For plan year 2021 affordable coverage is defined as a self-only premium on the employers plan that is less than 983 of the employees wages. If your taxable income is less than the top end of the 12 bracket for 2019 39475 for single or MFS 52850 for HoH 78950 for MFJ or widow er then any net longterm capital gains realized and thus reported as noted in comments and also any qualified dividends within that amount are.

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

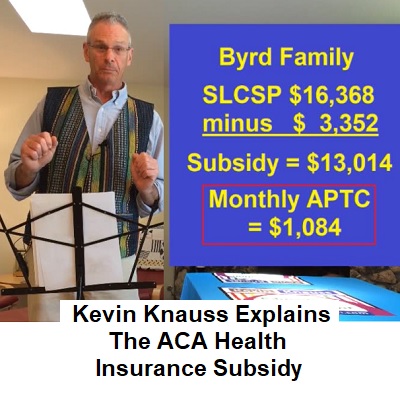

Subsidies or premium tax credits are based on three things.

How is aca subsidy calculated. To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level. 00978 50000 4890. Your income the price of the benchmark plan and how much the Affordable Care Act requires you to pay toward your health insurance.

November 2012 Newsletter from Bruce Jugan. 9500 - 4890 4610. Health care reform known as the Affordable Care Act ACA.

Thats line 37 on the 1040 line 4 on the 1040EZ or line 21 on the 1040A. A high level overview of how the Affordable Care Act - Obamacare - subsidy for health insurance premiums is calculated based on IRS forms and publications. 978 of your income.

The types of assistance offered under the Affordable Care Act are. For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of four. Then there are three things that you have to add to your AGI if they apply to you.

A person is not eligible for an ACA subsidy if they have access to affordable job-based qualifying coverage. As your income goes higher they expect you to pay a higher percentage of your higher income. DEMOCRATS PUSH 36B SUBSIDY FOR OBAMACARE IN MONSTER SPENDING BILL.

Calculating the Potential ACA Employer Tax Penalty. Non-taxable Social Security income this is line 20a minus line 20b on the 1040. To calculate your MAGI for subsidy eligibility you start with you AGI.

Requires employees to contribute too much for a company-sponsored health plan and the employees receive government subsidies. Under the Affordable Care Act the most youd pay in premiums for the second cheapest silver level plan is 2 of your income or 300 per year. Understanding how the tax credit is calculated requires knowing two numbers.

20 rijen When you fill out a Marketplace application youll need to estimate what your household. The actual subsidy is the difference between the. So if the second cheapest silver plan in your area costs 2000 per year youd get a 1700 subsidy to cover the difference.

If your income is low they expect you to pay a low percentage of your low income. The ACA uses the term modified adjusted gross income MAGI to describe the way income would be calculated for premium subsidy eligibility and thats accurate terminologythe calculation is a modification of adjusted gross income. With this calculator you can enter your income age and family size to estimate your eligibility for subsidies and how much you could spend on health insurance.

Your actual subsidy could be. To calculate where your income falls relative to the Federal Poverty Line please see Federal Poverty Levels FPL For Affordable Care Act ACA. Fortunately the HealthCaregov exchange figures it all out for you.

The first is the amount of income that Obamacare.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

Will You Receive An Obamacare Premium Subsidy Healthinsurance Org

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

We Claim Our Son But Not Our Daughter On Our Taxes How Are Premium Subsidies Calculated For Families Like Ours Healthinsurance Org

How Your Obamacare Insurance Subsidy Is Calculated An Advanced Lesson

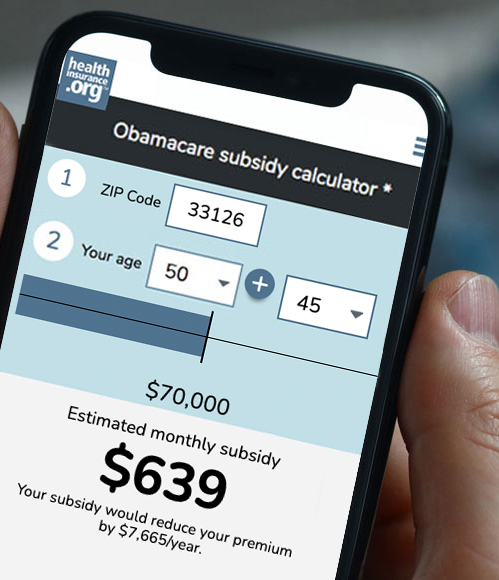

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Obamacare Calculator Subsidies Tax Credits Cost Assistance

Subsidy Calculator Health Beat By Maggie Mahar

Subsidy Calculator Health Beat By Maggie Mahar

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

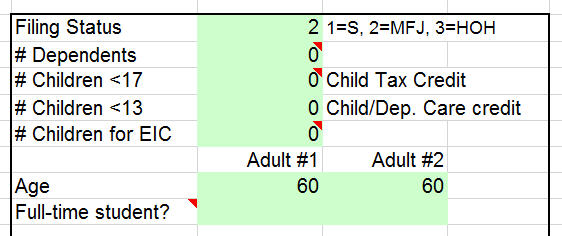

Tax Calculator With Aca Health Insurance Subsidy

Tax Calculator With Aca Health Insurance Subsidy

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

Obamacare S Subsidy Cliff Eliminated For 2021 And 2022 Healthinsurance Org

How Is The Obamacare Subsidy Calculated

How Is The Obamacare Subsidy Calculated

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.