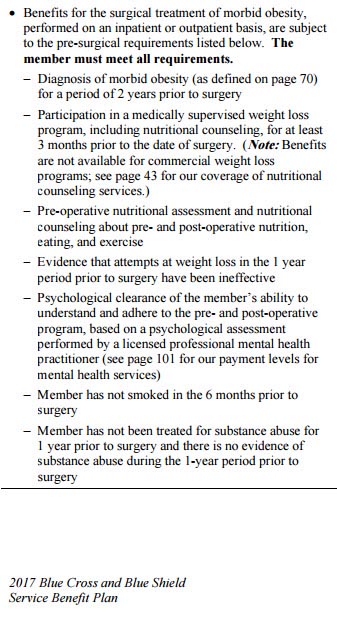

To qualify for coverage of weight loss surgery your policy must include coverage. This also applies to the Blue Care Network of Michigan.

Blue Cross Ma On Twitter If You Participated In A Fitness Or Weight Loss Program That Qualifies For One Of Our Reimbursements Make Sure You Send In Your Filled Out Form Most Are Due

Blue Cross Ma On Twitter If You Participated In A Fitness Or Weight Loss Program That Qualifies For One Of Our Reimbursements Make Sure You Send In Your Filled Out Form Most Are Due

Yours for the taking you go-getter.

Does blue cross blue shield cover weight loss programs. Thats why weve created the Win by Losing weight loss challenge a free competition that helps you lose weight while having fun and earning bragging rights. Our SpecialOffers let you keep more cash in your pocket with discounts on health-related products weight management programs and gym memberships. HealthSelect participants can apply to join a weight management program at no additional cost.

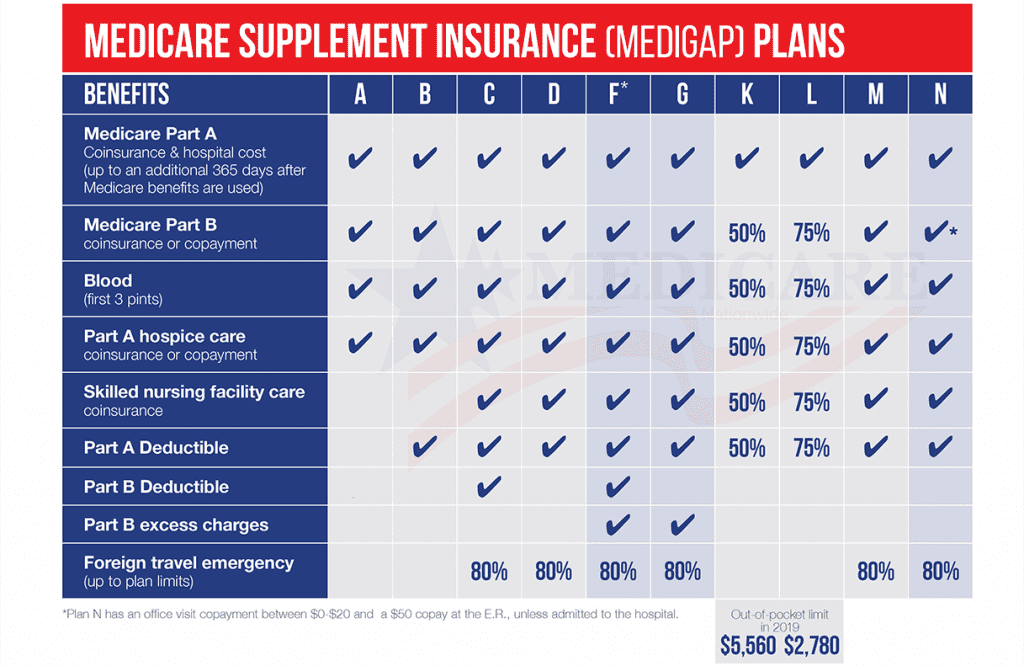

2 Blue Distinction Centers for Bariatric Surgery Program Selection Criteria The Program uses updated Metabolic and Bariatric Surgery Accreditation and Quality Improvement Program MBSAQIP accreditation levels which focus on site of service. Procedures Blue Cross Does Not Cover. In fact most of the Blue Cross Blue Shield network has some sort of coverage for weight loss surgery.

Ideally most healthy adults should be active for 30 minutes on most days of the week. Blue Cross Blue Shield of Michigan believes in supporting your health goals. Big congrats on your healthy habits.

An employee retiree or dependent enrolled in a HealthSelect plan excluding Medicare-primary participants 18 or older and. Following are a list of Arkansas Blue Cross Blue Shield plan types and whether they cover bariatric surgery. Stress and Mental Health Our Behavioral Health and Employee Assistance Program EAPs can help you work through stressful times in your life with tools for dealing with stress or anxiety.

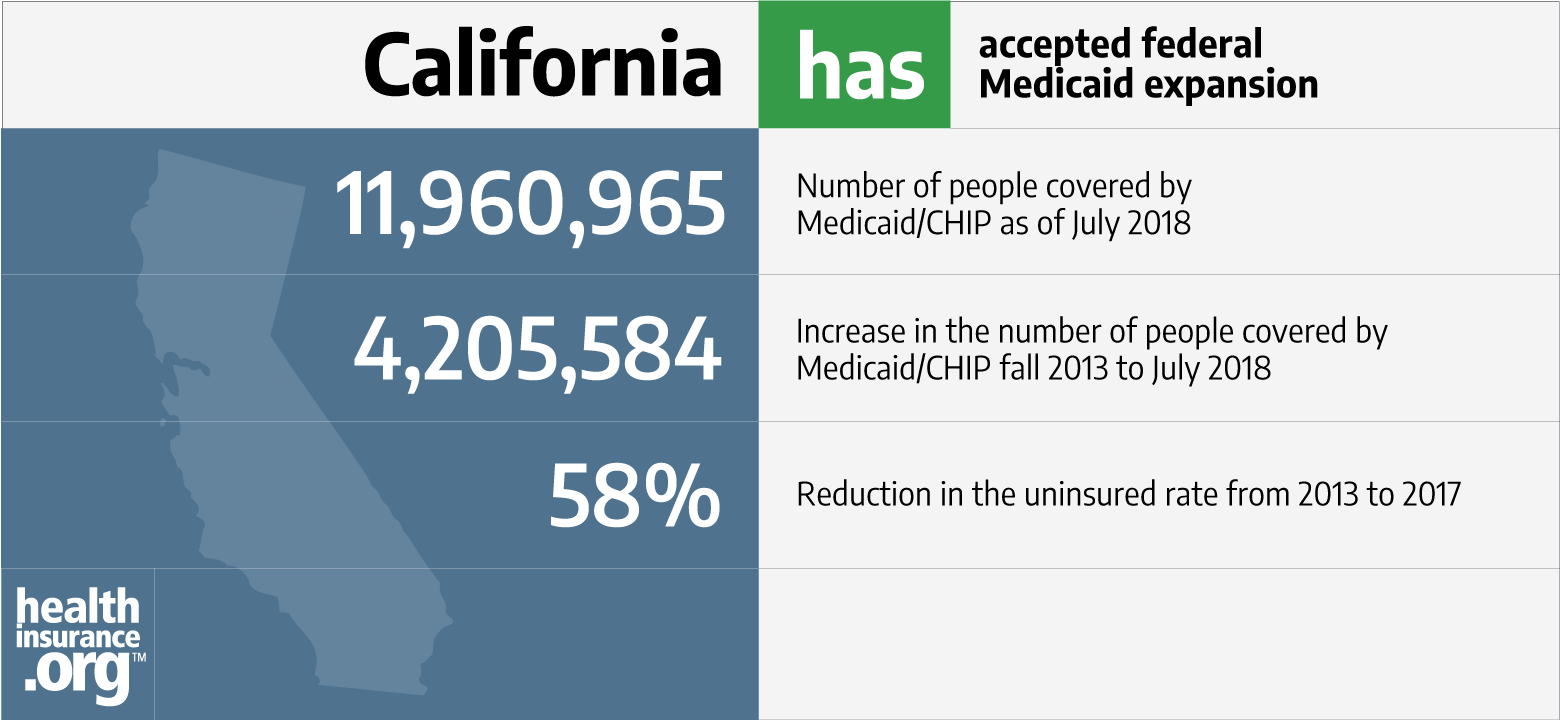

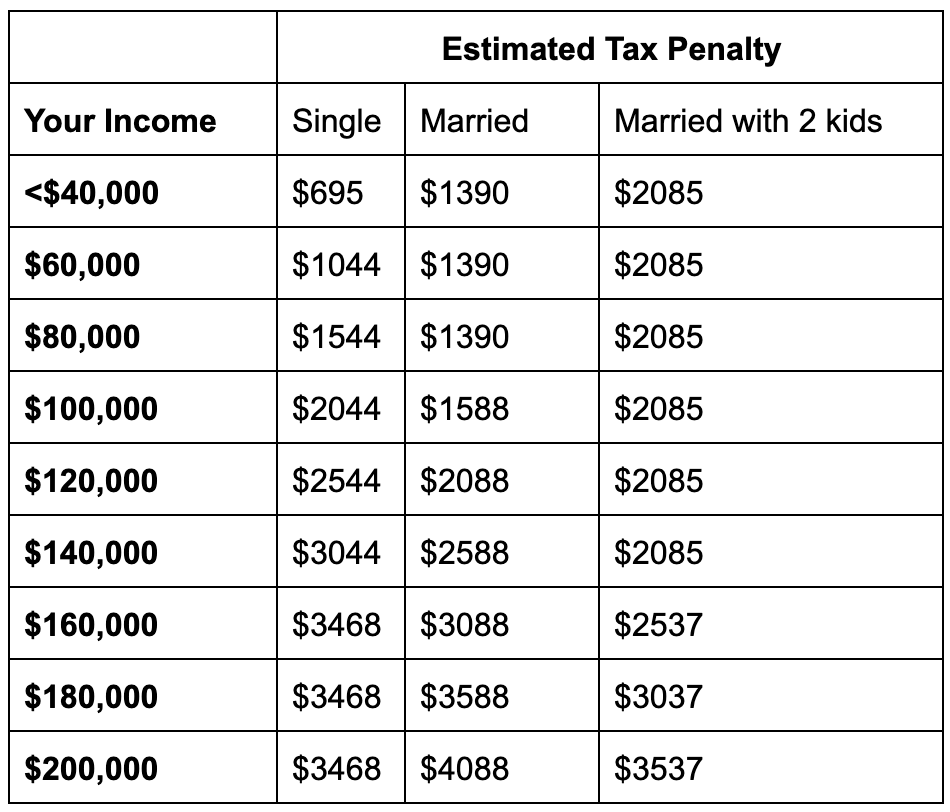

Blue Cross Blue Shield BCBS Weight Loss Coverage Being overweight or obese is something majority of Americans deal with on a daily basis. Have a BMI of 23 or higher. Blue Cross Blue Shield Weight Loss Since the passage of the Affordable Care Act of 2010 all insurances are obligated to provide screening and coverage for obesity treatment for eligible individuals.

Blue Cross Blue Shield of Michigan covers weight loss surgery. Qualified weight-loss program1 Weight-Loss Reimbursement Your reward for health Blue Cross Blue Shield of Massachusetts is an Independent Licensee of the Blue Cross and Blue Shield Association. Please note that not all policies include coverage.

You are leaving the Horizon Blue Cross Blue Shield of New Jersey website. To see how much youre eligible for sign in to MyBlue. Win by Losing is available to all of our group customers whether you have one employee or 10000.

Weight-loss resources and coaching from registered dietitians registered nurses and exercise specialists Are you sure you want to leave this website. You are eligible if you are. While Blue Cross does cover most of the weight loss procedures there are a few that they do.

The weight loss procedures that Blue Cross covers include. Earn rewards and up to 170 by taking the Blue Health Assessment BHA and meeting your goals. Weight Loss Surgery for Health Plans Through Your Work.

Blue Cross Blue Shield Association is an association of independent Blue Cross and Blue Shield companies. To celebrate all you do weve put together up to 300 in fitness and weight loss reimbursements. Coverage Criteria for initiation and continuation of therapy shall include.

Lap Adjustable Gastric Bands. Weight Height BMI Weight History Systolic Diastolic BP For Diabetics HbA1c Ruled out weight gain due to drug therapy eg anti-psychotics TZDs others Addition of drug therapy is clinically indicated for. Choose between two programs.

Treadmills and other workout equipment wearable health trackers like Fitbits and heart rate monitors gym memberships clothing and shoes. It helps manage weight can prevent and manage certain health conditions increase your energy improve your mood and can even help you sleep better. It is important to know that your employer can typically opt-out of weight loss surgery insurance coverage for their employees policies.

If youre worried about your weight understanding how much you need to lose is the first step. Consult an expert like your doctor before starting a weight loss program. Personalized nutrition plans dietweight loss programs cookbooks.

What Weight Loss Procedures Does Blue Cross Cover. Just by being a Florida Blue member youll get discounts on things like. As a Blue Cross member you can log in in to your member site or member app to see what wellness tools and programs are available to you on your weight loss journey.

Arkansas Blue Cross Blue Shield does cover weight loss surgery but your specific policy must include it in order for you get it covered. Blue Cross Blue Shield of Texas - Weight Management and Tobacco Cessation Weight Management and Tobacco Cessation Blue Care Connection will welcome in the New Year with two new programs to help those who want to quit smoking andor lose weight.