If you understand how each of them works it will help you determine how much and when. Coinsurance is a form of cost-sharing or splitting the cost of a service or medication between the insurance company and consumer.

Out Of Pocket Costs For Health Insurance

Out Of Pocket Costs For Health Insurance

Coinsurance is the share of the cost of a covered health care service that you pay after youve reached your deductible.

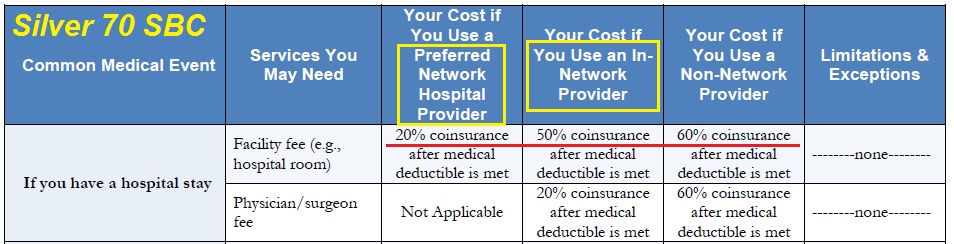

What does 50 coinsurance after deductible mean. Lets look at a 50-50 split HRA. If you have a high deductible or catastrophic health plan it may even go up as high as 100 until you reach the total amount of your deductible. For example your insurance may be set at 8020 which means that the insurance company pays 80 of the total bill and you pay the remaining 20.

With a split HRA you pay a portion and your HRA pays a portion. You pay 20 of 100 or 20. Your deductible is a fixed amount but your coinsurance is a variable amount.

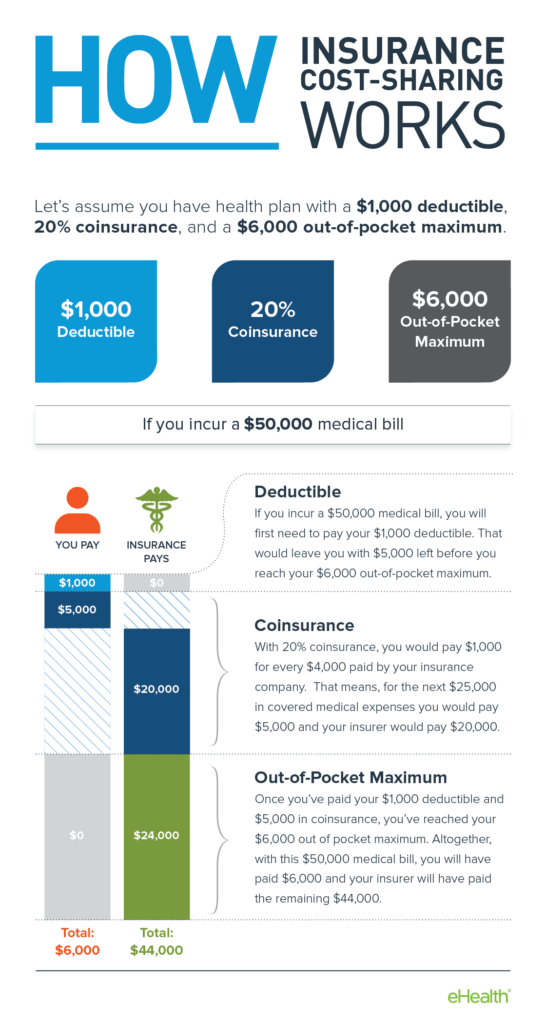

When you incur health care costs from a medical procedure you have to pay out of pocket until you spend a certain amount known as your deductible. You must pay 4000 toward your covered medical costs before your health plan begins to cover costs. Youve paid 1500 in health care expenses and met your deductible.

Your health insurance plan has a. You might pay 50 percent while your HRA pays 50 percent. After you pay the 4000 deductible your health plan covers 70 of the costs and you pay the other 30.

When you go to the doctor instead of paying all costs you and your plan share the cost. Counts toward your deductible. If you have a 1000 deductible its still 1000 no matter how big the bill is.

You pay the first 5000 of covered medical expenses towards your deductible. Deductibles coinsurance and copays are all examples of cost sharing. You know when you enroll in a health plan exactly how much your deductible will be.

Once youve met your deductible you might pay 20 of the cost of the health service or procedure for instance. Coinsurance is a portion of the medical cost you pay after your deductible has been met. Your insurance company would pay the balance.

The term no charge after deductible is frequently used in health insurance plans because these plans often require coinsurance which is a shared cost that must be paid even after the deductible is met. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100 percent. These figures are just examples that make the math simple.

Coinsurance may be as much as 50 for some insurance plans. Coinsurance is a percentage of a medical charge that you pay with the rest paid by your health insurance plan that typically applies after. Coinsurance is the percentage of your medical costs that you actually have to pay after reaching your deductible.

Or you might pay 25 percent and your HRA would pay 75 percent. Everything You Need to Know. You are responsible for the remainder.

For example if your coinsurance is 20 percent you pay 20 percent of the cost of your covered medical bills. Coinsurance is your share of the costs of a health care service. You start paying coinsurance after youve paid your plans deductible.

Its usually figured as a percentage of the amount we allow to be charged for services. If youve paid your deductible. Out-of-pocket maximum of 5000.

This brings you to a total of 8000. However your out-of-pocket maximum is 7150. Coinsuranceis what youthe patientpay as your share toward a claim.

Coinsurance is an additional cost that some health care plans require policy holders to pay after the deductible is met. Now you owe your coinsurance amount on the rest of the medical costs of 15000 for a total of 3000. Lets say your health insurance plans allowed amount for an office visit is 100 and your coinsurance is 20.

By doing so you accepted personal responsibility for 50 percent of the value. When you pay coinsurance you split a certain cost with the insurance company at a ratio determined by the terms of your. A copay after deductible is a flat fee you pay for medical service as part of a cost-sharing relationship in which you and your health insurance provider must pay for your medical expenses.

After meeting a deductible beneficiaries typically pay coinsurance a certain percentage of costsfor any services that are covered by the plan. They continue to pay the coinsurance until they. Its usually a percentage of the approved medical expense.

The deductible is fixed but coinsurance is variable. Once you hit your deductible your insurance company starts splitting the cost of future care based on a set percentage. You typically pay coinsurance after meeting your annual deductible.

Coinsurance The percentage of costs of a covered health care service you pay 20 for example after youve paid your deductible. This means your payout will only reflect 50 percent of the loss in this case 25000 minus any deductible.

What Does 50 Coinsurance After Deductible Out Of Network Mean Differences In A Deductible Also Coinsurance

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance Ramseysolutions Com

25 New Coinsurance After Deductible Meaning

Understanding Cost Sharing Deductibles Coinsurance And Copays Healthtn Com

Understanding Cost Sharing Deductibles Coinsurance And Copays Healthtn Com

What Does 60 Coinsurance After Deductible Mean What Is Coinsurance

What Does 60 Coinsurance After Deductible Mean What Is Coinsurance

What Does 60 Coinsurance After Deductible Mean What Is Coinsurance

What Does 60 Coinsurance After Deductible Mean What Is Coinsurance

What Does 50 Coinsurance Mean After Deductible Copays Deductibles As A Consequence Coinsurance

What Does 50 Coinsurance Mean After Deductible Copays Deductibles As A Consequence Coinsurance

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

Five Terms You Need To Know Before Buying Obamacare Coverage

Health Insurance Basics How To Understand Coverage

Health Insurance Basics How To Understand Coverage

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

Small Business How Does Coinsurance Work Ehealth

Small Business How Does Coinsurance Work Ehealth

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.