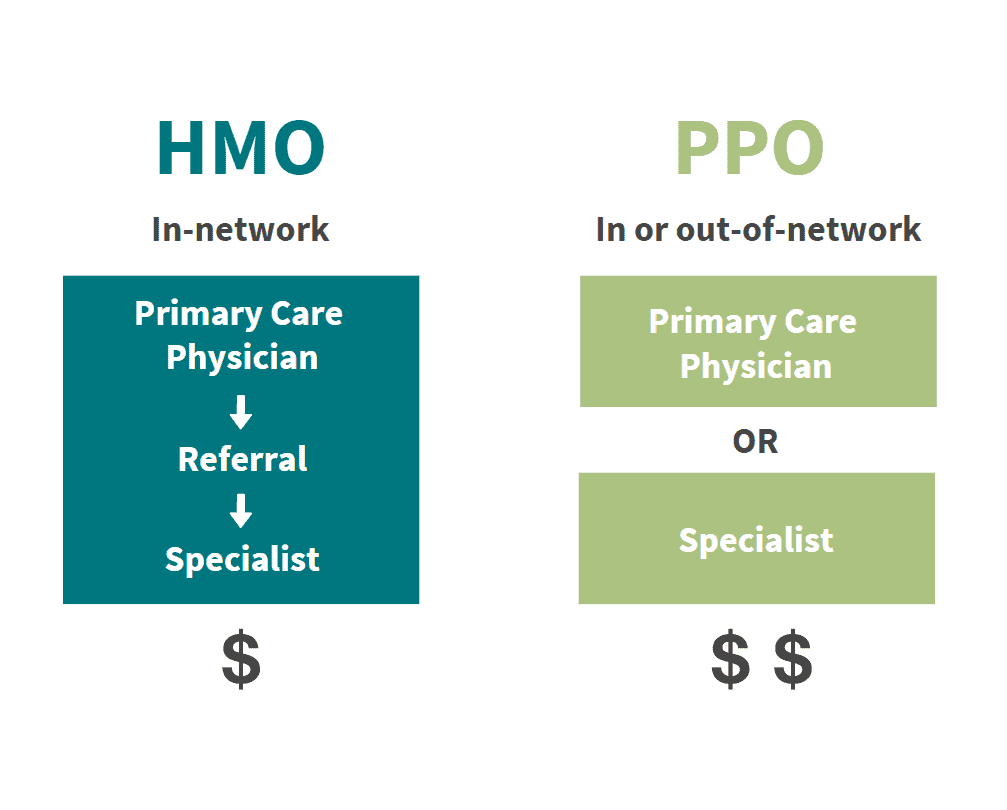

Compared to PPOs HMOs cost less. The cost of health insurance is an important differentiator between an HMO and a PPO.

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

A HMO health plan tends to be an affordable health care option as long you.

Whats the difference between an hmo and ppo. However PPOs generally offer greater flexibility in seeing specialists have larger networks than HMOs and offer some out-of. An HMO plan is a good choice if you. 7 Like HMOs many POS plans require you to have a PCP referral for all care whether its in or out-of-network.

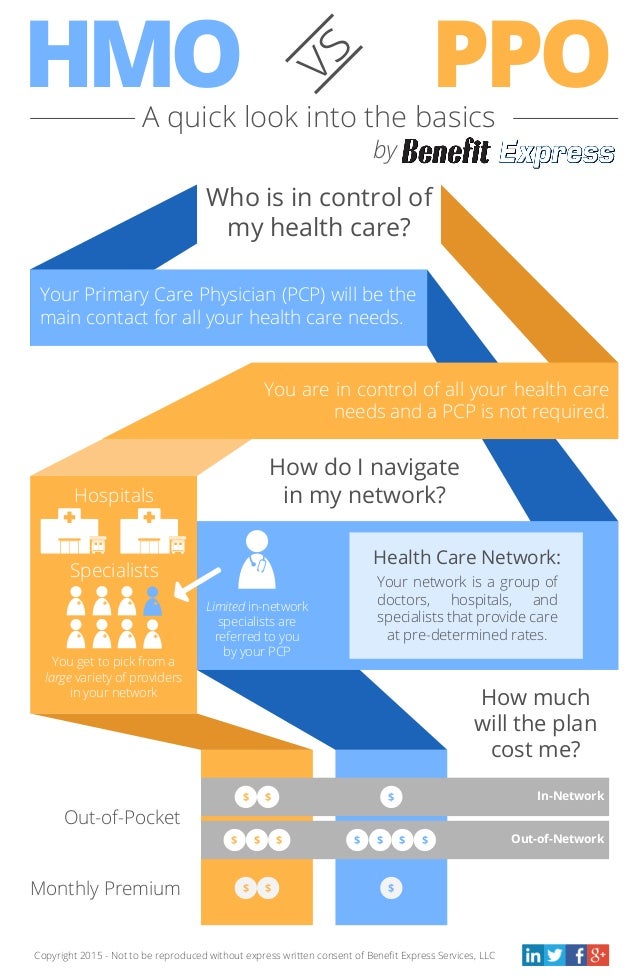

Take a quick look into the basics of what makes an HMO and PPO differentTo view or download the infographic visit httpwwwbenefitexpressinfoinfographi. An HMO offers no coverage outside of the network but patients typically enjoy lower premiums. Lets start with HMOs.

HMO plans typically have lower monthly premiums than PPO plans. However like an HMO there are no out-of. POS plans resemble HMOs but are less restrictive in that youre allowed under certain circumstances to get care out-of-network as you would with a PPO.

The difference between them is the way you interact with those networks. In 2018 the average PPO cost 3019 annually compared to an HMO which cost 2764 annually. A health maintenance organization HMO and a preferred provider organization PPO have several differences such as which doctors patients can see how much services cost and how medical records are kept.

A PPO might say it covers 60 percent out-of-network that doesnt mean the plan will pay. The major differences between an HMO and PPO plan are in terms of cost plan-network size access to specialists and coverage for out-of-network services. How can each plan benefit you and your family.

The main differences between them usually pertain to cost network size ability to see specialists and out-of-network coverage. Under HMO plans you have to pay 100 of the cost. HMO stands for health maintenance organization.

The differences besides acronyms are distinct. PPOs tend to have higher monthly premiums in exchange for the flexibility to use. Would like a central doctor who will serve as a coordinator for specialist care Are not tied to particular doctors that are outside of the HMO network.

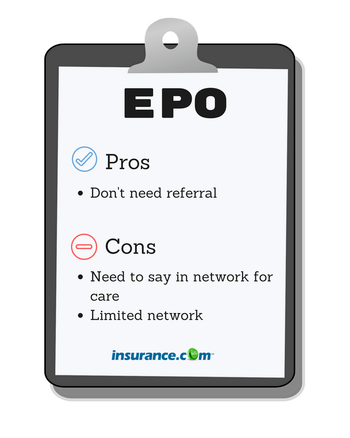

An exclusive provider organization EPO plan is situated between an HMO and PPO in terms of flexibility and costs. How much you have to pay if you see a provider who is out of network. HMOs and POS plans require a.

PPO stands for preferred provider organization. An HMO requires that patients see only doctors or hospitals on their list of providers. Whether or not you have to select a primary care physician who refers you to specialists.

HMOs and PPOs are distinct healthcare plans and networks and each provides members with quality care and benefits. As mentioned above Differences between HMO Health Maintenance Organization and PPO Preferred Provider Organization plans include network size ability to see specialists costs and out-of-network coverage. What Is The Difference Between an HMO Health Plan And a PPO Health Plan.

Individuals who are healthy with not many healthcare needs should opt for an HMO plan. Both HMO and PPO plans rely on using in-network providers. All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care.

However PPO plans offer flexibility by covering out-of-network providers at. They also have their own pros and cons. The central differences in HMO vs PPO vs POS plans are.

An HMO is a Health Maintenance Organization while PPO stands for Preferred Provider Organization. But the major differences between the two plans. With an EPO you typically dont need a referral to see a specialist which makes it more flexible than an HMO.

With a PPO the trade-off for receiving a little bit of coverage outside of your network is usually a higher monthly premium.