In the end many seniors opt for Medicare Part A and Part B together called original Medicare or Medicare Part C also called Medicare Advantage. Cigna-HealthSpring Medicare Prescription Drug Plans.

Find Medicare Part D Prescription Drug Plan Coverage

Find Medicare Part D Prescription Drug Plan Coverage

Medicare Prescription Drug Plans provide drug coverage with a monthly premium.

Medigap drug plans. Cigna Health-Spring Rx Secure. All lettered Medigap Plans. Humana Basic R Plan PDP provides copayments between 0 and 1 on covered generic.

These plans will offer you basic Part A and B coverage as well as prescription drug coverage ie. Learn more about Medicare Supplement Insurance Medigap Plans. Medicare Advantage plans with Prescription Drug coverage are also known as MAPD plans.

All Medigap policies must follow federal and state laws designed to protect. Like most of the big companies Cigna offers three PDP options to beneficiaries. A Medicare Supplement Insurance Medigap policy can help pay some of the remaining health care costs like.

You and policies must be clearly identified as Medicare Supplement Insurance Medigap policies are standardized and in most states are named by letters Plans AN. Plans available through Cigna. It first must go through.

The Medigap insurance company will remove the prescription drug coverage from your Medigap policy and adjust your premium. For example whats covered under original Medicare a Medigap supplement policy a Medicare Advantage plan a Plan D prescription drug plan a dental plan and a vision plan. The best time to purchase your policy is during the OEP Open Enrollment Period.

Medigap is Medicare Supplement Insurance that helps fill gaps in Original Medicare and is sold by private companies. Have coverage through a Medicare Advantage Plan or Medicaid. Original Medicare pays for much but not all of the cost for covered health care services and supplies.

To be a part of the Medicare Advantage Plan you must already be enrolled in Part A and B. Eligibility for a Medicare Prescription Drug Plan is much the same as it is for all other Medicare plans as individuals must be age 65 and an American citizen or a legal resident for the last five years. Furthermore your Medigap may pay for drugs administered in your.

Sold by private insurance companies it can offset some healthcare expenses that arent covered by Original Medicare. Humana offers 3 Part D plans to choose from. You can choose this option even if you already told your Medigap insurance company that you want to keep your existing Medigap policy with the drug coverage removed.

You must have coverage through Part A andor Part B or select an Advantage plan that includes Part D benefits. However your Medigap Plan will cover drugs while an inpatient in a hospital under Part A. Medicare Supplement Insurance Plans are also known as Medigap because they cover the gaps in Part A and B.

You must also be enrolled in Medicare Part B. Some MA plans may offer more benefits than combined Original Medicare and Medigap plans such as prescription drug coverage hearing dental and vision benefits. 1000 or 1500 choose one Policy Year Deductible.

Eligibility for a Medicare Supplemental Plan generally requires an individual must have the traditional Medicare coverage. If flexibility in providers and network is important remember MA plans have a narrower provider network. Anyone age 18 to 85 years old CA NC NM and VA the maximum issue age is 75 Policy Year Maximum Benefit.

Consider an affordable Medicare prescription drug plan from Humana. The costs youll pay for Medigap depend on the plan you choose your location and a few other. The Essential policy is the lowest premium option and the Extra has a higher premium than the other two.

If having a large network is. If you havent enrolled in a Medigap plan Medicare Supplement during your Initial Enrollment Period When is Medigap open enrollment during a Guaranteed Issue Period When is a Medicare Supplement Guaranteed Issue or during your Birthday Rule only in CA OR WA and MO your acceptance will not automatically be approved. If you have a Medicare Supplement plan you can still get drug coverage through a separate prescription drug plan through companies that offer drug plans such as Silverscript or Humana.

Medicare Supplement Medigap insurance policies do not provide prescription drug coverage. Most Medigap plans typically dont include extra services. Prescription drug plans are also known as Medicare Part D.

Like all insurance the best plan. Medigap Insurance is a supplement to Medicare coverage. You may experience changes in your benefits.

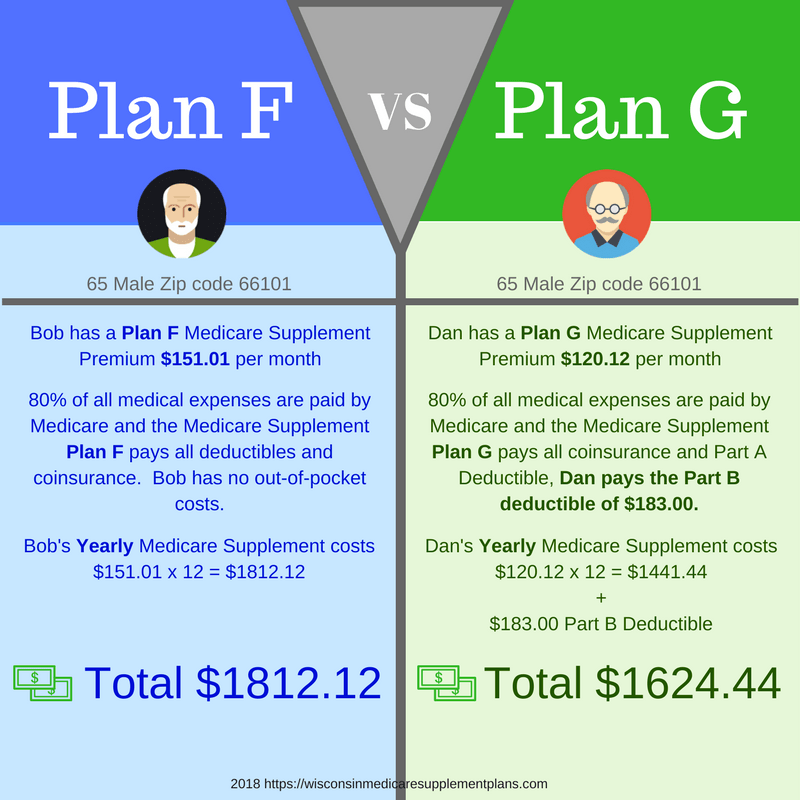

Those costs include copayments coinsurance and deductibles. Medigap helps to pay for some of the healthcare costs that arent covered by original Medicare. Medigap plans do not cover maintenance medications aka drugs that treat chronic health conditions.

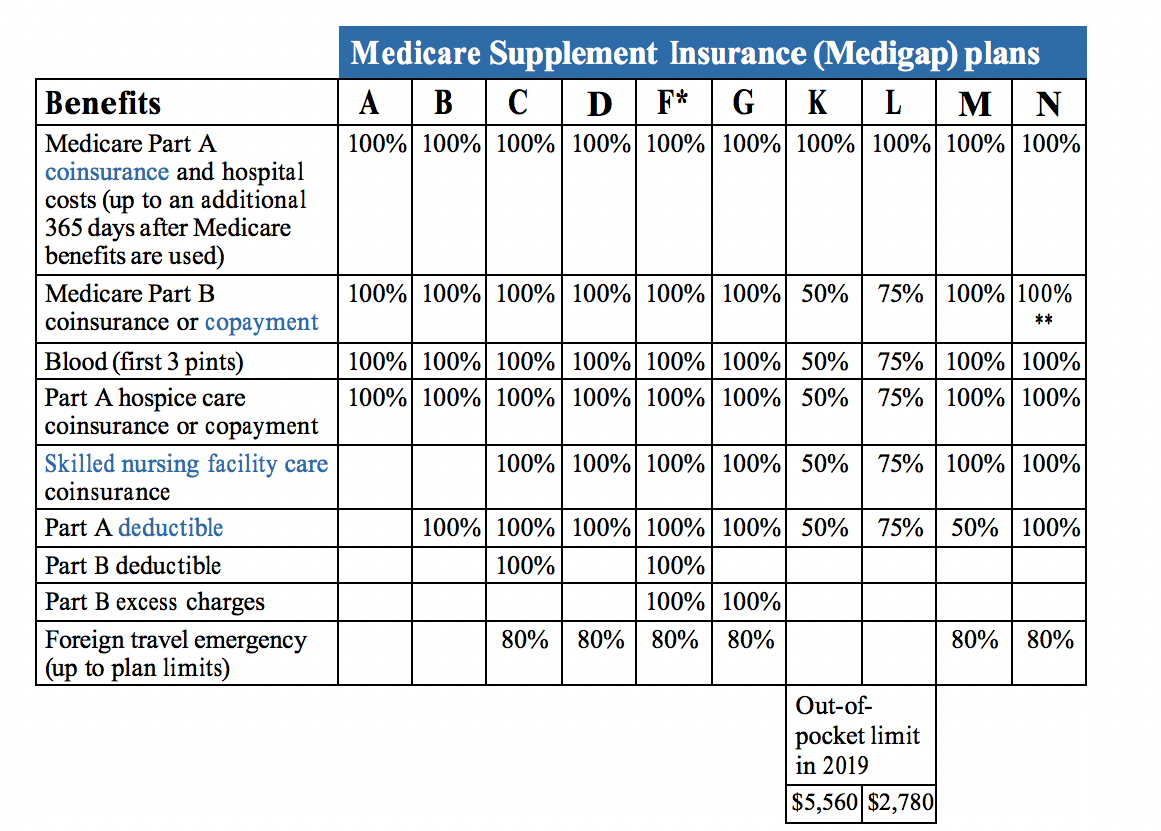

You can choose from any Medigap Plan A B C F K or L that your current insurance company sells. A B C D F G K L M and N do not cover prescription drugs. Each standardized Medigap policy under.

You have to be enrolled in either Part A or Part B before you can enroll in a Medicare Prescription Drug Plan. If your Medigap policy covers prescription drugs youll need to tell your Medigap insurance company if you join a Medicare Prescription Drug Plan. In case you have Prescription Drug Coverage through a Medicare Advantage Plan.

Medigap OEP dates will begin the 1 st day of the month you turn 65 or if you are older. Medicare Prescription Drug Plans. If you are still within 63.

Plans K and L are new Medigap policies that can be made available starting in 2005. Although Original Medicare is administered by the federal government Medigap plans are offered by health insurance companies approved by the federal government. Click to read more about our Dental Vision and Hearing Plan.

You cant join a Medicare Prescription Drug Plan and have a Medigap policy with drug coverage.