Its offered to people who have high-deductible health plans HDHP. Covered California offers these plans at the Bronze level.

California And New Jersey Hsa Tax Return Special Considerations

California And New Jersey Hsa Tax Return Special Considerations

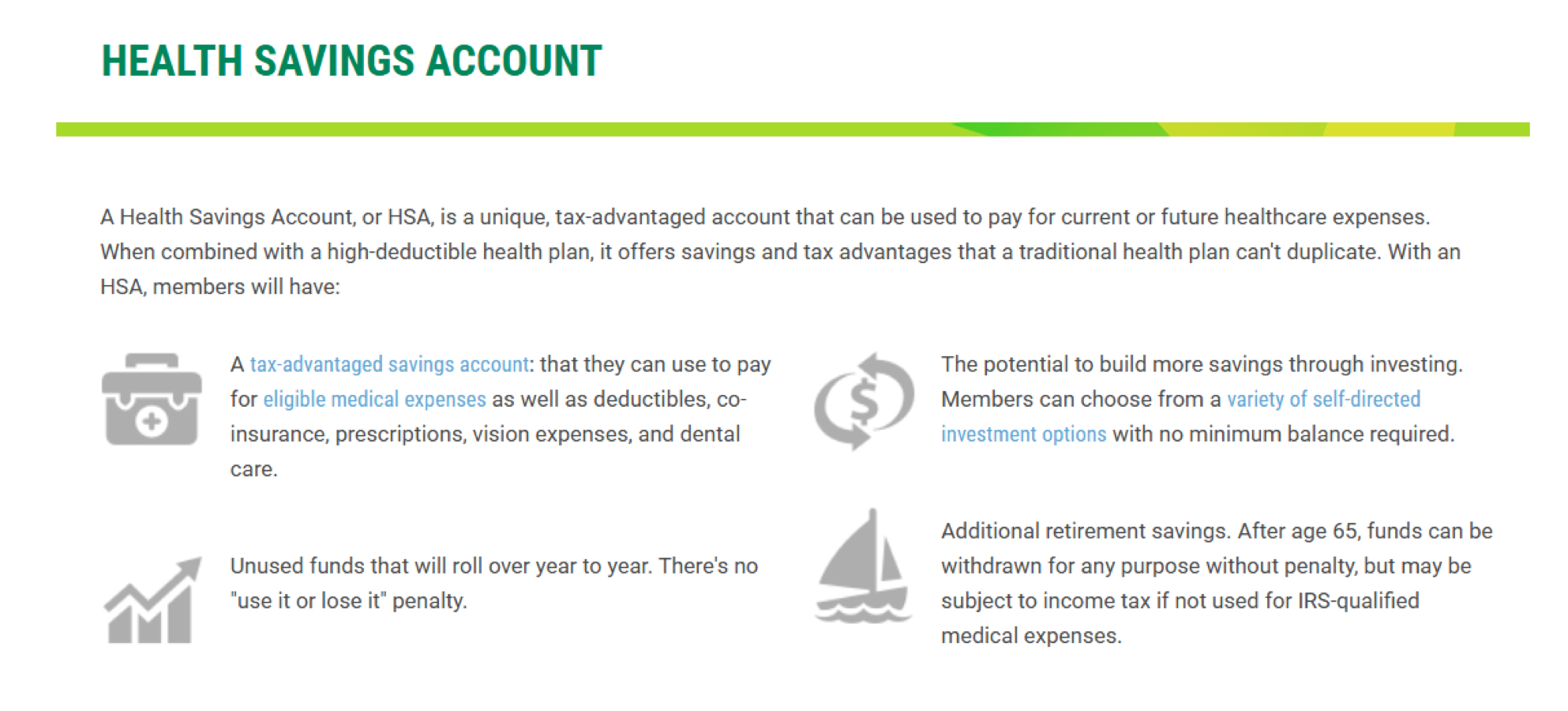

An HSA is tax-favored savings account that is used in conjunction with a high-deductible HSA-compatible health insurance plan to make healthcare more affordable and to save for retirement.

Health savings account california. For example currently California requires taxpayers to add back. For contributions its pretty straightforward I just have to add that income back to be taxed at the state level. The member or their employer contributes money to an HSA through pre-tax or post-tax contributions.

A Health Savings Account HSA can make it easier to save the funds you need to pay your medical deductible and other out-of-pocket expenses. If you are enrolling in a qualifying high-deductible health plan you can build a tax-free HSA with a bank or financial institution of your choice. Using FTB data it was determined that California taxpayers contributed 450 million to Health Savings Accounts HSAs in 2017.

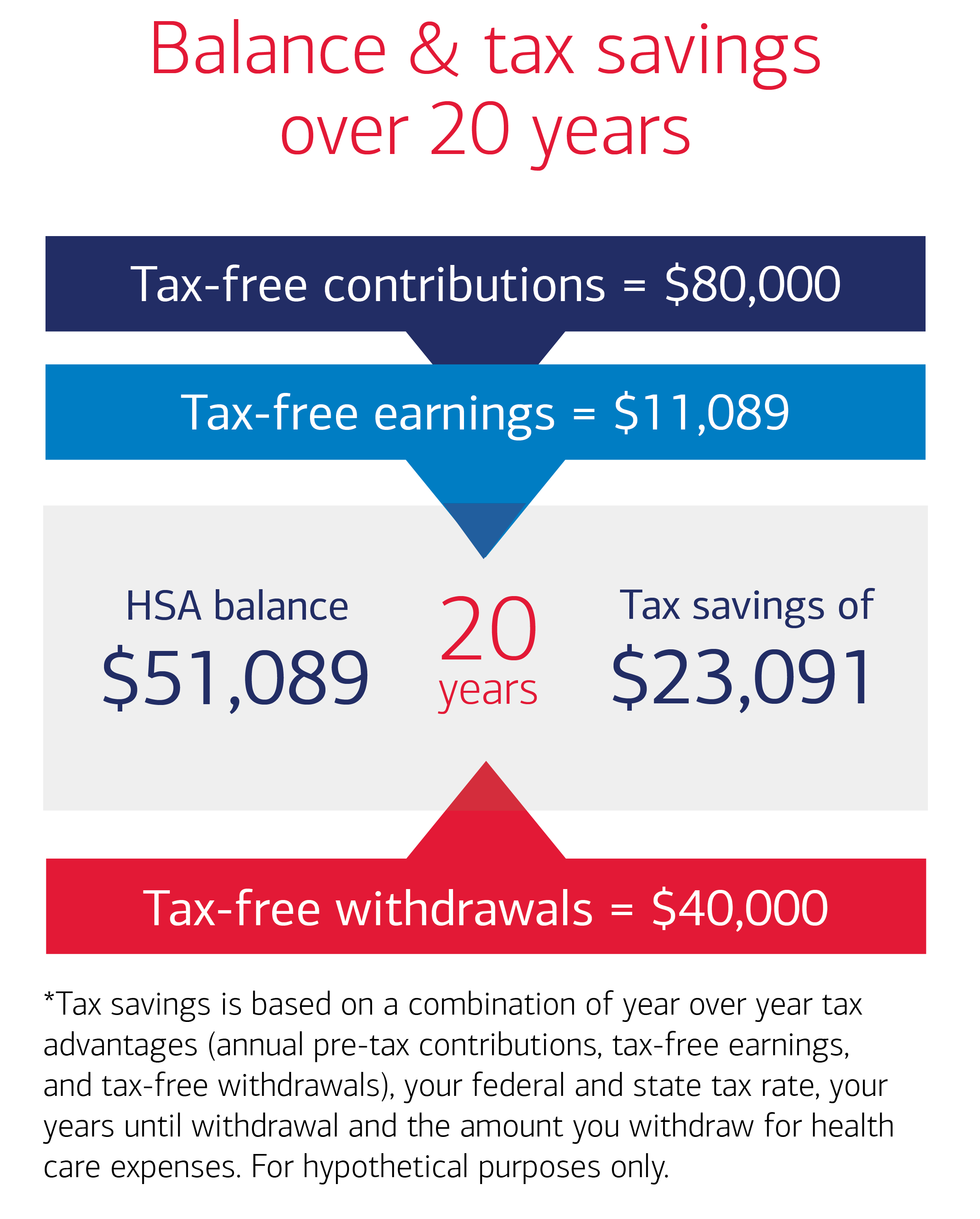

Health Savings Accounts were created to go hand-in-hand with a qualified high-deductible health care plan so that individuals could pay less in monthly dues and put the savings along with additional funds in a tax-exempt Health Savings Account. The funds contributed to an account are not subject to federal income tax at the time of deposit. HSAs enable you to pay for current health expenses and save for future qualified medical and retiree health expenses on a tax-free basis.

A business can allow employees to open a California HSA account only after the employee has enrolled in a qualified high deductible medical insurance plan. Health Savings Account HSA Insurance Info. A Health Savings Account allows you to use tax-free dollars to cover routine and minor medical expenses while you satisfy your deductible-expenses that would.

HSAs are owned by the individual which. HSA is an abbreviation for a specific bank account called a Health Savings Account. This amount was grown to reflect changes in the economy over time resulting in an estimated 600 million HSA deduction in taxable year 2020.

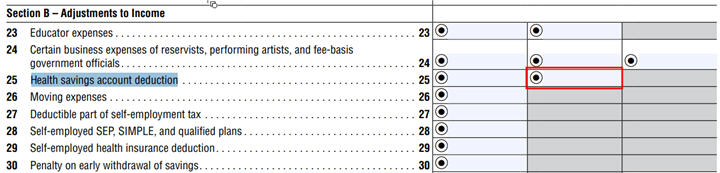

Interest or earnings in a HSA are taxable in the year earned. Health Savings Accounts A Health Savings Account HSA 1 is a personal savings account that allows a member to pay for qualified medical dental and vision care expenses with tax-advantaged dollars. Additionally according to Instructions for Schedule CA 540.

Health Savings Accounts HSA are special accounts that provide tax benefits when used to pay for medical expenses that are not covered by your health insurance. A health savings account is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan. Health Savings Account HSA California Times is pleased to offer a Health Savings Account HSA when you participate in the Collective Health High Deductible Health Plan HDHP.

HSA stands for health savings account. An HSA is a tax-advantaged savings account owned by you and can be used to pay for qualified medical expenses that you may incur now or later for you and your dependent. California Health Savings Accounts What is an HSA.

Tax Treatment of Health Savings Accounts HSAs in California. License 9530137 California Department of Business Oversight. Interest or other earnings earned from a Health Savings Account HSA are not treated as taxed deferred.

To combat the rising cost of health insurance government leaders and the insurance industry have developed a new way to finance medical expenses. Unlike a flexible spending account HSA funds roll over and accumulate year to year if they are not spent. People who choose to enroll in one can add funds to their HSA that arent subject to federal income tax when theyre deposited.

The Bronze 60 HSA can oftentimes be a few dollars cheaper than the standard Bronze 60. 7Your state may prohibit a state income tax deduction for your health savings account. With this health plan you have the option of setting up a separate Health Savings Account with a bank of your choice and saving money designated for medical expenses.

It is a savings product that offers a different way for consumers to pay for their health care. A Health Savings Account is an alternative to traditional health insurance. A health insurance policy.

They saved 1000s of our clients 1000s of dollars. Called Health Savings Accounts HSA these new plans have three features. Health Savings Accounts HSAs allow enrollees to save money on a tax favored basis to pay for medical expenses.

Weve been fans of the HSA or Health Savings Account health plans in California since they were called MSAs and for a very good reason. So what is an HSA health plan and what is their future in light of the Health Reform requirements. If you are using a screen reader or auxiliary aid and having problems using this website please call 800 334-8788.

It is estimated that employer contributions on behalf of. Health Savings Account HSA Plans California What Is A Health Savings Account HSA Plan.

Irs Announces Hsa Limits For 2020 California Benefits Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Irs Announces Hsa Limits For 2020 California Benefits Advisors Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Tap Into The Triple Tax Benefits Of An Hsa

Tap Into The Triple Tax Benefits Of An Hsa

University Of California One Of The Smartest Ways To Save Is Among Your Uc Health Benefits

University Of California One Of The Smartest Ways To Save Is Among Your Uc Health Benefits

Health Savings Account Habits Fidelity

Health Savings Account Habits Fidelity

Health Savings Account The Benefits Store

Health Savings Account The Benefits Store

Tax Treatment Of Health Savings Accounts Hsa 2020

Tax Treatment Of Health Savings Accounts Hsa 2020

Best And Worst Health Savings Accounts For Singles Families Benefits Broker California Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Best And Worst Health Savings Accounts For Singles Families Benefits Broker California Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Hras Hsas And Health Fsas What S The Difference Employee Benefits California Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Hras Hsas And Health Fsas What S The Difference Employee Benefits California Aeis Advisors Employee Benefits Insurance Broker In San Mateo

Health Savings Account Hsa Plans California

Health Savings Account Hsa Plans California

How Does A Health Savings Account Hsa Work Healthinsurance Org

How Does A Health Savings Account Hsa Work Healthinsurance Org

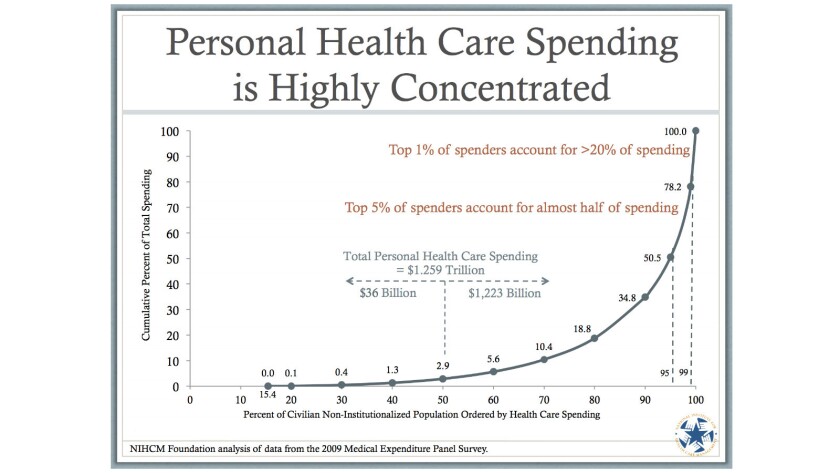

The Great Health Savings Account Scam

The Great Health Savings Account Scam

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

California And New Jersey Hsa Tax Return Special Considerations

California And New Jersey Hsa Tax Return Special Considerations

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.