Plan F is one of the 10 types of Medigap plans. The only difference is the monthly premium.

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

This deductible will reset each year and the dollar amount may be subject to change.

Does medicare supplement plan f cover part b deductible. You may be able to buy Medicare Supplement Plan F or Plan C. Medicare Supplement plans can help pay for deductibles coinsurance and copayments. Medicare Part B deductible Medicare Part B excess charges Plan F also covers 80 percent of the cost of medically necessary care while youre traveling in a.

Medicare beneficiaries who become eligible for Medicare after January 1 2020 will not be eligible to enroll in Plan C or Plan F. It covers a wide breadth of expenditures that original Medicare doesnt pay for. If you have questions about who pays first or if your coverage changes call the Benefits Coordination Recovery Center BCRC at 1-855-798-2627 TTY.

Starting in 2020 Medicare Supplement plans that cover the Part B deductible Plan F and Plan C are being gradually discontinued. The reasoning behind making Medicare beneficiaries pay the deductible themselves is that it will cause them to think twice before going to a doctor and perhaps costing the Medicare system unnecessary money. Also all the Medicare Supplement plans cover the exact same benefits.

Plan F covers the 20 of Medicare-approved hospital expenses not covered under Part A. This eliminates Plan C and Plan F for new beneficiaries. Almost any item or service that Part B covers.

You must meet this deductible before Medicare pays for any Part A services in each benefit period. Tell your doctor and other Health care provider about any changes in your insurance or coverage when you get care. Additionally it covers foreign travel agency care and skilled nursing facility coinsurance explains BlueCross BlueShield of Illinois.

Although AARP does not offer Plan F to everyone or in all areas see above where offered the plan covers the following. If you become eligible for Medicare before January 1 2020 you may be able to enroll in Medigap Plan C or Plan F both of which cover the Medicare Part B deductible. Enrollment in Medicare Supplement Plan F requires AARP membership which in 2021 is 16 unless signing up for automatic renewal which makes it 12.

Starting January 1 2020 Medicare Supplement insurance plans cant cover the Medicare Part B deductible. If you qualify for Medicare before January 1 2020. Every year youre an enrollee in Part B you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

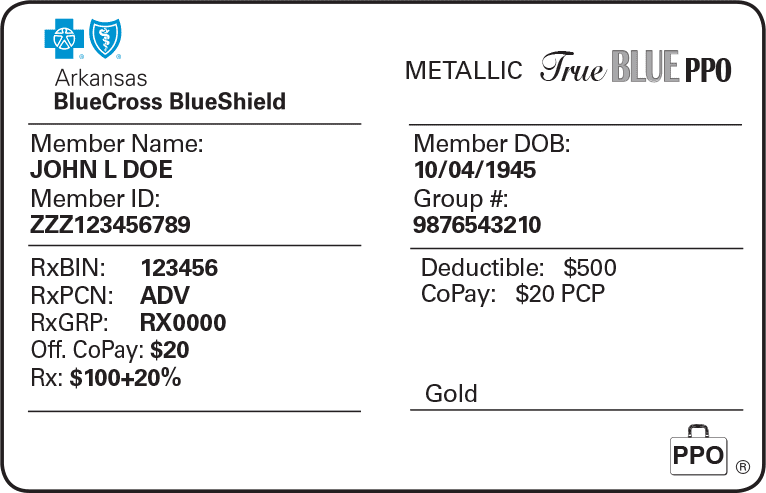

Its worth noting that Medicare Supplement Plan F may not be available to those new to Medicare. Generally Medicare covers approved charges for hospitalization at 80. Blue Cross Medicare Supplement Plan F pays the Medicare Part A hospital deductible and coinsurance the Part B deductible and excess charges.

So for instance a AARP Medicare Supplement Plan F is exactly the same as any other carrier. Medigap plans can help offset these costs making your healthcare more affordable and giving you more access to services you might otherwise be unable to afford. Here are the extensive benefits that Medicare Supplement Plan F and the high-deductible Plan F provide.

Medicare Plan F is the most comprehensive of the ten standard supplements sold by AARP Insured by UnitedHealthcare Insurance Company. It offers Plan F but not High-Deductible Plan F in all states except for Massachusetts Minnesota and Wisconsin. Plan F does cover the Medicare Part A Part B deductible.

In 2019 the Part A inpatient hospital deductible is 1364 and the Part B deductible is 185. This leaves the remaining 20 of expenses to be the responsibility of the Medicare patient. Part A hospital deductible and coinsurance.

How Medicare coordinates with other coverage. Understanding Medicare Deductibles Medicare Part A and Medicare Part B each have their own deductibles and their own rules for how they function. Starting in 2020 new rules prohibit Medigap.

The Medicare Part B deductible for 2020 is 198 in 2020. However if you already have one of these plans you can keep it. 12 rows As of January 1 2020 Medigap plans sold to new people with Medicare arent allowed to.

Plan F also covers other costs such as. Medicare Part B covers doctor visits and other outpatient care and currently Medigap plans C and F offer coverage of the Part B deductible. First three pints of blood 100 of Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits have been used 100 of Medicare Part B coinsurance or copayment.

The Medicare Part A deductible in 2021 is 1484 per benefit period.