After earning an income of 100400 or higher for a family of four 83120 for a family of three 65840 for a married couple with no kids and 48560 for single individuals you will no longer receive government health care subsidies. Rental real estate royalties partnerships S-corporations trusts etc.

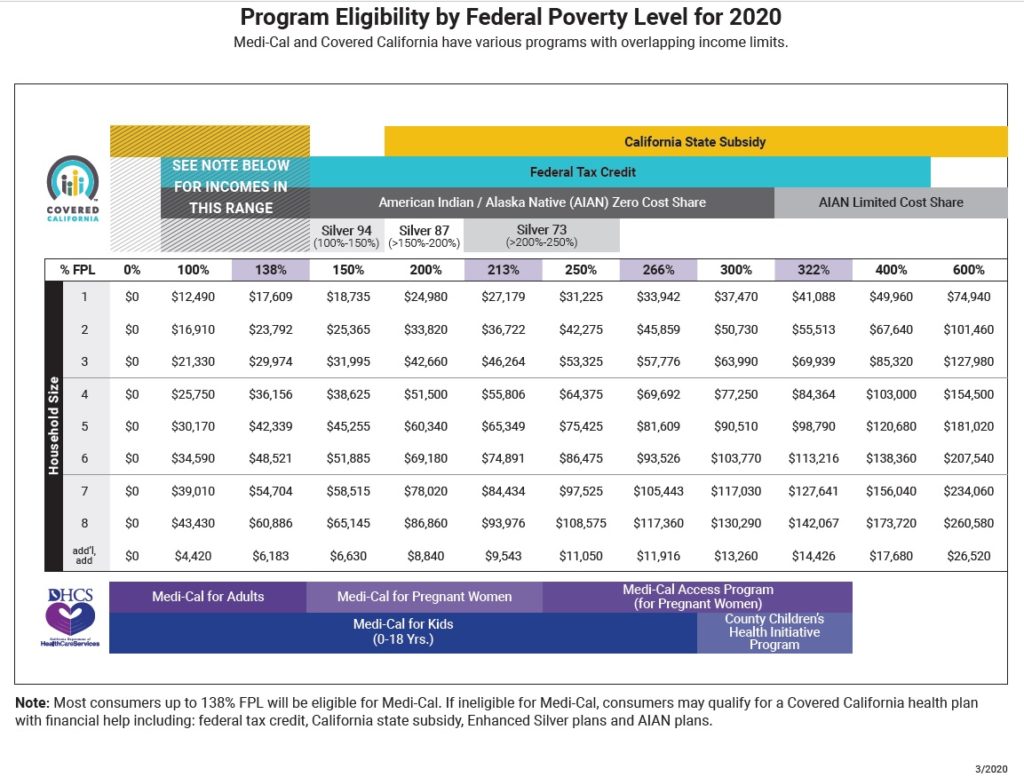

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

Learn more about who to include in your household.

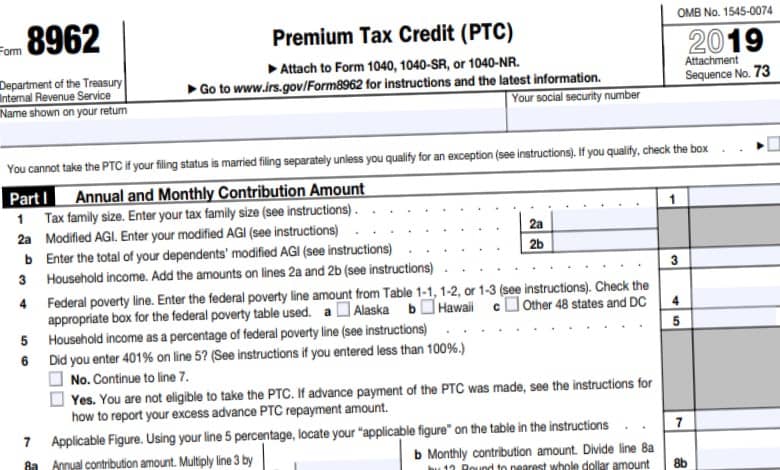

2020 affordable care act income limits. According to HR consultancy Mercer as a result the 2020 FPL safe-harbor monthly employee contribution limits for the lowest-cost self-only MEC with minimum value are. With passage of the American rescue plan 10200 of my unemployment pay in 2020. See the instructions for Form 8962 for more information.

9 Zeilen Lowest eligible income 100 FPL. Taxable refunds credits or offsets of state and local income taxes. If your estimated income is too low the ACA marketplace wont accept you.

You simply wont qualify for monthly premium assistance if you make more than the income limit. Prior to passage of the American Rescue Plan in March 2021 I was at 166 of the FPL. Alimony received under settlements executed before 2019.

With the rate of pay safe harbor coverage is affordable if employees pay no more than 978 for 2020 of their monthly rate of pay. However Children qualify for Medi-Cal when their family has a household income of 266 or less. The Marketplace counts estimated income of all household members.

In general you may be eligible for tax credits to lower your premium if you are single and your annual 2020 income is between 12490 to 49960 or if. Cost Share Reduction Tier 1 limit. WSIL--With the signing of the new stimulus bill by President Biden--many new changes were created to make the Affordable Care Act more accessible and more affordable.

Whose income to include in your estimate. Including the right people in your household. In states that didnt expand Medicaid the minimum income.

Glad for so many who were paid unemployment in 2020 that 10200 of unemployment is tax exempt but it appears to create a problem or at least confusion with 2020 ACA while doing 2020 taxes. If your household makes less than 100 of the federal poverty level you dont qualify for premium tax credits Obamacare subsidies. Footnote about question 3.

In order to qualify for Medi-Cal adults must have a household income of less than 138 of the FPL. For most people a household consists of the tax filer their spouse if they have one and their tax dependents including those who dont need coverage. For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify.

Under special circumstances you may be able to claim the PTC even though your income is below 100 percent of the federal poverty line. Minimum Income 100 Federal Poverty Level Maximum Income 400 Federal Poverty Level. Count yourself your spouse if youre married plus everyone youll claim as a tax dependent including those who dont need coverage.

For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of four. You will be asked about your current monthly income and then about your yearly income. To learn more its important to apply directly to your states.

For 2022 coverage see our page on the maximum income for ObamaCare for 2021 - 2022. To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level. However youre probably eligible for Medicaid depending on your states rules.

To figure the monthly rate of pay you must use 130 hours regardless of how many hours the employee actually works. Business income farm income capital gain other gains or loss Unemployment compensation. This tool provides a quick view of income levels that qualify for savings.

I had significant income from unemployment in 2020. This page features a 2021 ObamaCare eligibility chart the 2020 federal poverty level used for 2021 subsidies and a subsidy calculator. They will attempt to send you to Medicaid instead.

Less Than 100 of FPL. For 2020 coverage those making between 12490-49960as an individual or 25750-103000 as a family of 4 qualify for ObamaCare. In addition to the maximum income to receive the premium subsidy theres also a minimum income to get accepted by the ACA marketplace.

In 32 states plus Washington DC that expanded Medicaid the minimum income is 138 FPL. In order to qualify children must be under 19 years old. The basic math is 4X the Federal Poverty Level FPL as determined by the government.