Plans Costs Original Medicare pays for many but not all health care services and supplies. This can help you to work out whether you need a plan and what it could cover.

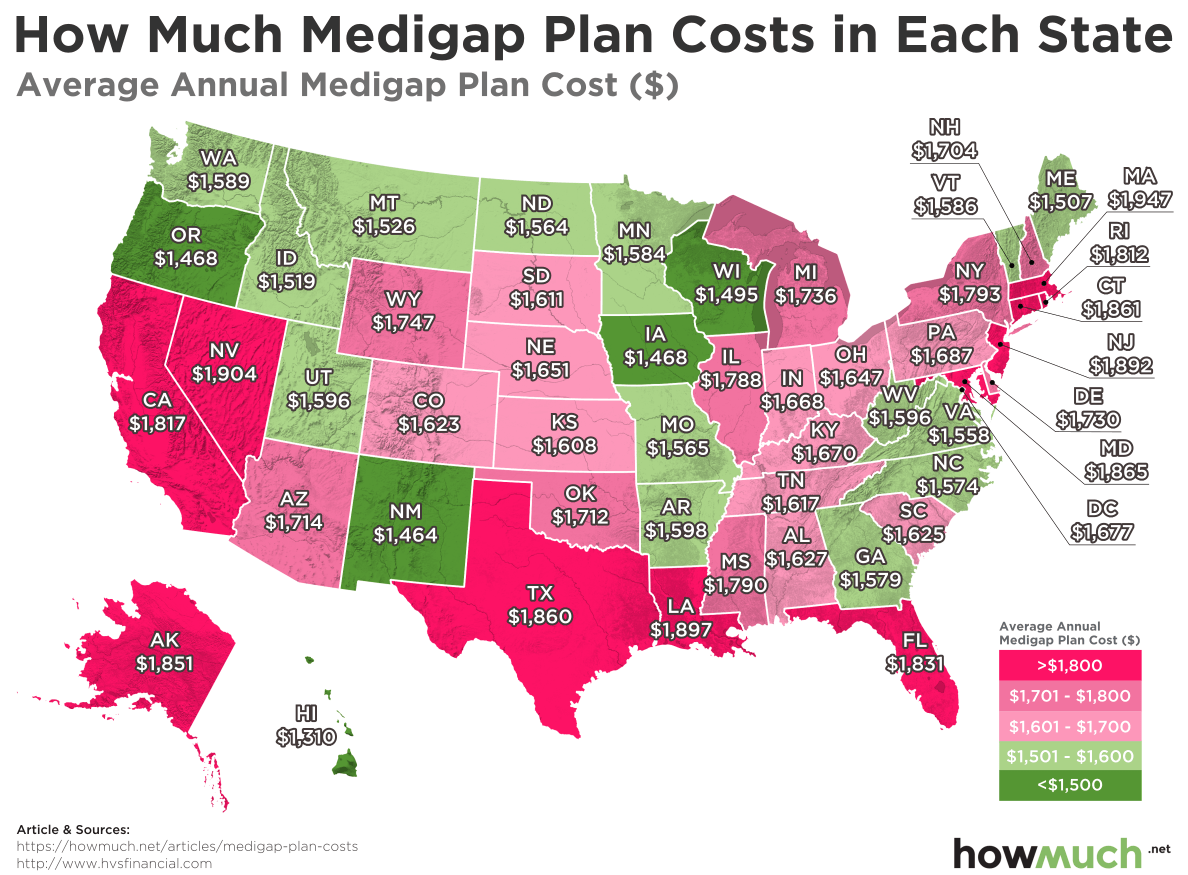

These Are The Most And Least Expensive States For Medigap Coverage Clark Howard

These Are The Most And Least Expensive States For Medigap Coverage Clark Howard

Then they pay the doctor directly.

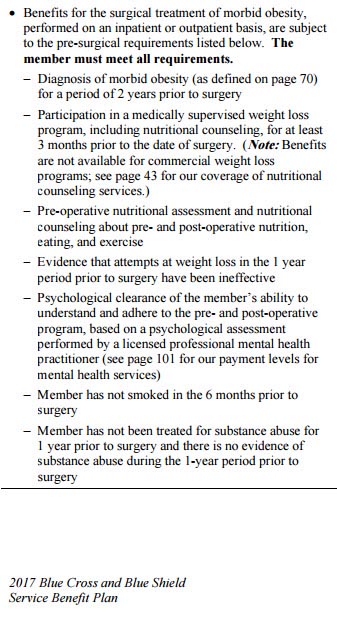

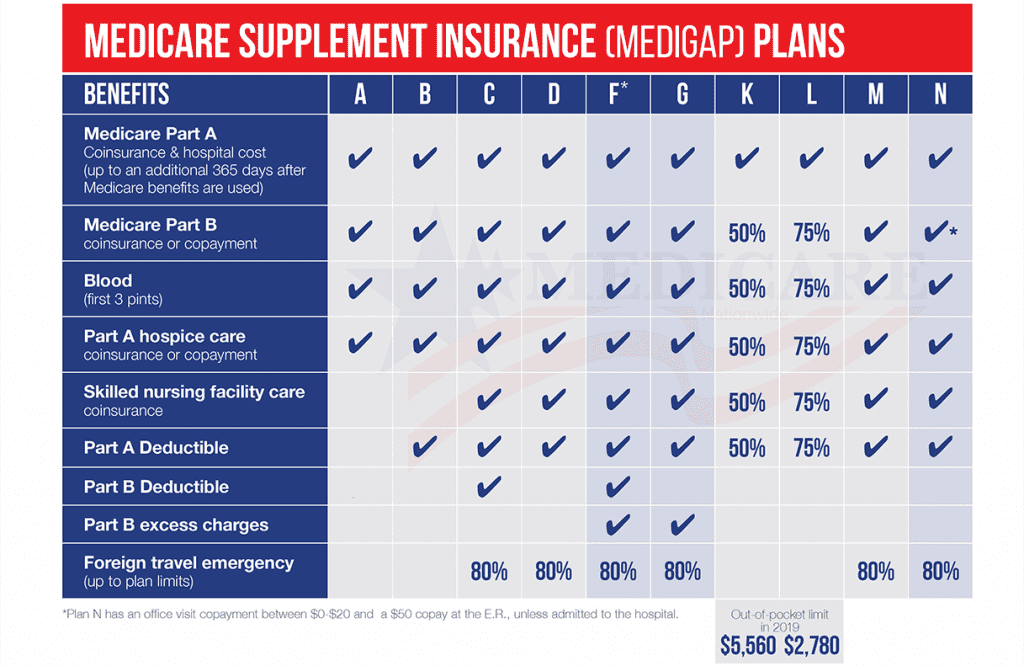

Medicare supplement plans cost. Its important to note that each type of Medigap plan offers a different combination of standardized benefits. This could mean that you dont get the treatment you need or you have to pay thousands of dollars for it. Medicare Supplements are a great fit for seniors who have some medical expenses that they struggle to pay.

Medicare Supplement Insurance policies sold by private companies can help pay some of the health care costs that Original Medicare doesnt cover like copayments coinsurance and deductibles. This is a maximum amount that youll have to pay out-of-pocket. Medicare doesnt pay any of the costs for you to get a Medigap policy.

Plans with lower monthly premiums typically have higher deductibles. In 2021 the Plan K and Plan L out-of-pocket limits are 6220 and 3110. Most Medicare Supplement plans provide coverage for your Part A hospital deductible.

Filling in the Gaps. The average cost of Medicare Supplement. What Affects Cost of Medigap Plans in 2021.

Plan M 21875 Plan A 19233 and Plan C 18988 all had higher average premiums than Plan F in 2018. The plan you select. The average premium a Medicare Supplement Insurance Medigap plan beneficiary paid in 2018 was 12593.

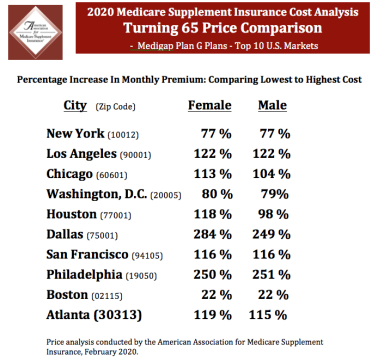

Medicare Supplement Plans have premiums that cost anywhere from around 70month to around 270month. Ultimately you want to know the cost of a Medigap policy. 21 Zeilen The table below displays the average cost of Medicare Supplement Insurance Plan G and Plan F.

The average premium for Medicare Supplement Insurance Plan F in 2018 was 16914 per month or 2030 per year. If you qualify for Medicare and dont know where to start MedicareUSA an independent HealthPlanOne insurance broker and partner of MedicareWire has licensed Medicare insurance agents at 1-855-266-4865 TTY 711 who can help enroll you in Medicare Advantage Medicare Supplement Insurance and Prescription Drug Part D plans. Plans with fewer benefits may offer lower premiums.

Your geography affects pricing more than any other factor. 3 Its important to note that each type of Medigap plan offers a different combination of standardized benefits. Plan premium above 111000 up to 138000 above 222000 up to 276000 not applicable 3180 your plan premium above 138000 up to 165000 above 276000 up to 330000 not applicable 5120 your plan premium above 165000 and less than 500000 above 330000 and less than 750000 above 88000 and less than 412000 7070 your plan premium.

Some Medigap insurance companies also provide this service for Part A claims. You have to pay the premiums for a Medigap policy. How Much Do Supplemental Medicare Plans Cost.

Medicare Supplement Insurance policies are also called Medigap. These plans can range in price from 100 or so a month to 400 depending on the. What is the average cost of Medicare Supplement Insurance Medigap.

1 But the average cost of each type of Medigap plan can vary quite a bit from one plan type to another. Medicare Supplement rates vary throughout the United States. Lets now take a look at some of the benefits of medicare supplement plans.

1 The average cost of Plan F in 2018 was the fourth highest among the 10 Medigap plans used for analysis. Medicare Supplement insurance coverage for these expenses varies by plan type. In most cases youre responsible for your Medicare Part B deductible which is an annual cost of 198 in 2020.

5 Zeilen Medicare Supplement plans can range from 50-300 in monthly premiums. The other major factors that affect Medigap insurance pricing are. Its a pre-set fixed cost.

How much a Medicare Supplement plan will cost may depend on factors such as. The cost of a Medicare Supplement insurance plan will be dependent on factors such as plan rating systems if you have guaranteed issue rights and the type of plans of you choose. The average premium paid for a Medicare Supplement Insurance Medigap plan in 2019 was 12593 per month.

Medicare Supplements give them a convenient way to do that. These premiums are. Typically plans with higher monthly premiums will have lower deductibles.

Medigap helps pay your Part B bills In most Medigap policies the Medigap insurance company will get your Part B Claim information directly from Medicare. Medigap Plan K and Plan L have out-of-pocket limits. If you enroll in a Medicare Supplement plan you will typically pay the insurance company a monthly premium in exchange for coverage.

Most people who sign up for Medicare Supplements will have already had Original Medicare for a while and will decide that they need additional coverage. While Medicare in general tends to cover the cost of quite a lot there are still some things missing.