There are two major changes that are coming under the new law. The Medicare Access and CHIP Reauthorization Act MACRA was passed into law in 2015.

2020 Medicare Supplement Changes Will Introduce Two New Eligibility Groups Ritter Insurance Marketing

2020 Medicare Supplement Changes Will Introduce Two New Eligibility Groups Ritter Insurance Marketing

What Does MACRA Do.

Macra and medicare supplement plans. MACRA stands for the Medicare Access and CHIP Reauthorization Act of 2015. This part of MACRA only affects beneficiaries who become Medicare. Repeals the Sustainable Growth Rate PDF formula Changes the way that Medicare rewards clinicians for value over volume.

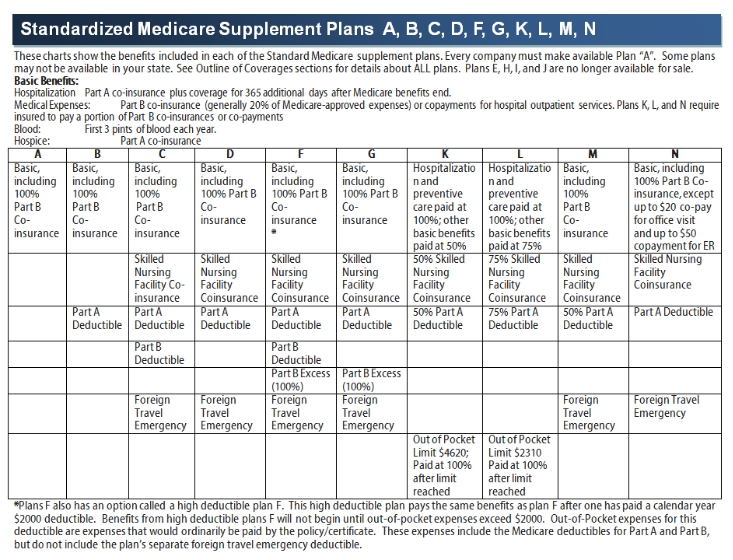

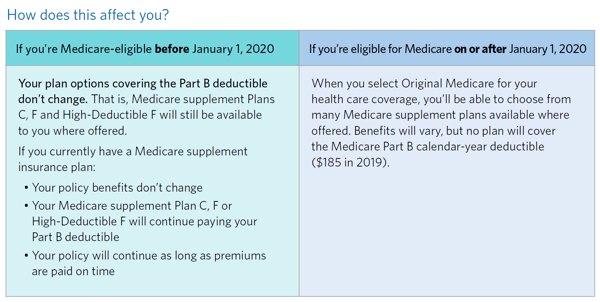

In this blog I want to give a little bit of explanation of what is happening in the industry in regards to some changes to Medicare supplement plans next year 2020. This law only affects people who become newly eligible for Medicare on or after January 1 2020. Specifically it bans insurers from selling Med Supp policies ie Plans C and F that cover the Medicare Part B deductible 183 in 2018 to newly eligible enrollees effective January 1 2020.

You may have heard some things that are happening. Specifically MACRA eliminates coverage of the Part B deductible in Plans C and F for newly eligible individuals on or after Jan. Understanding the Federal MACRA Mandate.

Effective January 1 2020 Medicare Supplement plans no longer cover the cost of the Medicare Part B deductible as part of a federal change under the Medicare Access and CHIP Reauthorization Act of 2015 MACRA. Beginning in 2020 newly eligible Medicare individuals wont be able to purchase Medicare Supplement Plans that cover the Part B deductible. Have you heard.

These plans will no longer be sold to Medicare beneficiaries who become Medicare Eligible on or after January 1 2020. MACRA primarily affects Medigap plans but it also impacted Medicare Advantage plans Medicare. This law prevents Medicare Supplement plans from covering the cost of the Medicare Part B deductible for newly eligible individuals as of January 1 2020.

MACRA is changing Medicare. Due to MACRA as of January 1 2020. Medigap is a supplemental insurance policy that helps cover some of the out-of-pockets costs leftover from Medicare coverage.

Members who currently have Medicare Supplement Insurance Plans C F or High Deductible F will be able to keep them. This includes Medicare Supplement Plans C F High-Deductible F and Minnesota and Wisconsin Part B deductible coverage. Congress added a provision in MACRA eliminating first-dollar coverage.

It is a law that states that anyone who is newly eligible for Medicare starting January 1 2020 and beyond may not enroll in a Medicare Supplement Plan that covers the Part B deductible such as plan C F or High Deductible F. Additionally all Medicare Supplement Insurance Plans must include identical benefits across all carriers. While the impact on Medicare Supplement doesnt occur until 2020 individual carriers are in a position now to plan a course to proactively mitigate risks or exploit opportunities.

MACRA is an acronym for Medicare Access and CHIP Reauthorization Act legislation signed into law in 2015. That is a mouthful so what does it mean. It has to do with the law that was passed a number of years ago.

MACRA also addresses the availability of Medicare Supplement Insurance Plans C F F Select and High Deductible F. MACRA defines newly eligible as anyone who is eligible for Medicare Supplements after January 1 2020. If a person has original Medicare they may also have a supplemental insurance plan known as Medigap.

It goes into effect on January 1 2020. Medicare Supplement plans with Part B deductible coverage Plans C F and high deductible F cannot be purchased by. Heres everything you need to know when considering which plans are best for you moving forward.

But in some cases the. The Medicare Access and CHIP Reauthorization Act of 2015 MACRA is a bipartisan legislation signed into law on April 16 2015. As a result of these changes some insurance providers offering Medigap policies will need to submit new plan filings for review and approval with the respective state departments of insurance.

MACRA was signed into law in 2015 and primarily affects Medigap. What does recently passed legislation referred to as MACRA Medicare Access and CHIP Reauthorization Act of 2015 mean for the Medicare Supplement industry. The law affects Medigap plans.

It is called MACRA. Medigap plans that pay for the Part B deductible cannot be sold to newly eligible Medicare. MACRA is a federal law that applies to all health care insurance companies offering Medicare Supplement Insurance Plans.

MACRA created the Quality Payment Program that. What is MACRA. The new rule states that as of January 1 2020 newly-eligible Medicare beneficiaries will not be able to purchase Medicare Supplement plans that cover the Part B Deductible.

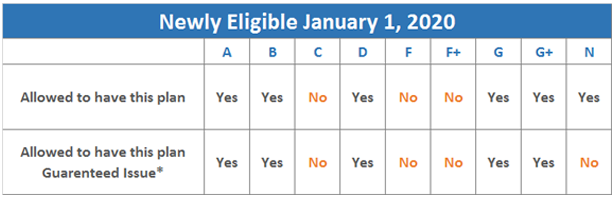

It eliminates so-called First dollar coverage. Newly eligible individuals can chose from Medicare Supplement Plans A D G High-Deductible Plan. The following guaranteed issue plans are accessible for newly eligible Medicare recipients.

MACRA refers to the Medicare Access and CHIP Reauthorization Act of 2015.

Medigap Plan N The Best Plan For 2021 And Beyond

Will Medicare Supplement Plan F Plan C Go Away In 2020 Medicare Mindset Llc

Will Medicare Supplement Plan F Plan C Go Away In 2020 Medicare Mindset Llc

2020 Brings Changes To Medicare Supplement Insurance Medigap California Health Advocates

2020 Brings Changes To Medicare Supplement Insurance Medigap California Health Advocates

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

.png) Confused About Macra We Break It Down For You Seniormarketsales

Confused About Macra We Break It Down For You Seniormarketsales

Macra Plan Changes And Eligibility

Macra Plan Changes And Eligibility

Medicare Supplement Plan N Why Get It Now Macra Impact On Plan G Youtube

Medicare Supplement Plan N Why Get It Now Macra Impact On Plan G Youtube

Is Medicare Supplement Plan F Really Going Away Clear Choice Insurance Group

Is Medicare Supplement Plan F Really Going Away Clear Choice Insurance Group

Macra How Medicare Will Change Medicarequick

Macra How Medicare Will Change Medicarequick

Medicare Blog Medicare News Medicare Information Macra

Medicare Blog Medicare News Medicare Information Macra

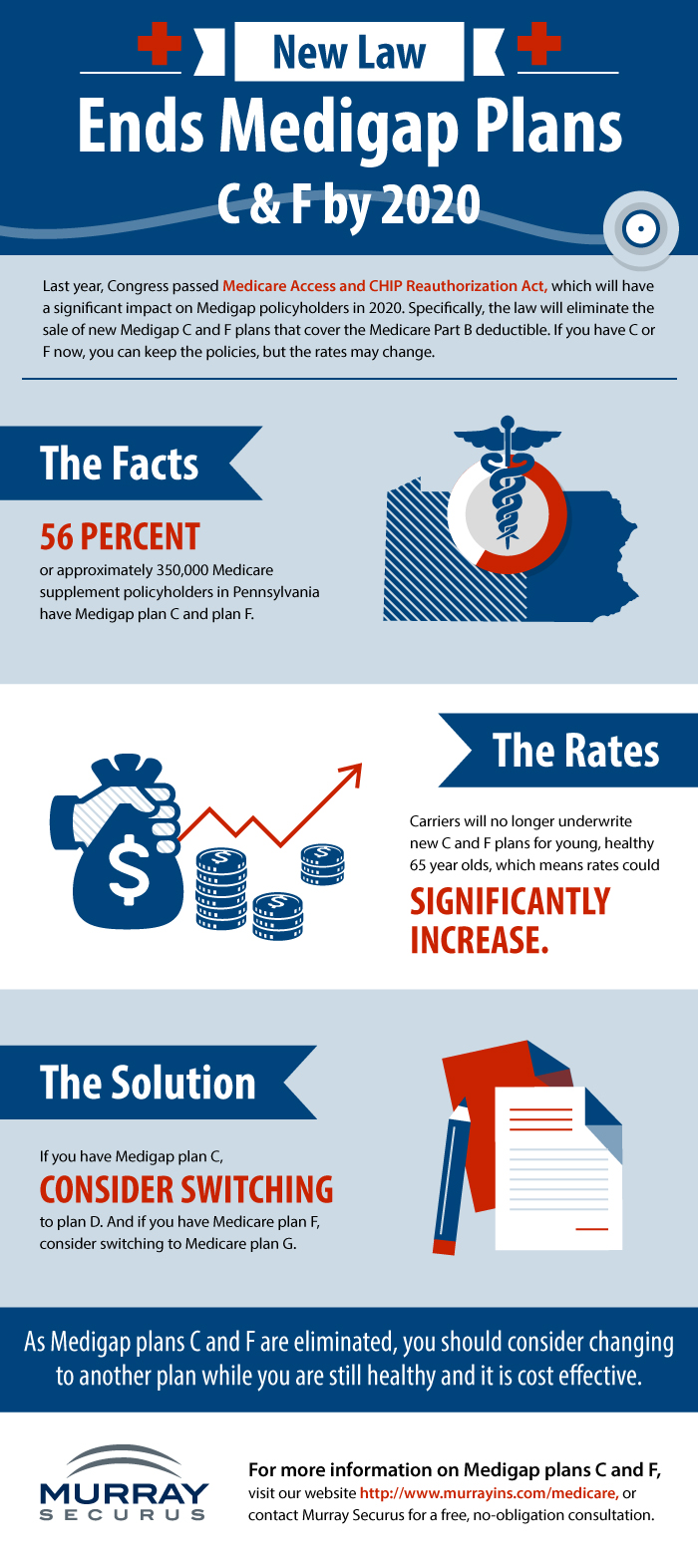

New Law Ends Medigap Plans C F By 2020 Murray

New Law Ends Medigap Plans C F By 2020 Murray

Https Seniormarketsales Com Education Content Library News Updates What Is Macra Mutual Of Omaha Macra

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.