Your beneficiary for ADD will automatically be the same as your life insurance beneficiary. If your life or group policy includes ADD dont include the benefit amount in your planning.

What Is Term Life Insurance Ramseysolutions Com

What Is Term Life Insurance Ramseysolutions Com

If you change your life insurance beneficiary that change applies to ADD as well.

Voluntary life insurance vs ad&d. It would pay for death or loss of limbs that occurred as the results of an accident. Some policies offer riders for ADD. The key takeaway when it comes to voluntary life insurance vs ADD is that ADD insurance is not in every policy individual or voluntary.

Voluntary accidental death and dismemberment insurance VADD is a financial protection plan that provides a beneficiary with cash in the event that the policyholder is accidentally killed or. Life insurance by state. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity.

ADD can leave you without protection if you die from natural causes sickness disease drug overdose or suicide. This coverage can be purchased in addition to or in place of ADD insurance and other life insurance you already have. The bottom line.

INSURANCE WHERE YOU LIVE. Like life insurance you are automatically. Voluntary life insurance is an optional benefit provided by employers that provides a cash benefit to a beneficiary upon the death of an insured employee.

Life insurance is the best choice for most shoppers because it covers more causes of death and is as affordable as accidental death dismemberment insurance. ADD could be a. Can I name any beneficiary for my ADD coverage.

These kinds of policies are much cheaper and inexpensive than other policies such as whole life variable life or universal life. Also voluntary intake or use of poison gas or fumes. Finally many voluntary life insurance policies will contain provisions for accidental death and dismemberment also known as Voluntary ADD.

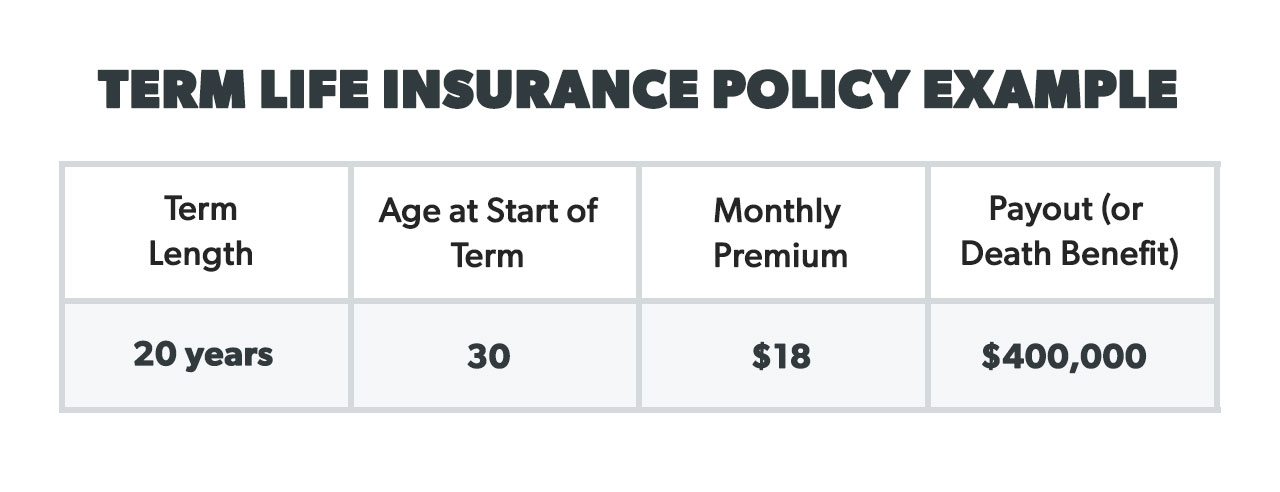

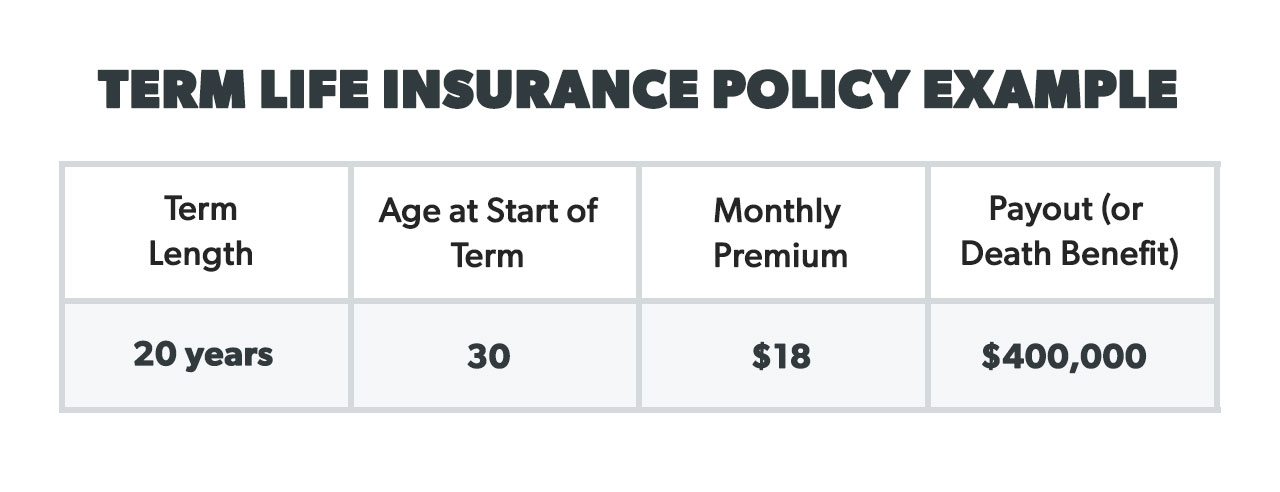

Term life insurance is the most common life insurance. ADD vs Term Life Insurance. ADD insurance may be a more affordable option than term life insurance but its very limited on what conditions it pays.

For those looking for the best of both worlds adding on an ADD rider to your life insurance policy is a better option than ADD. The amount of the ADD Insurance Benefit for Loss of life is equal to the amount of your Voluntary ADD insurance in effect on the date of the covered accident. Voluntary ADD Insurance is Accidental Death and Dismemberment Insurance that you can purchase through your place of work at group rates if you wish to do so.

If you are dismembered because of an accident the policy generally pays out a predetermined amount as specified in your policy. Voluntary spouse life insurance basic life vs voluntary life should i get voluntary life insurance voluntary term life insurance definition term life insurance rates chart by age voluntary term life insurance meaning what is voluntary life and add. Basic Life Insurance Vs.

Yes it pays a death benefit but as the name suggests only provides coverage in the event you die due to an accident. Term life insurance offers much better financial. Therefore if your goal is to provide your family with a financial safety net if you die life insurance is the right purchase.

And if your employer offers ADD insurance you might be able to. In the insurance business basic life insurance usually refers to term life insurance. Typically voluntary life insurance is cheaper for amounts under 50K while term life policies are more affordable for higher values.

Including alcohol in combination with any drug. If the policy pays itll be a pleasant bonus for your beneficiaries but you shouldnt count on it. The amount of the ADD Insurance Benefit for other covered Losses is a percentage of the Voluntary ADD insurance in effect on the date of the covered accident as shown below.

An accidental death and dismemberment insurance policy ADD is not the same as a standard life insurance policy. In comparison ADD protection is only of marginal value. It is paid for by a monthly premium one.

Employee ADD benefits are additional so remember that you will not likely have this coverage unless you add it. When youre deciding on your coverage life insurance is fundamental for most young couples. Accidental death and dismemberment insurance will come into effect if the insurance party suffered an.

Rates for ADD insurance tend to be lower than rates for traditional life insurance because the coverage is limited to accidents. It would not pay if death or dismemberment was due to illness.