To determine eligibility for subsidized health insurance that number is then multiplied by four to reflect four times the established poverty level or 45960 annually. Premier Financial Insurance is OPEN and here to help Illinois residents with new health insurance plans temporary coverage and subsidy.

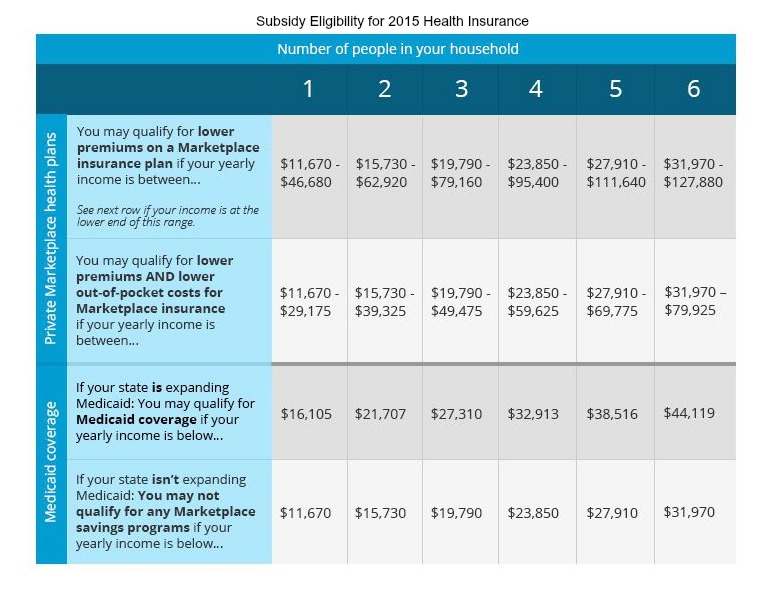

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Your unmarried partners children if they are not your dependents.

Health insurance subsidy qualifications. Eligibility for Low-Income Subsidy. For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of four. But you must also not have access to Medicaid or qualified employer-based health coverage.

The premium tax credit and the cost-sharing subsidy. They are higher in Alaska and Hawaii where the federal. There are two types of health insurance subsidies available through the Marketplace.

You qualify for subsidies if pay more than 85 of your household income toward health insurance. Your unmarried partner who doesnt need health coverage and is not your dependent. But it varies widely by income with.

Subsidy eligibility determinations are fairly simple. To qualify for a subsidy your household income must be between 100 and 400 of the FPL. It includes information on how one becomes eligible for the Low-Income Subsidy as well as useful outreach material.

Can I get a subsidy. How much health insurance costs where you live. Premium subsidies in the health insurance exchange are only available if your MAGI doesnt exceed 400 of the poverty level.

New Health Insurance Subsidy Qualifications Take Effect April 1st 2021 April 8 2021 Effective April 1st 2021 under the American Rescue Plan Act of 2021 many individuals and families who did not previously qualify for health insurance subsides on account of earning a higher income will now qualify for a healthcare subsidy which could significantly lower their. Thats about 47000 for an individual and 97000 for a family of four. 23 Families of four with a household income between 26500 and 106000 can also qualify for premium subsidies.

Learn more about who to include in your household. For a single person in 2021 thats 51040. So if an individual is making less than 45960 annually they will be able to apply for discounted coverage provided under the Affordable Care Act.

Including the right people in your household. The income limit for ACA subsidies in 2021 for individuals is between 12880 and 51520. If you already enrolled in an ACA plan and got a subsidy you can change your plan and get the added savings.

The types of assistance offered under the Affordable Care Act are. If youre an individual. Your parents who live with you but file their own tax return and are not your dependents.

To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level. For a family of four its 104800 these limits are for the continental US. Anyone else under 21 who you take care of and lives with you.

Marketplace insurance plans with premium tax credits are sometimes known as subsidized coverage too. Count yourself your spouse if youre married plus everyone youll claim as a tax dependent including those who dont need coverage. How do you know if you qualify for a premium subsidy on your ACA policy.

Find out whether you qualify for IL Medicaid or a Health Insurance subsidy under the Affordable Care Act. This tool provides a quick view of income levels that qualify for savings. If you meet these criteria youll be eligible for a subsidy on a sliding scale based on your income.

How Saving Money Might Make You Eligible for Subsidies. In a nutshell you look at your income as a percentage of the poverty level and then find where that puts you in the sliding. Well make it easy.

Examples of subsidized coverage include Medicaid and the Childrens Health Insurance Program CHIP. The main factor is your income. Prior to 2021 the rule was that households earning between 100 and 400 of the federal poverty level could qualify for the premium tax credit health insurance subsidy the lower threshold is 139 of the poverty level if youre in a state that has expanded Medicaid as Medicaid coverage is available below that level.

In states that have expanded Medicaid coverage your household income must be below 138 of the federal poverty level FPL to qualify. The average savings for current enrollees will be 70 a month or 25 of what they pay now Kaiser found. Premier agents are experts on Obamacare for Illinois.

How your income compares to the Federal Poverty Level. The majority of the states have expanded Medicaid. IMPORTANT INFORMATION REGARDING COVID-19 CORONAVIRUS.

The premium tax credit helps lower your monthly premium. This page contains information on eligibility for the Low-Income Subsidy also called Extra Help available under the Medicare Part D prescription drug program. Premiums will drop on average about 50 per person per month or 85 per policy per month.

You can qualify for a subsidy if you make up to four times the Federal Poverty Level. The additional premium subsidies became available on HealthCaregov as of April 1 2021 and the state-run exchanges are also working to get the new subsidy amounts displayed as quickly as possible.