PPO plans cover out-of-network visits although the level of coverage is lower than in-network benefits. However some feel that Blue Shield is gutting these plans so much that in reality they might as well be EPOs.

Hmo Vs Ppo Which Plan Is Best For You

Hmo Vs Ppo Which Plan Is Best For You

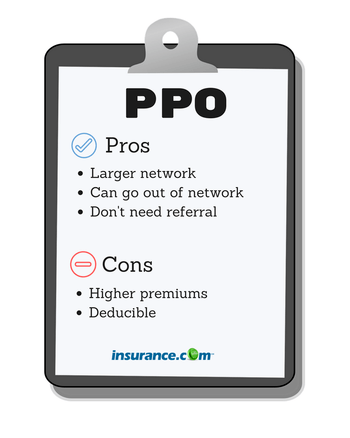

The more a plan pays for out-of-network care the higher your monthly payments will be.

Blue shield epo vs ppo. But overall PPO networks span large areas. Use our Blue Cross Blue Shield of Michigan PPO and EPO HSA Enrollment Form PDF to enroll. If you have any enrollment questions call us at 1-888-288-2738.

PPO insurance plans allow members to schedule appointments and receive treatment from specialists without first obtaining a referral from a PCP. For example copays and coinsuranceis usually higher for out-of-network benefits. And if youre getting coverage from your employer the scope of your plan options will generally depend on the size of your employer.

See the About BlueCard section for more information. What Are the Disadvantages of a PPO. This is especially important since the network size is already an issue.

Lower out-of-pocket maximum. So even if you move out of the area you will still be covered as long as you continue to seek services through in-network PPO providers. And a lower cost because no money is spent on an extra visit to a PCP.

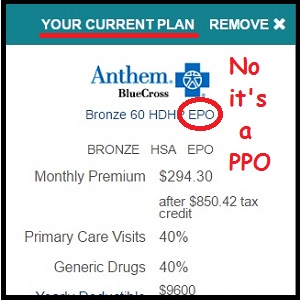

If youre buying your own coverage as opposed to getting it from your employer you may not have any PPO options as individual market plans have increasingly switched to the HMO or EPO model. Many Anthem PPO members have received notification that their PPO plan is turning into an EPO. All plans include vision services mental health services and supplies.

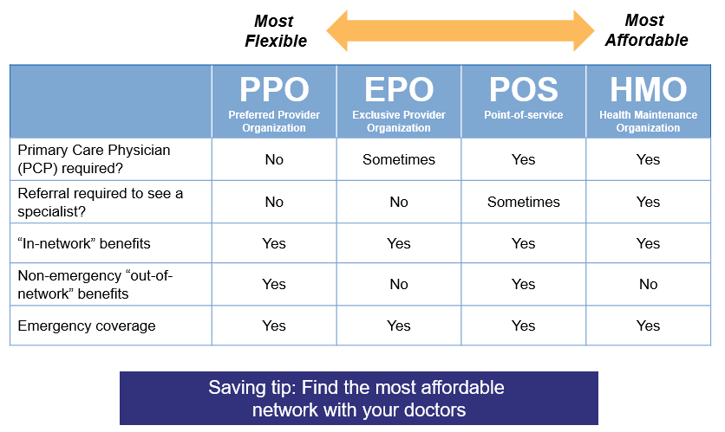

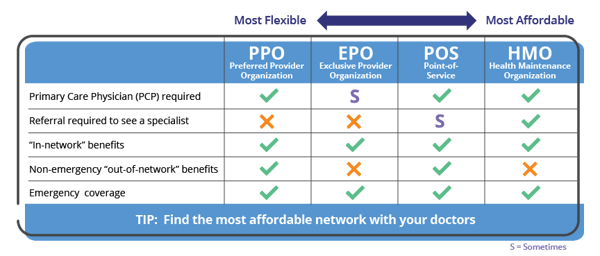

You can control your out-of-pocket costs by carefully choosing the providers from whom you receive covered services. Of course the true difference lies between which type of insurance carrier youre looking at and the types of services you need. EPO plans combine the flexibility of PPO plans with the cost-savings of HMO plans.

Several PPOs tend to carry lower deductibles as opposed to HDHPs. This reduces costs so your monthly payments will be lower. However if you choose to get care out of your plans network your medical care may not be covered.

You receive more choices for the care you need but at the expense of higher out-of-pocket costs when services are rendered. Blue Shield of California offers the only PPO available now on the market. One of the biggest perks of an EPO plan is that you do not always need a referral to see a specialist.

You wont need to choose a primary care physician and you dont need refe. Yes Blue Shield will continue to offer individual plans that say PPO at the end of the plan name. CareFirst BlueCross BlueShield EPO and PPO In general all options under each type of plan PPO or EPO cover the same services.

EPO health plans are often more affordable than PPO plans if you choose a doctor or specialist in your local network. You will pay the full cost of items such as prescription drugs and office visits until the plans deductible amount is met. An advantage of a plan without referrals is faster treatment for complex issues because a specialist can be consulted immediately.

However the participating provider networks for each plan are different. EPO plans on the other hand do not cover out-of-network benefits at all. After you enroll youll get an HSA Welcome Kit.

Blue Shield of California has a statewide network of physician members and contracted hospitals known as Preferred. The main differences between the two are the size of the health care provider network the flexibility of coverage or payment assistance for doctors in-network vs out-of-network and the monthly payment. For most services youll have to meet a higher deductible before the HSA Plan pays its share of the cost of services than you would in the EPO or PPO Plans.

When deciding between youre an EPO and a PPO there is a multitude of factors you must consider. On the other hand an EPO will typically have lower monthly premiums than a PPO. The PPO typically has a lower maximum out-of-pocket cost than an HDHP.

Read below for distinction between EPOs and PPOs. The Blue Shield of California EPO Plan is specifically designed for you to use Blue Shield of California Preferred Providers. A PPO plan gives you more flexibility than an EPO by allowing you to attend out-of-network providers.

EPO stands for exclusive provider organization and doesnt cover any out-of-network care. Even though the EPO product only provides benefits for in-network services it utilizes a large national network of PPO providers. A Blue Dental EPO plan only covers services from in-network PPO dentists.

You can quote 2017 Blue Cross EPO versus Blue Shield of California PPO here. The monthly payment for an HMO plan is lower than for a PPO plan with a comparable deductible and out of pocket maximum. It has information to help you activate and manage your account.

Preferred Provider Organizations do cost more as a health insurance plan. The main downside of a PPO is that youll pay higher monthly premiums. Although this feature can be a big help it can also be a wash financially by the time you pay all of your premiums for the year.

You will find that the monthly premiums you pay and the copays for your appointments will cost more with a PPO.

Covered California Misleads Consumers On The Anthem Ppo To Epo Plan Change

Covered California Misleads Consumers On The Anthem Ppo To Epo Plan Change

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Did Your Blue Cross Ppo Get Discontinued

Did Your Blue Cross Ppo Get Discontinued

Comparing Costs And Rates Of Hmo To Ppo Plans In California

Comparing Costs And Rates Of Hmo To Ppo Plans In California

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

Hmos Vs Ppos Health Insurance 101 Blue Cross Blue Shield Of Michigan

The Difference Between Blueselect Bluecare And Blueoptions

The Difference Between Blueselect Bluecare And Blueoptions

Looking For Ppo Health Plans In Texas For 2018 Good Luck

Looking For Ppo Health Plans In Texas For 2018 Good Luck

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.