Ad Health Insurance With The Same Level Of Cover Wherever You Might Be At Home Or Away. Almost all policies cover general dental treatments emergencies accidents oral cancer treatment and some cover hospital cash benefit.

Affordable Health Insurance Quotes Anthem Blue Cross Individual Health Dental Insurance Marketplace Exchange

Affordable Health Insurance Quotes Anthem Blue Cross Individual Health Dental Insurance Marketplace Exchange

Although not cheap the benefits of having your own teeth again is making this procedure increasingly popular.

/invisalign-and-dental-insurance-coverage-7565b48f924b43c7b9f7f7431be4dcbe.png)

Medical and dental insurance quotes. Get A Quote Today. Ad Compare 145 Car Insurance Quotes. Benefit from private UK medical health care and avoid NHS waiting lists.

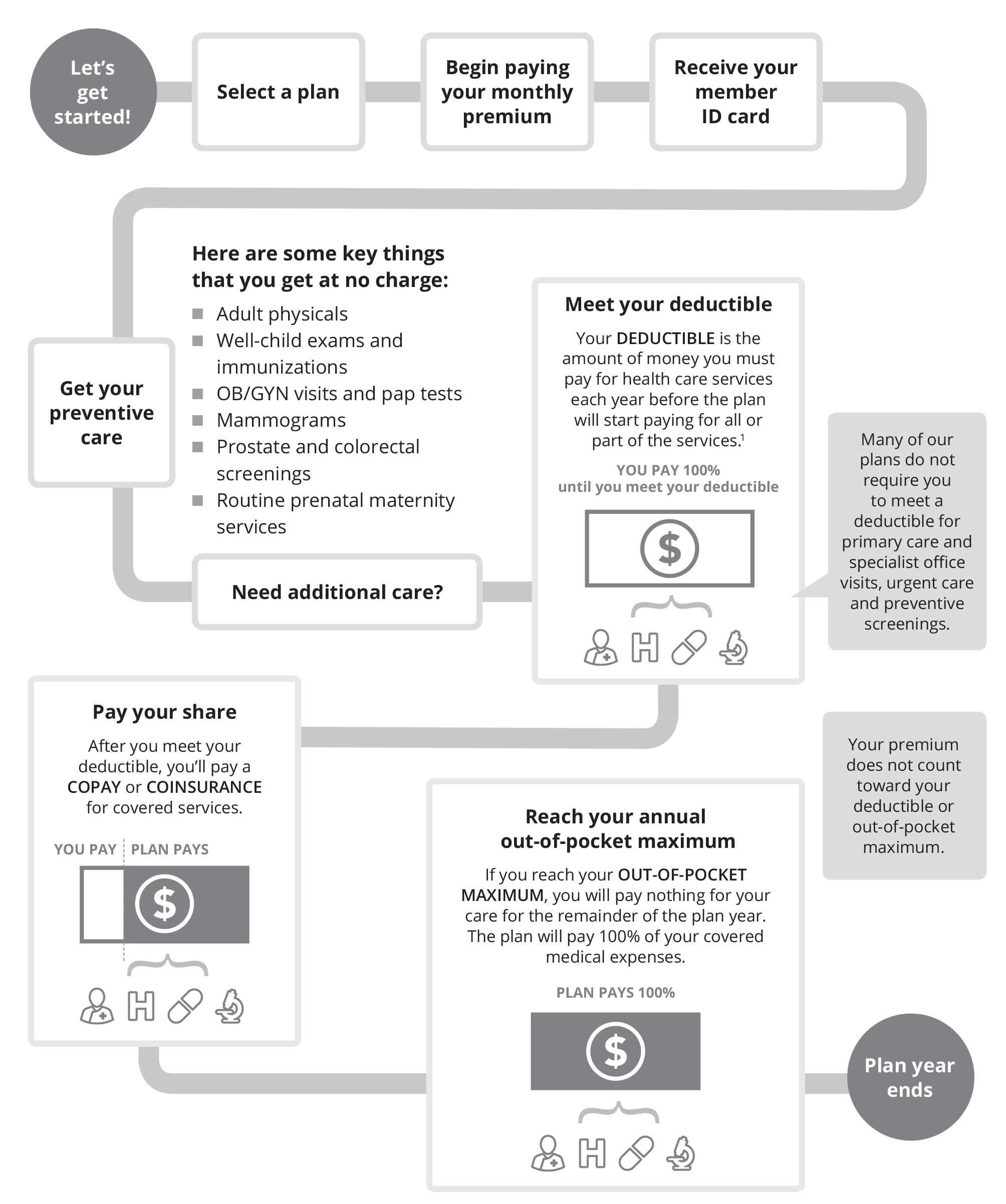

Get a quote online. It doesnt cover against incidents that occurred before the life of your policy. Using your dental insurance is simple.

Ad Health Plans Start From Just 9 a Month. Ad Health Insurance With The Same Level Of Cover Wherever You Might Be At Home Or Away. The costs of repairing or replacing them after an accident.

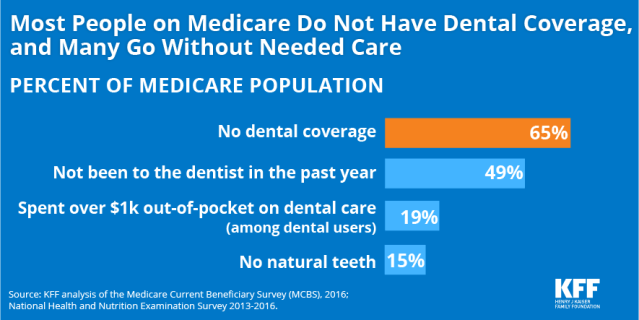

Look No Further For Life Insurance Policies Compare The Market Has You Covered. You wont be able to make a claim for treatment over this amount. Overall dental insurance is good to buy to be on the safer side or if you need the dental cover without having to pay in full for all the expenses.

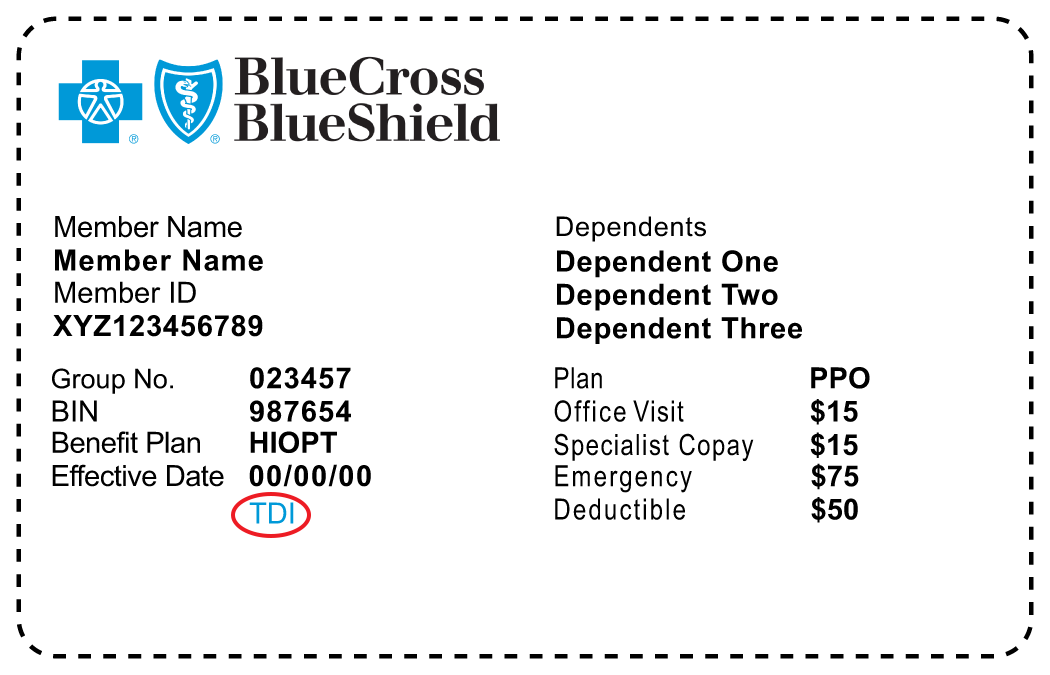

Ad Get a competitive quote from a first class UK indemnity provider. By choosing one of our dental insurance plans you will also receive a 25 no claims discount upon joining and have worldwide cover for dental accidents and dental emergencies. Premium International Health Insurance Designed For Globally Minded Individuals.

All you need to do is tell us a little about yourself and your medical history as well as the level of cover you want and well find a list of quotes tailored to your requirements. You Could Save up to 259 With us. This is a privately paid for procedure.

Get money back for all eligible claims up to the allowances stated in your plan. Find Cheapest insurance online here. Ad Get a competitive quote from a first class UK indemnity provider.

Do you offer dental indemnity insurance. For dental insurance from AXA Health. Now Get Up To 50 Off Today.

Compare and Buy Yours Now. Premium International Health Insurance Designed For Globally Minded Individuals. 5 rows Dental Cover 10 is appropriate if you are over 18 and want a product to cover the cost of dental.

Some dental policies might have set annual limits of around 500 to 1000. Just get treatment when you need it from either an NHS or private dentist depending on your level of cover. You can get dental insurance for NHS-only or NHS and private treatments.

Simple Honest Fair. If you want private health insurance comparing quotes with MoneySuperMarket and our preferred partner ActiveQuote can help you find the best available deal. Dental implants have improved over the years and computer technology is being introduced.

Medical indemnity insurance cover includes acts or omissions in the course of your professional duties. Ad We Help You Find The Right Life Insurance Policies To Suit Your Needs. Top 6 Dental Insurance policies in the UK AXA.

Ad Check out Cheapest insurance online on Teoma. Fill in the AXA Health dental claims form and return it to us with the original dental receipts. The cost of your premium might increase.

Dental Cover 10 is appropriate if you are over 18 and want a product to cover the cost of dental treatment carried out on the NHS by an NHS dentist and insurance against oral cancer. Find The Right Dental Health Insurance Uk Now. Find out more now.

This can include injury misdiagnosis delays in referral physical or mental harm to a patient. If you are a Dental Cover 10 customer and you have private treatment we will pay the NHS equivalent costs - the amount of money your treatment would have cost if it had been carried out and charged. Compare private health insurance quotes with GoCompare.

MDDUS provides healthcare professionals with access to indemnity assistance support. Dental implants help you regain your smile. MDDUS provides healthcare professionals with access to indemnity assistance support.

Call us on 0800 171 2055. Private medical insurance PMI helps cover the cost of private treatment for pre-agreed conditions and ailments. Youll still have pay the dentist first then claim back the cost from your insurer.

:max_bytes(150000):strip_icc()/BCBS-2b5e47a972e2479ebeeb0841cdc3c007.jpg)

/invisalign-and-dental-insurance-coverage-7565b48f924b43c7b9f7f7431be4dcbe.png)