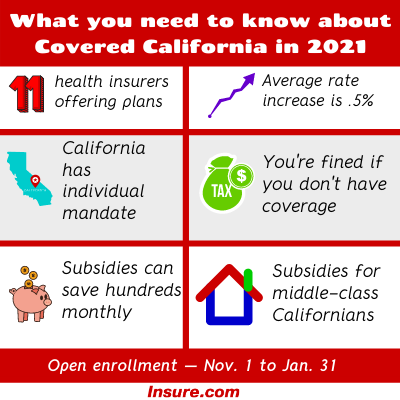

For all other qualifying events an application may only be submitted after the qualifying event has occurred. If you forget to enroll for coverage during the open enrollment period know that it will be much harder to get health insurance after open enrollment.

Qualifying Life Events For Covered California

Qualifying Life Events For Covered California

Most special enrollment periods last 60 days from the date of the qualifying life event.

Qualifying event health insurance california. After a qualifying life event you have a period of 60 days to change your health insurance plan or enroll in a new plan. One or both members of the new couple can use the special-enrollment period to enroll in coverage. Qualifying Life Event QLE A change in your situation like getting married having a baby or losing health coverage that can make you eligible for a Special Enrollment Period allowing you to enroll in health insurance outside the yearly Open Enrollment Period.

This can be during open enrollment or once open enrollment has ended. You qualify for a special enrollment period if you have a certain life event. Exceptional circumstances such as leaving jail and a variety of other events can be considered a qualifying life event.

The ability to apply up to 60 days prior to qualifying event date is limited to loss of coverage qualifying events only. Special enrollment periods due to a qualifying event include the following. If you wish to enroll in a health plan and its not currently an open enrollment period you will need to have a qualifying life event QLE.

In most cases you need to have proof of your life event. A qualifying event in the household will trigger a special enrollment period allowing the purchase addition or subtraction of insurance for individuals. The qualifying events that will occur most frequently are having a baby getting married losing group or COBRA coverage becoming a naturalized citizen or moving to California.

These are called qualifying life events. This could be a change to your family your residence your previous health coverage and a number of other things. Becoming pregnant is not a qualifying event for a special enrollment period.

There are 4 basic types of qualifying life events. California understands how important quality care is during pregnancy and has a variety of options available through our Medicaid program that allows you to enroll outside of the. There is a whole list of life events that can be.

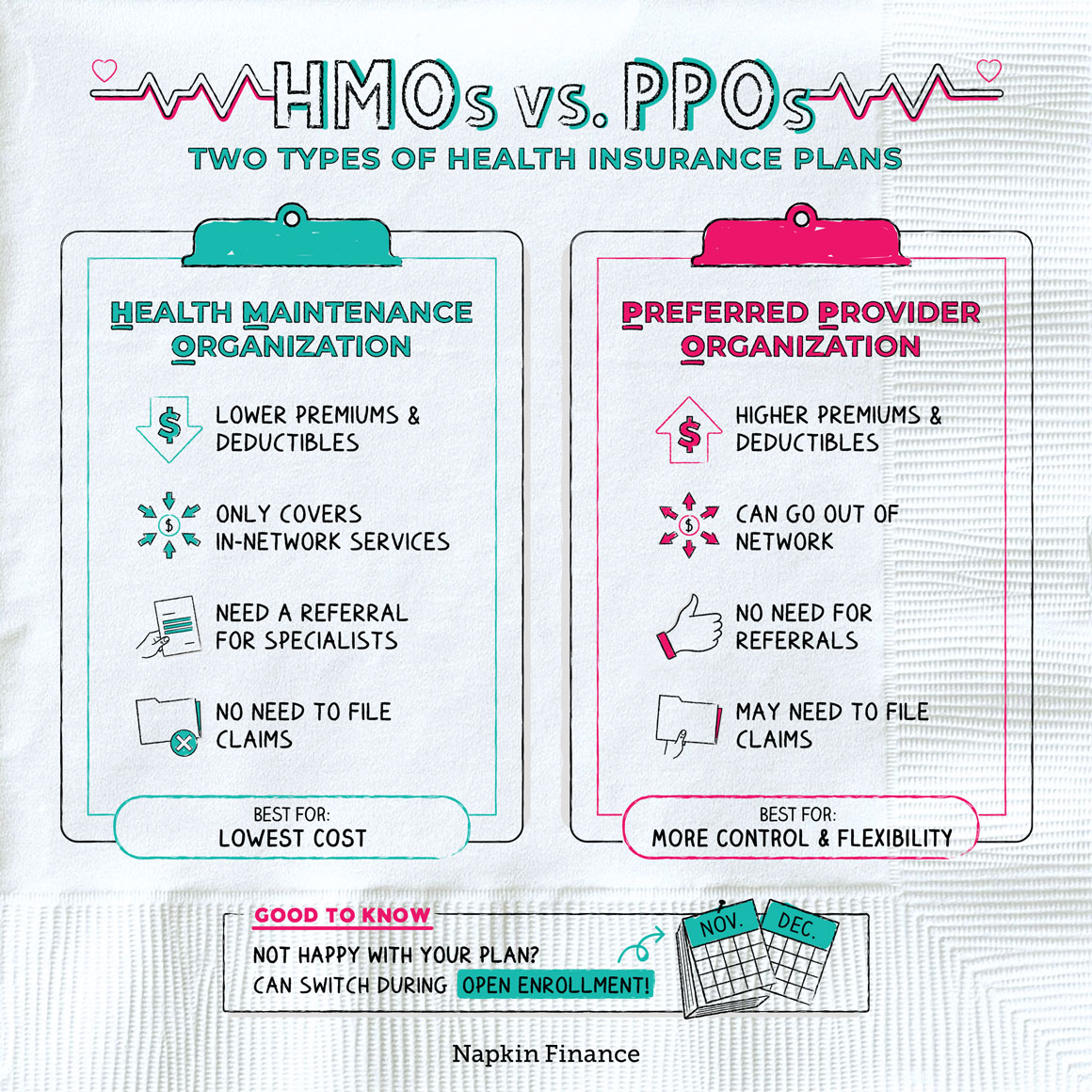

There are exceptions to the annual open enrollment period. Qualifying events in health insurance are events that alter the amount of health insurance you need or change what health policies you can purchase. Enrollment works this way because if people were allowed to purchase insurance anytime people could wait until they got sick and the system wouldnt work.

During these periods you will be allowed to choose a new health policy or update your existing insurance coverage. You also may be able to choose a plan up to 60 days in advance of some qualifying life events. These are called qualifying life events and if you experience one or more of them you can buy new coverage or change your existing coverage.

As an example for a new move qualifying event an application must be submitted after the move has been. Qualifying Life Events QLE are big life occurrences called triggering life events that allow you to enroll in individual or family health insurance outside of the Open Enrollment Period. A qualifying life event is a requirement for access to special enrollment periods.

What are the triggers for a qualifying event. Gains a dependent or becomes a dependent through birth or adoption. States can add more designated qualifying life events in addition to those allowed by HIPAA.

Married or Entered a Domestic Partnership expand_less. A qualifying event is a life change or circumstance affecting your health insurance needs or your qualification for existing health insurance or subsidies. Without a life event you wont.

You generally have 60 days from the date of your qualifying life event to enroll for health coverage or change your plan. A life event is generally a significant change that occurs in your life. Qualifying life events may entitle you to a special enrollment period to purchase health insurance without waiting for the open enrollment period.

HIPAA qualifying life events grant special enrollment rights to health insurance consumers who previously did not enroll in health coverage. You move within California and gain access to at least one new Covered California health insurance plan. Qualifying Life Events If you experience a qualifying life event you can enroll in a Covered California health insurance plan outside of the normal open-enrollment period.

IndividualFamily and Group health coverage sold in California only allows new membership during an annual open enrollment period.