Compare Medicare Advantage Plans Its good to know your options when comparing Medicare Advantage plans. In this review we compare Anthem Blue Cross Blue Shield and Anthem detailing the types of plans offered by each company and where you.

Anthem Blue Cross and Blue Shield is the trade name of.

Anthem medicare plans. HMO products underwritten by HMO Colorado Inc. Find your doctors facilities and other care providers. Blue Cross Blue Shield is a subsidiary of Anthem but the two entities each sell health insurance in different areas of the country and each company provides Medicare health benefits and prescription drug coverage to beneficiaries in those areas.

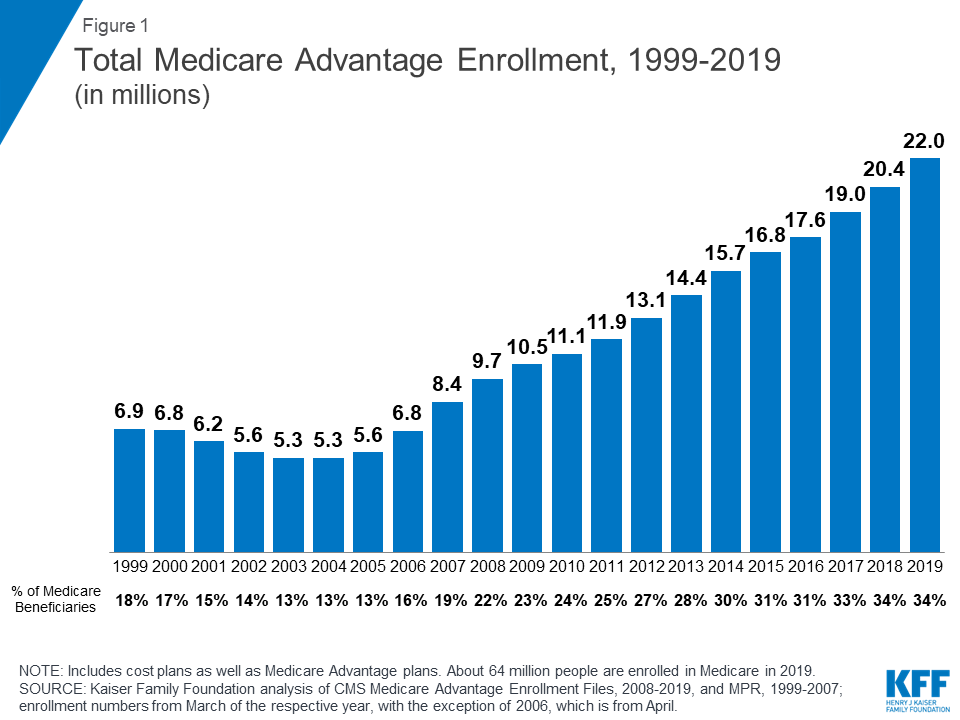

We invite you to visit us again soon and we apologize for any inconvenience. Keep in mind that you may qualify for a Medicare plan even if you are under 65. Many Medicare Advantage plans also include Medicare Part D prescription drug coverage.

If you prefer to see someone out of network you may pay a bit more. Rocky Mountain Hospital and Medical Service Inc. Anthem MedicareAdvantage Special Needs Plans SNPs.

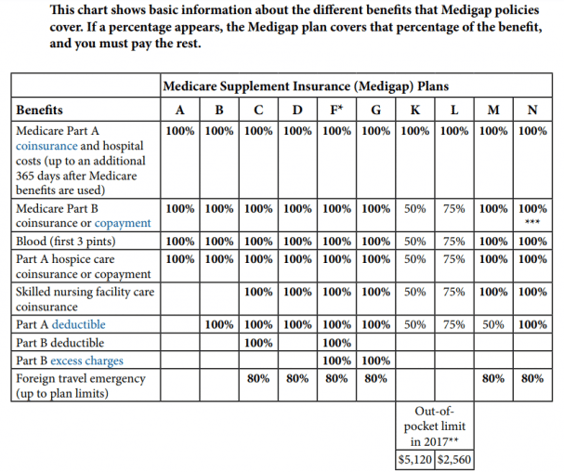

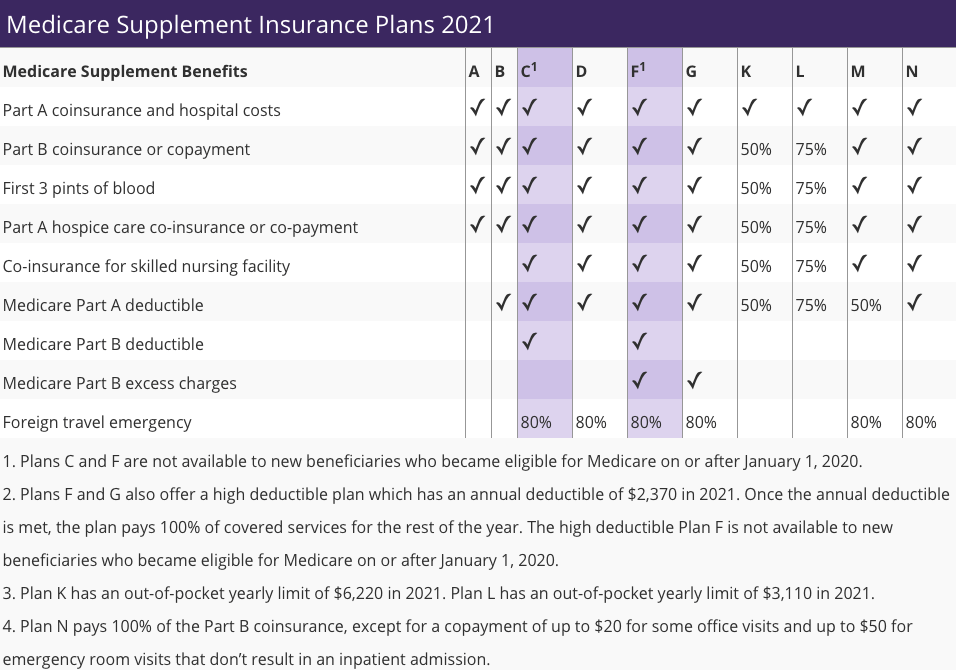

Anthem Blue Cross Anthem Blue Cross Life and Health Insurance Company and Anthem BC Health Insurance Company are independent licensees of the Blue Cross Association. Over 1 million people are enrolled in an Anthem Medicare Advantage Plan 1 Anthem Blue Cross Anthem Medicare Advantage Plans combine Medicare Part A hospital insurance and Medicare Part B medical insurance benefits into one convenient plan. Choose from Medicare Supplement insurance plans Medicare Advantage plans and Medicare prescription drug plans.

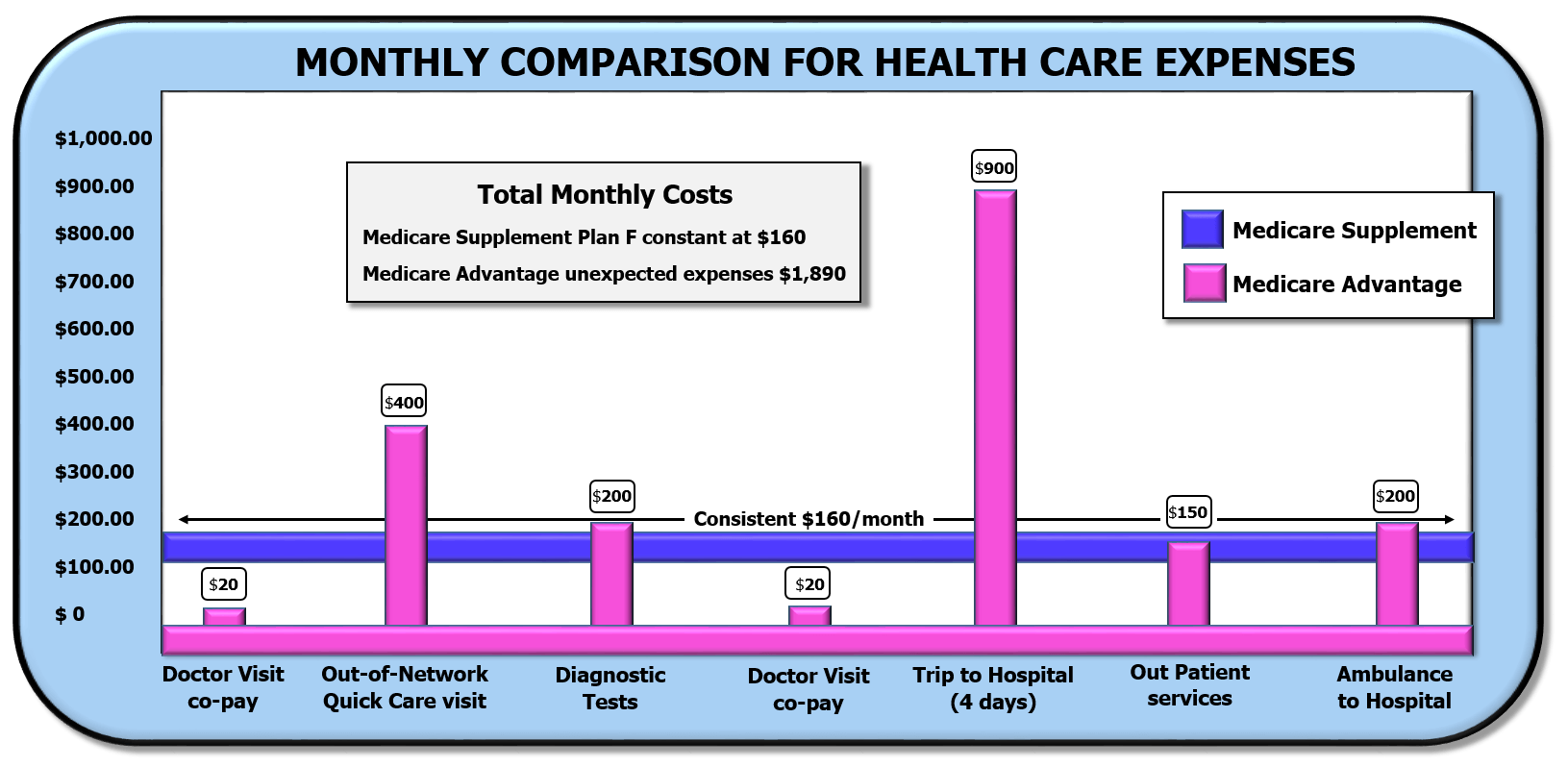

Ready to Shop our Medicare Plans. These plans package all the benefits of Medicare Part A and B into one plan that covers your hospital and medical costs. Although Medicare Advantage plans from many.

Your benefits from Anthem could include. Anthem Medicare Advantage Plans Many Anthem Part C plans include extra benefits such as vision prescriptions dental and hearing. Anthem-affiliated health plans are a D-SNP with a Medicare contract and a contract with the state Medicaid program.

0 monthly premium copays and emergency care copays 1. Anthem Blue Cross and Blue Shield is a DSNP plan with a Medicare contract and a contract with the state Medicaid program. Anthem MediBlue HMO is one type of Medicare Advantage plan that combines the benefits of a Medicare Advantage plan with the coordination of an HMO.

Anthem-affiliated health plans are Medicare Advantage Organizations and Prescription Drug Plans with a Medicare contract. Some things to consider when youre comparing Medicare Advantage plans. You receive all the benefits of the Medicare Advantage plan and can choose from our complete network of doctors and facilities.

Medicare Advantage March 2019 Anthem BC Health Insurance Company is the trade name of Anthem Insurance Companies Inc. For Dual-Eligible Special Needs Plans. Anthem MediBlue PPO is one type of Medicare Advantage plan that combines the benefits of a Medicare Advantage plan with the choice of a PPO.

Anthem Blue Cross is the trade name of Blue Cross of California. Many Anthem Medicare Advantage plans also offer additional benefits such as prescription drug coverage. With a Special Needs Plan you may get the same benefits as Original Medicare plus the added benefits and health care options of an Anthem plan.

These extras can help you live your life better and they wont cost you any more than Original Medicare. There are three types of Special Needs Plans SNPs available to people who have certain chronic or disabling conditions receive both Medicare and Medicaid benefits or live in an institution such as a nursing home. Enrollment in Anthem Blue Cross and Blue Shield depends on contract renewal.

Get personalized plan recommendations. You receive all the benefits of the Medicare Advantage plan and choose from our complete network of doctors and facilities for your care.