With our currently offered plans youll have access to our popular fitness program SilverSneakers. You can get a Medicare Supplement from Nevada Medicare Nevada Medicare contracts with all the carriers approved in the State of Nevada.

Medicare Supplement Plans In Nevada Senior Healthcare Direct

Medicare Supplement Plans In Nevada Senior Healthcare Direct

Plan A covers the most important benefit which is the 20 of the outpatient medical care that Medicare doesnt cover.

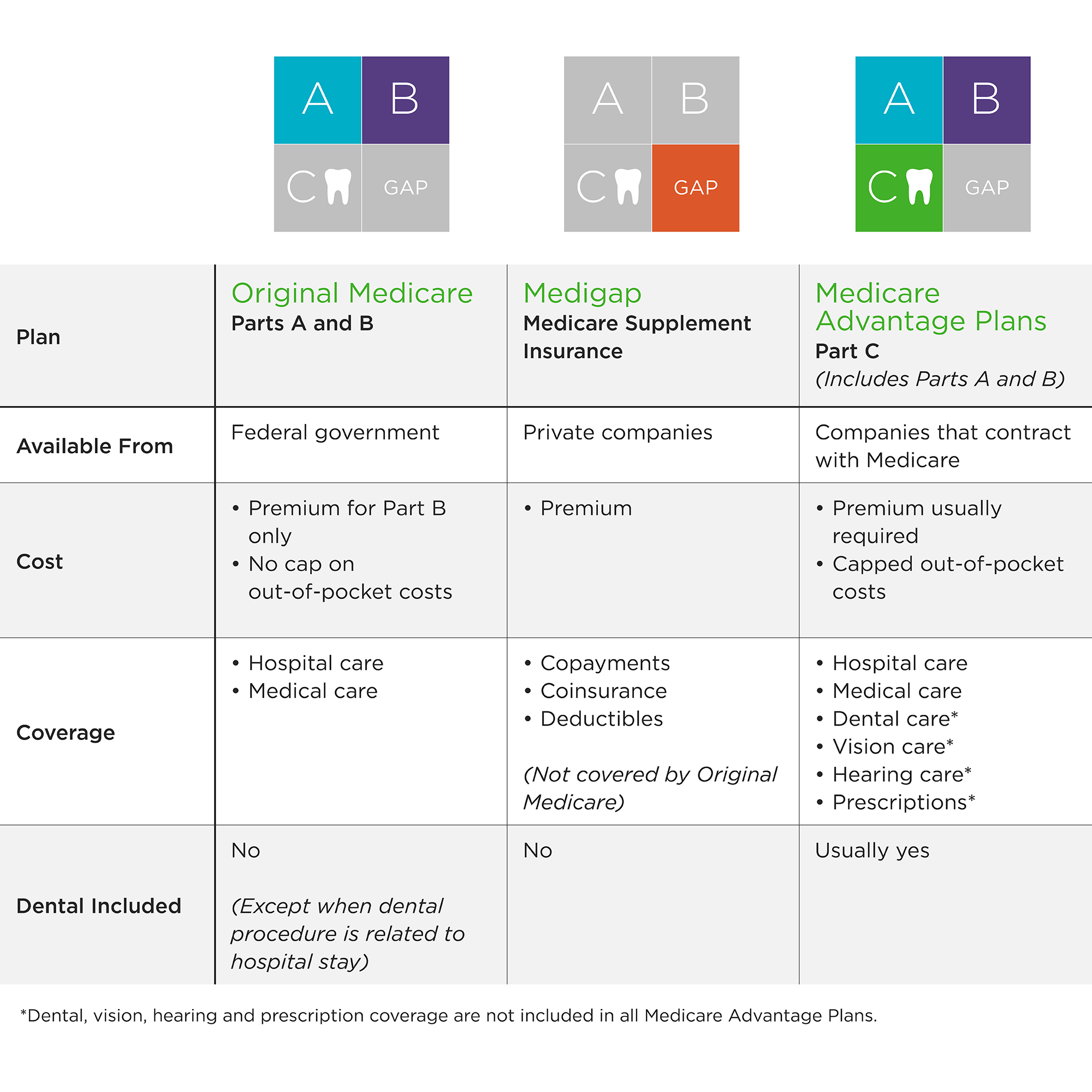

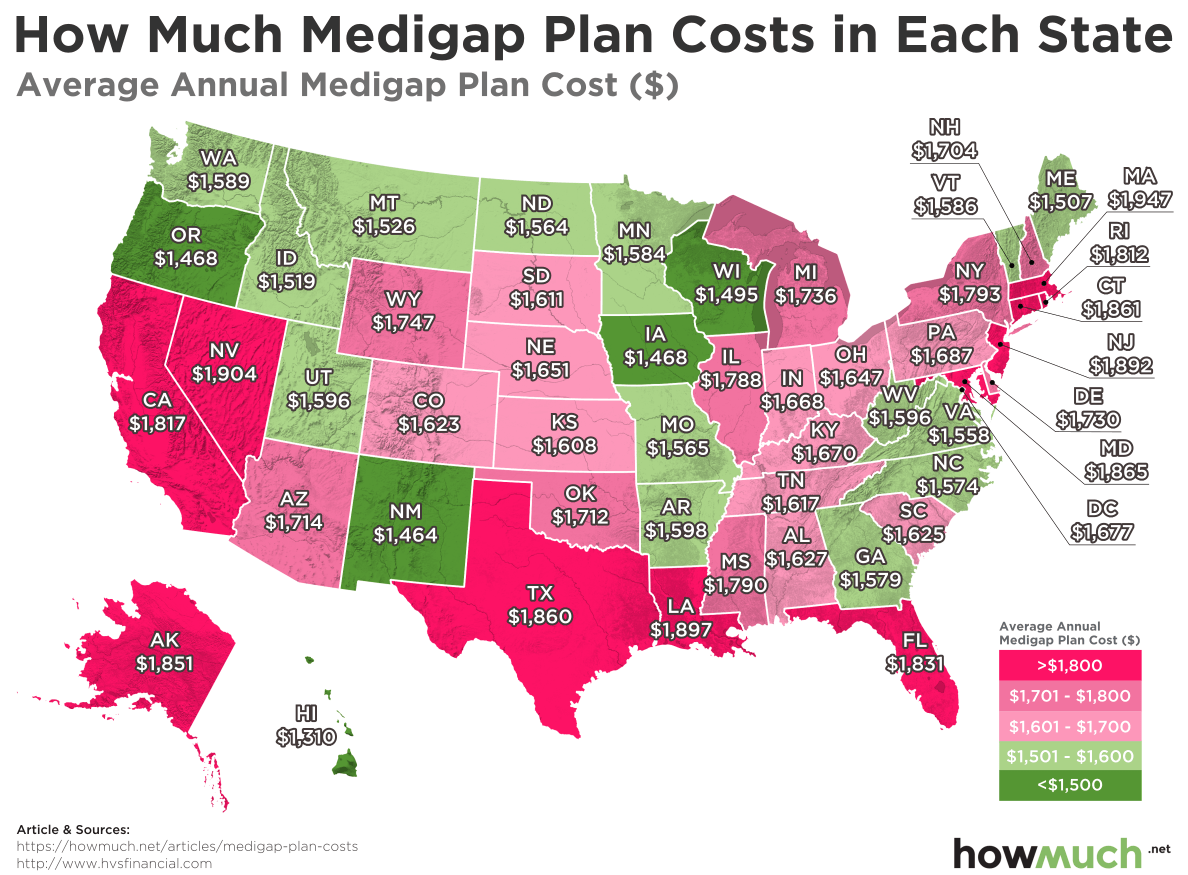

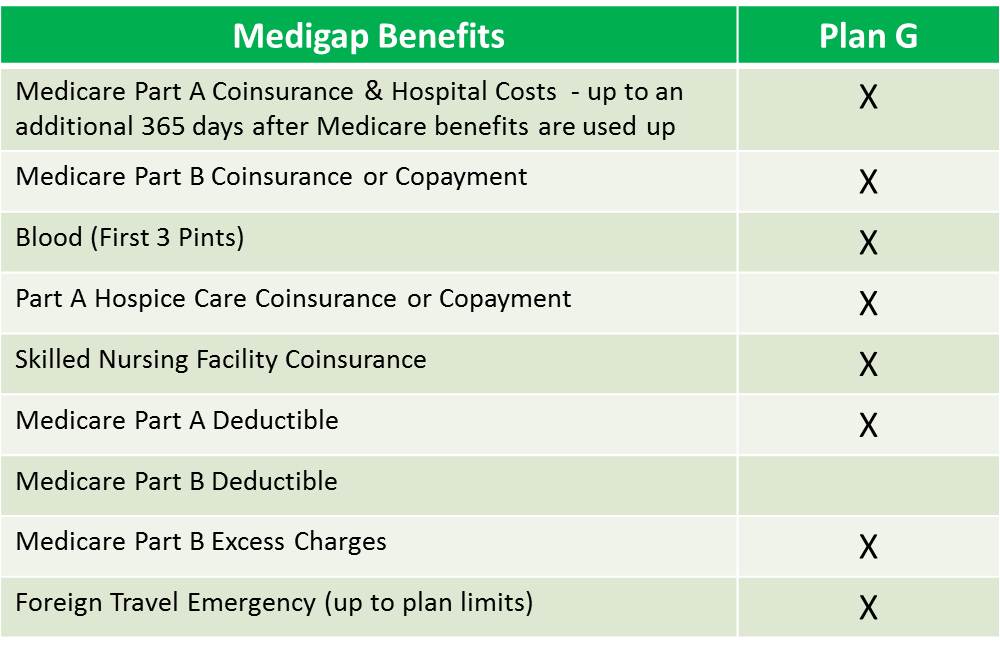

Medicare supplement plans in nevada. The Medicare Supplement Plan G is offers the exact same benefits of the Plan F except that you will pay the Part B deductible. Nevada Medicare Supplement plans also known as Medigap policies help pay for medical costs that arent covered by Original Medicare Medicare Parts A and B. The Part B deductible is set by Medicare and can change but at this time it is 18300 per year.

Medigap Plan C and Medigap Plan F in Nevada. Medicare supplement plans in Nevada Medicare supplemental insurance Medigap helps cover out-of-pocket costs for parts A and B. This makes Plan A still a very good plan today.

Find the best Medicare Supplement Plans offered in Nevada. There is no Supplement plan that included prescription drug coverage. Medicare Supplement Plans in Nevada provide comprehensive coverage of the gaps in Medicare.

Medicare Supplement Plan A is also referred to as Medigap Plan A. If you did not qualify for Medigap BEFORE January 1 2020 you may not sign up for Medigap. Depending on which plan you choose you will generally have very little out-of-pocket.

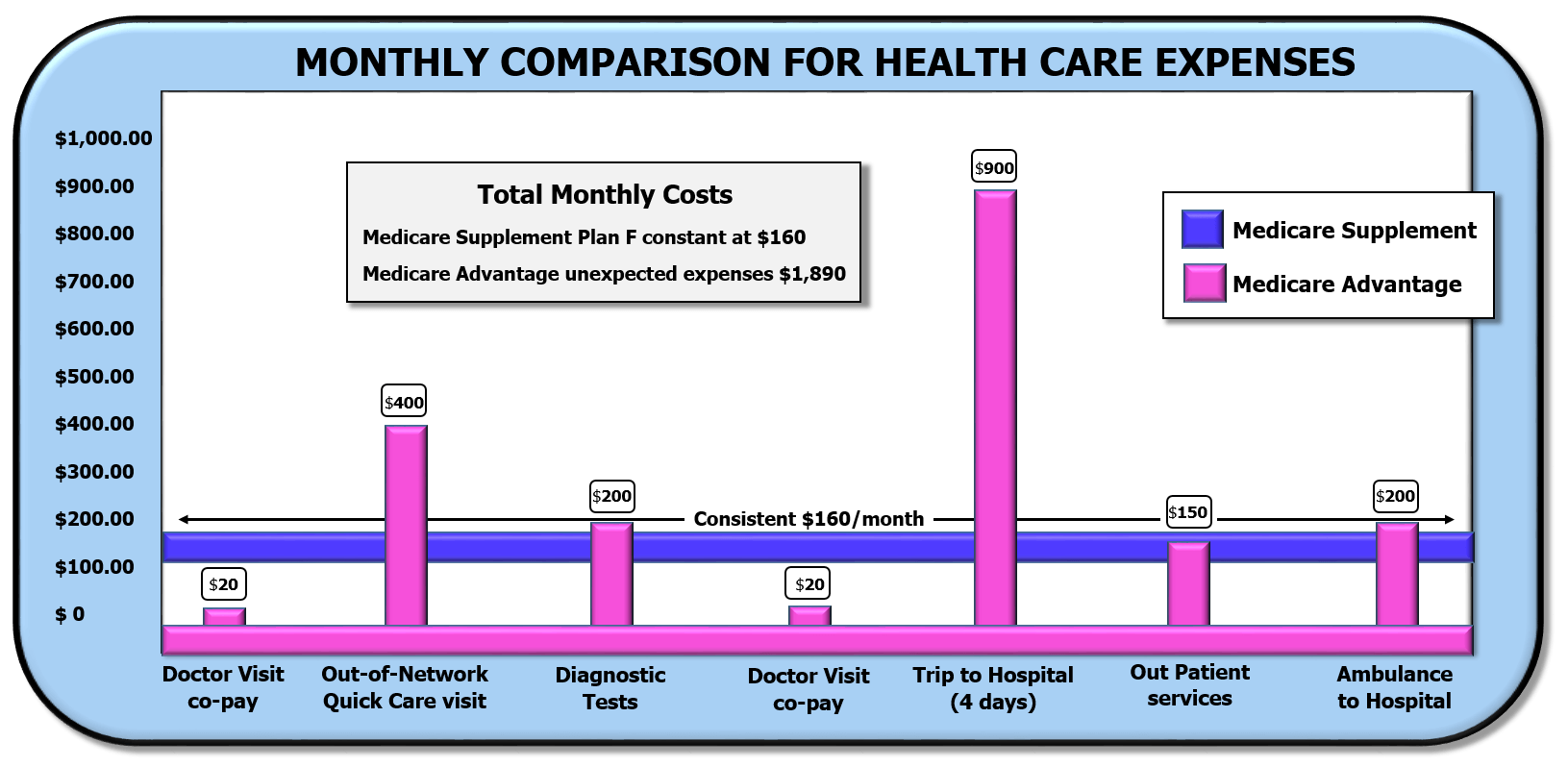

This plan has been overlooked at times because it has fewer benefits than other Medicare Supplement plans. Who has the best Medigap plan in Nevada. Original Medicare has deductibles and coinsurance that can leave you with significant out-of-pocket costs unless you also have a Medigap policy.

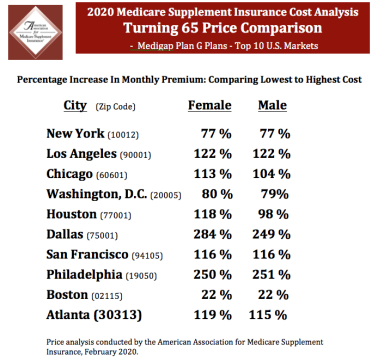

In Nevada when you choose a Medicare Supplement plan with Anthem Blue Cross and Blue Shield youre more than covered. Nevada Medicare can provide quotes from over 30 carriers of Medigap plans. Nevada Medicare Supplement insurance carriers are.

These plans are offered through private insurance providers. These benefits are available via Medicare Part D. A few companies you might recognize are Aetna Anthem Cigna Humana Mutual of Omaha Unitedhealthcare.

When it comes to Medicare supplements the best is. The benefits of a Medigap plan that starts with the same letter will be identical regardless of the county in which you reside. It helps to pay for inpatient hospital costs such as blood transfusions skilled nursing and hospice care.

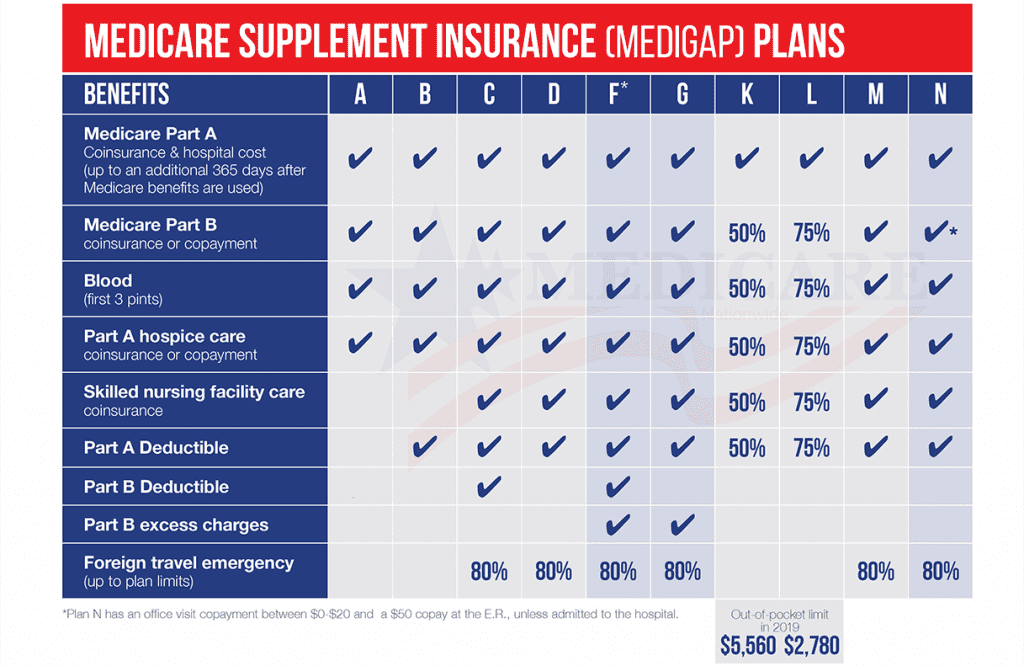

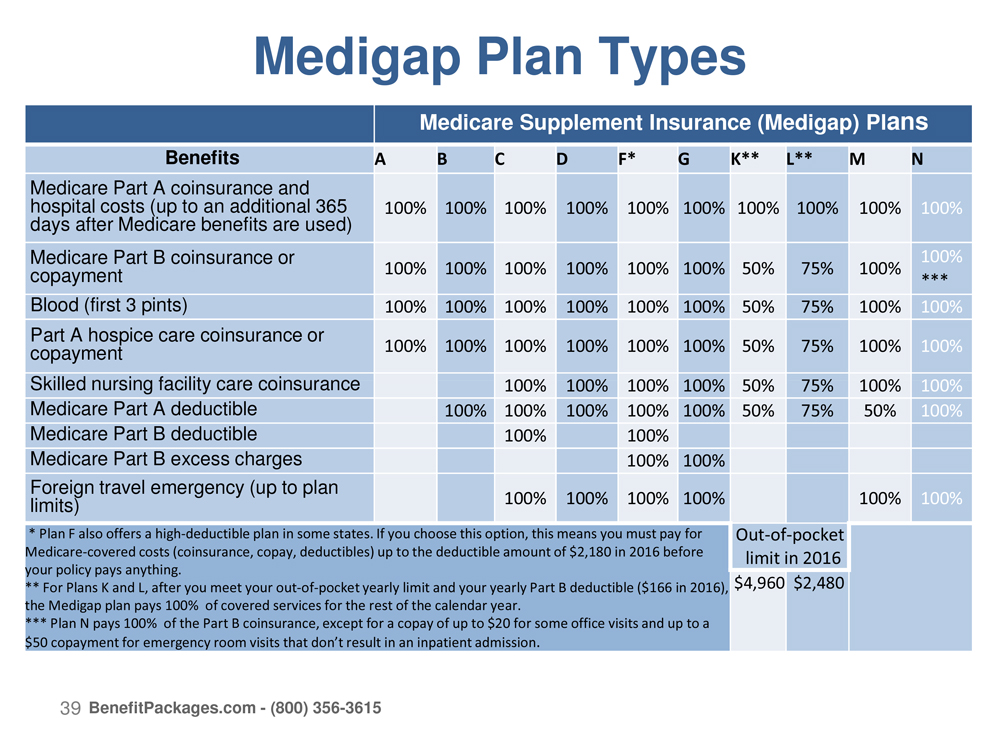

As of 2020 federal law prohibits Medicare Supplement plans from covering the Medicare Part B deductible. Plans A B C D F G K L M and N are now on the market E H I and J are actually discontinued. As mentioned above Medicare Supplement insurance plans in Nevada do not vary in coverage or benefits and are standardized for all insurers who offer Medigap plans.

11 Zeilen Nevada Medigap Plans are Standardized. You may sometimes here Medicare supplements also referred to as Medigap plans. Issue-age ratedYour premium is based on your age when you buy the plan.

Medicare Supplement plans. These plans may include prescription drug coverage even after January 1 2006 if the benefits are similar to the new Medicare benefit. To help make sure than a senior in Nevada has the exact same benefits as a senior in New Mexico the CMS Centers for Medicare and Medicaid Services are in charge of controlling the ten offered Medigap plans.

Some of the best Medicare supplement companies in the country provide Medigap plans in Las Vegas. We represent 20 plans from 4 carriers in Nevada. Any standardized Medicare Supplement policy is guaranteed renewable even if you have health problems.

Basically Medicare Supplement plans in Nevada are priced or rated in one of three ways. MedicareAdvantage plans formerly known as MedicareChoice plans are private managed care plans that provide the standard Medicare benefits plus additional supplemental benefits for a monthly fee. Medicare Supplement Plan G covers your share of any medical benefit that Medicare Government covers except for the outpatient deductible.

Community ratedEveryone pays the same premium regardless of age. Attained-age ratedThe premiums typically start out lower than. These plans pay after Medicare first pays its share.

The Medicare Supplement Plan Nevada that offers the most coverage for the lowest premium is the Medigap Plan G. Nevada Medicare Supplement Companies. This means the insurance company cant cancel your Medicare Supplement policy as long as you pay the premium.

:max_bytes(150000):strip_icc()/cigna-logo-wallpaper-e1474921230453-634b8d2d06db4376ab7e0fb3715ada8f.jpg)