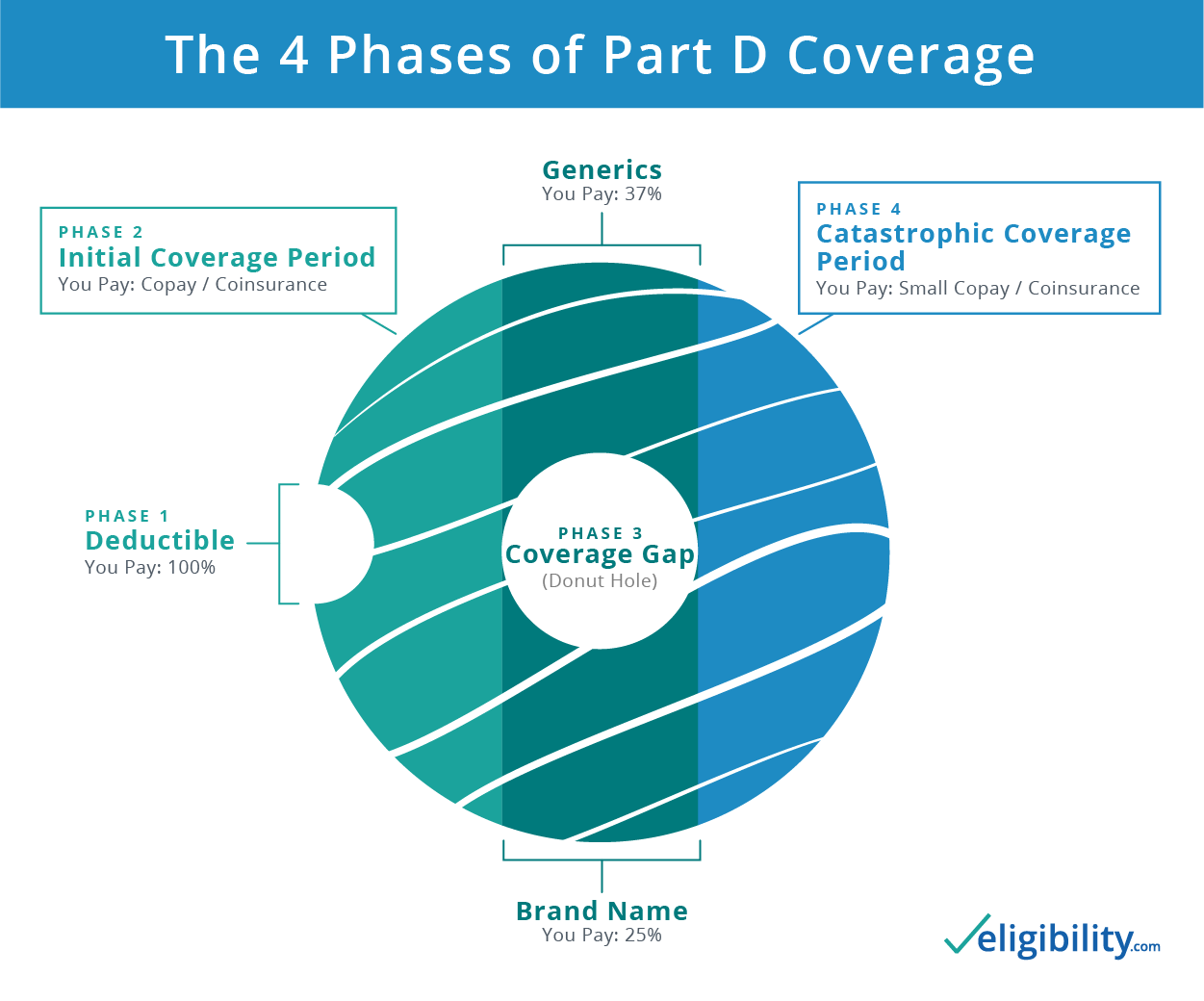

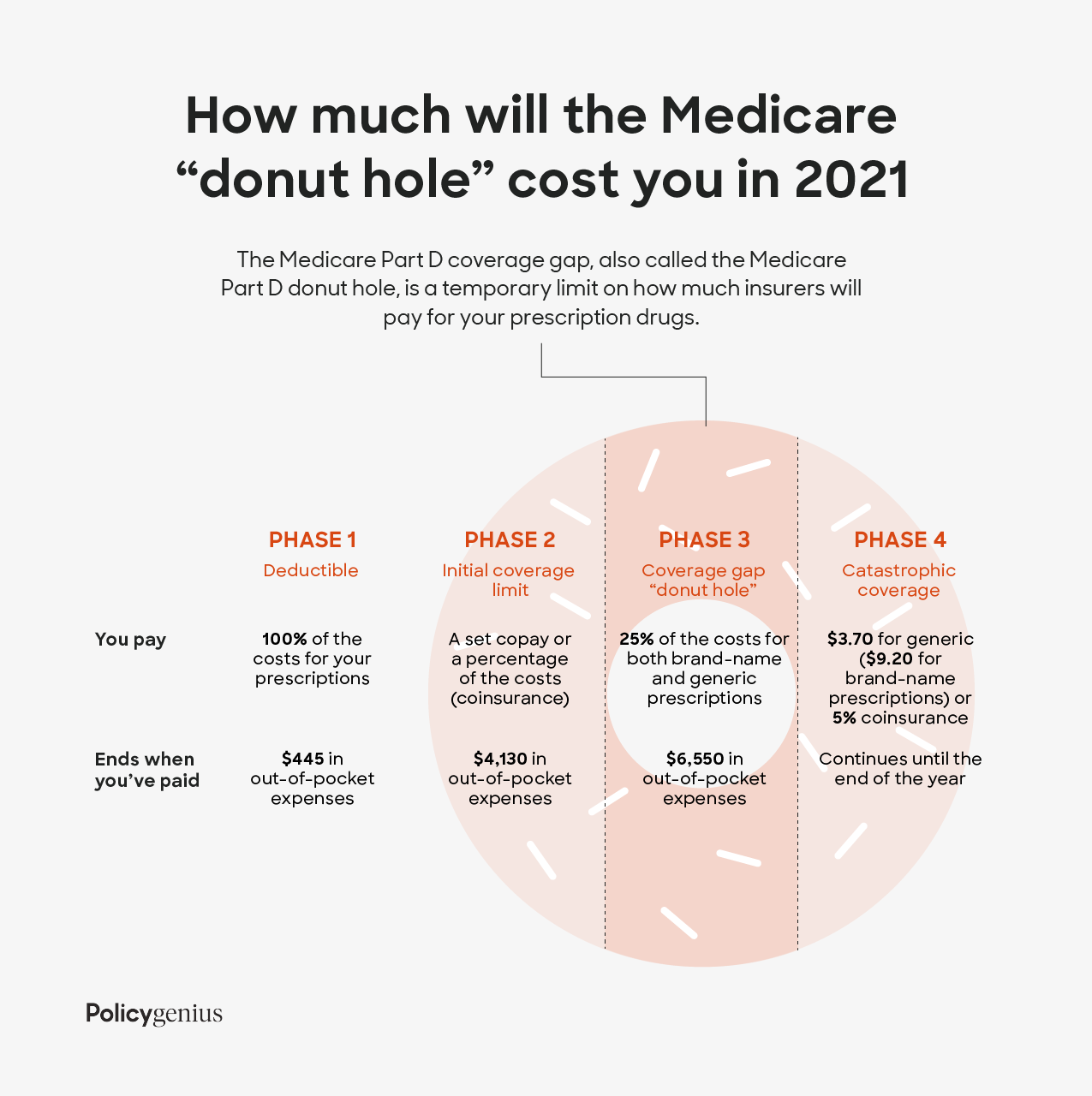

How much is the Part D penalty. The Medicare Part D penalty is calculated by multiplying 1 of the national base beneficiary premium 3306 in 2021 by the number of full months that you were eligible for but didnt enroll in a Medicare Prescription Drug Plan and went without other creditable prescription drug coverage.

Medicare Everything You Want To Know But Are Afraid To Ask Northern Trust

Medicare Everything You Want To Know But Are Afraid To Ask Northern Trust

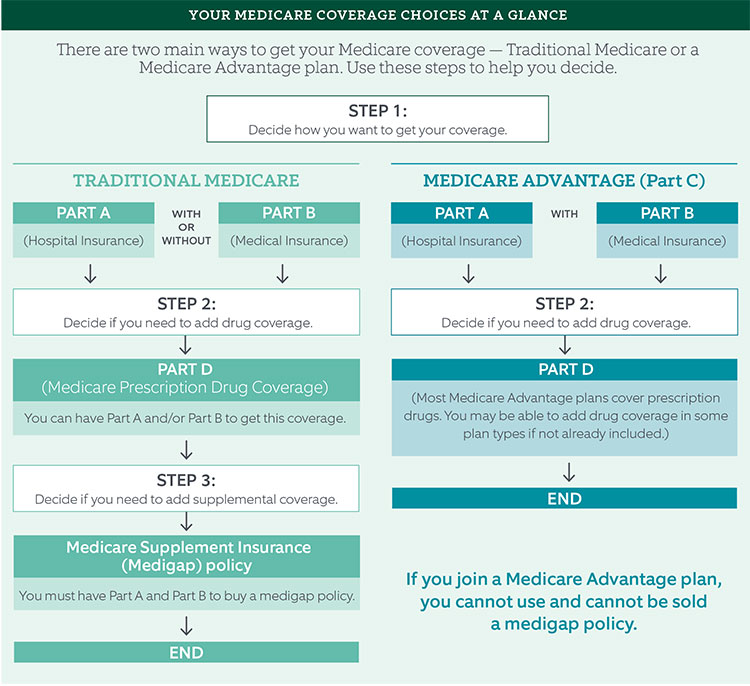

Medicare Part C also called Medicare Advantage is a way to get your Medicare Part A Part B and Part D benefits all in one plan.

Medicare advantage part d penalty. The figure is rounded to the nearest 010. Enrollment in a Medicare-approved drug. Original Medicare benefits include Part A and Part B but most Medicare recipient choose to enroll in Part D when they are first eligible for Medicare.

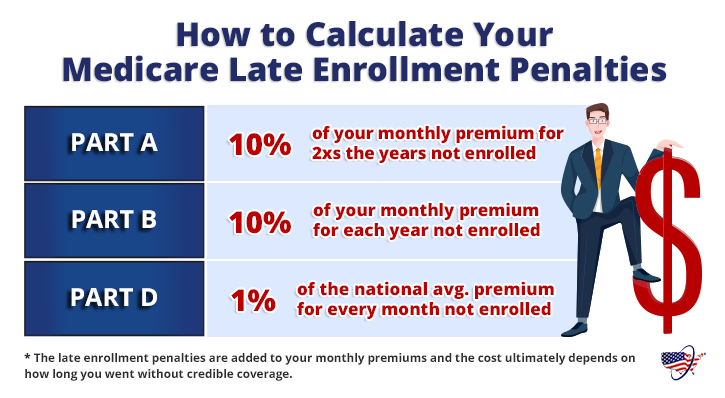

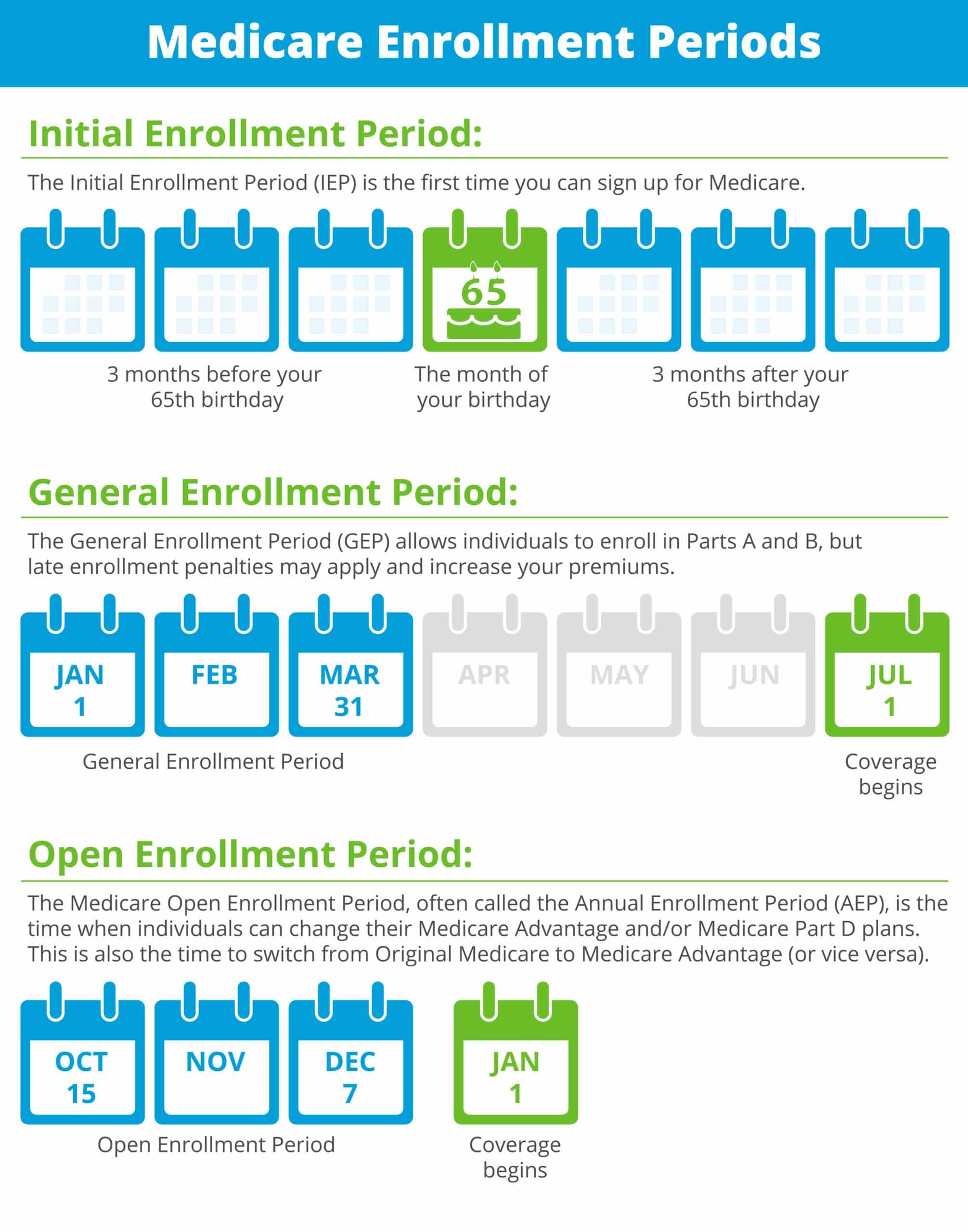

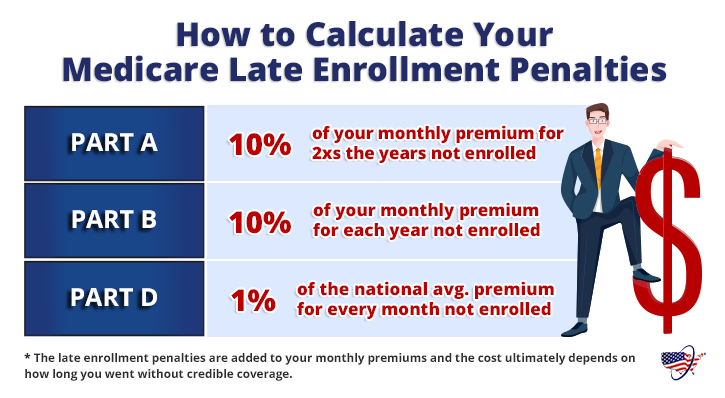

If you wait too long after your Initial Enrollment Period to sign up for Medicare Part A hospital insurance Part B medical insurance or Part D Medicare prescription drug plans you could be subject to a Medicare late enrollment penalty. Part D helps cover prescription drugs and is an optional plan available to Medicare beneficiaries. In a Medicare drug plan may owe a late enrollment penalty if he or she goes without Part D or other creditable prescription drug coverage for any continuous period of 63 days or more in a row after the end of his or her Initial Enrollment Period for Part D coverage.

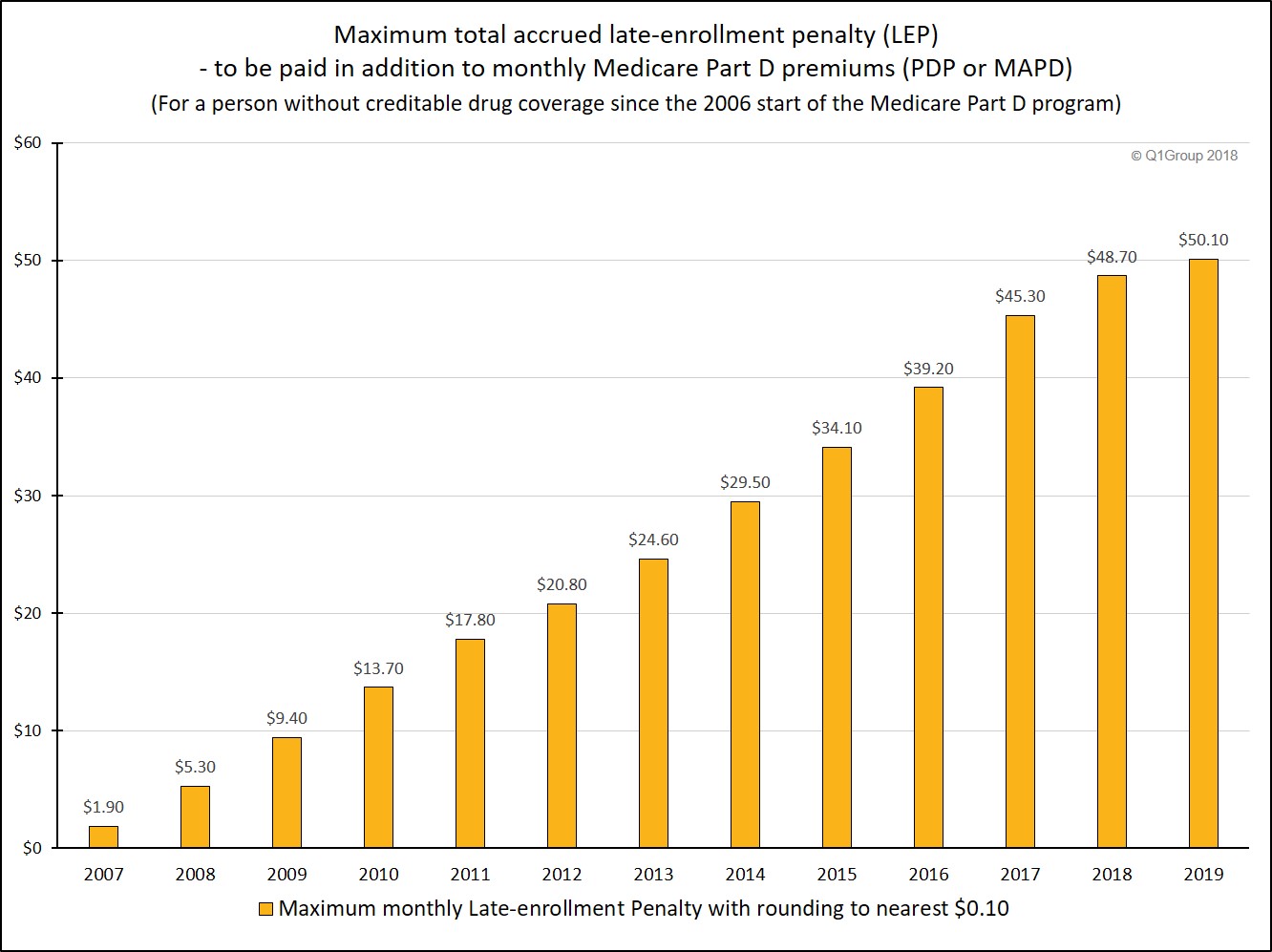

In other words if you were eligible for Medicare Part D coverage back in 2005 and first join a Medicare Part D plan or Medicare Advantage plan that includes drug coverage or MAPD in January 2021 you will pay an additional 69480 penalty in 2021 for your Medicare Part D drug coverage and as you can imagine this penalty can change every year as the Medicare Part D. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. The penalty is calculated by multiplying 1 of the national base beneficiary premium 3306 in 2021 times the number of full uncovered months you didnt have Part D or creditable coverage.

Seniors are often warned about the enormous fine theyll get if they dont buy a Part D plan as soon as they qualify for Medicare. The Medicare Part D late-enrollment premium penalty LEP is an additional monthly cost paid by Medicare Part D beneficiaries who did not enroll in a Medicare Part D prescription drug plan when they were first eligible - or who were without creditable prescription drug coverage for more than 63 days. In fact Medicare actively discourages lateness with hefty consequences.

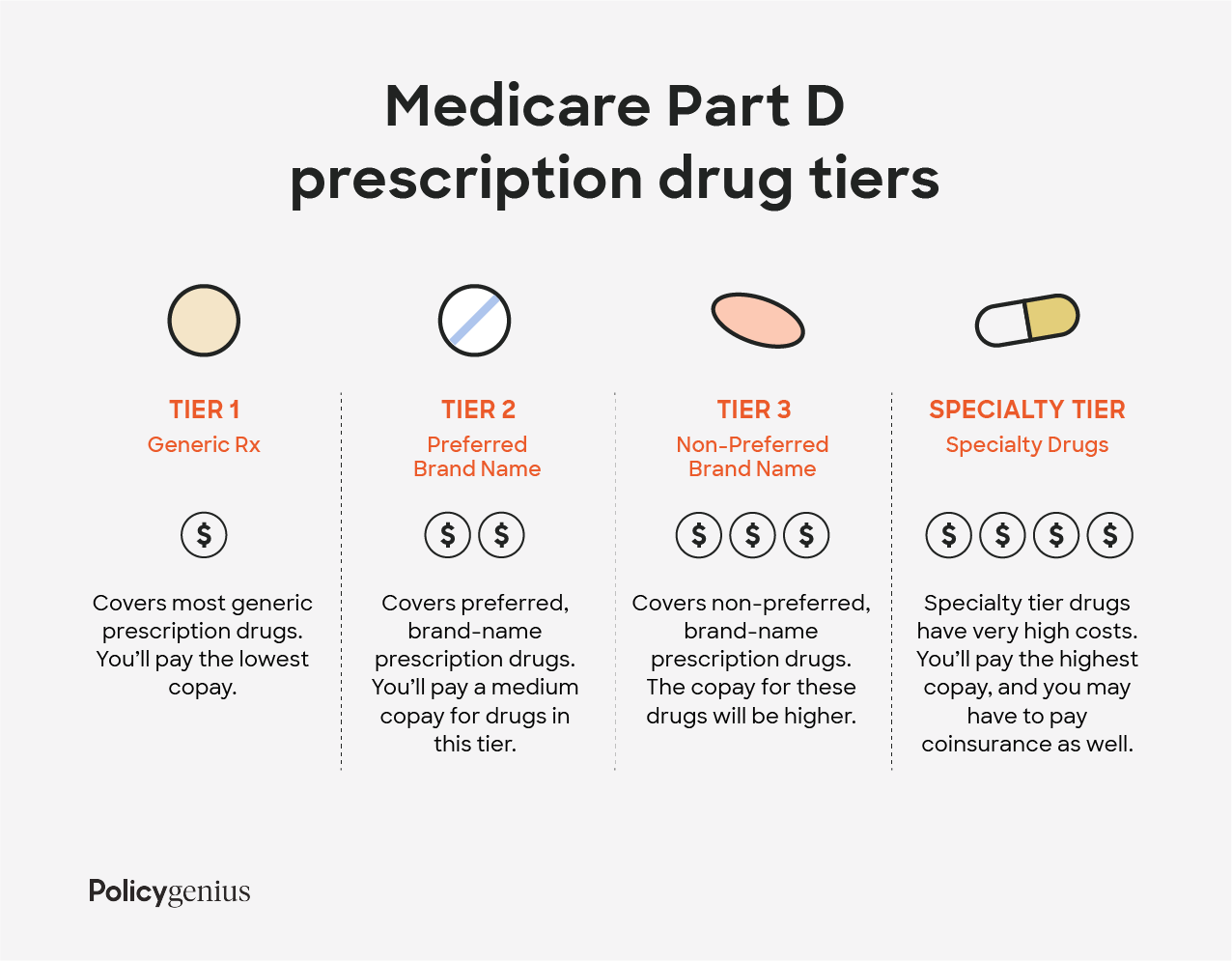

Medicare Part D is prescription drug coverage. Unlike Part A and Part B Medicare Part D is an optional benefit that sits outside Original Medicare. The penalty is assessed and charged only after you actually enroll in a stand-alone Part D plan or Medicare Advantage plan with Part D benefits.

A Part D plan Prescription coverage through a Medicare Advantage plan Any other Medicare plan that includes Medicare PDP coverage Another healthcare plan that includes. Reference THIS LINK to confirm your penalty calculation for the current year. Part D premium for as long as he or she has Medicare prescription drug coverage even if the person changes his or her Medicare drug.

The penalty is calculated based on the number of months you are late enrolling in Part D. Medicare Part A late enrollment penalty. If you qualify you are not subject to Medicare Part A late enrollment penalties.

Of course the best way to get out of the Part D late enrollment penalty is to avoid paying it in the first place so well cover when to sign up for Part D or Medicare Advantage with Part D and when you can delay enrollment without penalty. After that IEP youll pay a Part D late penalty if you go without one of these types of drug plans for 63 days or more. Medicare Part D prescription drug coverage is usually included in Medicare Advantage plans.

Medicare rounds this amount up to the nearest 010 then adds it to your monthly Part D. What very few people are told though is exactly how much that fine really is. Below is a list of recent CMP Intermediate Sanction and Termination notices issued.

Although it is voluntary a late penalty may be imposed if Part D is bypassed during the initial enrollment period. How the Medicare Part D Late Enrollment Penalty May Affect My Coverage. Enforcement and contract actions include.

Medicare Part B is medical insurance. The monthly premium is rounded to the nearest 10 and added to your monthly Part D premium. Medicare calculates the penalty by multiplying 1 of the national base beneficiary premium 3306 in 2021 times the number of full uncovered months you didnt have Part D or creditable coverage.

Your penalty for 2021 would be 33 cents x 12 for the 12 months of 2020 you werent covered or 396. But in case you already missed your deadline well help you calculate your Part D late enrollment penalty. Medicare Part A is hospital insurance.

Most people are eligible for premium-free Medicare Part A. Learn how the Part D late enrollment penalty is calculated and more about the ways to avoid the penalty. That enormous fine is 1 of the average Part D premium price for each month you delay buying into a Part D plan.

When Medicare recipients first become eligible they may think drug coverage is merely additional insurance they do not need or cannot afford. In general youll have to pay this penalty for as long as you have a Medicare drug plan. Civil money penalties CMP Intermediate sanctions ie suspension of marketing enrollment payment and.

Generally the late enrollment penalty is added to the persons monthly. A lifetime Part D late enrollment penalty. No longer substantially meets the applicable conditions of the Medicare Part C and D program.

The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage.

Find Medicare Part D Prescription Drug Plan Coverage

Find Medicare Part D Prescription Drug Plan Coverage

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

Your Guide To Medicare Part D For 2021 Policygenius

Your Guide To Medicare Part D For 2021 Policygenius

:max_bytes(150000):strip_icc()/medicare-part-d-overview-4589766-ec01f6e5f22546d8b45249a54d466e53.png) An Overview Of Medicare Part D

An Overview Of Medicare Part D

Medicare Part D Open Enrollment When Does It Start

Medicare Part D Open Enrollment When Does It Start

Medicare Part D What Are My Options Medicare University Powered By Local Medicare Agents

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

Medicare Part B Late Enrollment Penalty How To Avoid It Medicarefaq

When To Sign Up And Enroll In Medicare Aetna Medicare

When To Sign Up And Enroll In Medicare Aetna Medicare

Medicare Part D Premium And Deductible Costs For 2020 Eligibility

Medicare Part D Premium And Deductible Costs For 2020 Eligibility

How To Avoid The Part D Penalty

How To Avoid The Part D Penalty

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

2019 Medicare Part D Late Enrollment Penalties Will Decrease By 5 23 But Maximum Penalties Can Reach 601 Per Year

Your Guide To Medicare Part D For 2021 Policygenius

Your Guide To Medicare Part D For 2021 Policygenius

Medicare Part D Plans 2022 Medicare Part D Enrollment

Medicare Part D Plans 2022 Medicare Part D Enrollment

Medicare Mistakes How To Avoid 10 Costly Medicare Mistakes Medicare Usa

Medicare Mistakes How To Avoid 10 Costly Medicare Mistakes Medicare Usa

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.