Premium subsidy eligibility on the other hand is based on annual income. This subsidy is available to people with family incomes between 100 1 times and 400 4 times the poverty level who buy coverage through.

State And Federal Subsidies For California In 2020 Health For California Insurance Center

State And Federal Subsidies For California In 2020 Health For California Insurance Center

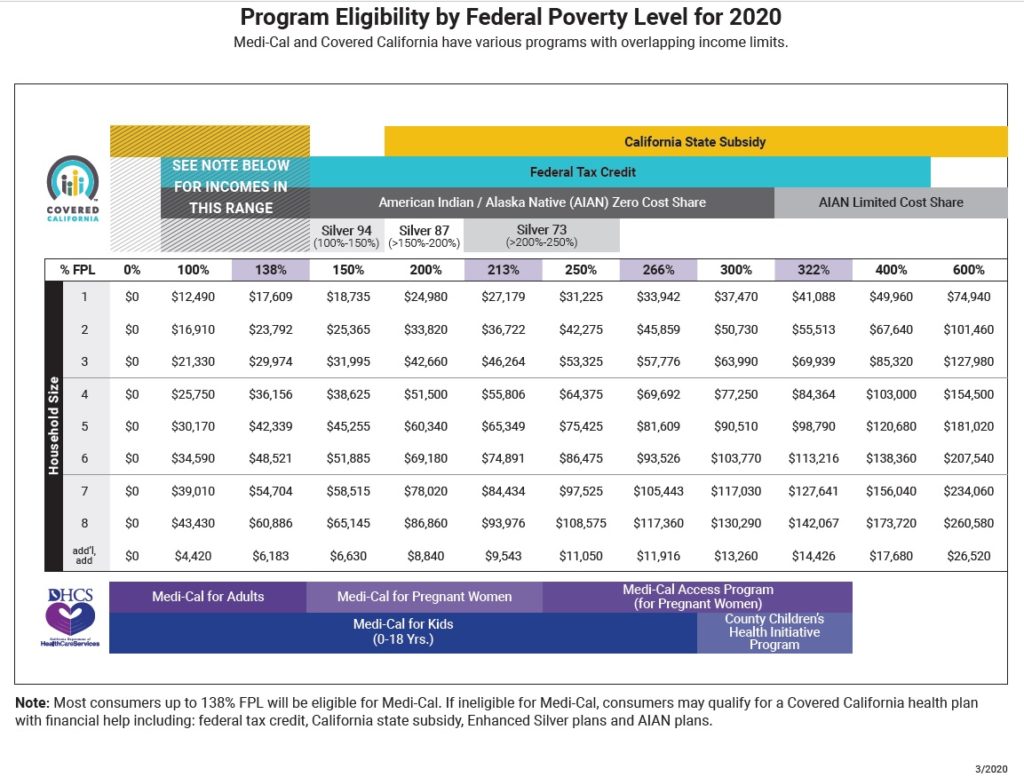

For 2020 coverage those making between 12490-49960as an individual or 25750-103000 as a family of 4 qualify for ObamaCare.

Income for aca subsidy 2020. The income limit for ACA subsidies in 2021 for individuals is between 12880 and 51520. Here are the limits for 2020 plans for individuals and families. AGI is roughly the figure on.

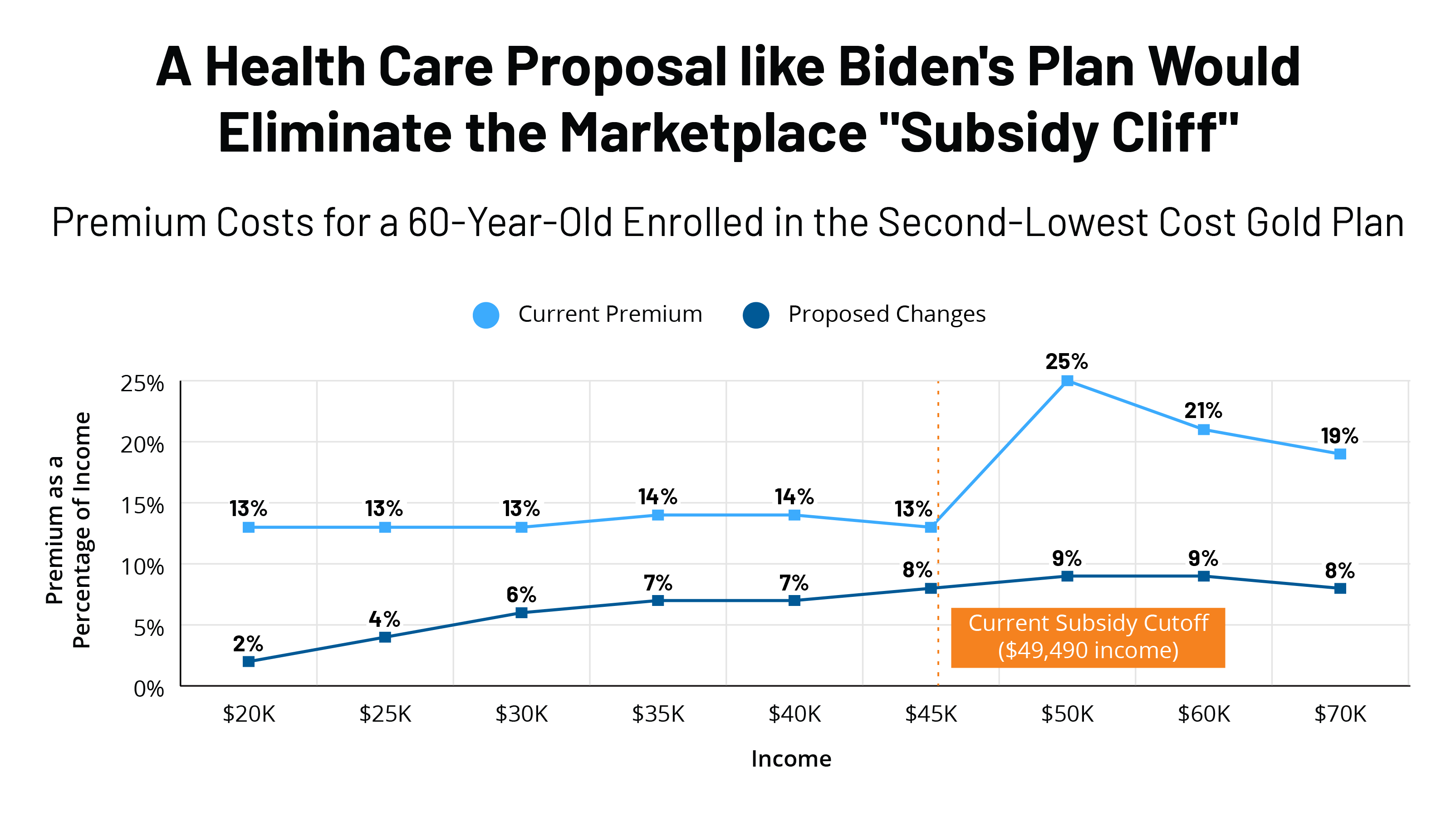

Remember the federally facilitated Affordable Care Act Marketplace savings are based on your expected household income for 2021 not last years income. And prior to 2021 you could earn up to 400 of the federal poverty level to qualify for subsidies also known as the subsidy cliff. 9 Zeilen Income Limits for 2021 ACA Tax Credit Subsidies on healthcaregov Based on eligibility.

The American Rescue Plan Act of 2021 lowered the applicable percentages significantly in 2021 and 2022 from previous years. Income Limits for 2020 Health Insurance Subsidy. Larger amounts are prorated over a longer timeframe Medicaid eligibility is based on monthly income.

See Stay Off the ACA Premium Subsidy Cliff. If your MAGI goes above 400 FPL even by 1 you lose all the subsidy. Households 400 of the FPL will now have premiums capped at 85 of their income.

1 Find out how to estimate your expected income Healthcaregov. For 2022 coverage see our page on the maximum income for ObamaCare for 2021 - 2022. 20 Zeilen Include net self-employment income you expect what youll make from your business.

For 2020 your maximum deductible is the same as the out-of-pocket maximum. Subsidy Amounts By Income For A Single Individual Analysis Of Income Limits For Subsidies Poverty levels are dependent on FPL Income under 25100 to be exact for a family of four two adults two children 20780 for a family of three and 12140 for an individual are considered poverty levels in the United States. The 2020 income figures are in the chart below.

The average subsidy amount in 2020 was 492month which covered the large majority of the average 576month premium note that both of these amounts are lower than they were in 2019. To qualify for a subsidy your household income must be between 100 and 400 of the FPL. As requirements vary by state reach out to your states Medicaid office or insurance office with eligibility questions.

Most customers who were close to the max income to receive a subsidy are now protected against having to pay them all back and many customers who were 400 of the FPL may now enroll if their premiums are significantly cheaper. For 2020 your out-of-pocket maximum can be no more than 8150 for an individual plan and 16300 for a family plan before marketplace subsidies. Locate the number of people in your household along the top row.

These amounts are just below and just above the upper threshold for subsidy eligibility so the 51000 income will allow the person to receive a premium subsidy while the 52000 income will not note that the 2020 poverty guidelines are used to determine premium tax credit eligibility for 2021 coverage. For income-based subsidy eligibility a household must have an income of at least 100 of the federal poverty level 139 percent of the federal poverty level in states that have expanded Medicaid. For a family of four that number equaled 104800 a year.

Prior to 2021 you were expected to chip in anywhere from 2 to 983 of your income. You qualify for the premium subsidy only if your modified adjusted gross income MAGI is at 400 FPL or below. How do you know if you qualify for a premium subsidy on your ACA policy.

And although there is normally an income cap of 400 of the poverty level discussed in more detail below that does not apply in 2021 or 2022. For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify. Again subsidies have increased for 2021 and will remain larger in 2022 due to the American Rescue Plan.

Well make it easy. For example in 2020 people with income between 250 and 300 of the Federal Poverty Level were expected to pay between 829 and 978 of their income toward a second lowest-cost Silver plan in their area. 23 Families of four with a household income between 26500 and 106000 can also qualify for premium subsidies.

If you meet these criteria youll be eligible for a subsidy on a sliding scale based on your income. Look in the corresponding column to see if your projected 2020 adjusted gross income AGI falls within the limits shown. Qualified lottery winnings and lump-sum income including inheritances tax refunds etc is only counted in the month its received if its less than 80000.

The subsidy cliff has been eliminated. To use the chart. But you must also not have access to Medicaid or qualified employer-based health coverage.

This is the number of people on your federal tax return.

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Affordability In The Aca Marketplace Under A Proposal Like Joe Biden S Health Plan Kff

Affordability In The Aca Marketplace Under A Proposal Like Joe Biden S Health Plan Kff

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.