Form 1099G is a record of the total taxable income the California Employment Development Department EDD issued you in a calendar year and is reported to the IRS. After completing the application you will receive your Tax ID EIN Number via e-mail.

California Tax Forms H R Block

California Tax Forms H R Block

Employers Quarterly Federal Tax Return Form W-2.

California tax id form. Again the most efficient way is to apply online. Then in most cases it takes us under an hour to prepare your forms and e-mail them directly to you. Some business structures arent legally required to be registered.

Fortunately you can get one in an hour if you apply online. Construction Contracts Partial Exemption Certificate for Manufacturing Research and Development. Apply for a California Tax ID EIN Number Online.

If you do youll get your state tax ID number in 4 to 6 weeks. 3 01-20 Acknowledgement of Licensee Responsibilities Under the California Interstate User Diesel Fuel Tax. The Internal Revenue Service issues employer federal identification numbers and administers federal payroll and income taxes including social security Medicare federal unemployment insurance and federal income tax withholding.

Due to state and federal tax law changes were revising tax forms and instructions. Employers engaged in a trade or business who pay compensation Form 9465. In this form business owners report individual employees wages personal income tax PIT withholdings and the amount of California personal income tax that was withheld from their pay.

If you want your LLC taxed as an S-Corp youll first apply for an EIN and then later file Form 2553. Unlike the EIN which is issued by the IRS the California SEIN is issued by the California. Before you can get your tax ID in California you may need to make sure your business is properly registered at the state and federal levels.

Claim for 60 Exclusion from Tax on Purchase of Factory-built Housing. In California DMV may issue an ID card to a person of any age. If the recent tax law changes do not affect you you can still file with these forms.

Welcome to the California Tax Service Center sponsored by the California Fed State Partnership. Acknowledgement of Licensee Responsibilities Under the International Fuel Tax Agreement. California Sales Tax.

Also known as a State Employer Identification Number or SEIN it functions much like an EIN or Employer Identification Number does at the national level identifying your company to the IRS like a Social Security number does for an individual. Get Ready for a Tax ID Number. Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS.

Partial Exemption Certificate for Manufacturing Research and Development Equipment. California Tax Service Center. Review IRS tax guidance on benefit identity theft.

Our partnership of tax agencies includes Board of Equalization California Department of Tax and Fee Administration Employment Development Department Franchise Tax Board and Internal Revenue Service. Regardless if your business falls into one of. Once you have it youll have your choice of application methods just like you did with the federal tax ID number.

That means that regardless of where you are in the state you will pay an additional 725 of the purchase price of any taxable good. If you are opening a business or other entity that will have employees. If instead you want your California LLC taxed as a C-Corp youll first apply for an EIN and then later file Form 8832.

As taxable income these payments must be reported on your federal tax return but they are exempt from California state income tax. Total taxable unemployment compensation includes. Before you can get a California state tax ID number youll need a federal tax ID number.

Access to California Department of Tax and Fee Administration Records. The Employer ID Numbers EINs webpage provides specific information on applying for an EIN making a change in the application for an. You will receive a Form 1099G if you collected unemployment compensation UC from the EDD and must report it on your federal tax return as income.

January April July and October. The undersigned certify that as of June 22 2019 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 or a subsequent version June 22 2019 published by the Web Accessibility Initiative of the World. There are three types of ID cards.

What is a 1099G form. To begin your application select the type of organization or entity you are attempting to obtain a Tax ID EIN Number in California for. Since many cities and counties also enact their own sales taxes however the actual rate paid throughout much of the state will be even higher than that.

Simplified income payroll sales and use tax information for you and your business. Employees Withholding Certificate Form 941. The table below shows state and county tax rates for each of the 58 counties in California.

State ID number California refers to the number that will be assigned to your company in California to identify your company for tax purposes in the state. Identification ID cards are used to prove your identity or age like drivers licenses but they do not allow you to operate a motor vehicle. Californias base sales tax is 725 highest in the country.

Employers must mail the DE 6 Form to the EDD by the end of the month following the end of each quarter ie. The default tax status for a California Multi-Member LLC is Partnership meaning the IRS taxes the LLC like a Partnership.

How To Get A Resale Certificate In California Startingyourbusiness Com

How To Get A Resale Certificate In California Startingyourbusiness Com

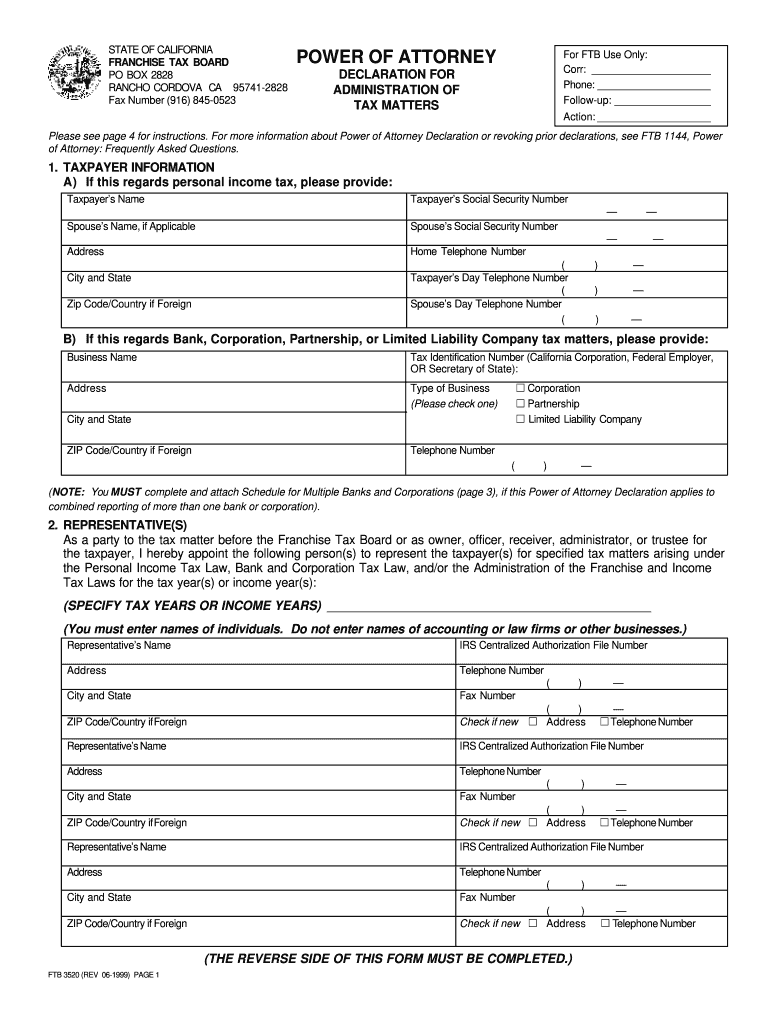

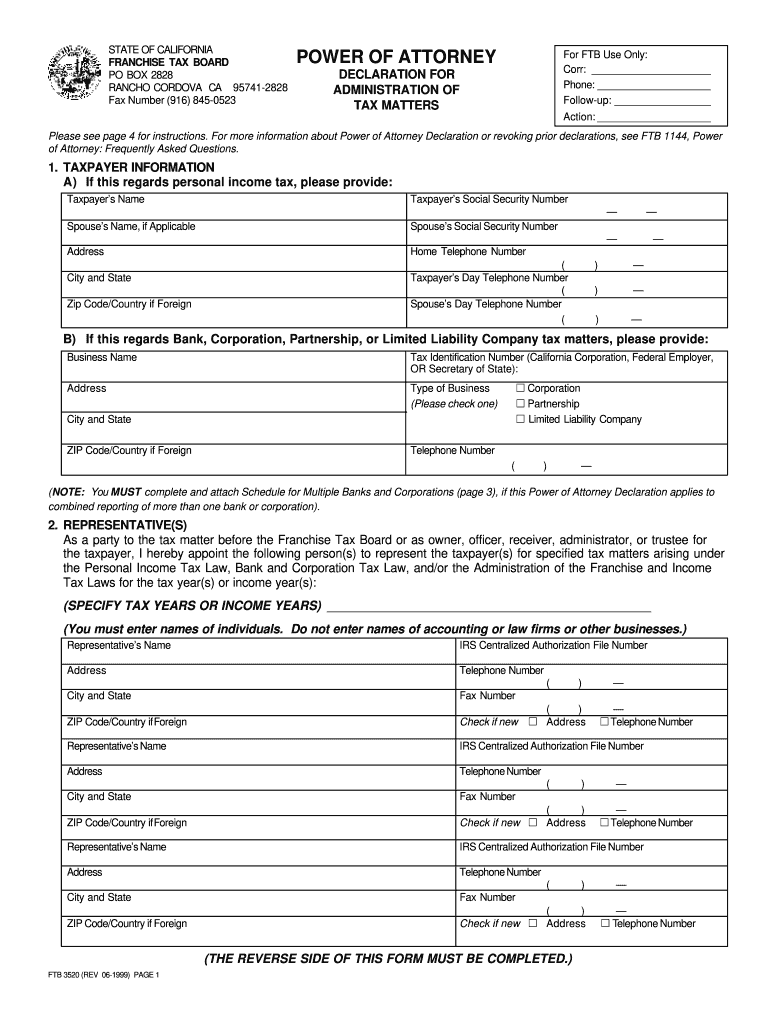

Franchise Tax Board Fill Online Printable Fillable Blank Pdffiller

Franchise Tax Board Fill Online Printable Fillable Blank Pdffiller

Ca State Tax Id Number Gallery

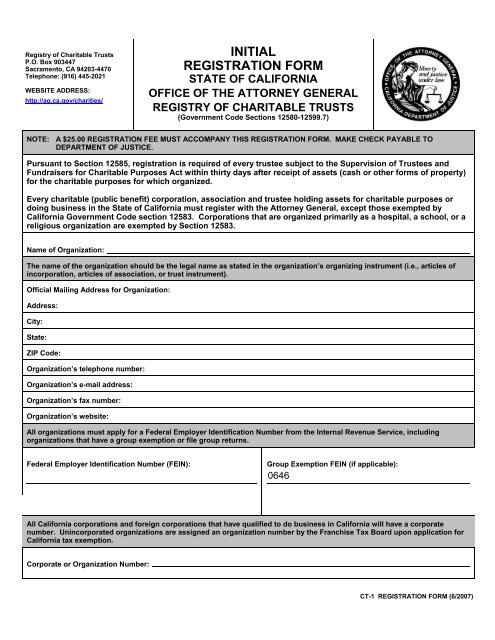

Ct1 Initial Registration Form Registry Of Attorney General

Ct1 Initial Registration Form Registry Of Attorney General

How To Get My Employers Tax Id Number Quora

New York State Tax Exempt Form Hotel Lovely Free Professional Resume California Sales Tax Exemption Models Form Ideas

New York State Tax Exempt Form Hotel Lovely Free Professional Resume California Sales Tax Exemption Models Form Ideas

Tax Id Number Apply Online Federal Ein Application Com

Tax Id Number Apply Online Federal Ein Application Com

Printable California Sales Tax Exemption Certificates

Printable California Sales Tax Exemption Certificates

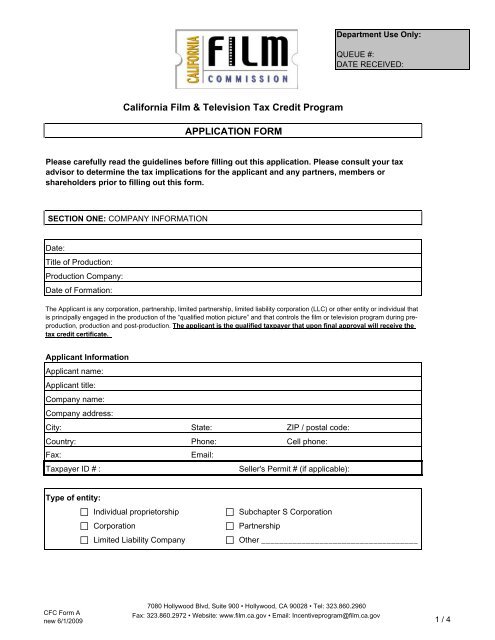

Application Form California Film Commission State Of California

Application Form California Film Commission State Of California

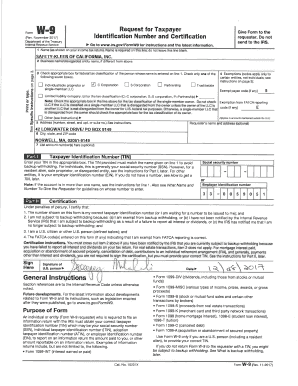

:max_bytes(150000):strip_icc()/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg) Form W 9 Request For Taxpayer Identification Number Tin And Certification Definition

Form W 9 Request For Taxpayer Identification Number Tin And Certification Definition

California Tax Id Fill Online Printable Fillable Blank Pdffiller

California Tax Id Fill Online Printable Fillable Blank Pdffiller

:strip_icc()/tax-id-employer-id-397572v24-8e7a9cdb60a144cebc57e59288feeff8.jpg) Differences Among A Tax Id Employer Id And Itin

Differences Among A Tax Id Employer Id And Itin

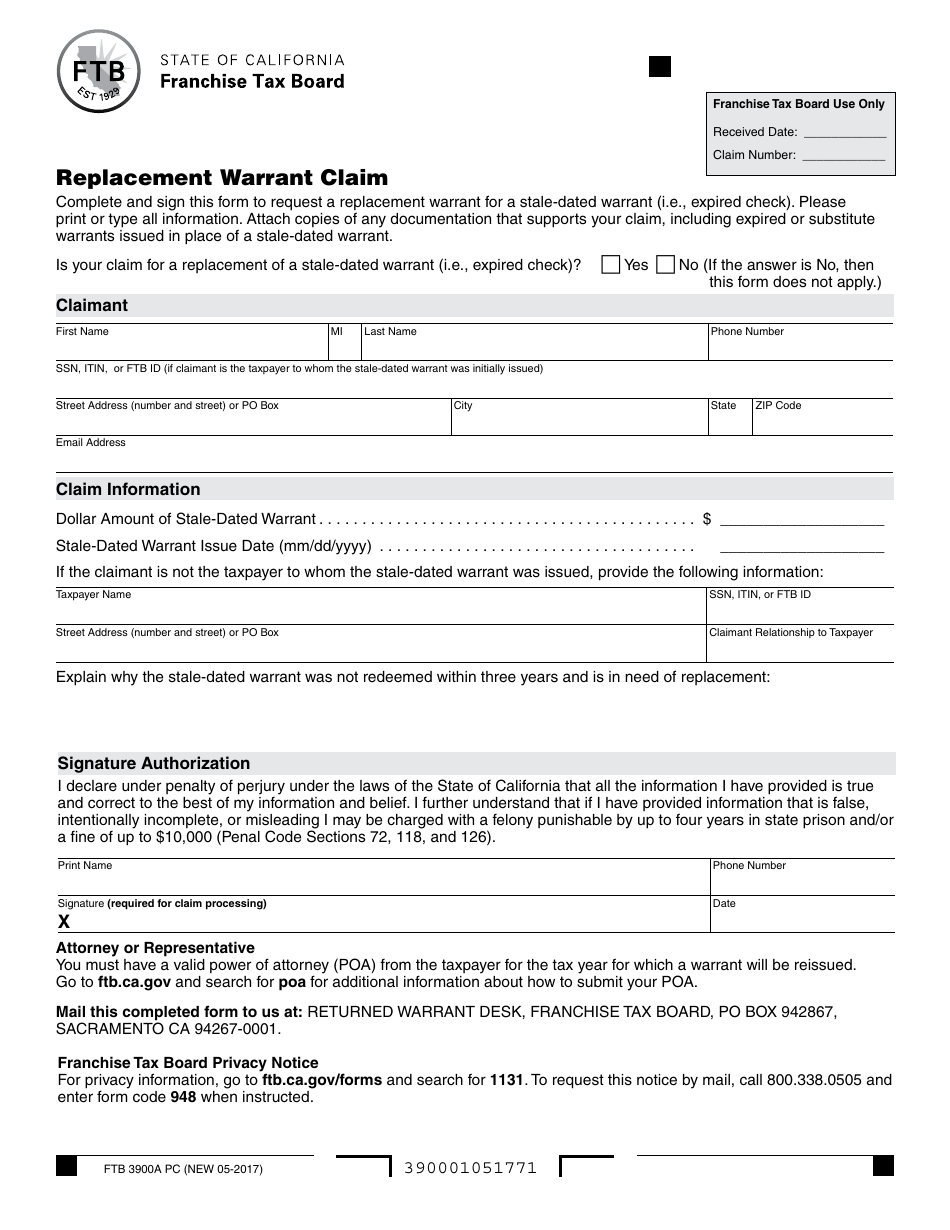

Form Ftb3900a Pc Download Fillable Pdf Or Fill Online Replacement Warrant Claim California Templateroller

Form Ftb3900a Pc Download Fillable Pdf Or Fill Online Replacement Warrant Claim California Templateroller

Corporate Documents Tax Returns Etc Question Copyright

Corporate Documents Tax Returns Etc Question Copyright

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.