This is a federally supported subsidy. COBRA generally requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity for a temporary extension of health coverage called continuation coverage in certain instances where coverage under the plan would otherwise end.

Immediate Employer Action Required As Dol Issues Guidance Model Notices On Cobra Subsidy Program Mcafee Taft

Immediate Employer Action Required As Dol Issues Guidance Model Notices On Cobra Subsidy Program Mcafee Taft

The employee should make an affirmative election to reduce the severance payments to pay for the COBRA.

Employer cobra obligations. The entity responsible for covering COBRA premium costs upfront depends on the type of plan. Below is an overview of the Rescue Plans COBRA relief which provides a 6-month. The Rescue Plan was signed by the President on March 11 2021.

Unless the federal agencies provide otherwise in subsequent guidance the responsible entity for most employer plans will be the employer. An employee becomes eligible for COBRA if they leave their job for any reason other than gross misconduct. As an employer you are responsible for notifying your former employee of the right to elect COBRA.

Most employer-sponsored group health plans must comply with the Employee Retirement Income Security Act ERISA which sets standards to protect employee benefits. Employers are required to notify COBRA recipients who are receiving the COBRA subsidy when the subsidy is expiring and of their payment obligations to continue COBRA coverage after that. Employees entitled to continuing coverage and qualifying events Employees entitled to COBRA are those who qualified for the employer sponsored health plan on the day before the qualifying event occurred and their spouses former spouses and dependents.

The employer then has 14 days to notify the employee. Employers can be reimbursed up to 102 of AEIs COBRA costs through a dollar-for-dollar credit against the employers Medicare tax obligations. One of the protections contained in ERISA is the right to COBRA continuation coverage a temporary continuation of group.

Because identifying persons who get the second bite at electing coverage may be a time consuming process employers are well-advised to get started now. The IRS has issued regulations that address how business reorganizations impact an employers obligation to provide COBRA coverage. Maybe if some requirements are satisfied.

The American Rescue Plan Act of 2021 ARPA among other significant items imposed new obligations for employers pursuant to the Consolidated Omnibus Reconciliation Act COBRA. If the total COBRA premium assistance amount is greater than their Medicare obligations the government will pay the employer back. An employer is obligated to provide COBRA coverage to qualified employees and their dependents if they offer a group health plan.

Employers can require an employee to pay 100 percent of the costs of health insurance under COBRA. As of April 1st 100 percent of premiums for COBRA or state continuation coverage must be paid by the employer. COBRA applies only to private-sector employers with 20 or more employees and a group health insurance plan.

When an employee becomes eligible for COBRA the employer must notify the insurer or plan administrator 30 days before this comes into effect 60 days if a dependents will also be affected. For employers with group health plans COBRA obligations under President Bidens premiere 19 trillion stimulus legislation the American Rescue Plan Act of 2021 the Rescue Plan are an early priority. If the plan sponsors COBRA premium costs exceed its Medicare payroll tax.

Use specific termssuch as buying group selling group and M. When an employee is terminated for gross misconduct the employee and any covered dependents lose the right to elect COBRA coverage and the employer is not required to provide an election notice. The APRA-21 COBRA premium assistance provisions create additional obligations for employers related to COBRA continuation of coverage and will require prompt action and coordination with employer.

The cafeteria plan is the written plan that allows for payment of. The employers cafeteria plan must allow it. The premium that is charged cannot exceed the full cost of coverage plus a two percent surcharge to help the employer or health insurance company cover administrative expenses.

For employers with group health plans COBRA obligations under President Bidens premiere 19 trillion stimulus legislation the American Rescue Plan Act of 2021 the Rescue Plan are an early. What Is an Employers Responsibility Regarding COBRA.

Employers Now Required To Pay 100 Of Cobra Premiums

Employers Now Required To Pay 100 Of Cobra Premiums

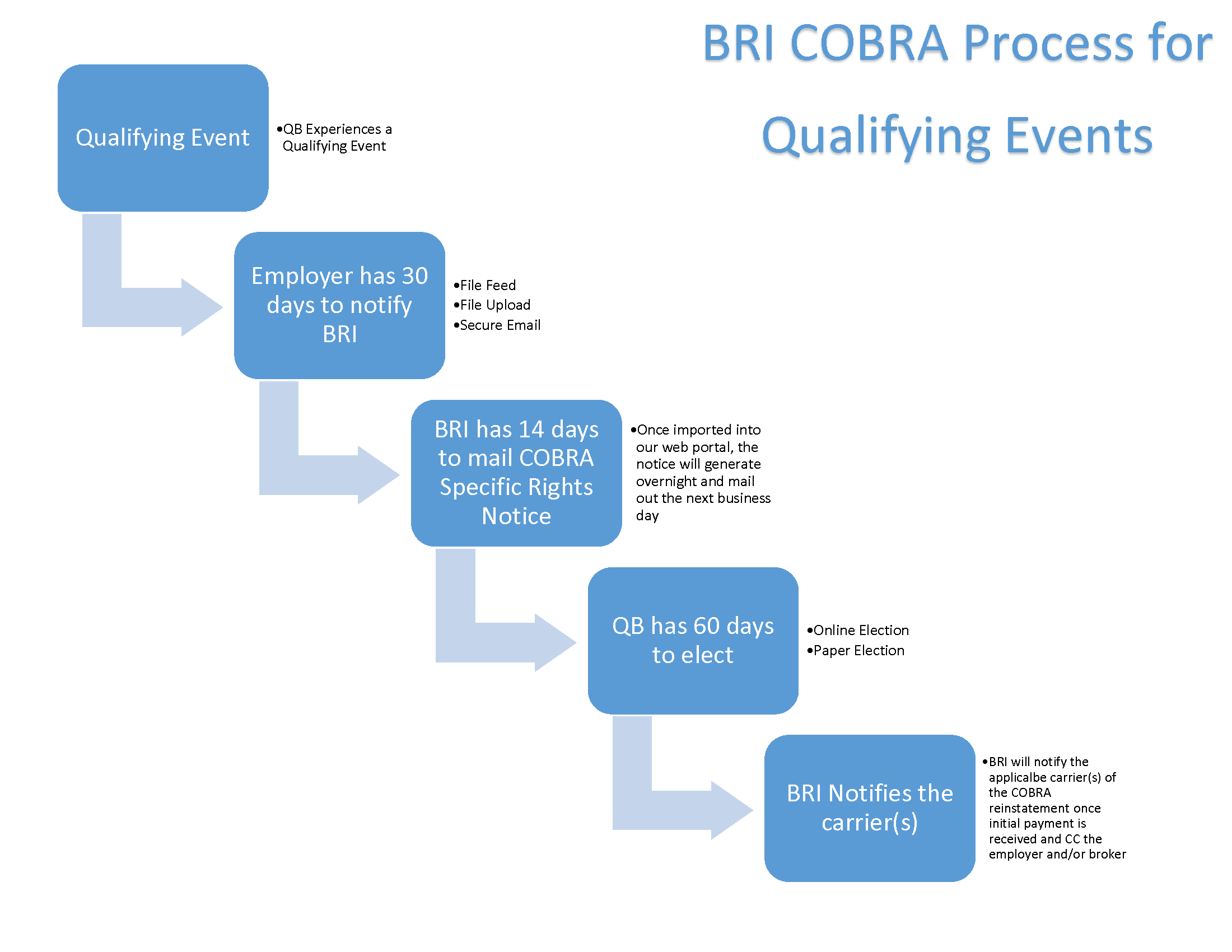

The Next Step What Happens When A Qualifying Cobra Event Occurs Bri Benefit Resource

The Next Step What Happens When A Qualifying Cobra Event Occurs Bri Benefit Resource

Cobra Changes And Other New Requirements Impose New Obligations On Plan Sponsors Insurers Tpas And Pbms

Cobra Changes And Other New Requirements Impose New Obligations On Plan Sponsors Insurers Tpas And Pbms

Cobra Rules For Employers Simplicityhr

Cobra Rules For Employers Simplicityhr

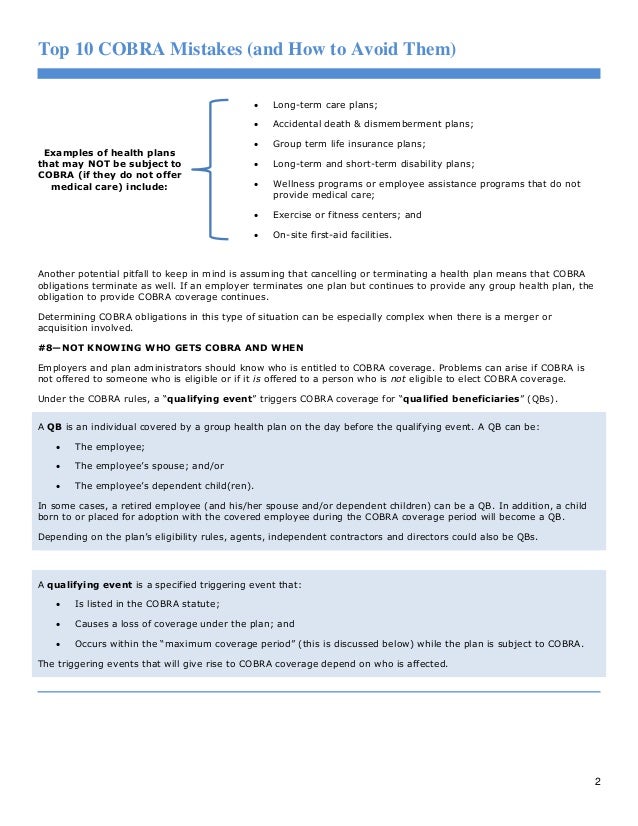

Top 10 Cobra Mistakes And How To Avoid Them

Top 10 Cobra Mistakes And How To Avoid Them

Employee S Cobra Rights Forfeited Due To Employer S Plan Termination Hr Daily Advisor

Employee S Cobra Rights Forfeited Due To Employer S Plan Termination Hr Daily Advisor

Http Www Stellarbenefitsgroup Com Wp Content Uploads 2015 11 Cobra Covered Employers And Health Plans Pdf

Employer Cobra Coverage Responsibilities Employer Obligations

Employer Cobra Coverage Responsibilities Employer Obligations

Employer Cobra Coverage Responsibilities Claim Compensation Top Class Actions

Employer Cobra Coverage Responsibilities Claim Compensation Top Class Actions

Https Www Ajg Com Us Media Files Us Legacy An Employers Guide To Cobra Pdf

The Impact Of The Cares Act On Employee Benefit Plans Part Four Analyzing Cobra Coverage Rules And Aca Information Reporting Levenfeld Pearlstein Llc

The Impact Of The Cares Act On Employee Benefit Plans Part Four Analyzing Cobra Coverage Rules And Aca Information Reporting Levenfeld Pearlstein Llc

Employers Top Cobra Subsidy Questions Under The American Rescue Plan Act Of 2021 Onedigital

Employers Top Cobra Subsidy Questions Under The American Rescue Plan Act Of 2021 Onedigital

Employer Able To Fend Off Cobra Claim Thanks To Clear Notice Procedures Hr Daily Advisor

Employer Able To Fend Off Cobra Claim Thanks To Clear Notice Procedures Hr Daily Advisor

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.