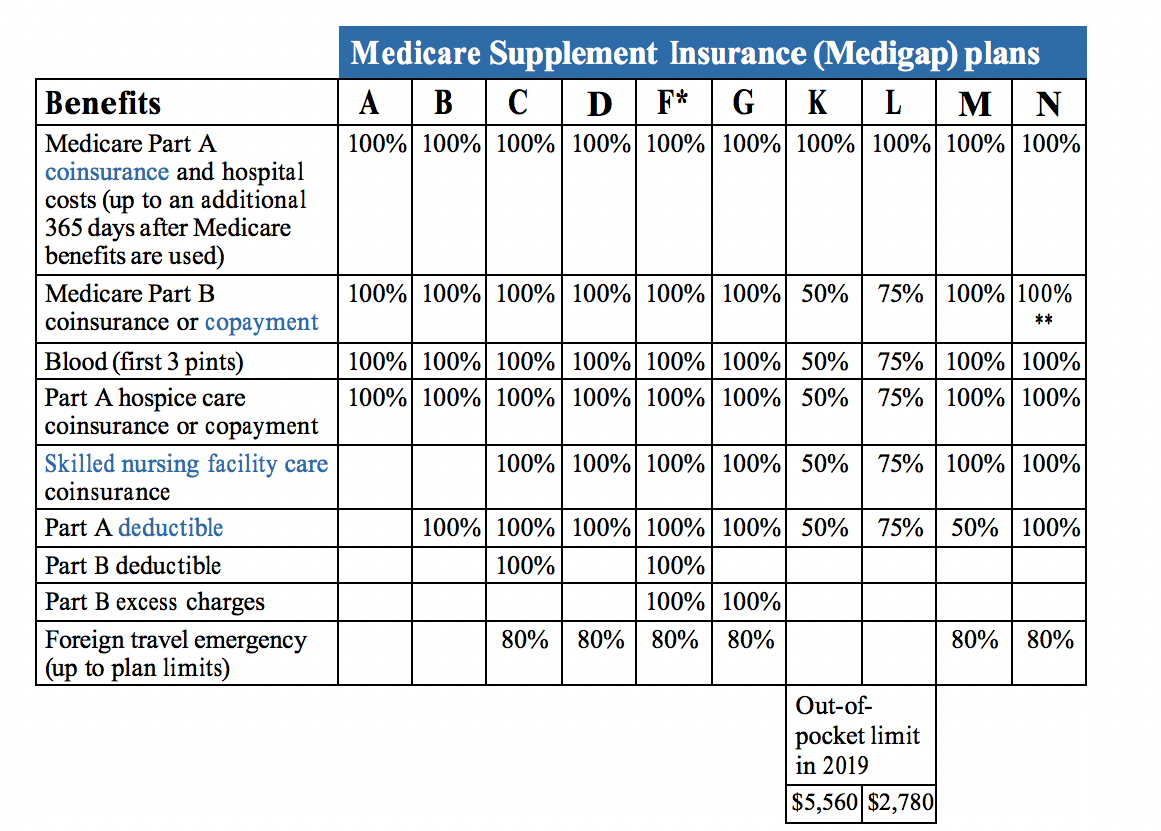

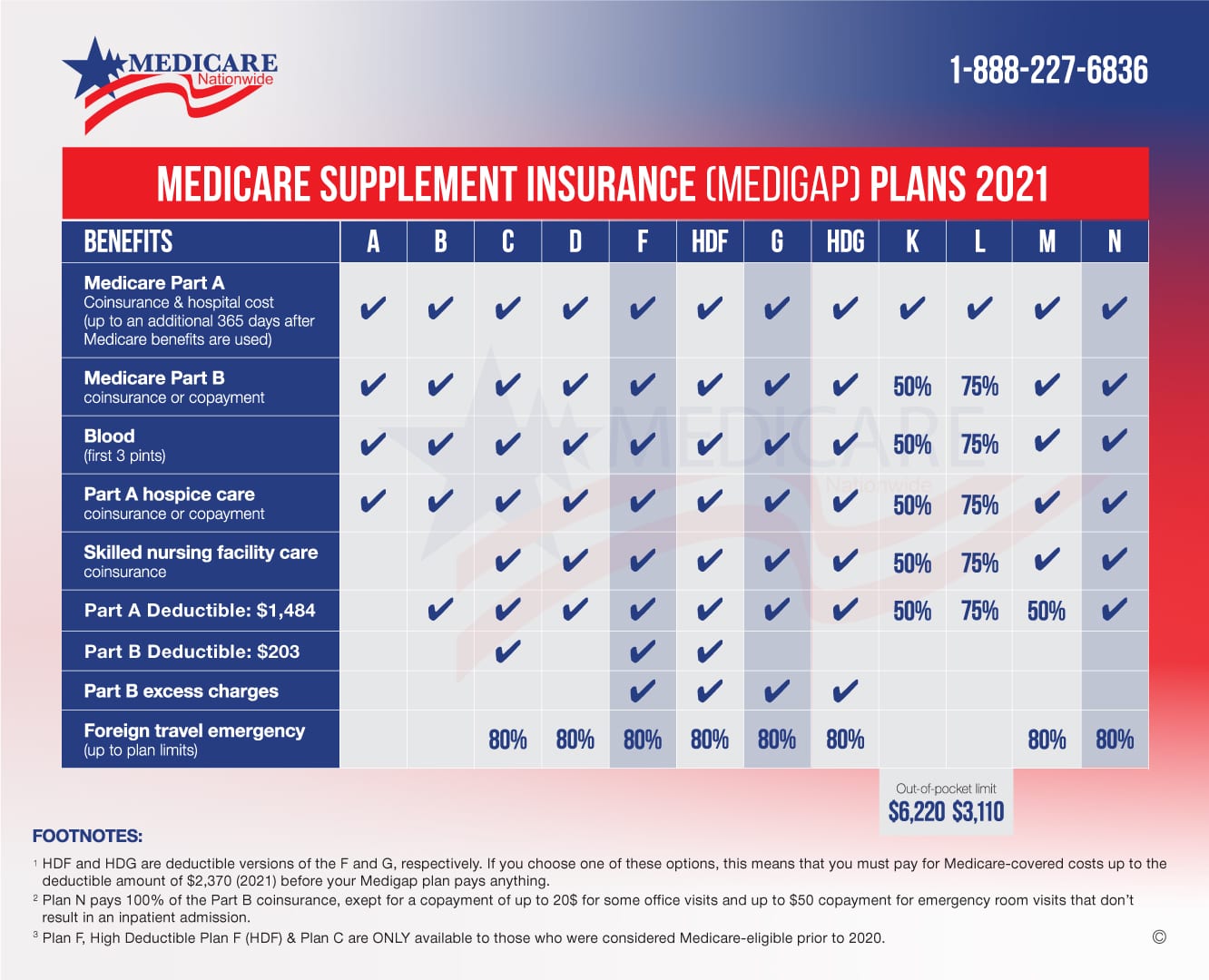

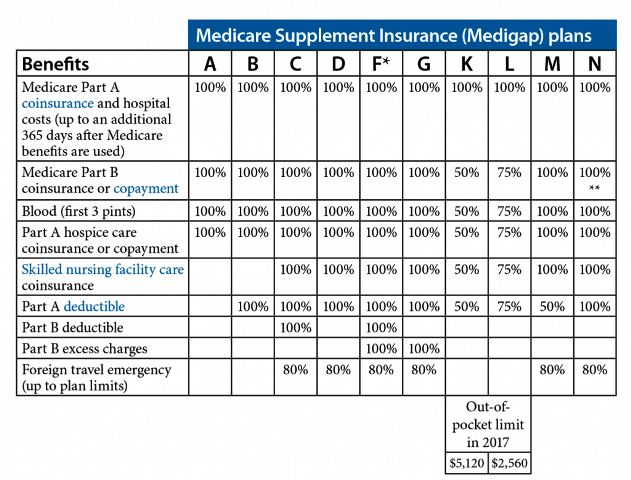

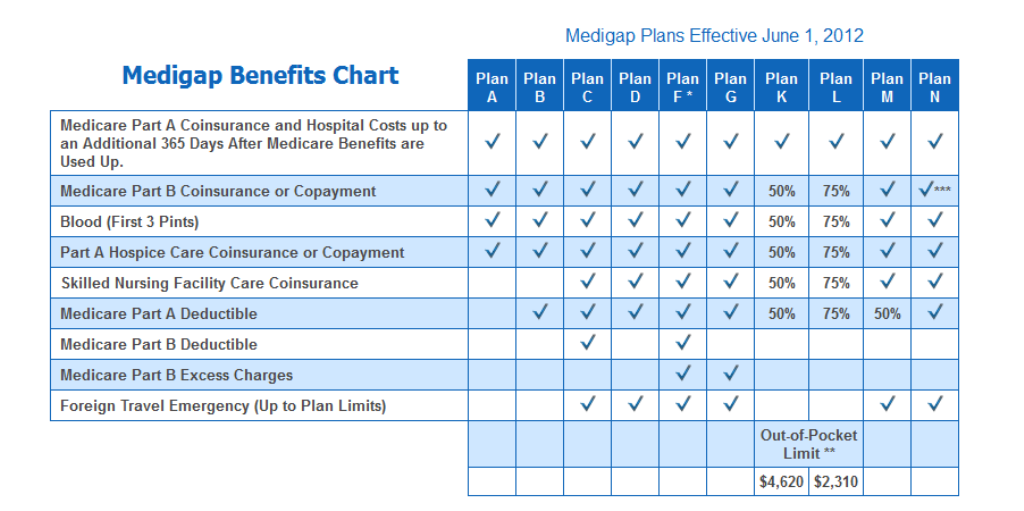

Some benefits Plan A doesnt cover that other Medigap plans do include the Part A deductible Part B deductible Skilled Nursing Care coinsurance excess charges and foreign travel emergency coverage. You pay the private insurance company a monthly Premium for your Medigap policy.

Comparing Medigap Plans Senior65

Comparing Medigap Plans Senior65

Medigap plans are policies that pay after Medicare to fill the in the gaps.

Medigap plan a benefits. Surveys consistently find that Medigap beneficiaries are highly satisfied with their Medigap coverage. It covers basic benefits 20 Part B coinsurance hospital coinsurance an additional 365 hospital days past what Medicare covers and the first 3 pints of blood each calendar year. Learn more about Medigap Plan B and if it is a good fit for your health insurance needs.

There are 10 plan types available in most states and each plan is labeled with a different letter that corresponds with a. What does Medigap Plan A cover. You need to have Medicare Parts A and B before buying this policy.

Insurance companies generally cant sell you a Medigap policy if you. Medigap plans Medigap plans Medigaps are health insurance policies that offer standardized benefits to work with Origi-nal Medicare not Medicare Advantage. Medicare Supplement also known as Medigap or MedSupp insurance plans help cover certain out-of-pocket costs that Original Medicare Part A and Part B doesnt cover.

11 Zeilen Medicare Supplement insurance also known as Medigap insurance may help cover your Original. It also covers the Part A coinsurance and Part B coinsurance for preventive care. Still it covers the most critical benefit.

Medigap Plan A works in conjunction with your Medicare Part A and Part B coverage to help pay for some of the deductibles and coinsurance costs associated with Original Medicare. This plan is sometimes overlooked because it has fewer benefits than other Medigap insurance plans. Analyses of federal data show that Medigap is a particularly important coverage option for low-income and rural seniors.

If you have a Medigap it pays part or all of certain remaining costs after Original Medicare pays first. The benefits that have a check mark are covered by Plan A. Again these plans are also called Medicare Supplements same thing just two different terms.

A Medigap policy is different from a Medicare Advantage Plan. Any benefits without a check mark are not covered by. What Benefits Does Medigap Plan A Cover.

Medicare Supplement insurance plans are designed to help pay some of the out-of-pocket costs not paid by Medicare. Medigap plans are used by over 11 million seniors and other Medicare beneficiaries offering them a sense of security about both the predictable and unexpected costs associated with medical care. Because those plans are another way to get your Part A and Part B benefits while a Medigap policy only helps pay for the costs that Original Medicare doesnt cover.

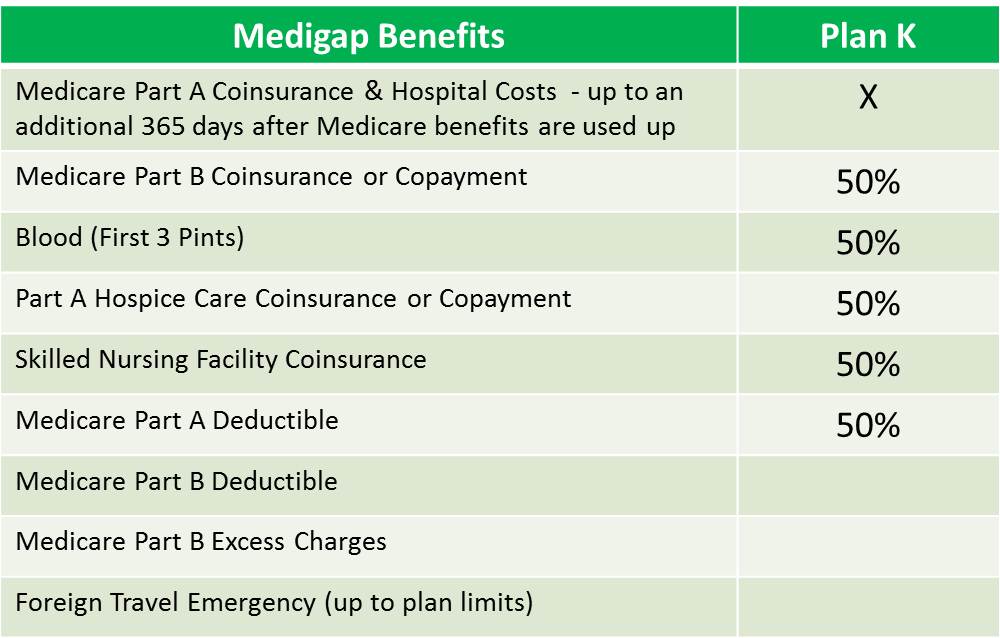

The table below shows what is covered by Medigap Plan A. These costs typically include Medicare deductibles copayments and. 12 Zeilen For Plans K and L after you meet your out-of-pocket yearly limit and your yearly Part B.

Medicare Supplement also known as Medigap insurance plans are sold by private insurers. Medigap Plan B is one of the standardized Medicare Supplement Insurance plan options available in most states. The 20 of outpatient medical care that Original Medicare leaves behind.

Those plans are ways to get Medicare benefits while a Medigap policy only supplements your Original Medicare benefits. What does Medicare Plan A cover though. Once Medicare has paid its approved share of your healthcare costs the Medigap.

Plan A is the foundation of all Medigap Plans ie. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. Medicare Supplement Plan A is also referred to as Medigap Plan A.

Medigap Plan A Medigap Plan A is the least complex of all Medicare Supplement plans and provides the least coverage. Medigap Plan A Medicares Supplement Insurance programs are known as Medigap since they help fill the gaps in your Original Medicare plan. As a basic-level plan Medigap Plan A covers the following costs and benefits.

They are sold by private insurance companies. Medigaps may also cover health care costs that Medicare does not cover at all. Therefore seniors should not overlook Plan A.

You can choose a Medigap plan that will help you to pay for your deductibles copays and coinsurance. Medigap Plan A Benefits. Part A coinsurance hospital costs up to an additional 365 days after Medicare benefits are exhausted Part A hospice care copayment or coinsurance.

Medigap Plan A is the most basic coverage plan. Medicare Supplement Plan B offers fewer benefits than some other Medigap plans but it also comes with lower average premiums than most other plans. It still covers the most important benefit which is the 20 of outpatient medical care that Medicare doesnt cover.

A Medigap policy is different from a Medicare Advantage Plan.

Medigap Plans 2021 What Is Medigap Insurance In 2021

Medigap Plans 2021 What Is Medigap Insurance In 2021

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

Medicare Supplement Plan Medicare Supplemental Insurance Medigap

How Do Medicare Advantage Medicare Supplemental Insurance Differ

How Do Medicare Advantage Medicare Supplemental Insurance Differ

Blog How Much Can A Medigap Plan Save You When Medical Bills St

Blog How Much Can A Medigap Plan Save You When Medical Bills St

What Is A Medicare Supplement Medigap Plan Gomedigap

What Is A Medicare Supplement Medigap Plan Gomedigap

Medigap Plan A Core Policy Benefits Medicarefaq

Medigap Plan A Core Policy Benefits Medicarefaq

Comparison Chart Of All 10 Medicare Supplement Plans Policies

Comparison Chart Of All 10 Medicare Supplement Plans Policies

Ultimate Guide To Selling Medicare Supplements Senior Market Advisors

Ultimate Guide To Selling Medicare Supplements Senior Market Advisors

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medigap Plans What You Need To Know Before You Buy

Medigap Plans What You Need To Know Before You Buy

Here S A Brief Look At Medicare Supplement Medigap Plans

Here S A Brief Look At Medicare Supplement Medigap Plans

Medicare Supplement Benefit Table 2020 Vibrantusa

Medicare Supplement Benefit Table 2020 Vibrantusa

Other Medigap Plans Medigap Plans C D And More 65medicare Org

Other Medigap Plans Medigap Plans C D And More 65medicare Org

Medicare Plan A Medigap Plan A Medicare Supplement Plan A

Medicare Plan A Medigap Plan A Medicare Supplement Plan A

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.