Under the CARES Act which passed in March 2020 you can now use your HSA card to pay for a variety of OTC. For Health Savings Accounts and High-Deductible Health Plans.

Health Savings Account Habits Fidelity

Health Savings Account Habits Fidelity

These limits for 2021 are.

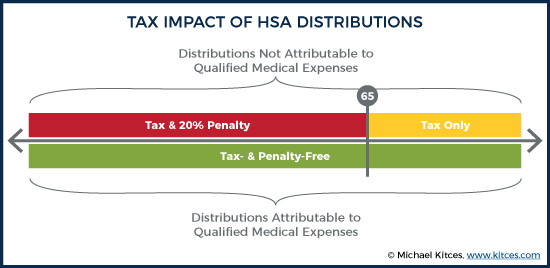

Hsa eligible health plans 2020. If you are age 55 or older at the end of your tax year your contribution limit is increased by 1000. As part of the 2020 CARES Act over-the-counter medications and menstrual care products are now eligible for purchase with health savings accounts HSAs flexible spending accounts FSAs and health reimbursement arrangements HRAs. The vast majority of high deductible health plans dont apply based on 2016 exchange plans.

The comparable figure for family coverage is. On June 8 2020 the Internal Revenue Service IRS issued a short proposed rule that would allow employers to reimburse employees for fees for direct primary care and health. HSA contribution limit employer employee Self-only.

Amounts are adjusted yearly for inflation. If you become eligible by Dec. You can contribute no more than 212.

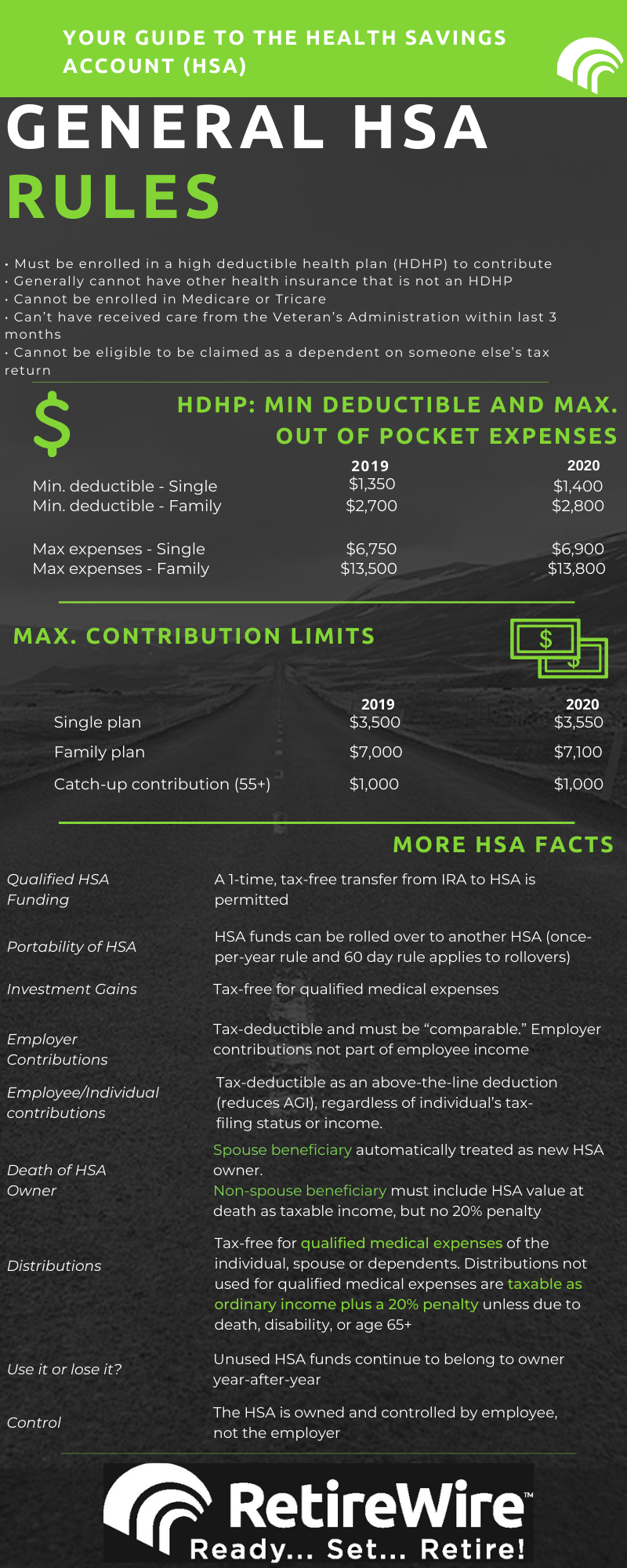

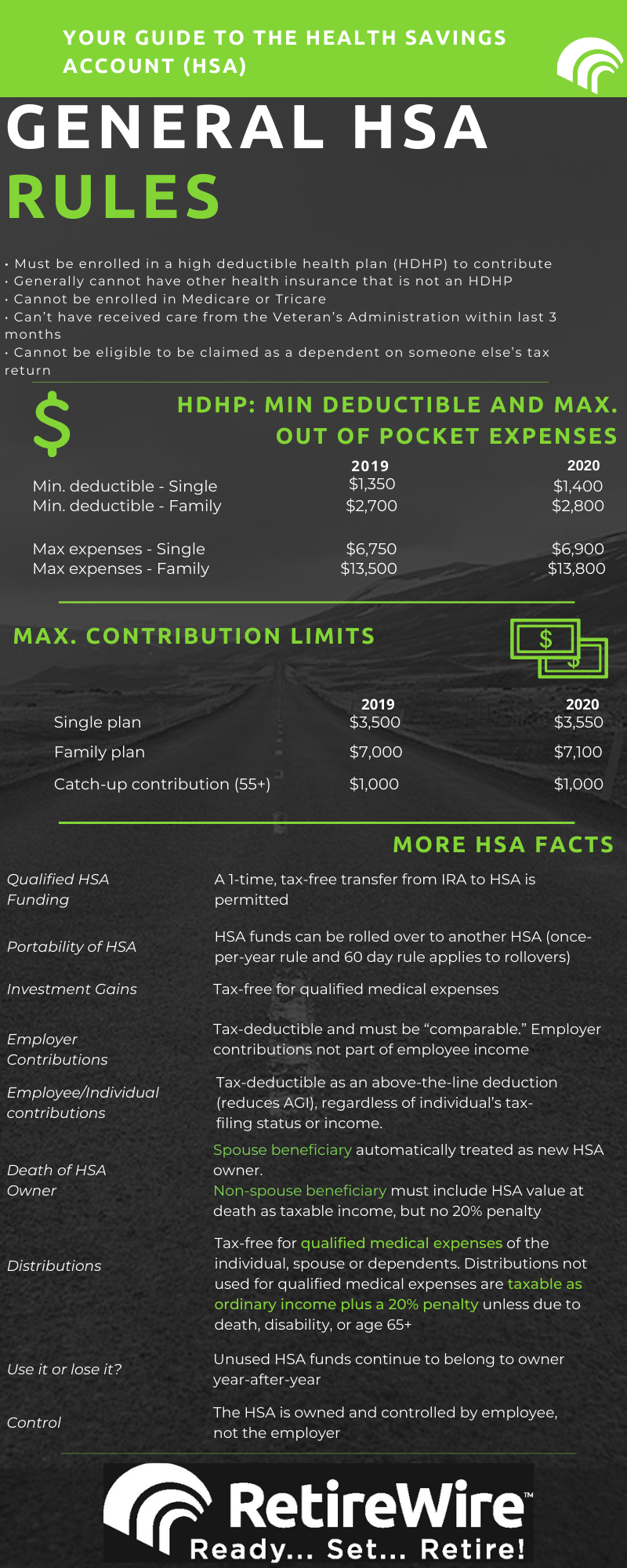

Here well discuss why most HDHP arent eligible and why it matters if you cant have an HSA. These lower-premium high-deductible health plans give members affordable coverage and the flexibility to choose any provider in the Signature network. 1 The 2020 HSA chart below shows several figures pertaining to HSAs and health plans.

7200 for family HDHP coverage. 2021 2020 Change. The HSA can only be used to pay for eligible medical expenses incurred after your HSA was established.

The plans HSA trustee is HealthEquity Inc. Maximum HSA contribution limit in 2020 and 2021 The maximum HSA contribution limit can change from year to year and varies depending on whether you have self-only individual coverage or a family. When you enroll in a CDHP you are automatically enrolled in an HSA.

Previously many OTC medications and products were HSA eligible only with a prescription. 2020 Annual HSA Contribution Limits Self-only single HDHP coverage 3550 3500 in 2019 Other than self-only family HDHP coverage 7100 7000 in 2019 Catch-up contributions HSA-eligible individuals who have reached age 55 by the end of the taxable year can make an extra annual 1000 catch-up contribution. Of the 3550 annual maximum or 59166.

There are yearly limits for deposits into an HSA. Health savings account HSA contribution limits for 2022 are going up 50 for self-only coverage and 100 for family coverage the IRS announced giving employers that sponsor high-deductible. Criteria you wont be HSA-eligible until Nov.

Yes there are exceptions for coverage for accidents disability dental care vision care long-term care permitted insurance preventive care certain prescription drug plans limited-purpose health flexible spending arrangements FSAs limited-purpose health reimbursement arrangements HRAs suspended HRAs post-deductible health FSAs or. This list includes products like allergy medication pain relievers prenatal vitamins and tampons. When you view plans in the Marketplace you can see if theyre HSA-eligible For 2019 if you have an HDHP you can contribute up to 3500 for self-only coverage and up to 7000 for family coverage into an HSA.

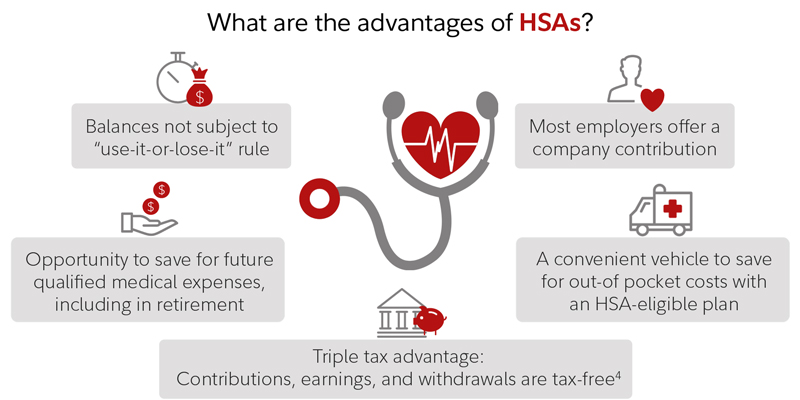

An HSA-eligible consumer-driven health plan must. HSAs or Health Savings Accounts offer excellent financial benefits but not many people are eligible for them according to IRS rules. New 2020 guidelines for health savings account HSA.

A health FSA may allow participants to carry over unused benefits from a plan year ending in 2020 to a plan year ending in 2021 and from a plan year ending in 2021 to a plan year ending in 2022. 2020 enroll in an HSA-qualified medical plan immediately and meet all eligibility. 2020 Guidelines 2019 Guidelines Minimum deductible amounts 1400 self only plans 2800 for family plans 2800 for embedded individual deductible family plans.

Members can keep this account even if they change employers. You must incur all eligible expenses for the 2019 benefit period by December 31 2019. For 2020 a Health Savings Account can be paired with any plan with an annual deductible of more than 1400 for self-only coverage or 2800 for family coverage AKA any High Deductible Health Plan HDHP.

3600 for self-only HDHP coverage. 1350 self only plans 2700 for family plans 2700 for embedded individual deductible family plans. Meet the IRS minimum annual deductible for 2021 this is 1400 for self-only coverage and 2800 for family coverage.

Finding using HSA-eligible HDHPs. They also help members save for future health care needs via a tax-advantaged health savings account. A health FSA may extend the grace period for using unused benefits for a plan year ending in 2020 or 2021 to 12 months after the end of the plan year.

For the 2020 benefit period you must incur all eligible expenses by December 31 2020. Not exceed the IRSs maximum out-of-pocket threshold the most youre responsible for. 1 you can contribute up to the.

The PEBB Program offers consumer-directed health plans CDHPs with health savings accounts HSAs to eligible members through Kaiser Permanente NW 1 Kaiser Permanente WA 2 and Uniform Medical Plan. For plan year 2020 the minimum deductible for an HDHP is 1400 for an individual and 2800 for a family.

Common Hsa Eligible Ineligible Expenses Optum Bank

Common Hsa Eligible Ineligible Expenses Optum Bank

Https Tuftshealthplan Com Broker Broker News 2019 2020 Irs Limits For Hsas And Hdhps

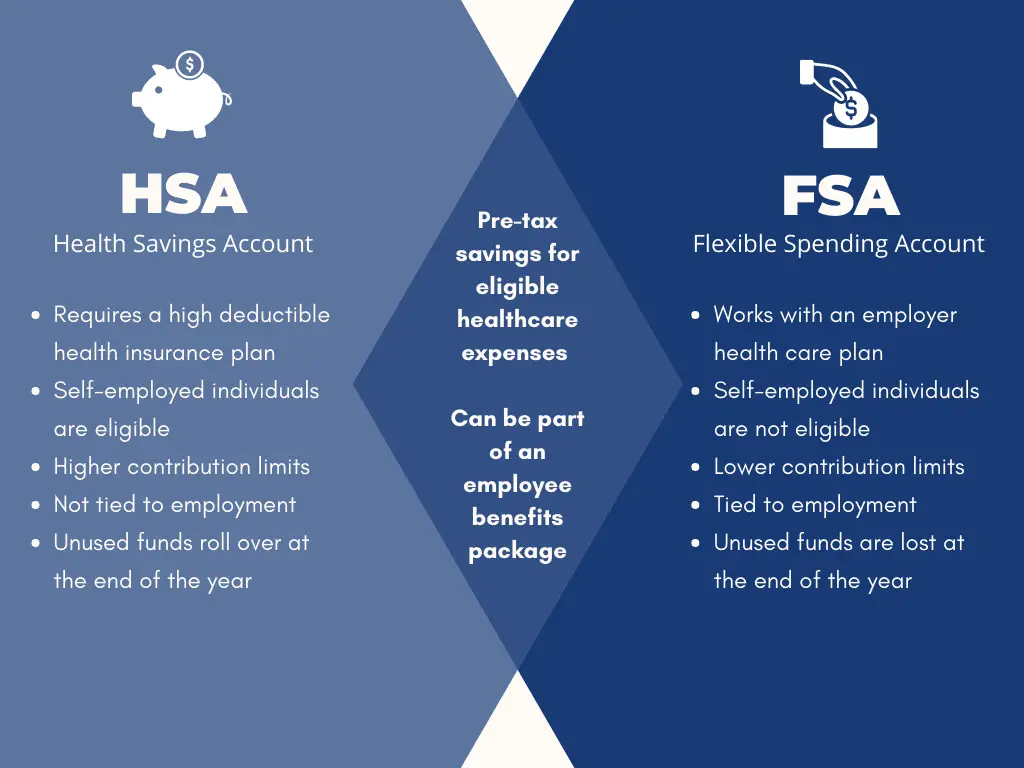

Hsas Fsas Eligibility And Contribution Limits Hays Companies

Hsas Fsas Eligibility And Contribution Limits Hays Companies

Hsa Planning When Both Spouses Have High Deductible Health Plans

Hsa Planning When Both Spouses Have High Deductible Health Plans

Health Savings Account Thrive Credit Union

Health Savings Account Thrive Credit Union

Health Savings Accounts Howard Bank

Health Savings Accounts Howard Bank

How Does An Hsa Work The 2020 Hsa Rules Strategy Retirewire

How Does An Hsa Work The 2020 Hsa Rules Strategy Retirewire

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Https Www Uhc Com Content Dam Uhcdotcom En Healthreform Pdf Provisions Reform Hsa External Flier Guidelines Pdf

Is It Worth Having A Hdhp To Be Eligible For A Health Savings Account

Is It Worth Having A Hdhp To Be Eligible For A Health Savings Account

Legal Alert Irs Releases 2020 Hsa Contribution Limits Ban

Legal Alert Irs Releases 2020 Hsa Contribution Limits Ban

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.