Medicare Supplement Plan G is almost identical to Plan F except for the Part B deductible. Medigap Plan G offers all of the same benefits as Plan F except for the Part B deductible.

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

The only difference in coverage between the two is that Plan G doesnt cover the Medicare Part B deductible.

Difference between medicare plan f and g. This part is easy to answer because there is only one benefit difference between Medigap plan G and F. Plan F covers the Medicare Part B deductible and Plan G doesnt. Second you will pay a 203 Part B deductible in 2021.

Plan G may be a good option if you are new to Medicare and cant enroll in Plan F. There are two big differences between Medicare Plan F and Plan G. The better option depends on the monthly premium difference between Plan G and Plan F in your area.

The deductible amount for Plan F and Plan G can change every year and is 2370 in 2021. The Part B deductible is a one time deductible you must play each year when you see the doctor for non-preventive visits. Please visit our Plan G page or call 18885633307 for additional details on how you can enroll in Plan G.

In 2021 the Part B deductible is 203. The difference between Plans C and D and Plans F and G is the coverage of the Part B deductible. In response to this new law Blue Cross is offering Plan G which is less expensive than Plan F.

Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. This high-deductible option might have a lower premium than the regular Plans F and G. Once the deductible is met then you will receive the same benefits offered by Medicare Supplement Plan G.

The only difference between Plan F Plan G is the Part B deductible which will be 198 in 2020. This means that you will have to pay 183 annually before Plan G begins to cover anything. Medicare Supplement Plan N Medigap Plan N covers the same benefits as Plan F except the Part B deductible and Part B excess charges.

It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible. What are the similarities and differences between Medicare Plan F and Plan G. Comparing Plans F G and N Because Medigap Plan F offers the most benefits it is usually the most expensive of the Medicare Supplement insurance plans.

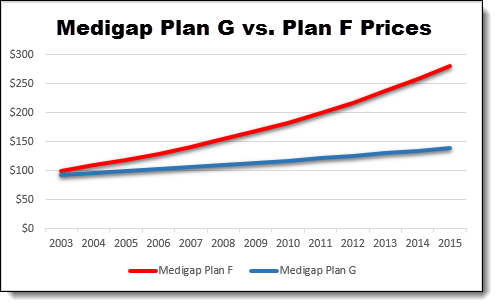

When you compare the lower premium benefit of Plan G you can save 500 or more. First Plan G has lower premiums than Plan F. The difference between Plan F and Plan G is the annual Part B deductible.

Plan F and Plan G both charge monthly premiums. However once the Part B deductible for Plan G is paid for you essentially have Plan F. 9 rows Plan G coverage is similar to that of Plan F but does not cover the Medicare Part B.

Yes but only for new enrollees on or after January 1 2020. The cost of your monthly premiums. What is the difference between Plan F and G.

After the deductible is met Plan G benefits are exactly the same as Plan F. Medicare Supplement Plans F and G are identical with the exception of one thing. Plan G does not cover the Part B deductible the Part B deductible for 2018 is 183.

The better option depends on the monthly premium difference between Plan G and Plan F in your area. Is Medicare Plan F being discontinued. Plan F is the best plan and Plan G is the 2nd.

Plan G will offer a high deductible option beginning January 1 2020. 16 rows Most people will select Plan F or Plan G. If you select Plan G youll need to pay your Part B deductible 203 for 2021 yourself.

Plan F benefits include coverage for all copays deductibles and coinsurance. However Plan F covers the Medicare. They also cover 80 of the costs of emergency care when traveling abroad.

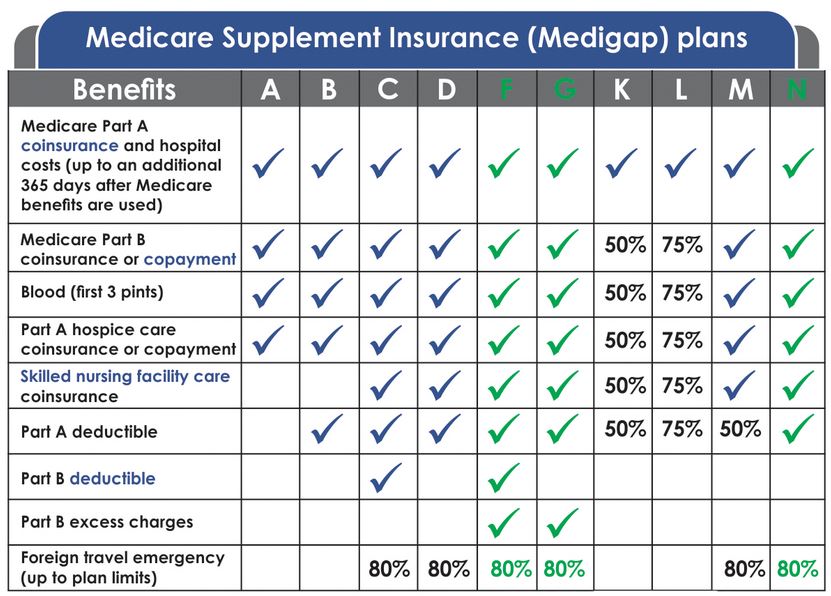

If you select Plan G youll need to pay your Part B deductible 203 for 2021 yourself. There are also high-deductible versions of Plans F and G where beneficiaries pay a deductible of 2370 in 2021 before the Medigap plan begins to cover Medicare-covered costs. The chart below allows you to compare Medicare Supplement insurance plans based on whats offered across the standardized plans that are available in most states.

Just like High-Deductible Plan F High-Deductible Plan G will not offer you coverage until you have paid the deductible 2340.

Medicare Supplement Plans Seniorquote Insurance Services

Medicare Supplement Plans Seniorquote Insurance Services

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

Plan F Vs Plan G Comparison By Gomedigap Medicare Supplement Medicare Supplement Plans Medicare

Plan F Vs Plan G Comparison By Gomedigap Medicare Supplement Medicare Supplement Plans Medicare

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medigap Plan G Medicare Supplement Plan G 65medicare Org

Medigap Plan G Medicare Supplement Plan G 65medicare Org

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Comparing Medicare Supplement Plan F G Medicarehaven Com

Comparing Medicare Supplement Plan F G Medicarehaven Com

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medigap Plan F Medicare Supplement Plan F Medicarefaq

Medigap Plan F Medicare Supplement Plan F Medicarefaq

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.