For 2020 where the advance credit payments exceed the PCT no additional income tax will be imposed. If your premium tax creditis more than your advance well either.

Maximizing Premium Tax Credits For Self Employed Individuals

Maximizing Premium Tax Credits For Self Employed Individuals

The IRS recently announced that for tax year 2020 taxpayers with excess APTC for 2020 are not required to file Form 8962 Premium Tax Credit to reconcile their APTC with the amount of PTC they may.

Premium tax credit 2020. Any word on when ProSeries will be updated to reflect the change to the premium tax credit for 2020. The IRS announced on Friday that taxpayers who may have had excess Sec. Subtract the difference from your balance due.

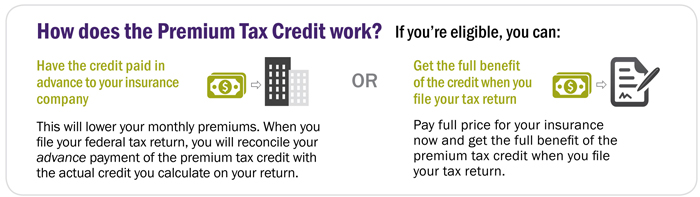

Eligible people can choose to have all some or none of the estimated credit paid in advance directly to their insurance company on their behalf. Individual Income Tax Return or Form 1040-SR US. This change is temporary and only applies to your 2020 taxes.

Requirement to repay excess advance payments of the Premium Tax Credit is suspended Filing a federal tax return to claim and reconcile the Credit for tax years other than 2020 Failing to file your tax return for tax years other than 2020 may prevent future advance credit payments Reporting changes in circumstances. The Internal Revenue Service has announced that taxpayers with excess APTC for 2020 are not required to file Form 8962 Premium Tax Credit or report an excess advance Premium Tax Credit repayment. The premium tax credit is limited by comparing the cost of your coverage to that of the second lowest cost silver plan that covers you and your family.

7 Zeilen If you buy health insurance from healthcaregov or a state-run ACA exchange up through the year. For 2020 the American Rescue Plan provides that taxpayers receiving excess advanced premium tax credits would not have to later reconcile the amount on their income taxes. WASHINGTON The American Rescue Plan Act of 2021 suspends the requirement that taxpayers increase their tax liability by all or a portion of their excess advance payments of the Premium Tax Credit excess APTC for tax year 2020.

Tax Return for Seniors. You must file Form 8962 with your income tax return Form 1040 1040-SR or 1040-NR if any of the following apply to you. Premium tax credits are tax credits that can be taken in advance as Advanced Premium Tax Credits or at tax time as Premium Tax credits or you can do a mix.

A taxpayers excess APTC is the amount by which the taxpayers advance payments of the Premium Tax Credit APTC. 2020 Premium Tax Credit IRS suspends requirement to repay excess advance payments of the 2020 Premium Tax Credit. Temporary Premium Tax Credit Changes in 2021 and 2022 The new stimulus package makes changes that impact multiple tax years.

36B premium tax credits to report for the 2020 tax year are not required to file Form 8962 Premium Tax Credit or report an excess advance premium tax credit APTC repayment on their 2020 Form 1040 US. I am holding a return for a client that has to repay but apparently the American Rescue Plan has cancelled any repayment of the PTC for 2020. The IRS also says.

A taxpayers excess APTC is the amount by which the taxpayers advance payments of the Premium Tax Credit APTC exceed his or her Premium Tax Credit PTC. I was reading elsewhere that there was also a change to the law regarding the Premium Tax Credit. If you are enrolled in more expensive coverage you will pay the additional amount.

However if you are enrolled in coverage that costs less your share of the premium will also be less. IRS suspends requirement to repay excess advance payments of the 2020 premium tax credit. Add the difference to your refund.

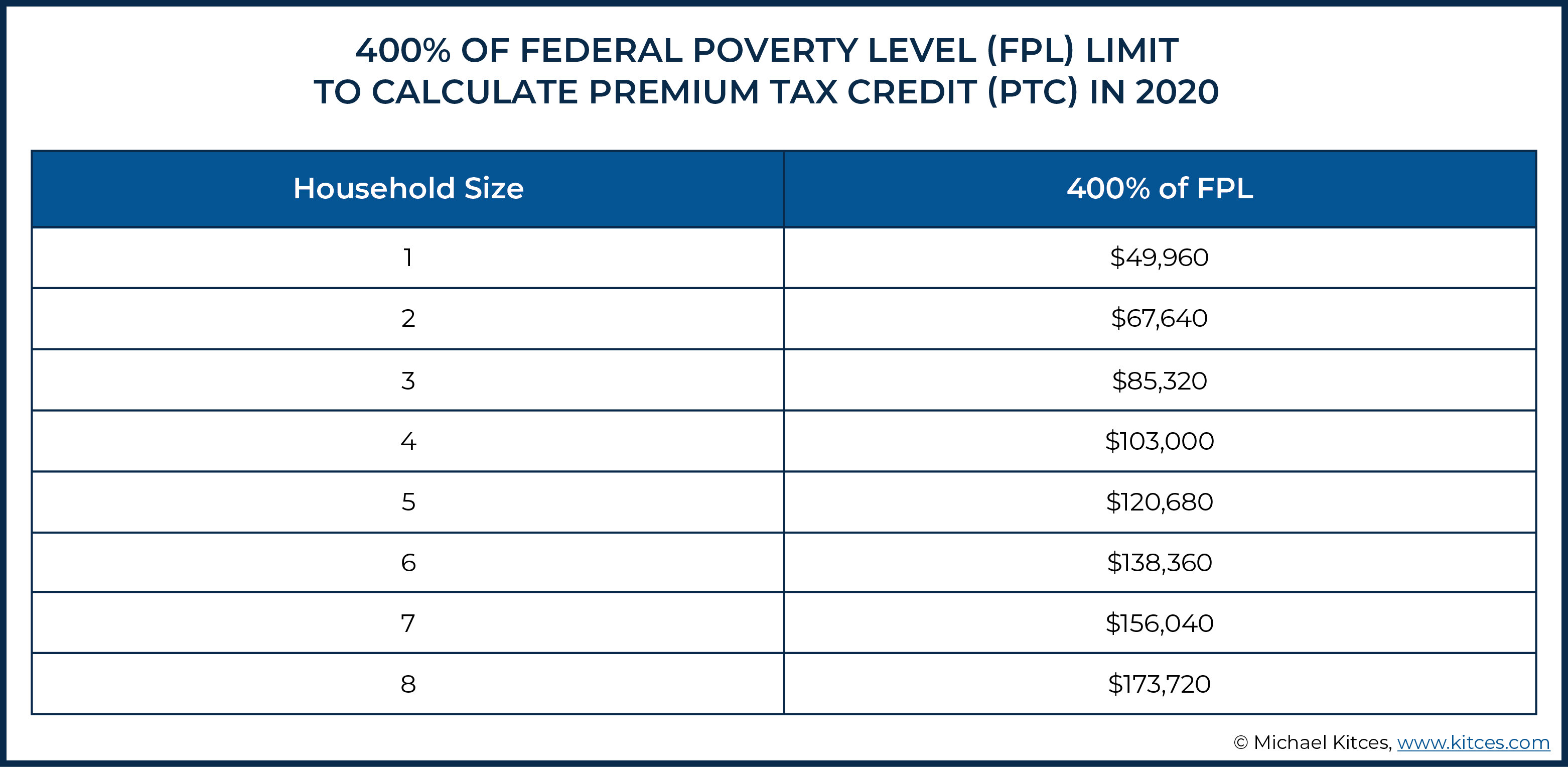

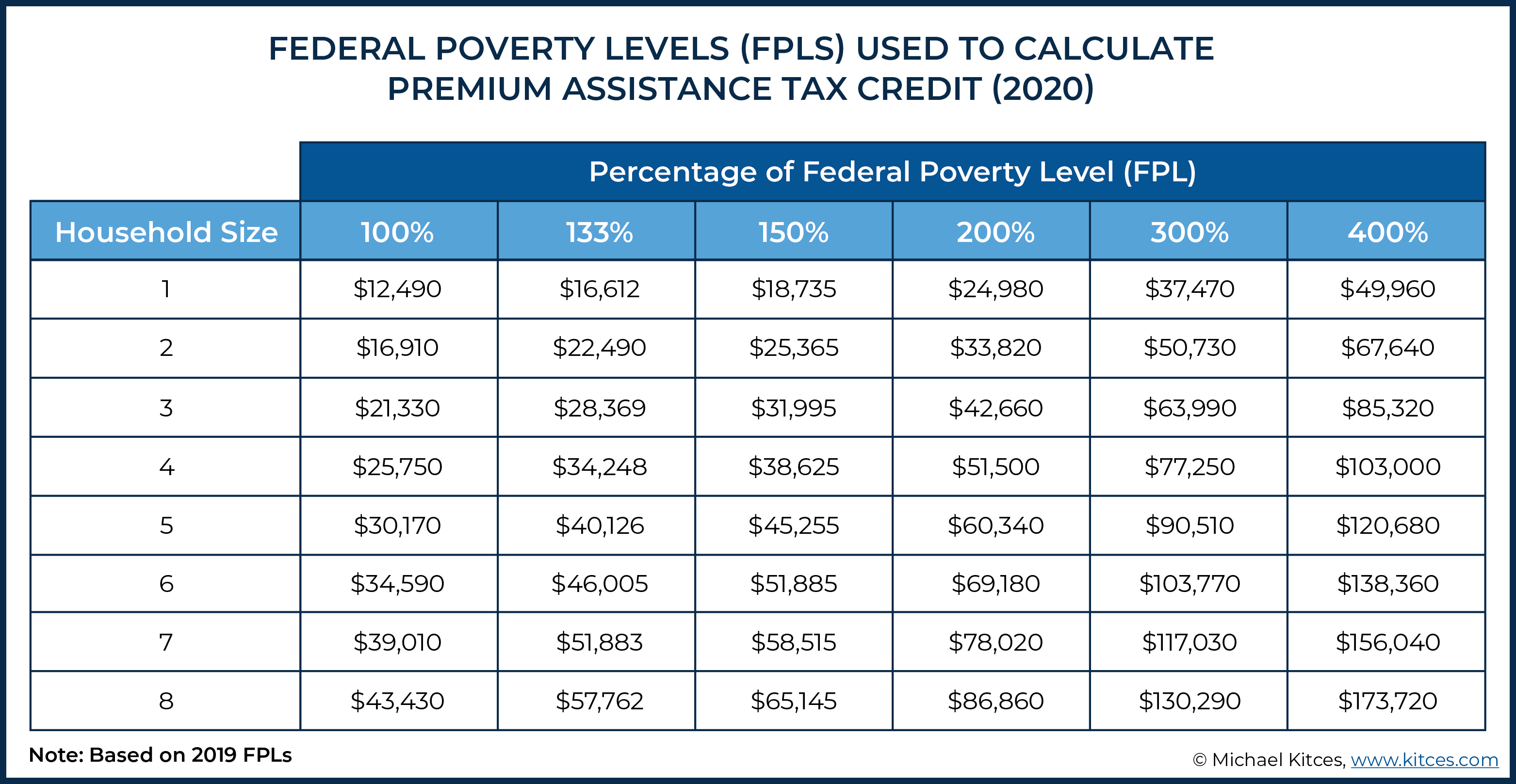

For 2020 where the advance credit payments exceed the PCT no additional income tax will be imposed. Premium tax credit caps on 2020 marketplace coverage range from 206 978 of income based on the 2019 federal poverty level. The American Rescue Plan Act of 2021 suspends the requirement that taxpayers increase their tax liability by all or a portion of their excess advance payments of the Premium Tax Credit excess APTC for tax year 2020.

They must file Form 8962 when they file their 2020 tax return. The premium tax credit helps pay for health insurance coverage bought from the Health Insurance Marketplace. The easiest way to avoid having to pay back this health insurance tax credit is to update the marketplace when you have any life changes.

The process remains unchanged for taxpayers claiming a net PTC for 2020.

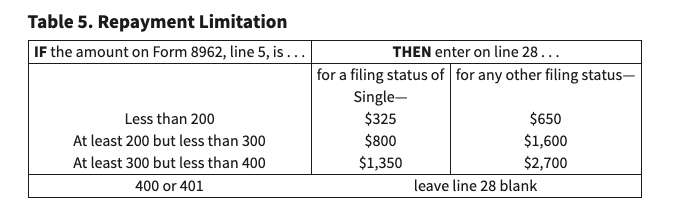

Advanced Tax Credit Repayment Limits

Advanced Tax Credit Repayment Limits

Maximizing Premium Tax Credits For Self Employed Individuals

Maximizing Premium Tax Credits For Self Employed Individuals

Key Facts Premium Tax Credit Beyond The Basics

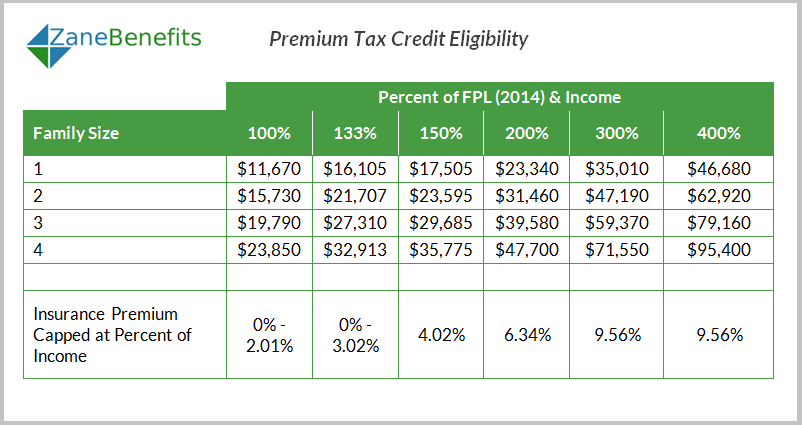

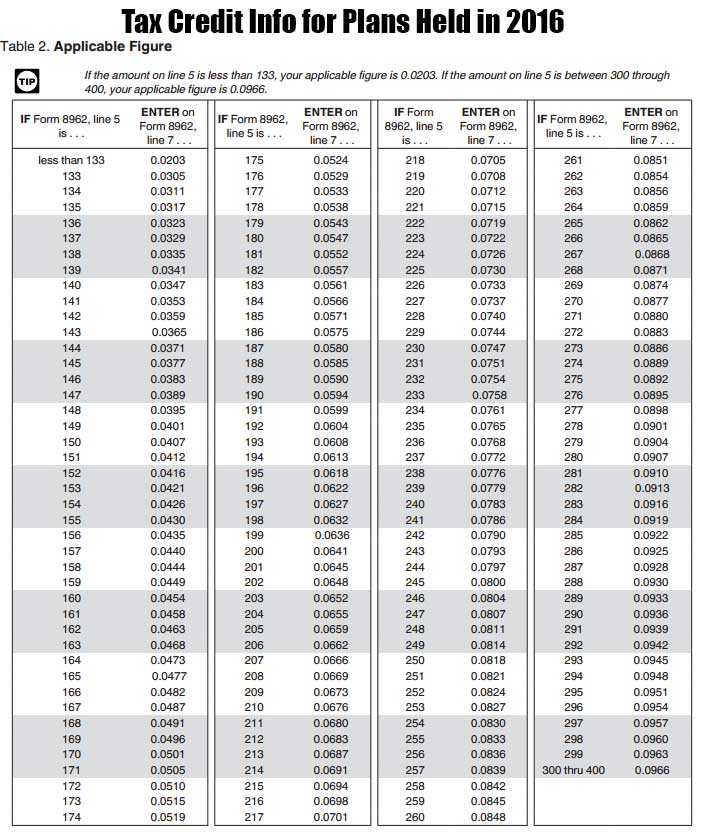

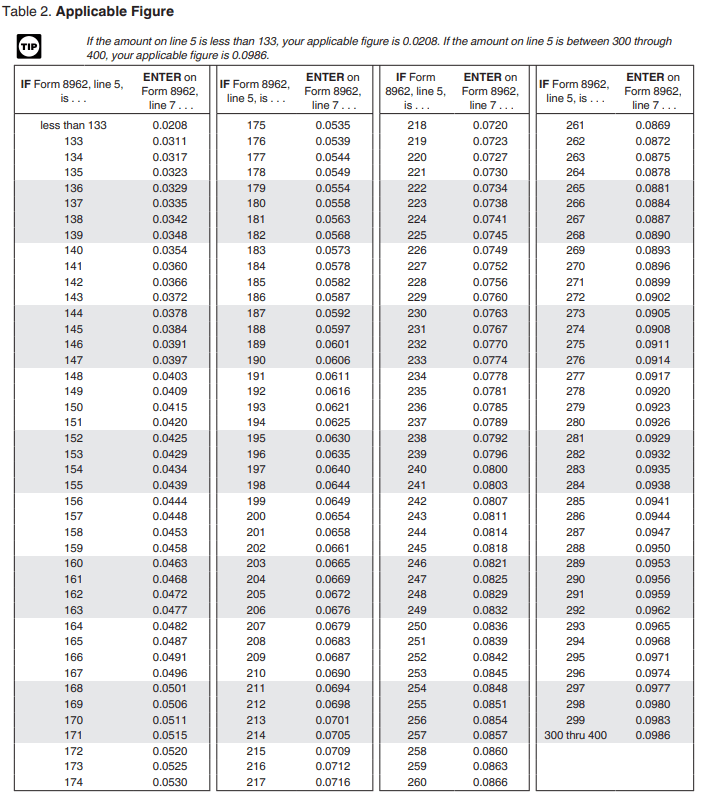

Premium Tax Credit Charts 2015

Premium Tax Credit Charts 2015

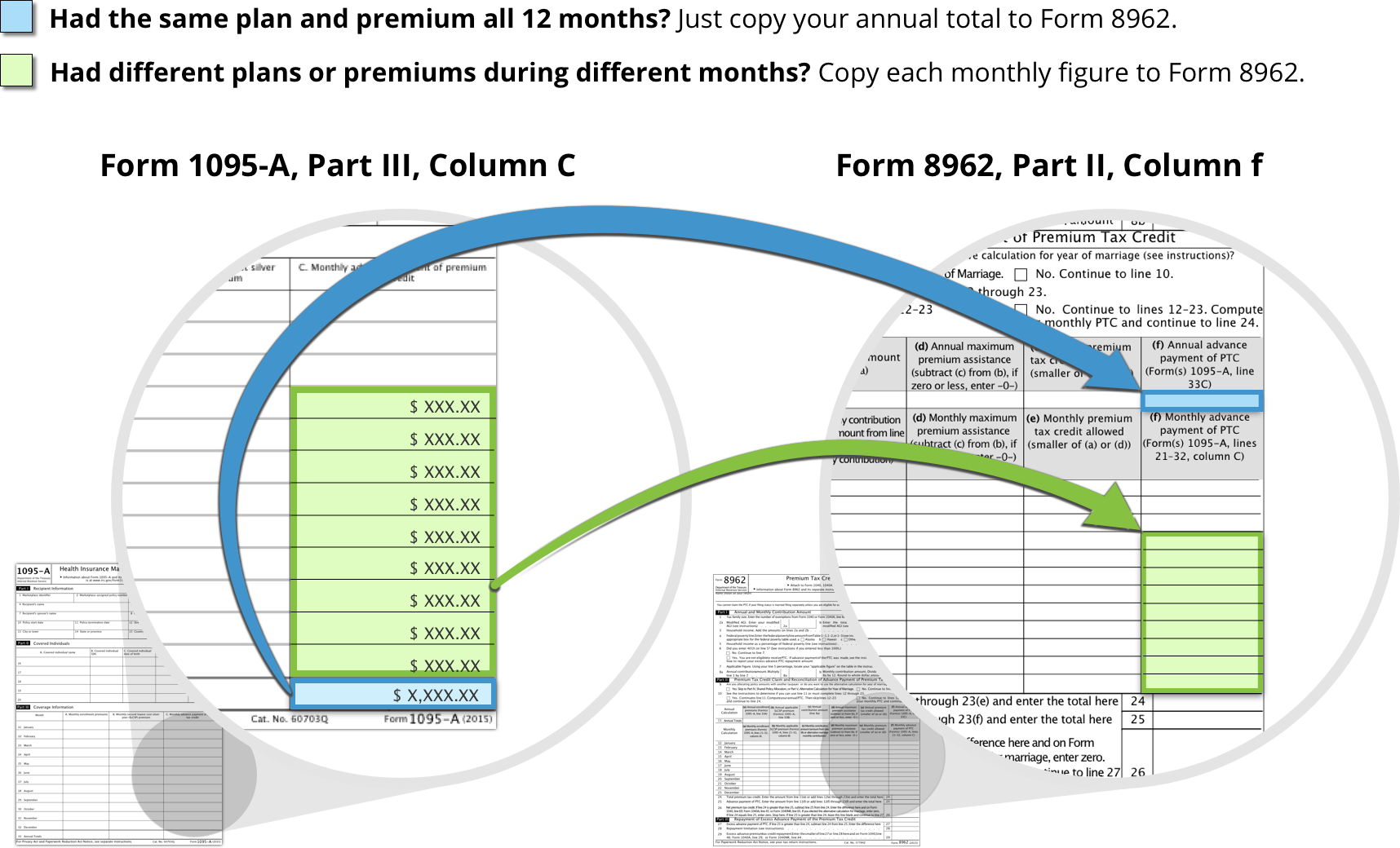

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png) Form 8962 Premium Tax Credit Definition

Form 8962 Premium Tax Credit Definition

How To Reconcile Your Premium Tax Credit Healthcare Gov

How To Reconcile Your Premium Tax Credit Healthcare Gov

Premium Tax Credit Ptc 965 Income Tax 2020 Youtube

Premium Tax Credit Ptc 965 Income Tax 2020 Youtube

Https Oci Wi Gov Documents Consumers Calculatingpremiumtaxcredits Pdf

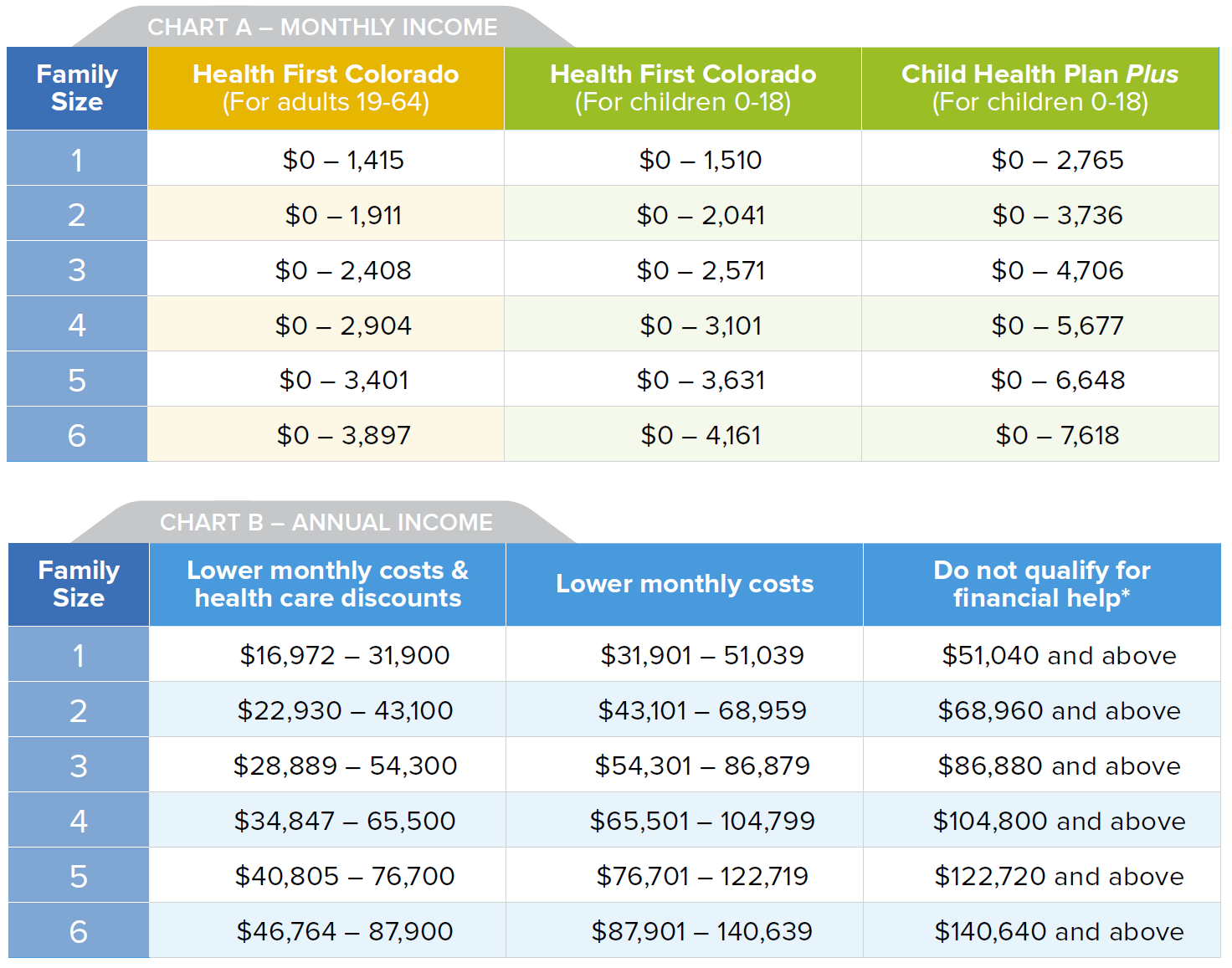

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

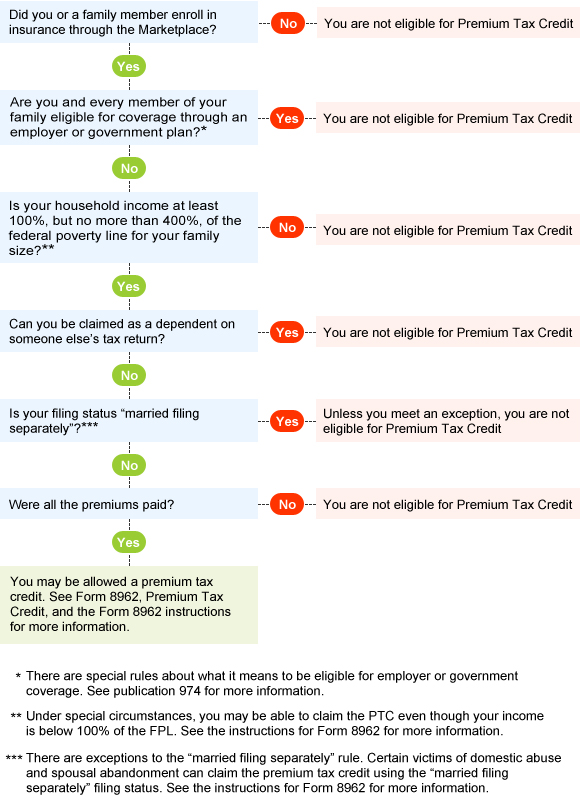

Premium Tax Credit Flow Chart Are You Eligible Internal Revenue Service

Premium Tax Credit Flow Chart Are You Eligible Internal Revenue Service

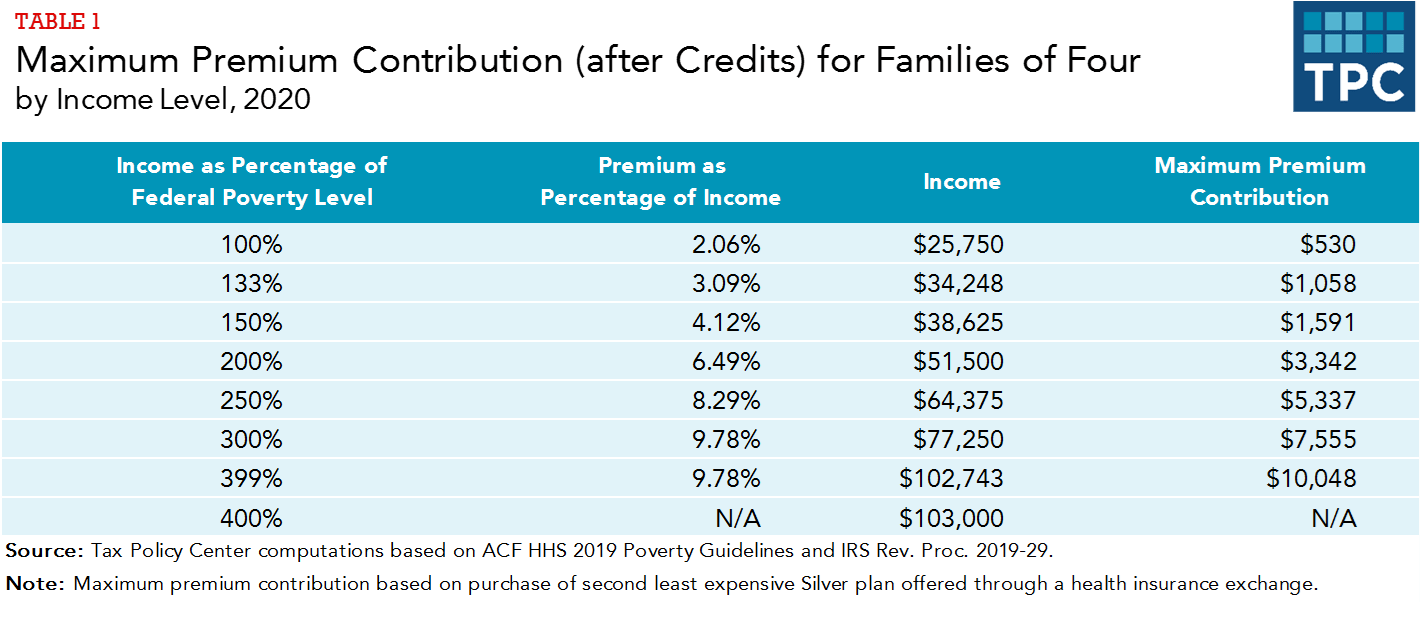

What Are Premium Tax Credits Tax Policy Center

What Are Premium Tax Credits Tax Policy Center

Health Care Premium Tax Credit Taxpayer Advocate Service

Health Care Premium Tax Credit Taxpayer Advocate Service

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.