I was not pressured forced or unfairly induced by my employer the agent or the insurers into waiving or declining the group health insurance. Note that your employer might have a vested interest in keeping employees on the workplace plan.

Fewer Americans Getting Health Insurance From Employer

Fewer Americans Getting Health Insurance From Employer

If healthy individuals opt out and leave only sicker employees that will cause the employer-sponsored plan premiums to rise.

Declining health insurance from employer. Beginning in 2016 employers who have 50 or more full-time or full-time-equivalent employees are required to offer health insurance to their full-time employees under the Affordable Care Act. This means that health costs take a bigger chunk from workers paychecks every year. For example you wouldnt want a 250-pound bodybuilder competing in a weight class for 150-pound bodybuilders.

However the fact that employees can simply keep the cash without evidence of health care coverage elsewhere could be an issue if questions arise in the future. This could apply to health insurance group plan that you are being offered as part of a. Theyre receiving insurance from another employer.

They prefer an individual health plan because it offers better benefits or is more affordable. This is in contrast. The smaller the group the higher its rates may be.

Why do people decline employer-sponsored health insurance. If If in the future I apply for coverage I my spouse or any of my dependent children may be treated as a late enrollee and subject to postponement or an. If someone in the family has a particular condition that is well-covered by your employer-based insurance such as a therapy or an expensive prescription you are probably smart to hold on to it.

The employer benefits from reduced insurance costs but the effect to the employee is cushioned with an HRA. Its a choice left between the employer and employee but there are a few important rules to follow. The penalty for employer or employee is triggered when the employee goes to the exchange and receives a tax credit.

This is an arrangement that requires proof of employee health coverage through another source such as a spouses employer. Under the Affordable Care Act employers can be penalized if their health insurance is too costly. Employees who choose to decline one or more lines of coverage offered by a company for themselves or their dependents must sign a waiver and provide a reason for declining.

There are a few main reasons your employees may reject the health coverage youre offering. Theyre already under a family members plan. The government now views all health-related employer payment arrangements as employer-sponsored health insurance plans.

Employees can fill out an attestation form that can be filed to avoid the. Employers can make healthcare arrangements to help employees with health insurance payments or simply just choose to pay an employee more taxable income. You want an even playing field.

Under the Affordable Care Act employers cant reimburse an employee for non-group. Employers still have to report coverage offers to the IRS and employees as subsidy eligibility is based in part on whether the person has access to an employer-sponsored plan. First health care costs are growing faster than workers wages.

The penalty on employer payment arrangements helps enforce the ACAs mandate. Employees however do not have to accept the insurance and inevitably some will turn it down. Obesity has largest impact on employers health care expenditures.

An employee who declines affordable minimum value employer coverage and applies for subsidized coverage on the exchange will be subject to a penalty. You must offer affordable minimum value health coverage. Lets revisit your responsibilities as a large employer.

A health insurance waiver is a document that when signed provides the option to opt-out of a health insurance plan offered to you by making a formal request. The declining generosity some might say adequacy of employer-sponsored insurance stems from several factors. Amounts contributed to an HRA can be in a lump sum or in increments throughout the year.

You can decline employer health insurance its called a waiver of coverage but you wont be able to get cost assistance through ObamaCare or dependent coverage through the employer plan if coverage was offered. And exchanges still have to provide the information that individuals and the IRS need in order to reconcile subsidy amounts. Plan Design Flexibility HRAs provide employers with a lot of flexibility in Plan design.

Declining Health of US. Workers Is Driving Up Employer Costs. The waiver that the employee will be required to sign will overview what declining coverage means for.

Limits can be set on types of services reimbursed by an HRA. The consequences for a business if an employee declines the employer-sponsored coverage depend on the nature of the. It leaves no loopholes for companiesbig or smallto provide health.

Kaiser Group Health Insurance Waiver

Kaiser Group Health Insurance Waiver

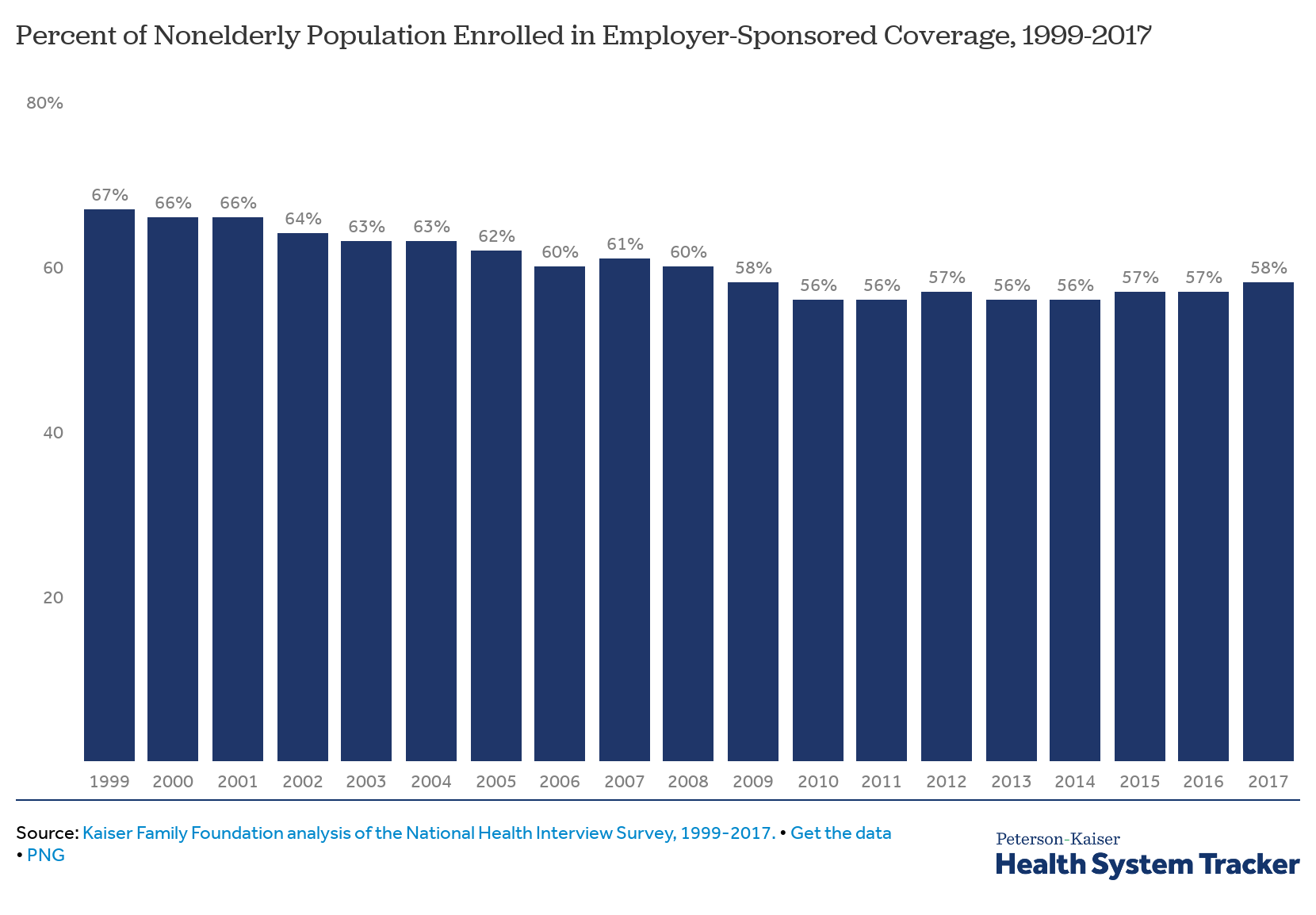

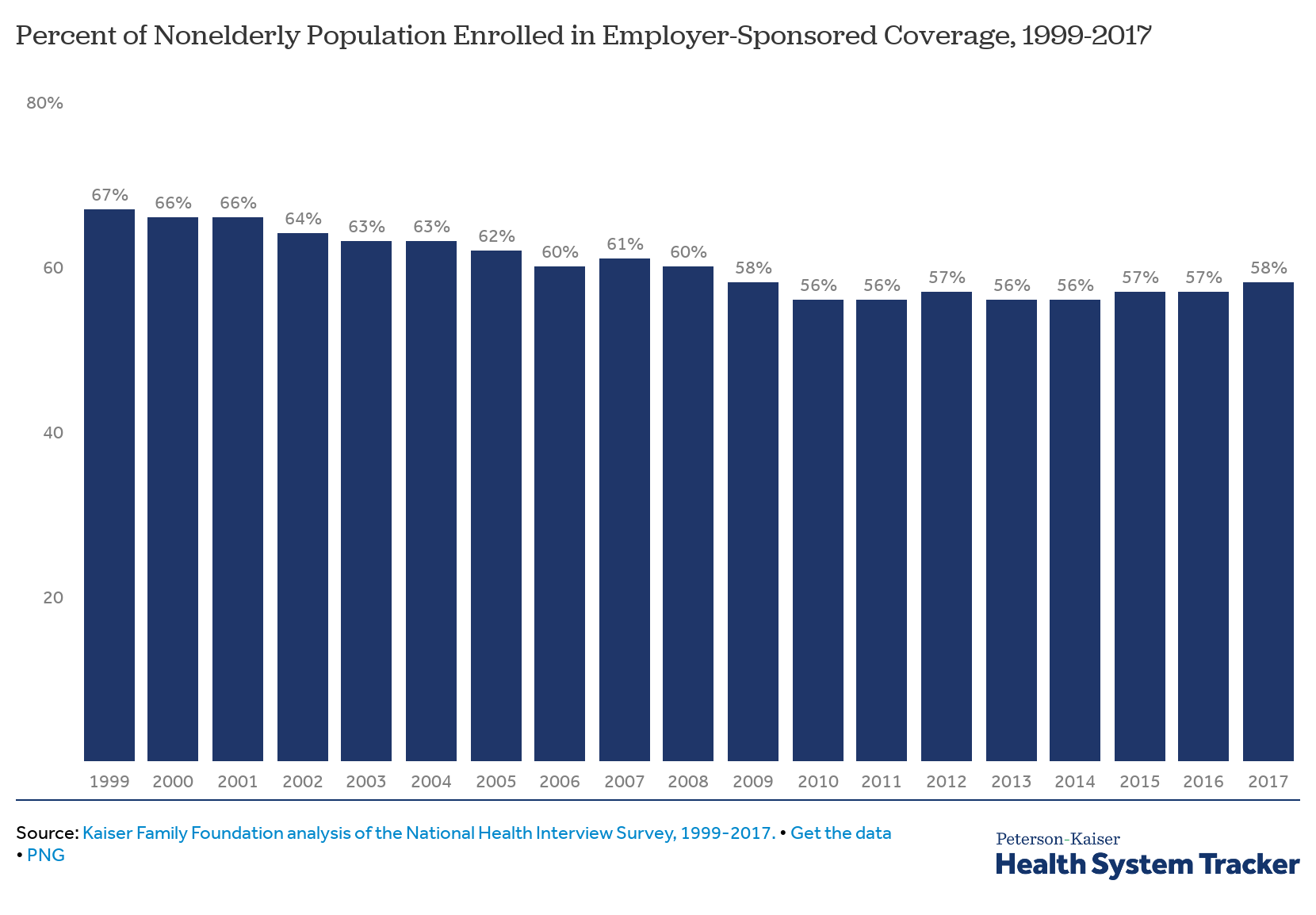

![]() Long Term Trends In Employer Based Coverage Peterson Kff Health System Tracker

Long Term Trends In Employer Based Coverage Peterson Kff Health System Tracker

Cost Of Employer Provided Health Insurance Rises Toward 19 000 A Year Wsj

Cost Of Employer Provided Health Insurance Rises Toward 19 000 A Year Wsj

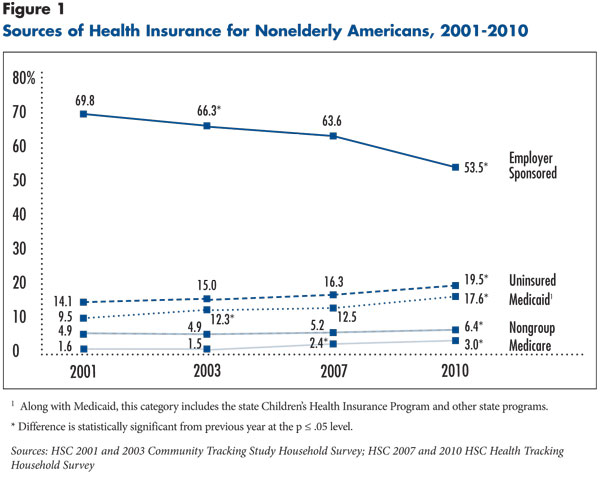

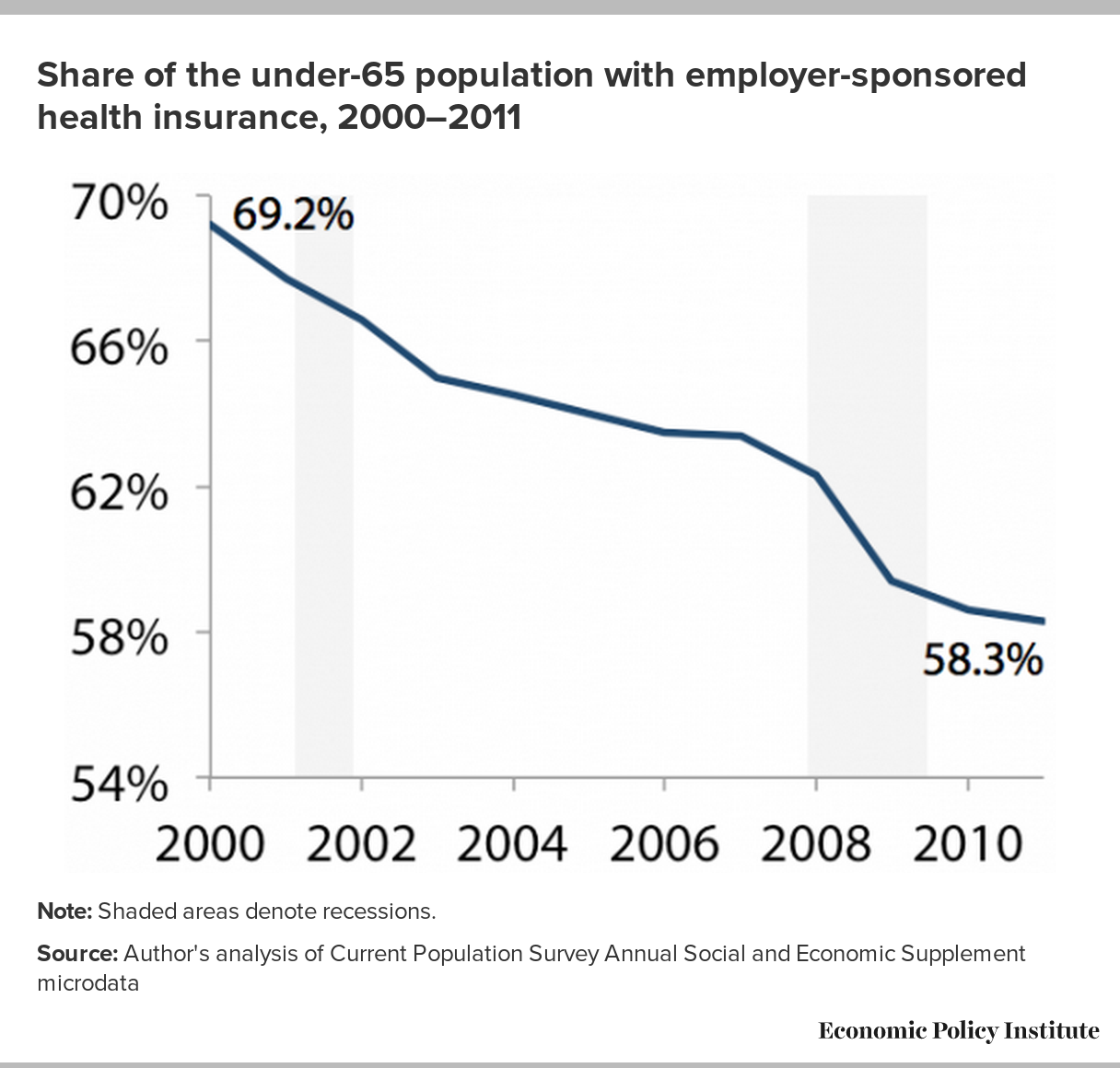

A Decade Of Declines In Employer Sponsored Health Insurance Coverage Economic Policy Institute

A Decade Of Declines In Employer Sponsored Health Insurance Coverage Economic Policy Institute

What S Wrong With Employer Sponsored Health Insurance Niskanen Center

What S Wrong With Employer Sponsored Health Insurance Niskanen Center

Nihcrgreat Recession Accelerated Long Term Decline Of Employer Health Coverage

Nihcrgreat Recession Accelerated Long Term Decline Of Employer Health Coverage

Cost Of Employer Provided Health Insurance Rises Toward 19 000 A Year Wsj

Cost Of Employer Provided Health Insurance Rises Toward 19 000 A Year Wsj

Employer Based Health Insurance Continues To Trend Down

Employer Based Health Insurance Continues To Trend Down

Employer Sponsored Health Insurance Still The Most Popular Option Benefitspro

Employer Sponsored Health Insurance Still The Most Popular Option Benefitspro

What S Wrong With Employer Sponsored Health Insurance Niskanen Center

What S Wrong With Employer Sponsored Health Insurance Niskanen Center

Employer Health Insurance In Rapid Decline Across U S And Not In Ma Health Stew Boston Com

Employer Sponsored Health Insurance Coverage Continues To Decline In A New Decade Economic Policy Institute

Employer Sponsored Health Insurance Coverage Continues To Decline In A New Decade Economic Policy Institute

Can An Employee Decline Health Insurance Gusto

Can An Employee Decline Health Insurance Gusto

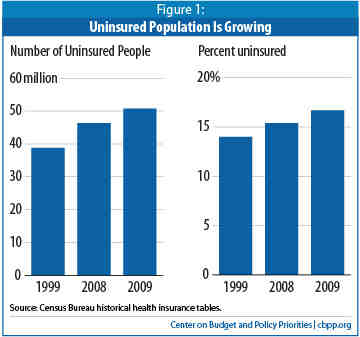

Employer Based Health Coverage Declined Sharply Over Past Decade Center On Budget And Policy Priorities

Employer Based Health Coverage Declined Sharply Over Past Decade Center On Budget And Policy Priorities

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.