How do I find a doctor near me. Heath Dreyfuss is an ear nose and throat doctor treating patients in McLean Virginia and the surrounding communities.

Keystone Hmo Network Doctors Keystone Insurance Accepted At Sjra

Keystone Hmo Network Doctors Keystone Insurance Accepted At Sjra

Ear Nose Throat Doctor.

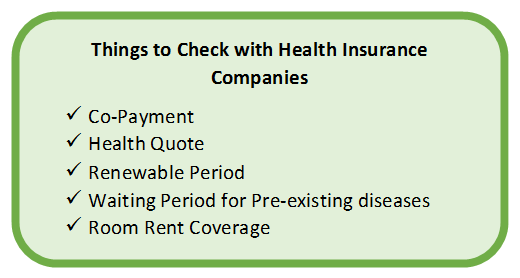

Doctors that accept hmo insurance near me. Its important to note that when selecting an HMO insurance plan you have several networks within each HMO product to choose from. Based on your needs and the needs of your family you may be looking for a doctor who specializes in Family Practice Internal Medicine or Pediatrics. Availability of providers provider groups and hospitalsfacilities is not guaranteed by this carrier or carriers and is subject to addition deletion or change by this carrier or carriers at any.

22 Lynn Grillo is a Family Nurse Practitioner trained at George Washington University and George Mason University in a collaborative program. Find a physician mental health provider hospital or health care facility. Call your insurance company or state Medicaid and CHIP program.

Novant health brunswick medical center. PPO Plans 800 944-9399. We accept no responsibility or liability for any damages arising from your use of this information.

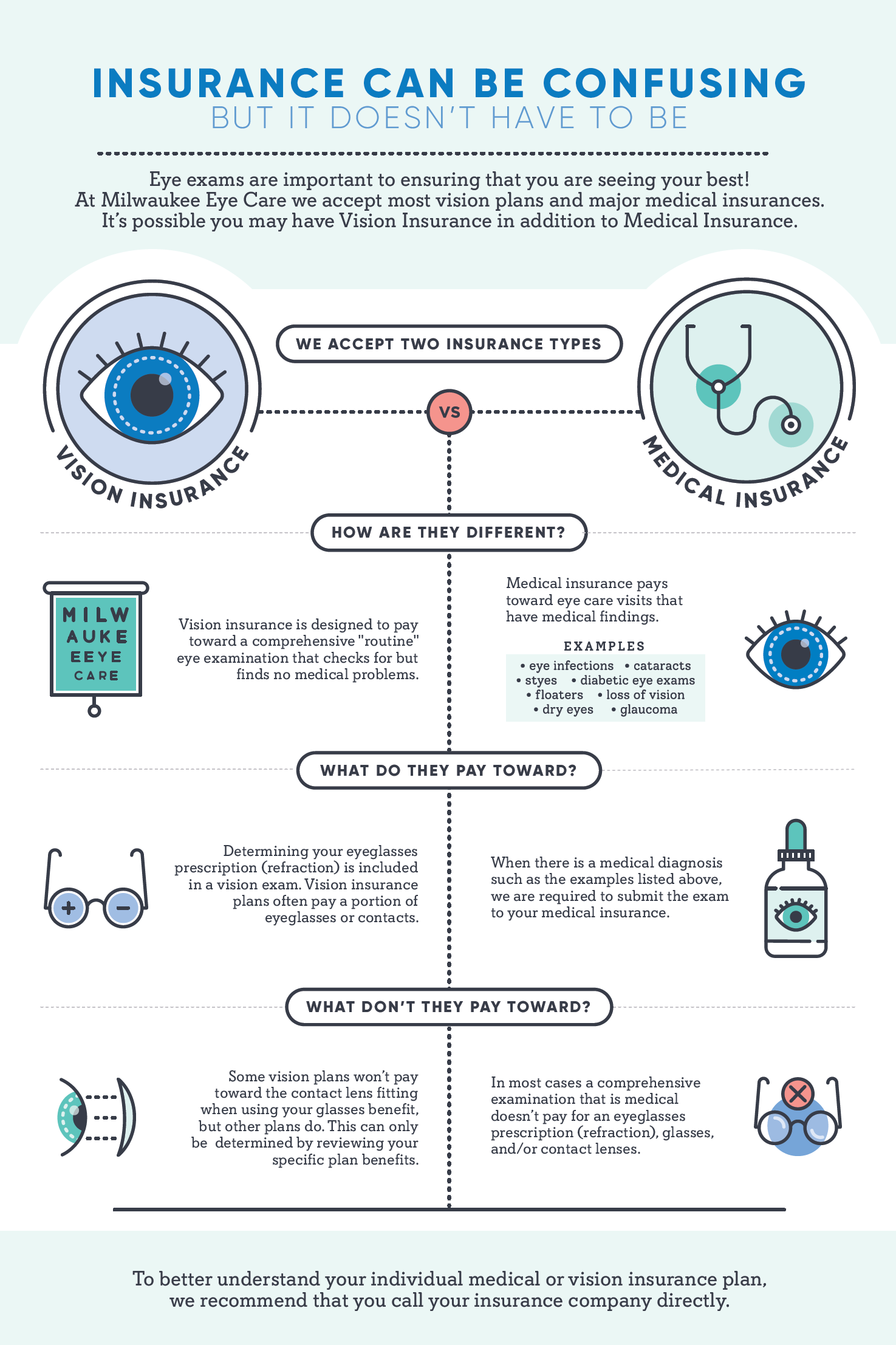

You also can look for more than 25 other types of health care providers including pharmacies marriage counselors urgent care centers acupuncturists drug and alcohol counselors hospice care providers dialysis centers vision care providers flu shot providers and physical therapists. Ask your friends or family if they have doctors they like and use this tool to compare doctors and other health care providers in your area. Riverside shore memorial hospital.

Riverside regional medical center. To ensure you have access to the. Take advantage of the TK-DoctorGuide to quickly conveniently and easily find an expert for your health issues.

Enrollment in CareSource Medicare Advantage plans depends on contract renewal. Childrens hospital of the kings daughter. Gynecologist pediatrician dermatologist etc.

CareSource is an HMO with a Medicare contract. Alliance Health and Life Insurance Company 888 999-4347. Self-funded ASO 866 766-4709.

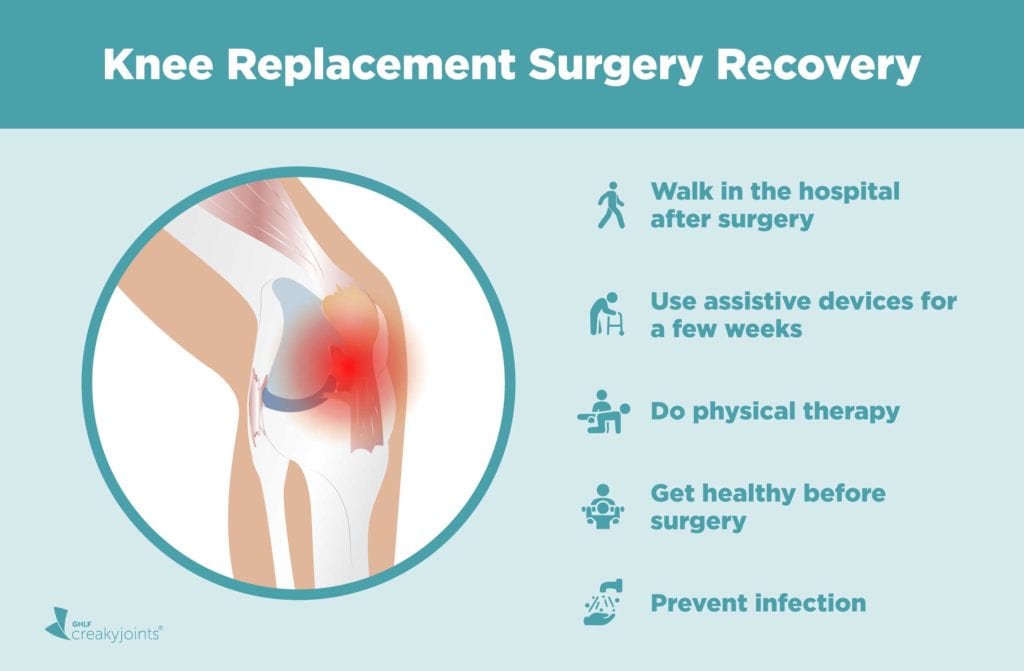

If you need a service thats not available in the network your primary care physician can also refer you to hospitals and specialists in the. Pain Management 29 years experience. HAP Empowered 888 654-2200.

You are looking for a physician dentist or psychotherapist. Chesapeake regional medical center. HAP Senior Plus 800 801-1770 TTY.

Online you can look up where they are located at your hmos website. His goal as a practitioner is to ensure that each of his patients receives the highest available quality of medical care. Your hmo directory will help find someone near.

You can choose the language in which you would like to talk. Health plan coverage provided by or through UnitedHealthcare Insurance Company or its affiliates. Youll choose a primary care physician from the Metro Detroit HMO network who will refer you to other doctors in this plans network.

You can get started right here. HAP Senior Plus PPO 888 658-2536 TTY. Calling number on your card another source of information.

Bon secours st marys hospital. If you get your insurance through your employer check with the person who manages health insurance for your business. A symptom or keyword to start your search for example flu will find family physicians and skin rash will find dermatologists.

First enter your ZIP code in the box on this page and click Enter. This listing of providers does not constitute a recommendation of any physician provider group hospitalfacility or other provider. 1 doctor answer 2 doctors weighed in.

Lynn is certified by the ANCC and brings to Care Med over 18 years of Nurse Practitioner experience including Emergency and Hospitalist Medicine. Riverside walter reed hospital. HAP HMO 800 422-4641.

Bon secours mary immaculate hospital. Because printed directories arent frequently. A provider type such as PCP.

HMO Plans 800 759-3436. TK-DoctorGuide More details The TK-DoctorGuide lists established doctors and dentists as well as psychotherapists. Next make sure the Medicare Advantage tab near the top of the page is selected click this tab if its not already selected.

Northern virginia mental health institute. Hoag offers a find a doctor tool to help you select your primary care physician provider. Bon secours depaul medical center.

Naval medical center portsmouth. Here are some tips for how to find a doctor near you. Type one of the following in the search box.

Look at their website or check your member handbook to find doctors in your network who take your health coverage. If youre not sure if a primary care physician has been selected for you just call the customer service number on the back of your Blue Cross ID card and well help. Administrative services provided by United HealthCare Services Inc.

Orthopaedic hospital at sentara careplex. Of course you can use our directories to find doctors and hospitals that take your insurance. How can I find an Aetna doctor near me.

Some HMO plans will select a primary care physician for you. Go to Find a Doctor. The Metro Detroit HMO network covers Macomb Oakland and Wayne counties.

CareSource plans do not discriminate exclude people or treat them differently on the basis of race color national origin disability age sex gender identity sexual orientation or health status in the administration of the plan including enrollment and benefit. Heres how to find a doctor near you whos in an Aetna Medicare Advantage plan network.

:strip_icc()/coordination-of-benefits-1850523021ff453f8f4f2e19a99324ea.png)