Medi-Cal is the state of Californias version of Medicaid for those with low assets or income or both. Medical Electronic Data Interchange.

Integrated Care What Choices Exist For Californians With Medicare And Medi Cal The Scan Foundation

Integrated Care What Choices Exist For Californians With Medicare And Medi Cal The Scan Foundation

Medi-cal Medical is the California version of medicaid which is generally based on income and assets.

What is medi medi. Medicaid is a joint federal and state program that helps pay medical costs if you have limited income and resources and meet other requirements. Cal MediConnect is a type of health care plan that promotes coordinated healthcare and long-term services and supports LTSS for seniors and people with disabilities who are eligible for both Medicare and Medi-Cal sometimes referred to as dual eligible beneficiaries or Medi-Medis. This Web site allows authorized users online access to departmental information on the following HFS programs.

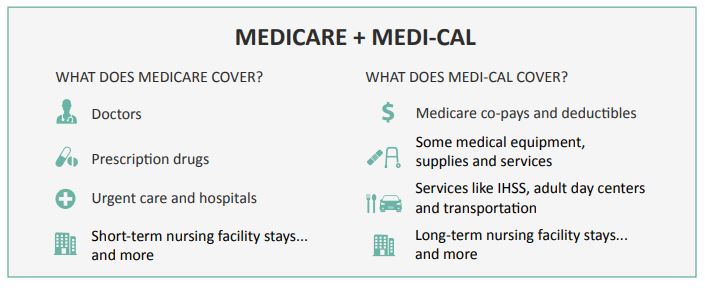

Medi-Cal closes the gaps in Medicare coverage and provides additional benefits not covered by your Medicare. The Medicare-Medicaid Data Match program Medi-Medi program enables program safeguard contractors PSC and participating State and Federal Government agencies to collaboratively analyze billing trends across the Medicare and Medicaid programs to. Medi Cal covers most medically necessary care.

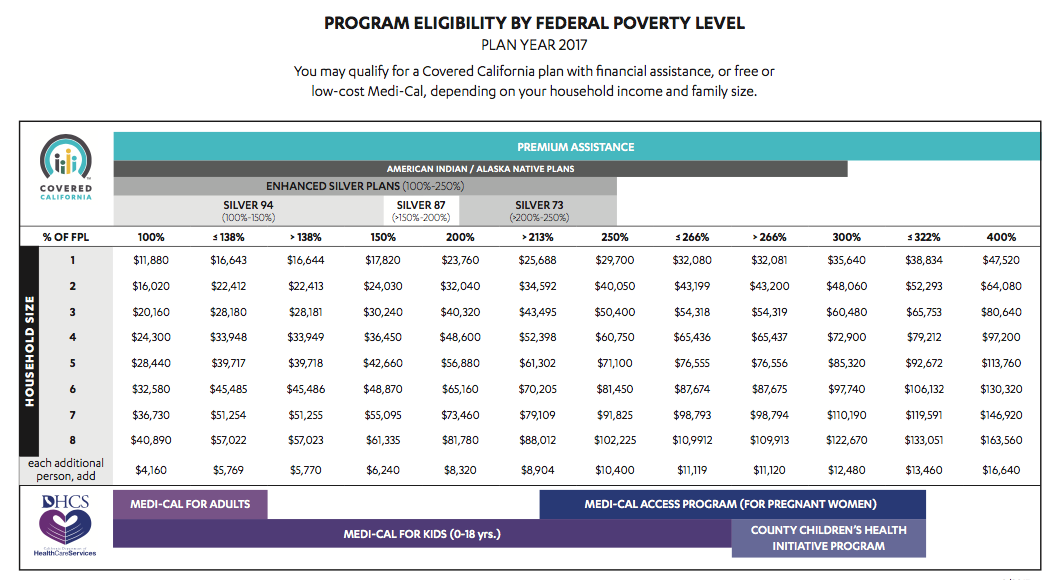

Medi-Cal the Medicaid program in California provides health coverage to people with low-income and asset levels who meet certain eligibility requirements. Meditate Energy Dream Insight. Covered California offers a streamlined application process that will determine the consumers eligibility.

This is also referred to as Medi-Medi. These spas use medical treatments such as lasers microdermabrasion Botox and other medical beauty procedures as well as providing traditional spa services such as facials and massages. Medicine and Engineering Designing Intelligence.

Some people qualify for both Medicare and Medicaid and are called dual eligibles. Medi-Cal for People with Medicare Medi-Cal the Medicaid program in California provides health coverage to people with low-income and asset levels who meet certain eligibility requirements. What is medi medi.

This includes doctor and dentist appointments prescription drugs vision care family planning mental health care and drug or alcohol treatment. Read more in Covered Benefits on page 12. Medi-Cal is Californias Medicaid health care program.

Medi-Cal can supplement Medicare services and help pay Medicare premiums deductibles and copayments. While there are several ways to qualify for Medi-Cal this section focuses only on Medi-Cal beneficiaries who also qualify for Medicare individuals who are over a certain age andor disabled. Medical Assistance Information for Medicaid Providers.

This program pays for a variety of medical services for children and adults with limited income and resources. With Medi-Cal in Covina and Temple City you may only qualify for Medi-Cal long-term care benefits if you have limited assets such as cash. Medi spas will consult with you to put together a customised.

Medi-Cal Rx is the name the Department of Health Care Services DHCS has given to the collective pharmacy benefits and services that will be administered through the Fee-for- Service FFS delivery system by its contracted vendor Magellan Medicaid Administration. Its a program in the state of California that helps pay for long-term care and other medical care needs. Maximallly Efficient Dose Interval.

Medi-Share is a unique non-profit health care sharing membership program founded on the belief that there is a biblical and Christian way of taking care of health care. Medi-Cal is your secondary insurance. Medi medi is the short-hand term for having Medicare and Medi-cal at the same time.

Instead of being health coverage that you draw from after reaching a certain age after contributing to it for years it is a benefit that reimburses healthcare facilities for costs incurred. Medi-Cal is supported by federal and state taxes. Generally speaking Medicare is based on either age 65 and over or permanently disable status.

Morphology Enabled Dipole Inversion. MEDI News Welcome to myHFS - the secure Web site for the Illinois Department of Healthcare and Family Services. In certain cases Medi-Cal may also be used to pay private health insurance premiums.

If you qualify you can enroll in Medi-Cal year-round. All said there are over 300000 members so they do have a fairly large base. Medi-Cal is a program that offers free or low-cost health coverage for children and adults with limited income and resources.

A medi spa is a spa that has a medical program operated under the supervision of a licensed health care professional. Medi Cal also covers transportation to these services.