EIN Employer Identification Number An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. What is an NPI Number.

Box 33 Billing Provider Info Ph Therabill

Box 33 Billing Provider Info Ph Therabill

A business must obtain an EIN.

Physician tax id number. A business needs an EIN in order to pay employees and to file business tax returns. The NPI number is a unique 10-digit identification number issued to covered health care providers by the CMS Centers for Medicare and Medicaid Services. The United States federal government uses a federal tax identification number.

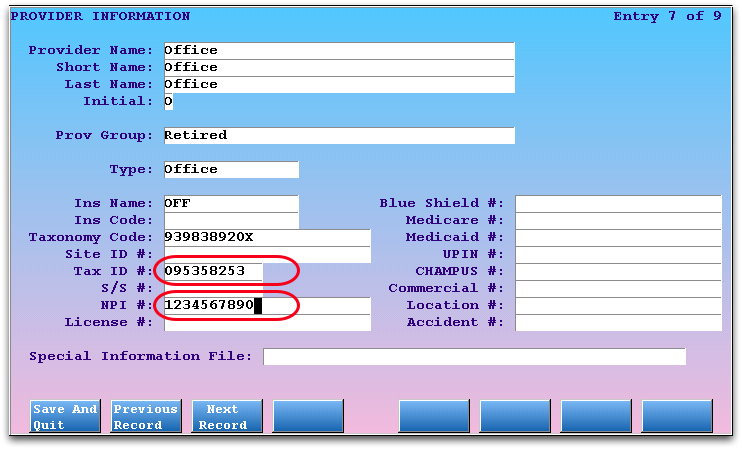

It is a 9-digit number beginning with the number 9 formatted like an SSN NNN-NN-NNNN. Adding an NPI and Tax ID to an office location. Friday March 1 2013.

Organizing this is a real challenge not only because of the sheer volume of data to be processed but also because identifying people can be quite tricky without the right systemFor example according to the Whitepages name William Smith has over 1000 entries in the State of. Other commonly used terms for EIN are Taxpayer Id IRS Number Tax Id Taxpayer Identification Number TIN etc. WMC ADVANCED PHYSICIAN SERVICES PC.

Generally businesses need an EIN. The NPI is a 10-digit intelligence-free numeric identifier. Ie a CA Federal Tax Id Number and an CA State Employer Tax Number Instead of filing a fictitious business name DBA Filing in Needles Incorporate in CA or form an CA LLC.

If you are in a practice group and have multiple tax IDs and billing NPI numbers to bill from you will have to set up an office attaching the numbers you would like to use typically this will be an organizational NPI number. Healthcare providers acquire their unique 10-digit NPIs to identify themselves in a standard way throughout their industry. The IRS have to process huge amounts of data from millions of different US citizens.

It is required information on all tax returns filed with the IRS. The NPI has replaced the UPIN Unique Provider Identification Number as the required identifier for all Medicare services including health insurance claims. The National Provider Identifier NPI is a unique identification number for covered health care providers doctors dentists chiropractors nurses and other medical staff.

You can use the IRSs Interactive Tax Assistant tool to help determine if you should file an application to receive an Individual Taxpayer Identification Number ITIN. If you are thinking of hiring help you will need a tax id called a state EIN and an IRS tax id number called an EIN Employer ID Number. There is no reason a doctor would withhold TIN information if there is a viable business need.

How to Find a Doctors Federal Tax ID Number Ask the Doctors Office. The NPI Number is a unique 10-digit number issued by the CMS Centers for Medicare Medicaid Services to health care providers in the United States. Generally businesses need an EIN.

Required Tax IDs for. Tax identification numbers are issued to businesses by the IRS depending on their structure. A federal tax ID lookup is a method of searching for a businesss information using their tax identification number FTIN or employer identification number EIN.

An NPI number is required for healthcare providers are used in a variety of ways that including billing insurance medicare Medicaid pharmacy information and state specific medical boards NPIs have replaced health care provider identifiers used for standard transactions under the Health Insurance Portability and Accountability Act HIPAA. Tax ID number physician Free Tax ID Number for Lewes Sussex County DE 19958. The NPI Registry Public Search is a free directory of all active National Provider Identifier NPI records.

Employees and former employees need the TIN also referred to as the Employer Identification Number. You may apply for an EIN in various ways and now you may apply online. 5 Click on the provider name for additional information.

An Company Business Name DBA. EIN REST API PDF. Look at Past.

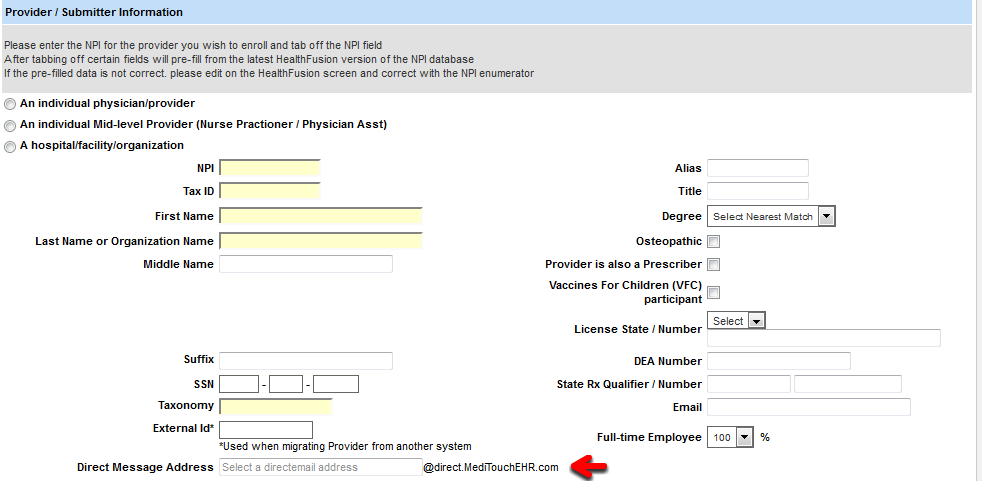

Please use the following article to see where to enter in this information. The federal taxpayer identification number TIN that identifies the providerphysicianpracticesupplier to whom payment is made for the service. 2 Enter your Criteria.

An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. A Tax Identification Number TIN is a nine-digit number used as a tracking number by the Internal Revenue Service IRS. To be considered a Partnership LLC Corporation S Corporation Non-profit etc.

An Business Tax Registration ID. 1 Choose a Search Type. 3 Select the State in which you would like to search.

Network Status Provider NameTIN Search. When a business changes its structure it will usually be issued a new ID number. You may apply for an EIN in various ways and.

Get FREE TAX ID Get Started.

Health Care Provider Data Validation Form Aetna

Health Care Provider Data Validation Form Aetna

Help With Insurance Credentialing Ms Pinky Maniri Medical Practice Management Consulting Group

Help With Insurance Credentialing Ms Pinky Maniri Medical Practice Management Consulting Group

Https Www Uhcprovider Com Content Dam Provider Docs Public Eligibility Single Eob Qrg Pdf

Https Eus Custhelp Com App Answers Detail A Id 376

Http Www Anthem Com Provider Nh F5 S1 T0 Pw A032592 Pdf Refer Ahpfooter

Provider Maintenance Important To Check Before Claim Submission

Provider Maintenance Important To Check Before Claim Submission

Provider Specialty Incident To Services In The Office Setting

Provider Specialty Incident To Services In The Office Setting

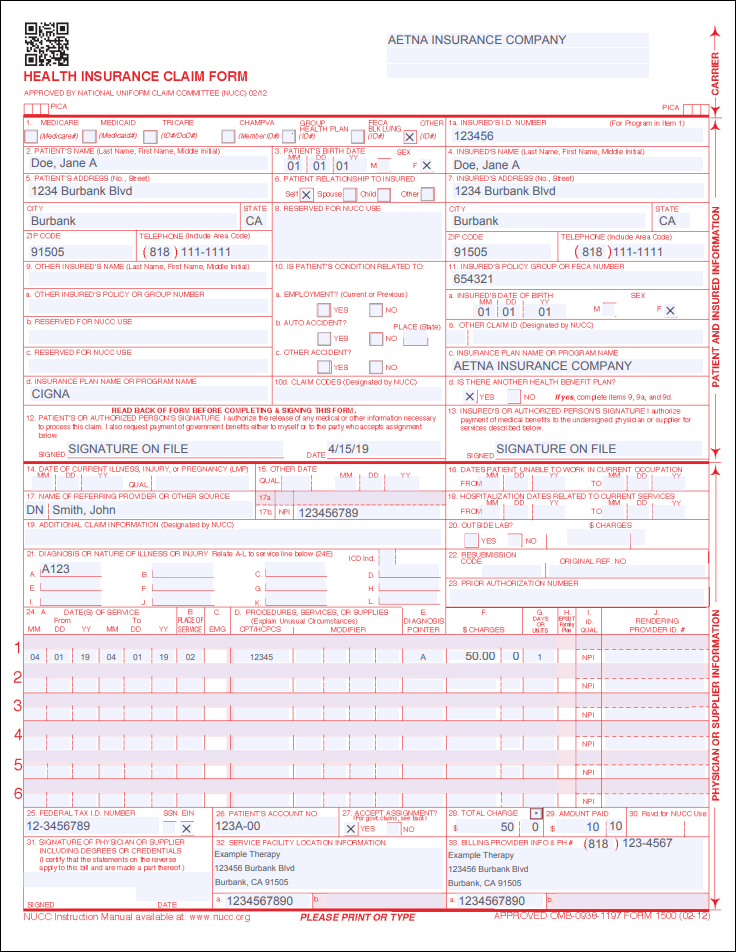

Cms 1500 Reference Page Theraplatform

Cms 1500 Reference Page Theraplatform

Provider Id Cannot Be Same Value As Tax Id Powered By Kayako Help Desk Software

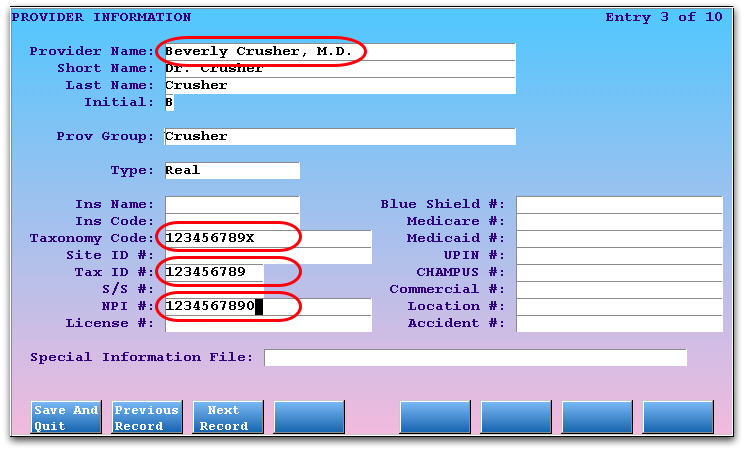

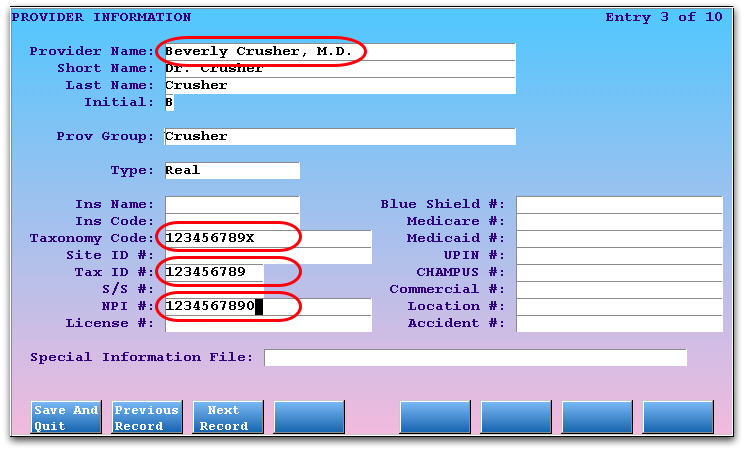

Update Npis Taxonomy Codes And Tax Ids Pcc Learn

Update Npis Taxonomy Codes And Tax Ids Pcc Learn

Claim Reconsideration With Attachment Unitedhealthcareonline Com

Claim Reconsideration With Attachment Unitedhealthcareonline Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.