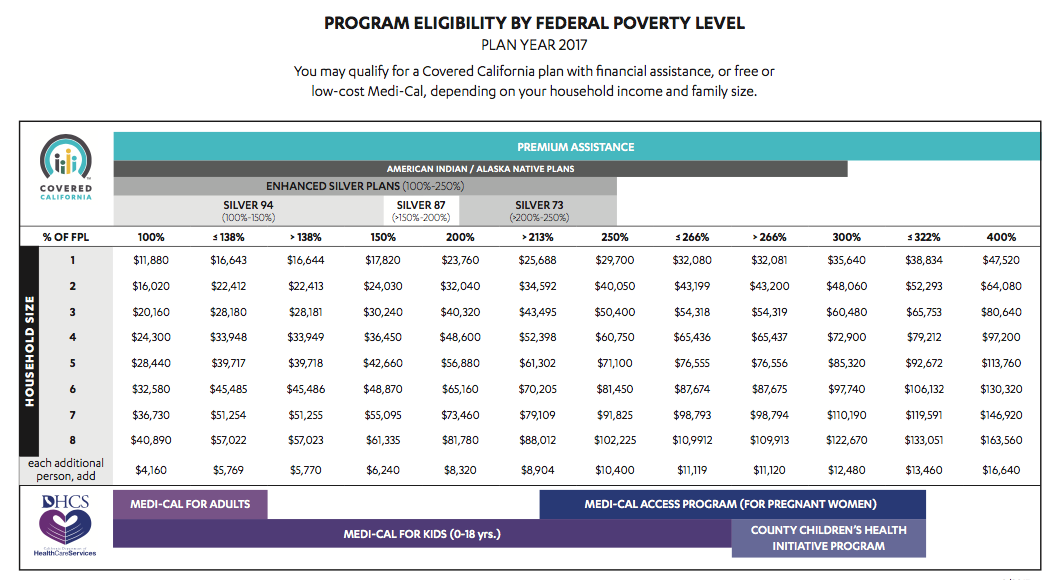

They can check to see if they are eligible for free or low cost Medi-Cal which is coverage through the state of California though benefits may be limited. Exemptions Processed by Covered California.

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

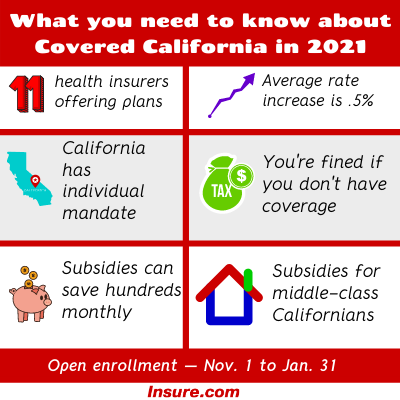

The following Covered California income restrictions apply to adults.

What is the income limit for covered ca. 8 Zeilen Financial Help Repayment Limits. If ineligible for Medi-Cal consumers may qualify for a Covered California health plan with financial help including. Covered California is the new marketplace that makes it possible for individuals and families to get free or low- cost health insurance through Medi-Cal or to get help paying for private health insurance.

To qualify the coverage must be. Medi-Cal and Covered California have various programs with overlapping income limits. Traditional IRA Income Limits in 2020 and 2021 Find out if you can contribute and if you make too much money for a tax deduction.

You can start by using your adjusted gross income AGI from your most. Income numbers are based on your annual or yearly earnings. 0 to 138 Percent of FPL.

If your income is verified as eligible for premium assistance and then later you become Medi-Cal eligible you do not have to repay the premium assistance you received as long as you report the income change within 30 days. If ineligible for Medi-Cal consumers may qualify for a Covered California health plan. When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes.

Any financial help you get is based on what you expect your household income will be for the coverage year not last years income. It is your responsibility to report this change to Covered California. When and where to apply for Covered California health insurance.

Most consumers up to 138 FPL will be eligible for Medi-Cal. People with lower incomes will pay a lot less than that. Health coverage is considered unaffordable exceeded 824 of household income for the 2020 taxable year Families self-only coverage combined cost is unaffordable.

Most consumers up to 138 FPL will be eligible for Medi-Cal. The income thresholds to qualify for the additional help from the state are 74940 for an individual 101460 for a couple and 154500 for a family of four. Children qualify regardless of their immigration status.

Covered Californias answer is Generally no. Can anyone get Covered California. Those who are undocumented have two options.

What is Covered California. Qualification for Medi-Cal 138 to 400 Percent of FPL. Federal tax credit Silver 94 87 73 plans and AIAN plans.

To see if you qualify based on income look at the chart below. Family size adjustments HUD applies to the income limits and 4 determining income limit levels applicable to Californias moderate-income households defined by law as household income not exceeding 120 percent of county area median income. If you live with a spouse or another adult your combined income cannot be more than 22108 a year.

Your household income must not exceed more than 138 percent of the federal poverty level FPL based on your household size. Under the new law no one eligible for our coverage will have to pay more than 85 percent of their overall household income for health insurance unless you choose to sign up for a plan with richer benefits like a Gold or Platinum plan. Our goal is to make it simple and affordable for Californians to get health insurance.

We determine the amount of financial help you receive based on. Income is below the tax filing threshold. For example if you live alone your income cannot be more than 16395 a year.

The states open enrollment period is longer than the federal open enrollment period available to citizens in. Short coverage gap of 3 consecutive months or less. Medi-Cal and Covered California have various programs with overlapping income limits.

Children are covered in a family of four with a household income of 68495 or less. Qualification for a subsidy on a. Certain non-citizens who are not lawfully present.

Immigrants Can Apply for Medical Coverage Through Covered California.