This is a variation on the standard Plan F that requires beneficiaries to pay all out-of-pocket expenses up to the deductible which is 2370 in 2021. Plan C is the other.

Medigap Plan F Medicare Supplement Plan F Medicarefaq

Medigap Plan F Medicare Supplement Plan F Medicarefaq

Part A coinsurance and hospital costs up to an additional 365 days after youve used up your standard Medicare benefits.

What does plan f pay for. That means you could see a doctor with little to no money out of your own pocket. The panel above briefly outlines the coverage. Plan F Means Full Coverage.

Some carriers offer access to a SilverSneakers gym membership. You pay for Medicare-covered costs up to the 2340 2370 in 2021 before the plan begins to pay for anything. Plan F covers the Medicare-approved expenses not covered under Medicare Part A deductibles coinsurances and copays.

Innovative Plan F benefits may include nurse hotline access or a drug discount card. Plan F Means No More Copays Plan F pays for all copays Medicare Part A and B dont cover including hospital and outpatient deductibles even the remaining 20 percent left behind by Part B. Medicare Part B deductible.

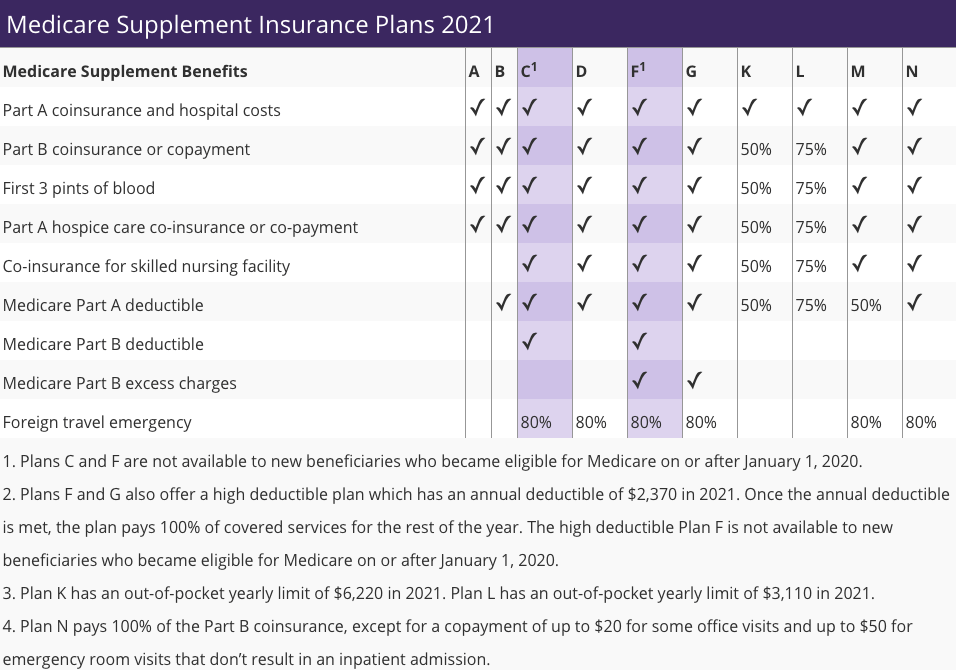

This means you never have to pay a dime at the hospital or doctors office. 52 lignes 1 Plans F and G offer high-deductible plans that each have an annual. Plan F is one of two Medicare Supplement plans that covers Part B excess charges what some doctors charge above what Medicare pays for a service.

There is an additional high deductible Medigap Plan F option that requires beneficiaries to pay out-of-pocket expenses for the first 2370 in 2021 before the plan will begin paying for coverage. Medigap Plan F may cover. Plans E H I and J are no longer sold.

Supplement Plan F is a high-coverage plan which pays for a lot of the out-of-pocket costs typically incurred by Medicare beneficiaries. This plan covers Medicare deductibles and all copays and coinsurance which means you pay nothing out of pocket throughout the year. Plan G is almost identical to Plan F with only one exception.

Medicare Part A deductible. With Plan F you have no out of pocket costs no co-pays or deductibles to pay. High-deductible Plan F.

Blue Cross Medicare Supplement Plan F pays the Medicare Part A hospital deductible and coinsurance the Part B deductible and excess charges. Plan F is only available if you first became eligible for Medicare before January 1 2020 which means your 65th birthday occurred before January 1 2020. One has a high deductible but costs.

Part A is the hospitalization component of Original Medicare and covers Medicare expenses typically associated with a hospital stay. This Medigap plan will help you pay your portion of the costs of your Medicare Part A and Medicare Part B benefits. Like many other Medigap policies Plan F also covers Part B copayments and the deductible.

Generally Medicare covers approved charges for hospitalization at 80. Plan F has two versions. After meeting the deductible the plan begins to pay for Medicare-covered costs.

According to medicaregov it means that MedSup Plan F pays for 100 of the following. Most notably Plan F pays the Medicare Part B Medical calendar year deductible which most other standardized plans do not. Medicare Supplement Plan F benefits As mentioned Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings Plans A-N.

In summary Plan F is the most comprehensive plan it pays everything that Medicare Part A hospital and Part B doctoroutpatient do not cover. Instead the high-deductible Plan F may have. Additionally it covers foreign travel agency care and skilled nursing facility coinsurance explains BlueCross BlueShield of Illinois.

If you are shopping for a Medicare Supplement Plan F AARP is one option. The high-deductible version of Medicare Plan F has a lower monthly premium and higher out-of-pocket expenses. Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers.

This plan is a cheaper alternative to the standard Medigap Plan F since the beneficiary is responsible for higher out-of-pocket costs from the start. Keep in mind that the high-deductible Plan F option doesnt vary from the standard Plan F when it comes to basic benefits. Medicare Plan F also referred to as Medigap Plan F is the most comprehensive Medicare supplement plan.

Plans offering routine eye exams range. The internet is full of information about traditional providers of Medicare Plan F policies like AARP Insured by UnitedHealthcare Insurance Company.

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

What Does Medicare Supplement Plan F Cover Helpadvisor Com

What Does Medicare Supplement Plan F Cover Helpadvisor Com

Medigap Plan F High Deductible Nevada Medicare

Medigap Plan F High Deductible Nevada Medicare

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Is Plan F Going Away Medigap Plan F Discontinued Boomer Benefits

Is Plan F Going Away Medigap Plan F Discontinued Boomer Benefits

What Is Medicare Supplement Plan F Gomedigap

What Is Medicare Supplement Plan F Gomedigap

High Deductible Plan F High Deductible Medicare Supplement

High Deductible Plan F High Deductible Medicare Supplement

Medicare Supplement Plan F Quote Senior Healthcare Direct

Medicare Supplement Plan F Quote Senior Healthcare Direct

Comparing Medicare Supplement Plan F G Medicarehaven Com

Comparing Medicare Supplement Plan F G Medicarehaven Com

Is Plan F Worth The Price Ensurem Life Optimized

Is Plan F Worth The Price Ensurem Life Optimized

What Is Medicare Plan F Medicare Life Health Medigap Made Simple

What Is Medicare Plan F Medicare Life Health Medigap Made Simple

What Does Plan F Cover Medicare Plan F Coverage

What Does Plan F Cover Medicare Plan F Coverage

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.