That only leaves a premium difference of 17-27. Some states do not allow excess charges.

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

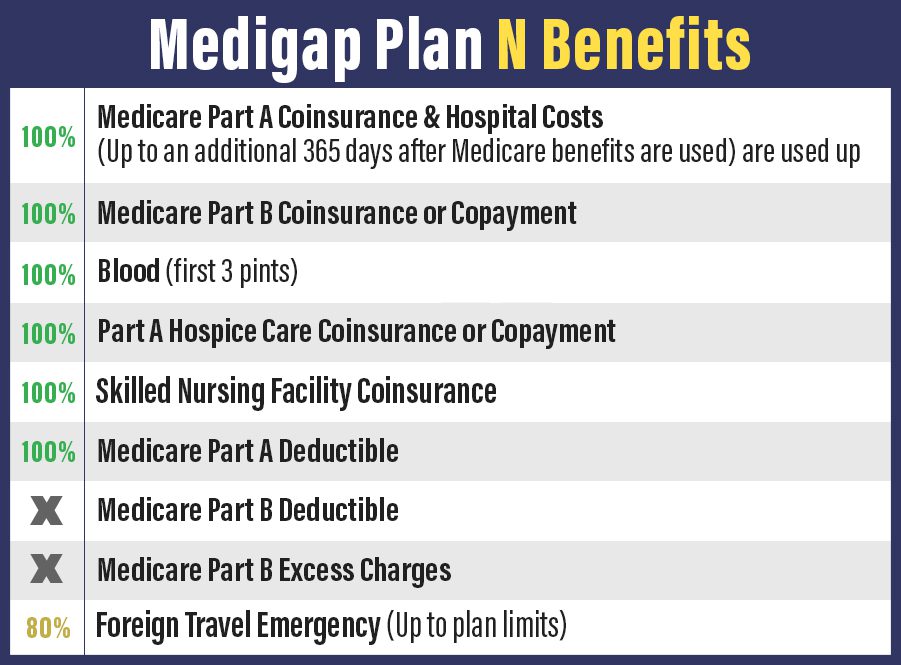

With Medicare Supplement Plan N 100 percent of the Part B coinsurance is paid with the exception of copayments of up to.

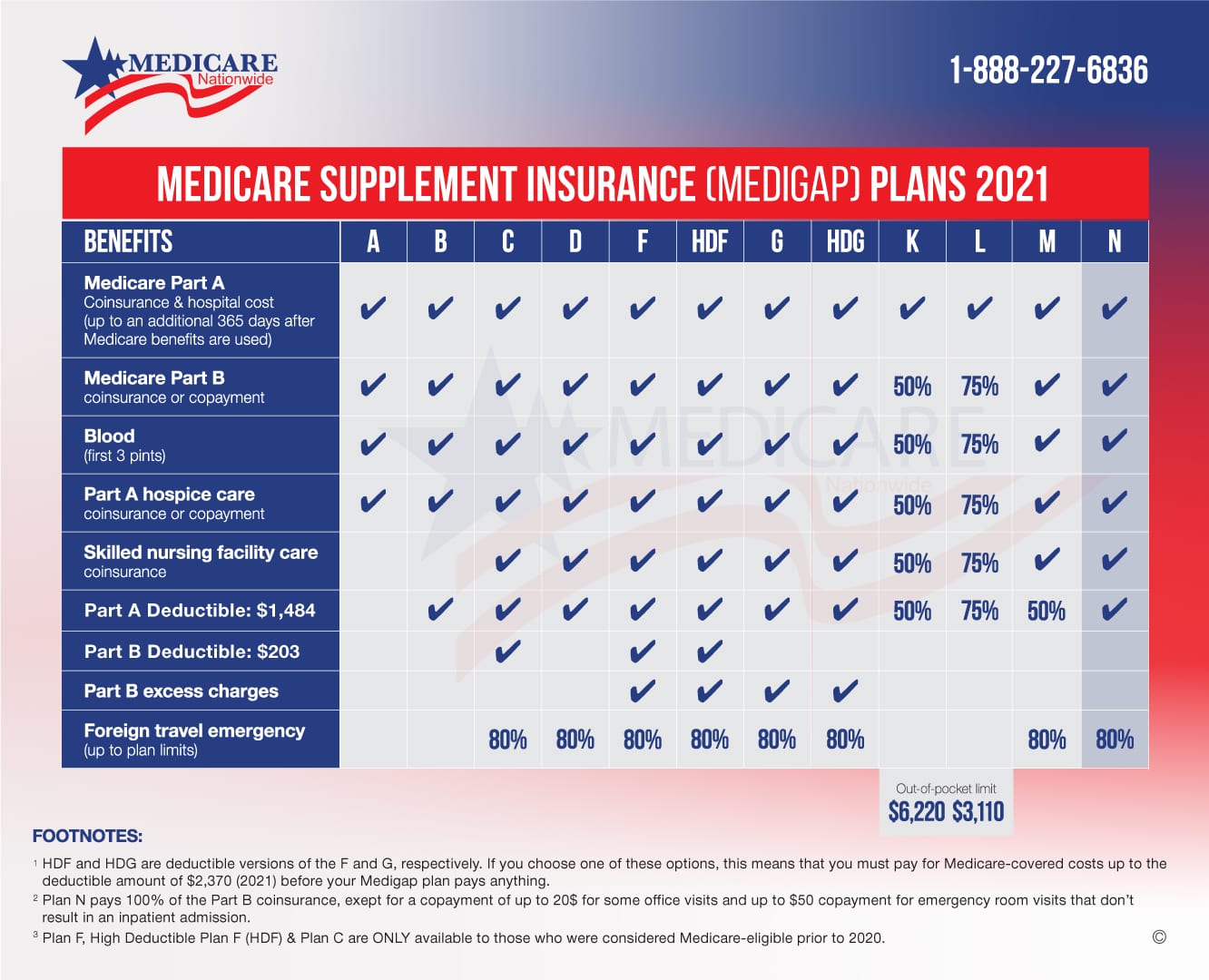

Plan n excess charges. Plan N also includes foreign travel emergency benefits. Excess charges can be easily avoided altogether by simply asking your doctor if he or she accepts Medicare Assignment If they do they cannot overcharge the Medicare-approved amount. Below well explain how excess charges.

There are several Medigap plans that do not cover Medicare Part B Excess charges most notably Plan N. In many states like Ohio for instance Part B excess charges are not allowed. This is called an excess charge.

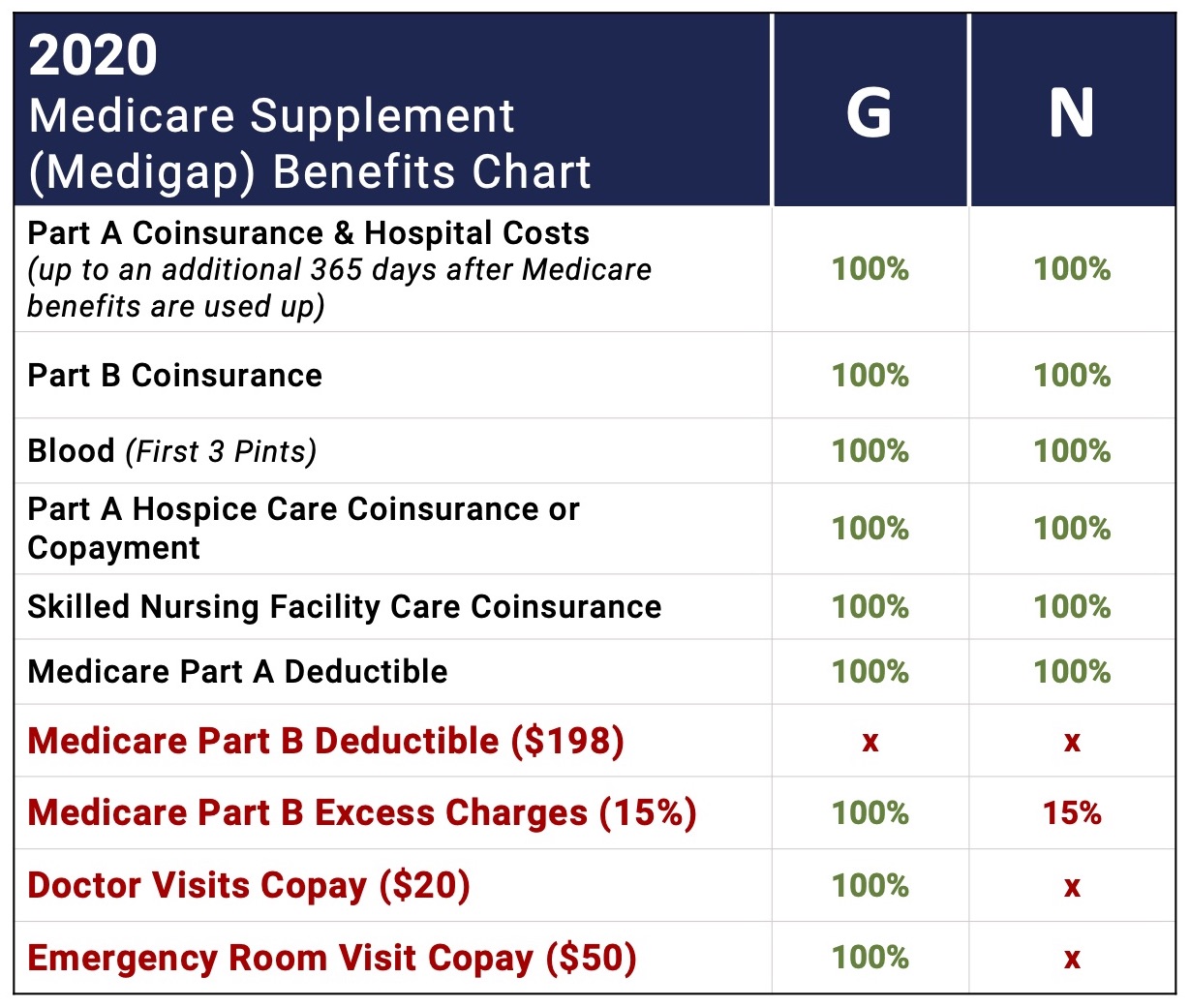

If you live in a state that allows excess charges you may have to pay those as well. So if the doctor billed 200 and Medicare approved 100 then Medicare would pay 80 and the client would pay the other 20 15 for excess charges. One big difference is that Plan N does not cover excess charges so the premiums for Plan N are lower.

These so-called Medicare Part B Excess charges of up to 15 above the Medicare-approved amount are passed on to the patient and billed directly to you after the fact. Theres only a 30-40 difference in premium. Finally people with Medigap N also pay excess charges to some medical providers.

In these cases a provider can charge you up to 15 more than the Medicare-approved amount. After they pay the 155 part B deductible 1551213mo. Plan N does not cover this for you like Plan F or G would.

Doctors who do not accept Medicare assignment may charge you up to 15 percent more than what Medicare is willing to pay. An excess charge happens when you receive health care treatment from a provider who does not accept the Medicare-approved amount as full payment. Your Part B excess charge.

Your doctor cant charge you more than 15 above the Medicare assignment. With Plan N you are responsible for copayments up to 20 when you visit the doctors office or up to 50 for emergency room visits. But most doctors accept Medicare assignment so excess charges are rare.

Medigap Plan N does not cover the Medicare Part B deductible or Part B excess charges and thus the beneficiary is responsible for paying these costs out-of-pocket. Providers can charge 15 more than what Medicare allows. Plan N does not cover Part B excess charges but these fees are very rarely encountered.

That means that if you live in one of these states you will not have to pay these charges. This amount is known as a Medicare Part B. After you meet your Part B deductible Medicare covers 80 of Part B covered charges and the Plan N covers the other 20 for you.

This can result in small bills from time to time. If you reside in one of these states you may want to consider a Medigap Plan N. Medigap N is less expensive than Plan G but doesnt cover excess charges.

If Susan has a supplement plan that does not cover excess charges such as Plan N she would be responsible for the excess charge of 75. Plan N does not cover excess charges Medicare supplement Plan N does not cover the Part B deductible. The benefits of Medigap Plan N are similar to Plan Ds policy the sole exception being how it covers Medicare Part B coinsurance costs.

If you travel outside the United States Plan N will cover emergency services up to plan. Once in a while a beneficiary may receive a medical bill for an excess charge Doctors that dont accept Medicare as full payment for certain healthcare services may choose to charge up to 15 more for that service than the Medicare-approved amount. If you are considering Plan N in a state like Ohio then you need not worry about Part B Excess.

Just remember that when you are out of state you need to ask the assignment question to providers. Plan N is increasingly becoming a popular option for people purchasing Medicare supplement insurance as it is a lower premium alternative to Plans F and G Get a Medicare Supplement comparison to see if Plan N works for you. If you live in a state that doesnt allow excess charges Plan N might appeal to you.

So if Medicare deems your procedure to be a 250 service the most the doctor can charge is 28750. Me Im a Plan F guy. With Plan N youd have the 250 portion of the bill covered and be personally responsible for the remaining 3750 Medicare excess charge.

A doctor has the option in most states of charging up to 15 ABOVE the Medicare-approved payment schedule. Here is a list. You are also responsible for any excess charges the additional amount a doctor may charge for services above what Medicare covers.

In 2021 that deductible is 203.

Plan F Vs Plan N What Most People Don T Know Clear Medicare Solutions

Medigap Plan N Tupelo Ms Bobby Brock Insurance

Medigap Plan N Tupelo Ms Bobby Brock Insurance

How To Avoid Medicare Part B Excess Charges Adh Insurance Agency Inc

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medigap Plan G Vs Plan N Medicare Hero

Medigap Plan G Vs Plan N Medicare Hero

Medicare Plan N Medigap Plan N Medicare Supplement Plan N

Medicare Plan N Medigap Plan N Medicare Supplement Plan N

Nevada Medicare Supplement Medigap Plan N Nevada Medicare

Nevada Medicare Supplement Medigap Plan N Nevada Medicare

Medicare Supplement Plan N Review Cost Copays Excess Charges

Medicare Supplement Plan N Review Cost Copays Excess Charges

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medicare Supplement Plan N Medicare Plan N Medigap Plan N

Medicare Supplement Plan N Is It Right For You

Medicare Supplement Plan N Is It Right For You

Medicare Supplement Plan N Overview And Pricing

Medicare Supplement Plan N Overview And Pricing

United American Medicare Supplement Boomer Benefits

United American Medicare Supplement Boomer Benefits

Medicare Plan F Vs Plan N Which One Is Right For You

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.