To be licensed in California healthcare professionals must meet minimum standards for education training and experience plus pass professional exams and criminal background checks. The bulk of the time is spent on studying for your California insurance exam.

How To Get A California Insurance License A D Banker Company

How To Get A California Insurance License A D Banker Company

How to Get Your California Insurance License 1.

California health insurance license. Choose a study package that caters to your learning style and begin preparing for your insurance license. Click on Verify a License. How long does it take to get an insurance license in California.

Producer Online Services Convenience Security at your Fingertips. Please select the link above and use either a license number or name to retrieve the license status and discipline history of an agent broker adjuster bail agent business entity or another licensee. California Insurance License Renewal.

You can verify the license of any DCA-licensed healthcare professional by going online to wwwdcacagov. The license is granted upon the successful passing of your specific states exam and allows the recipient to solicit and build a book of business of health and life insurance within that state. Search for license status information based on license number or name.

California Life and Health Licensing Examination Requirements The application process for an agent license does not require sponsorship by an insurer Candidates for an insurance license must be 18 years of age or older California residency is not required Submit fingerprints and undergo basic. Best Cheap Health Insurance in California 2021. Prelicensing courses with Kaplan give you the best chance to passour pass rates are among the highest in the industry.

Convenience Security at your Fingertips. Apply for an Insurance License Schedule Examination License Renewal Change Your Address and more. Obtain facilityprovider information via the California Health Facilities Information Database Cal Health Find Learn about new health care requirements andor guidance via All Facilities Letters.

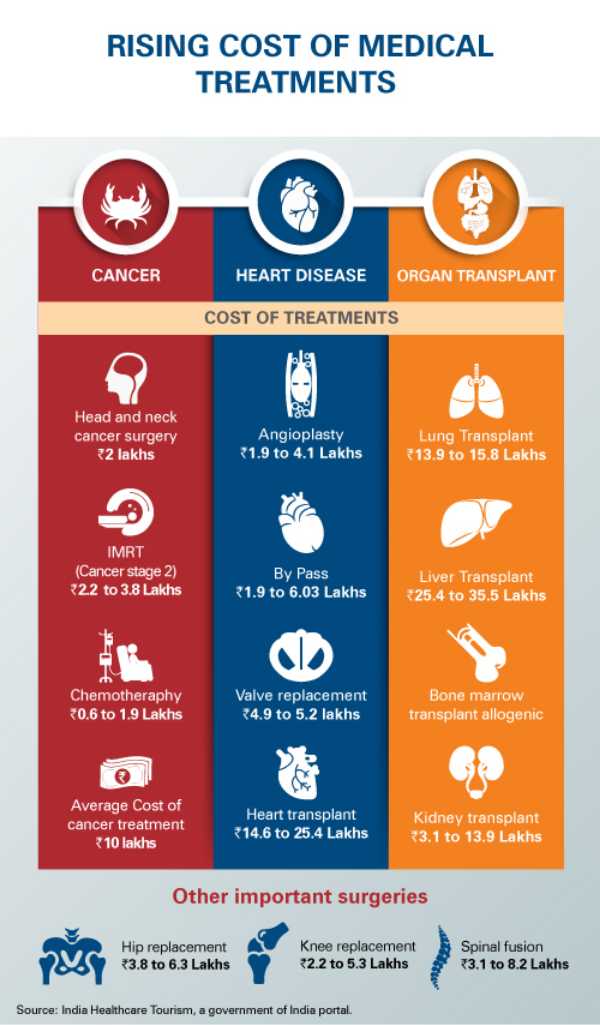

In California cheap health insurance can be purchased through the online state insurance exchange or acquired through Medicaid if your household income falls below 138 of the federal poverty level. An HHA means a private or public organization including but not limited to any partnership corporation political subdivision of the state or other government agency within the state which provides or arranges for the provision of skilled nursing services to persons in their temporary or permanent place of residence pursuant to Title 22 of the California. Life and Health Insurance License Exam Cram.

Access compliance information on State enforcement actions and penalties. In order to obtain a life and health insurance license individuals must take and successfully pass an exam that is offered by the state licensing boards. Earning your life and health insurance license is your first step to selling life andor health insurance in your respective state as an insurance agent.

A State license is required to operate as a Home Health Agency HHA in California. If you frequently use the Check a License online service after opening the application you may want to save the new Check a License link in your browser favorites. How long is the insurance license period in California.

California requires those seeking an insurance license to complete prelicensing before taking the state licensing exam. Apply for an Insurance License Schedule Examination License Renewal Change Your Address and more. California Life and Health Insurance License Course Meet Our Partner Securities Training Corporation Since 1969 Securities Training Corporation or STC has successfully helped over 1000000 candidates pass FINRA and insurance regulatory exams and launch careers.

To qualify for the California insurance license exam you must complete a pre-licensing insurance course that is certified by the California Department of Insurance CDI. If playback doesnt begin shortly try restarting your device. Access license fee reports and licensing fee schedules.

To receive a California license to become a health insurance agent or broker a person must complete a state approved insurance course pass a licensing exam be fingerprinted for a background check and have their application approved by the. Applying for a License How to apply for a license for individual resident license individual non-resident license and business entity licenses. Some people study for as little as one week and feel comfortable taking the exam.

To prepare for your licensing exam use the full-length Life Health Insurance Agent Practice Exam with. Upon passing the pre-licensing course final exam you will be awarded a Certificate of Course Completion. California Life Health Insurance Prelicensing Prepare for your California Life Health insurance license with Kaplan Financial Educations prelicensing and exam prep study options.

By Sterling Price Reviewed by licensed agent Brandy Law updated April 27 2021. In addition to obtaining a license from DHCS in accordance with California Health and Safety Code Section 11834015 all licensed adult alcoholism or drug recovery or treatment facilities will be required to obtain at least one DHCS Level of Care Designation andor at least one residential American Society of Addiction Medicine ASAM Level of Care Certification. Complete an Insurance Prelicensing Course.