In the Health Insurance Marketplace cost-sharing reductions are often called extra savings. Based on the chart the 2020 poverty level for a five-person family or household is 31040.

/GettyImages-8972434181-b7ccb004f35c457b93a1701137183642.jpg) How Cost Sharing Reductions Make Health Care More Affordable

How Cost Sharing Reductions Make Health Care More Affordable

Cost Sharing Reduction CSR A discount that lowers the amount you have to pay for deductibles copayments and coinsurance.

Cost sharing reduction income limits. Additionally insurers must offer plans with reduced cost-sharing for eligible low-income enrollees who enroll in silver-level marketplace plans. These figures represent an increase of 316 from the 2019 final cost-sharing limits of 7900 self and 15800 other. Out-of-Pocket Spending Limits for Consumers Based on Income.

For example instead of paying a 45 doctor visit cost sharing. Individuals and families with income between 100 and 250 percent of the federal poverty level may also qualify for help paying out-of. The 2021 out-of-pocket maximum amounts for the income levels of people receiving cost-sharing reductions appear in Table 2.

But if you qualify for cost-sharing reductions your deductible for a Silver plan could be 300 or 500 depending on your income. If you make under 250 of the Federal Poverty Level under 64505 for a family of four you may qualify for cost sharing reduction CSR. These are the payments you make each time you get care like 30 for a doctor visit.

At 194 of the federal poverty guidelines this income could qualify for a premium tax credit and a cost-sharing reduction via a Marketplace Silver plan. For example a person with income at 140 percent of the poverty level will receive a silver plan with an out-of-pocket limit no greater than 2850. Cost Sharing Reduction CSR subsidiesreduce your out-of-pocket expenses on silver plans purchased through the health insurance marketplace for those with incomes between 100 250 of the poverty level.

Cost-Sharing Limits for 2020. This means better benefits for you at the same monthly premium. Cost-sharing reductions CSRs are a form of financial help that help to reduce the out-of-pocket costs associated with private health insurance such as deductibles co-insurance and co-payments.

These pair with Premium Tax Credits which lower premium costs for those making between 100 400 of the poverty level. Coverage other than self-only. Lower Deductibles and Copays.

All health and dental insurance premiums covering the waiver person and for which he or she is responsible and pays a premium must be deducted from income when calculating cost share. Covered California Cost Sharing Reductions Eligible Income Level 133 to 250 FPL. Someone whose income goes up may be eligible for a smaller credit and will be responsible for repaying the difference between the smaller credit they should have gotten and the larger one they were getting based on old income information.

A married couple with three kids living in Illinois with a MAGI of 130000. If you qualify you must enroll in a plan in the Silver category to get the extra savings. The ACA provides that the federal government shall make periodic and timely payments to the insurer equal to the value of the cost-sharing reductions.

Special exempt income see Section 1572 Special Exempt Income must be deducted from income when calculating cost share. How cost-sharing reductions work. The final 2020 annual out-of-pocket OOP maximums for nongrandfathered group health plans are.

You can find out if you qualify for cost-sharing reductions and tax credits by completing a MNsure application WITH financial help. CSR subsidies lower your coinsurance and lower copays deductibles and maximum out-of-pocket costs you will pay in a policy period. Youll have lower copayments or coinsurance.

100 150 11880-17820 24300-36450 Yes 150 200 17821-23760 36451-48600 Yes 200 250 23761-29700 48601-60750 Yes 250 29700 60750 No. Household Income Tier by Federal Poverty Level Household Income Range Individual Household Income Range Family of Four Eligible for Cost Sharing Reductions. Eligible Californians who buy health care coverage through an Covered California.

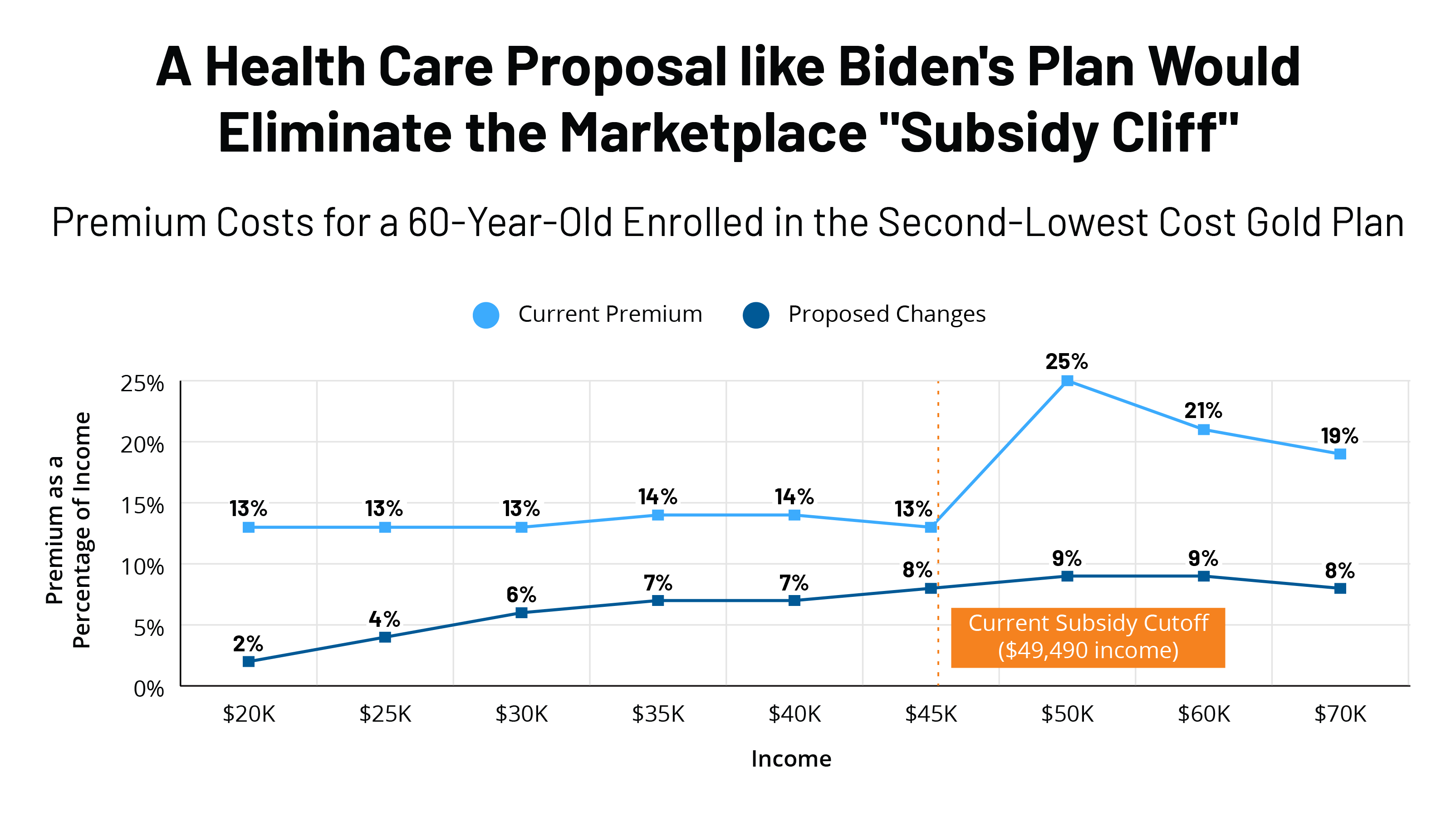

Cost sharing Reduction Subsidies CSR lower out-of-pocket cost sharing amounts on Health Insurance Marketplace Silver plans for those making between 100 250 of the Federal Poverty Level in household income. Tax credits are based on the Second-Lowest Price Silver Plan in your zip code NOT exceeding 850 of your Modified AGI for tax year 2021. Those with incomes over the set 400 FPL income limit may now qualify for lower premiums based on their location age and income.