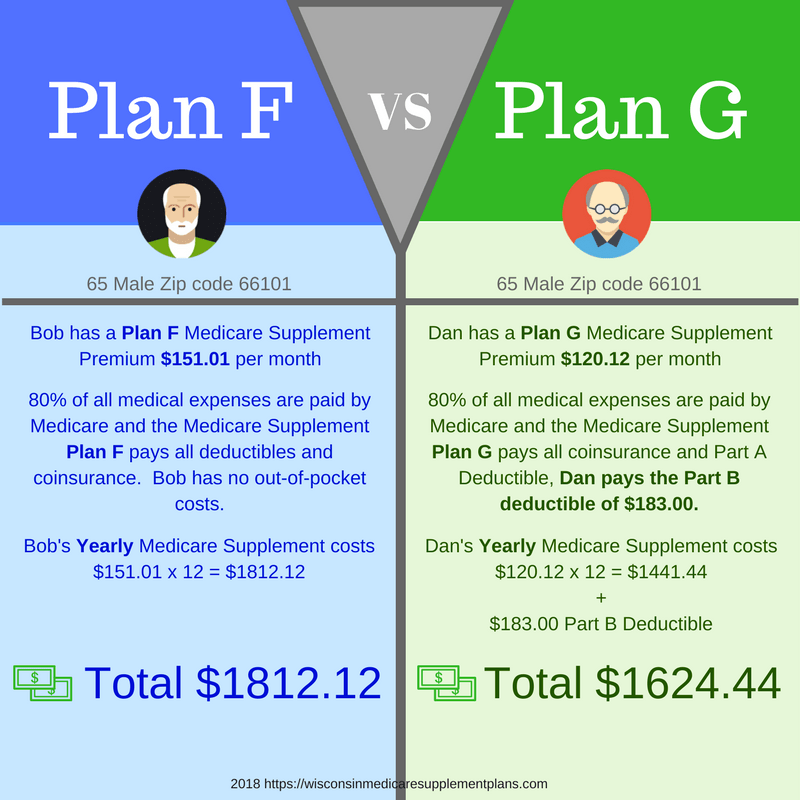

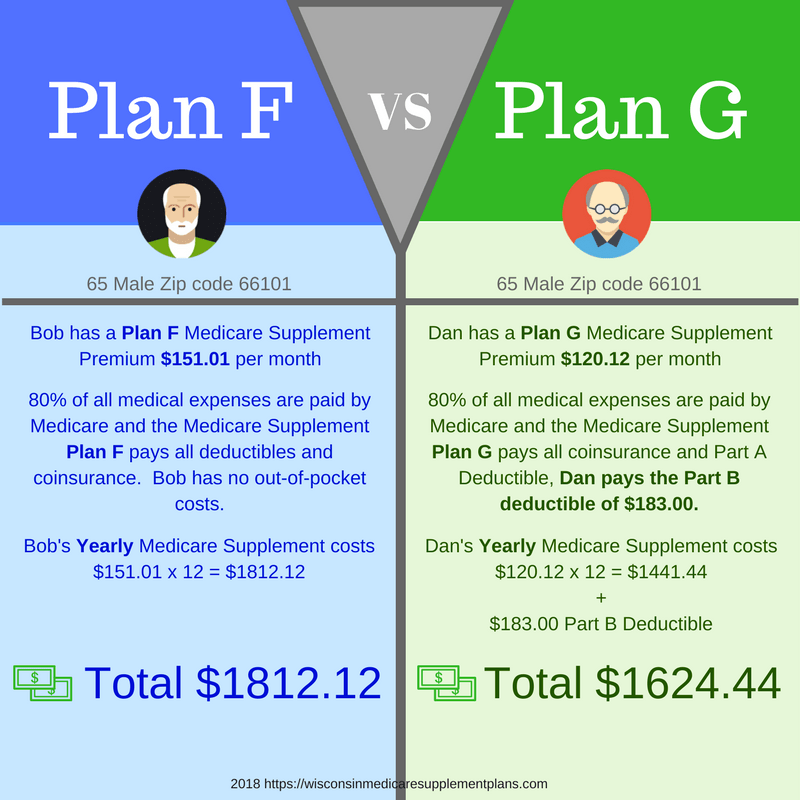

Original Medicare is divided into Part A and Part B and they represent your inpatient and outpatient services. Even though it has similar coverage Medigap Plan Gs monthly premiums are typically much less expensive than those for Plan F.

Medicare Supplement Medigap Plan F What Is Medicare Plan F

Medicare Supplement Medigap Plan F What Is Medicare Plan F

The new Medigap option may pay for your annual physical or routine hearing exam.

Medigap plan f benefits. Plans offering routine eye exams range from 10 to 25. Medigap Plan C covers the same benefits as Plan F except for Medicare Part B excess charges. Medigap Plan F also increases the reach of your Medicare policy.

Because this insurance policy covers most of the gaps in. Plan F might be able to do the same for you. Plan N also covers similar Medicare.

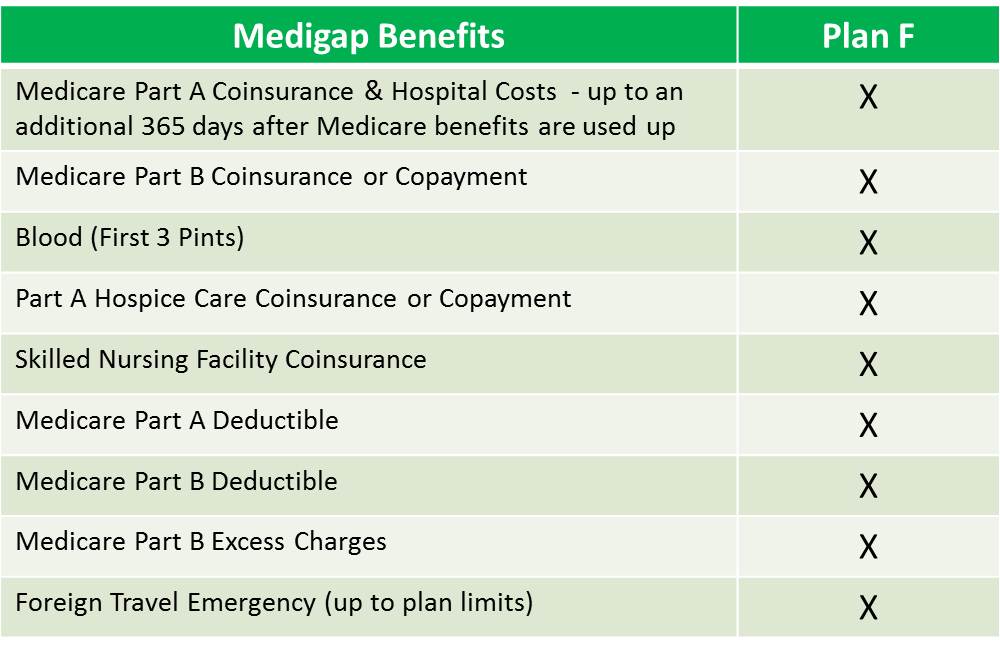

100 coverage of Part A coinsurance and costs while staying in the hospital for up to 365-day once Medicare benefits are exhausted. When it comes to Medicare Supplement plans MediGap Plan F will have the highest coverage level available of the lettered plan options. It is very popular for this same reason and seniors love how much coverage it provides them.

Compare Medigap plans side-by-side. Medicare Supplement Insurance Plan F is the only Medigap plan to offer coverage in all. Medicare Supplement Insurance Plan F provides the most comprehensive benefits of all the 10 standardized Medigap plans sold by insurance carriers however like Plan C this policy is also not available for new enrollees onafter January 1 2020.

Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers. Medicare Part A Coinsurance and Hospital Costs Under Original Medicare Part A requires that you pay some of the costs associated with longer hospital stays. Core policy benefits are covered under all Medicare Supplement plans.

Medicare Supplement Insurance Plan F covers each of the following Medigap benefits. For some people just having all supplementary expenses covered means they get to enjoy peace of mind about their healthcare. Beginning in 2020 Plans F and C which cover the Part B deductible are no longer available to people newly eligible to Medicare after January 1 2020.

Plans E H I and J are no longer sold. Medicare Supplement Plan F benefits As mentioned Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings Plans A-N. Out of all the available Medigap plans Medigap Plan F is the biggest and offers the most benefits.

Lack of a yearly out-of-pocket expense limitation Cost-sharing for most Medicare Parts A and B services. Medicare Supplement High Deductible Plan F is one of 10 standardized Medicare Supplement plans Medigap plans that help seniors pay medical expenses such as deductibles copayments and coinsurance that Original Medicare does not cover. Medigap Plan F will have limited availability.

Usually Original Medicare only pays up to 80 of your bill after deductibles and copays. Medigap Plan F may cover. Advantages of Medigap Plan F.

The most desired benefit of Medicare Supplement plan F is that it covers all of the deductibles copays and even coinsurances under Original Medicare Parts A and B. Innovative Plan F benefits may include nurse hotline access or a drug discount card. Some carriers offer access to a SilverSneakers gym membership.

12 Zeilen Medigap Plans. This is covered more further down the page. If you became eligible for Medicare in 2019 or earlier however you can still enroll in Plan F in 2020 and beyond.

Some gaps in the Federal Medicare Program that Medicare Supplement Plan F helps rectify are. Is Medigap Plan F the Best Plan. This means youll have no out-of-pocket expenses to worry about.

Medigap Plan F covers many of the out-of-pocket expenses that Original Medicare does not including the following benefits. You can avoid facing. Original Medicare consists of two parts.

Meaning there are more benefits Plan A doesnt cover than there are benefits. Medicare Supplement Plan F covers the costs for the services you receive under Original Medicare. Medigap Plan A has the least amount of benefits it only covers what is considered the core policy benefits.

Plan F is a very comprehensive plan helping cover expenses that original Medicare doesnt. Medigap Plan G provides coverage for all of the same benefits that Plan F covers except for the Medicare Part B. In some cases the difference in premiums between the two plans may be so large that you could save money by choosing Plan G even after the Part B deductible.

This includes your deductibles coinsurance and copays when receiving. Ultimately Plan G has the same benefits as the Plan F. Medigap Plan F is the most comprehensive Medigap plan covering 100 of your cost-sharing.

100 coverage of Part B outpatient coinsurances and copayments. Plan F is for beneficiaries looking for full coverage for all out-of-pocket costs including deductibles coinsurance and copayments. The chart below shows.

Lets look in depth at.

Medicare Supplement Plan F Wisconsin Medicare Plans

Medicare Supplement Plan F Wisconsin Medicare Plans

Mutual Of Omaha Medicare Supplement Mutual Of Omaha Medicare

Mutual Of Omaha Medicare Supplement Mutual Of Omaha Medicare

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplement Plan F Quote Senior Healthcare Direct

Medicare Supplement Plan F Quote Senior Healthcare Direct

Transamerica Medicare Supplement Plans For Baby Boomers

Transamerica Medicare Supplement Plans For Baby Boomers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplement Plan F Medigap Plan F Freemedsuppquotes

Medicare Supplement Plan F Medigap Plan F Freemedsuppquotes

Best Medicare Supplement Plan F Rates Benefits Medigap Plan F Comparison

Best Medicare Supplement Plan F Rates Benefits Medigap Plan F Comparison

Medicare Supplement Plan F 7 Essential Facts You Must Know Clear Medicare Solutions

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.