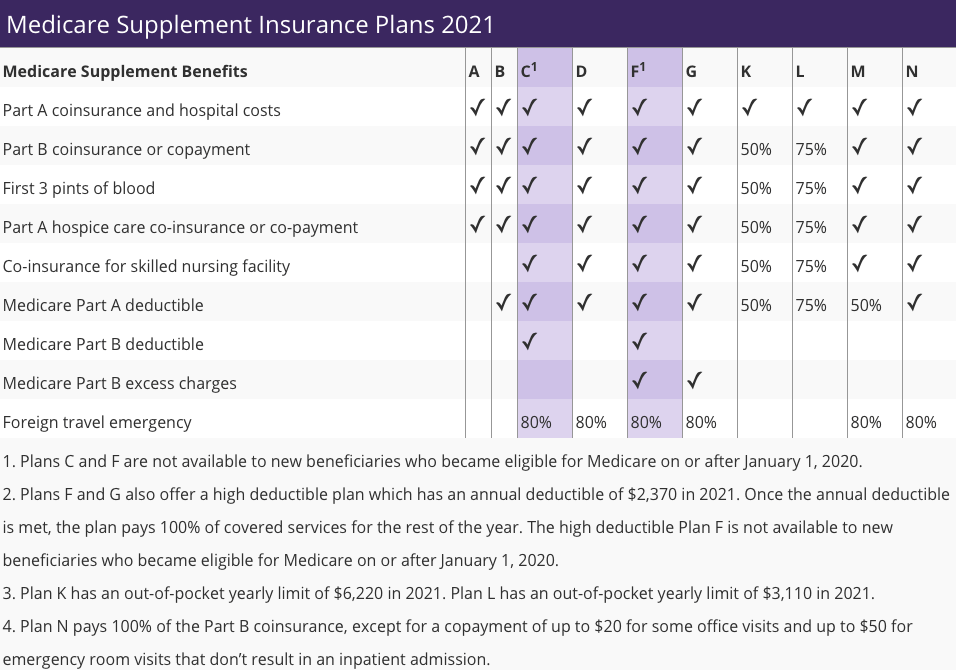

Medicare Plan G coverage is very similar to Plan F. Although Plan G does not cover the Part B deductible 198 in 2020 the premium savings could offset the cost of the yearly deductible.

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Plan F and Plan G both charge monthly premiums.

Medicare part g vs part f. Plan G does not cover the Part B deductible the Part B deductible for 2018 is 183. Is Medicare Plan G better than Plan F. Plans F and G also offer a high-deductible plan in some states.

In addition monthly premiums vary from policy to policy so it is always in your interest to compare multiple policies before purchasing have knowledge of What is Medicare Part G and F. Medigap Plan G offers all of the same benefits as Plan F except for the Part B deductible. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.

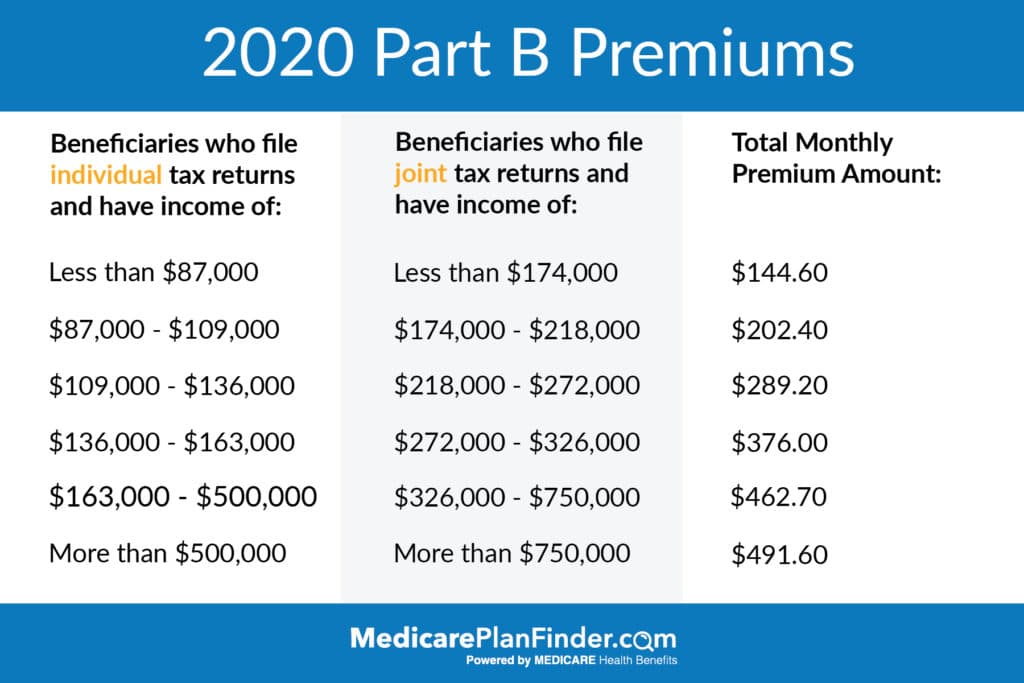

Medicare Part B excess charges. The current part B deductible cost is 203. With a standard Medicare Supplement Plan G there is a small deductible per year 203 in 2021 and 203 is.

However once the Part B deductible for Plan G is paid for you essentially have Plan F. However while Plan G is available to any new entrant to Medicare Plan F policies cannot be obtained by those new to Medicare after January 1 st 2020. Plan F covers the Medicare Part B deductible and Plan G doesnt.

That difference is that the Plan G does not cover the annual Part B deductible see the Medicare supplement plan chart on our comparison page. Part B of Medicare is the part that is paid to physicians and outpatient services for your care. However this could not be the case in another area.

They also cover 80 of the costs of emergency care when traveling abroad. The only difference in coverage between the two is that Plan G doesnt cover the Medicare Part B deductible. PLEASE see the Plan N Update critical.

16 rânduri The decision is really not complicated. This means Medigap Plan F pays the 203 while Plan G does. It pays for your hospital deductible copays and coinsurance.

Medicare Supplement Plan G is almost identical to Plan F except for the Part B deductible. Most people will select Plan F or Plan G. Medicare Part A hospice care coinsurance or copays.

Example if the Plan F premium in your area is 140 but the Plan G premium is 100 you end up spending 480 more over a 12-month period in premiums with Plan F just to have the Part B deductible of 198 covered. This part is easy to answer because there is only one benefit difference between Medigap plan G and F. Plan G costs approximately 25-40 less per month.

There is only one difference between the Plan F and Plan G. Medicare Part B coinsurance or copays. Medicare Supplement Plan N Medigap Plan N covers the same benefits as Plan F except the Part B deductible and Part B excess charges.

Plan G will offer a high deductible option beginning January 1 2020. With this option you must pay for Medicare-covered costs coinsurance copayments and deductibles up to the deductible amount of 2340 in 2020 2370 in 2021 before your policy pays anything. The better option depends on the monthly premium difference between Plan G and Plan F in your area.

After that Plan G provides full coverage for all of the gaps in Medicare. Plan G may be a good option if you are new to Medicare and cant enroll in Plan F. This means that you will have to pay 183 annually before Plan G begins to cover anything.

Both plans F and G offer a high deductible version of their plans. Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. For example the average 2020 premium ranges from 160 to 210 for Plan G and 185 to 250 for Plan F for a 65-year-old Florida woman who does not use tobacco.

However Plan F covers the Medicare Part B deductible while Plan G does not. It offers great value for beneficiaries who are willing to pay a small annual deductible. The Part B deductible is a one time deductible you must play each year when you see the doctor for non-preventive visits.

Medicare Supplement Plans F and G are identical with the exception of one thing. If you select Plan G youll need to pay your Part B deductible 203 for 2021 yourself. After you pay your deductible you have no other out-of-pocket costs just like the Plan F.

Freedom from many of the payment hassles of constant copays and out-of-pocket expenses that are part of Medicare Advantage plans. Plan G coverage is similar to that of Plan F but does not cover the Medicare Part B deductible.