It must contain the persons first and last name income amount year and employer name if applicable. Covered California is a partnership of the California Health Benefit Exchange and the California.

Proof Of Income For Covered California Attestation Form

Proof Of Income For Covered California Attestation Form

One of the most common proofs is a pay stub.

How does covered california verify income. When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes. In short you dont need to include any stimulus payments the federal 1200 600 and 1400 payments. Will Covered California share my personal and financial information.

In order to be eligible for assistance through Covered California you must meet an income requirement. Members who did not file their 2015 Federal Tax Return with form 8962 are at risk of losing their tax credits. If you submit a pay stub make sure that it is current and within the last 45 days.

Be signed by the employer. Any financial help you get is based on what you expect your household income will be for the coverage year not last years income. Otherwise Covered California may not accept it.

On January 1 2014 California expanded Medi-Cal eligibility to include low-income adults. Be no older than 45 days from the date received by Covered California. It is projected that in fiscal year 2015 that Covered California will have a multimillion-dollar deficit.

For many people especially for those who are self-employed or who are paid by commissions annual income fluctuates greatly. What is Covered California. The employer statement must.

The fiscal year 2015-2016 was the last year that Covered California used federal establishment funds. Proof of Income Proof of Citizenship or Lawful Presence Proof of California Residency and Proof of Minimum Essential Coverage. You can start by using your adjusted gross income AGI from your most.

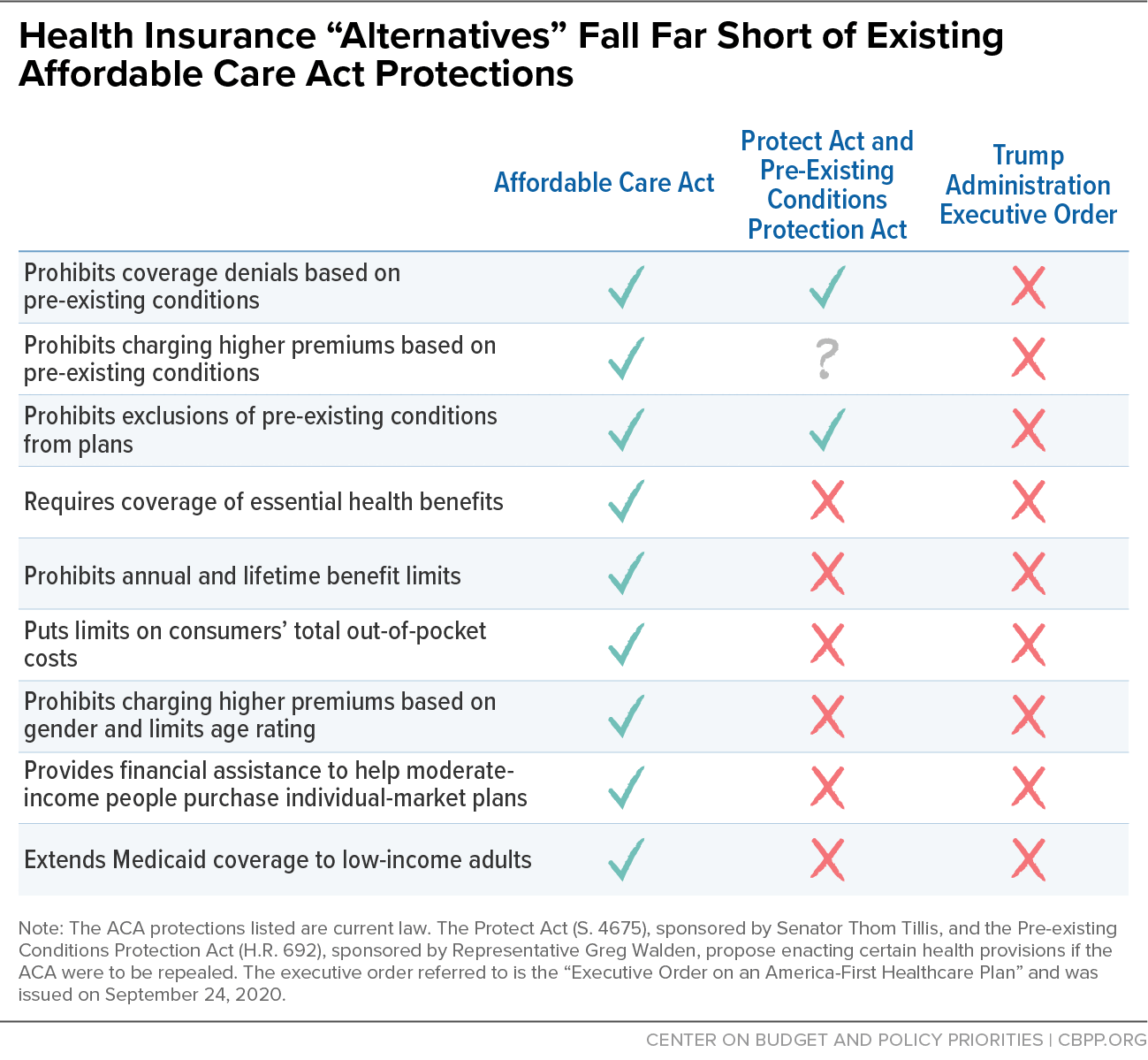

The government extended funding for that year and gave approximately 100 million. Covered California is the new marketplace that makes it possible for individuals and families to get free or low- cost health insurance through Medi-Cal or to get help paying for private health insurance. If you make 601 of the FPL you will be ineligible for any subsidies.

In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL. So how do you report your income to Covered California. After that year Covered California has gradually reduced expenses to save their funds.

If the data is inconsistent we ask you to submit documents to confirm the. If you have private health insurance through Covered California call to report any change in your income that may affect your eligibility within 30 days. You can apply for Medi-Cal benefits regardless of your sex race religion color national origin sexual.

What is your total household income per year. This allows Covered California to verify the taxpayers income. Our goal is to make it simple and affordable for Californians to get health insurance.

More information Enter an estimated amount of your total annual household income. Covered California will accept a clear legible copy from the allowable document proof list from the following categories which you can click on for more details. When you complete a Covered California application your eligibility for Medi-Cal will automatically be determined.

Income can be verified by providing various types of documents such as the acceptable list below. This application asks for a lot of personal information. Can anyone get Covered California.

If you have Medi-Cal and your income changes contact your county social services office within 10 days. Keep in mind that Tax deductions can lower your income level and. Be on company letterhead or state the name of the company.

And Californias 600 Golden State Stimulus payment when you calculate your household income. Covered California will let you know which categories they need documentation from for each person in your. When you apply through Covered California for your health insurance you must indicate what your income will be for the benefit year since the premium assistance that you may receive is based on your annual income.

Individuals currently covered on the Exchange may have already received a consent for verification request. Include the following information. 3 TAX ATTESTATION.

To report an income change you can call Covered CA or your insurance agent for assistance or log in to your Covered CA account online to report the change yourself. Documents to Confirm Eligibility. Enter the gross amount before taxes are deducted and be sure to include the income of all household members.

Medi-Cal has always covered low-income children pregnant women and families. Coverage through Covered California either a Covered California Health Plan or Medi-Cal will be asked for information to verify their citizenship or lawfully present status such as a Social Security Number or Alien Number. In 2015 it proposed a budget of.

How will Covered California check my income. Protecting Privacy Covered California uses the information provided on an individuals application. You do need to include the 300 per week PUC except for Medi-Cal eligibility.

Covered California compares the information you enter on your application with government data sources or information youve provided before.